Disclosure regarding our editorial content standards.

When a relative dies, the last thing you might be thinking about during the grieving process is how to report their death to credit bureaus.

The unfortunate reality, however, is that a deceased person’s debts and liabilities need to be resolved as soon as they can be. Failing to do so can cause financial headaches for beneficiaries and the estate of the deceased, with creditors attempting to collect the deceased person’s debts and causing you stress during a time when you don’t want to be thinking about such matters.

What follows are answers to some of the most common questions about what happens to debt when a family member dies and why you should report deaths to credit bureaus to prevent any credit problems.

What happens to a person’s credit report when they die?

When someone dies, their credit report is closed — eventually. It doesn’t happen instantly and automatically, which is why it’s best to inform the credit bureaus as soon as possible.

Once you do provide the credit bureau with a death notice, the bureau will make a notation in the deceased person’s credit report.

While this doesn’t immediately close their credit report, it lessens the chance of the deceased’s identity being stolen. Flagging that the person is deceased will stop an identity thief from fraudulently opening a new line of credit in the deceased person’s name.

After seven years of being flagged due to death and all accounts being settled, the credit report will be closed for good. It will then be deleted entirely by the credit bureaus and will no longer exist.

How do the credit bureaus find out about a person’s death?

There are a few different ways for the three credit bureaus (TransUnion®, Experian® and Equifax®) to find out that someone has died:

- By the deceased person’s lenders. After a death, the estate’s executor or a relative of the deceased notifies one or more lenders — for instance, a credit card issuer or an auto loan provider that had been used by the deceased — to inform them of the death. When the lender updates the account noting the death, the death will get reported to one or more of the credit bureaus.

- Via the Social Security Administration (SSA). The SSA routinely notifies the three credit bureaus about deaths. To do that, of course, the SSA itself needs to have been notified about the death. This is often done by the funeral home. Additionally, the deceased person would need to have been receiving Social Security benefits for the SSA to inform the credit bureaus.

- From the executor or a relative. Notifying a credit bureau directly that someone has died is the most surefire way to make sure the credit bureaus update their credit reports in a timely fashion. It’s faster and more reliable than the other ways mentioned above.

How you report a death to the credit bureaus

To report a death to the credit bureaus, you must contact one of them and provide a death certificate. This can be done online or through the mail.

While you can notify all three credit bureaus, it’s really only necessary to inform one of them; when one credit bureau is notified, that bureau will inform the other two.

Here are the steps you need to take to report at death to the credit bureaus:

1. Make sure the Social Security Administration has updated its files

While funeral homes often do the job of reporting the death to the Social Security Administration, you may also want to contact the SSA directly to make sure the information was transmitted properly. This can’t be done online; you must call the SSA.

In addition to making sure the SSA reports the death to the credit bureaus, calling the SSA can give you a chance to discuss receiving any death benefits (if eligible).

2. Get the death certificate

The credit bureau will require a death certificate as proof that someone has died, so this step should be done as quickly as possible.

Depending on your state and locality, the process for obtaining a death certificate will vary. The document may be issued from a city clerk, records department or courthouse. Checking the website of or calling the Department of Health in the state where the person died is a good place to start.

3. Request a credit freeze from the credit bureaus

Contacting each credit bureau to request a credit freeze will flag the account and prevent new lines of credit from being opened by identity thieves. It can be done online or over the phone.

If you decide to do it over the phone, it’s a good idea to ask any questions you may have about the more formal step of informing the credit bureau of the death.

Here’s how to contact each credit bureau online to request the credit freeze:

4. Send in a copy of the death certificate to one of the credit bureaus

Once you’ve obtained the death certificate, send a copy to one of the bureaus. Experian is the only one of the three credit bureaus that allows you to complete the process online instead of via the mail.

In addition to sending the death certificate, including the following information about the deceased:

- Legal name

- Social Security number

- Date of birth

- Date of death

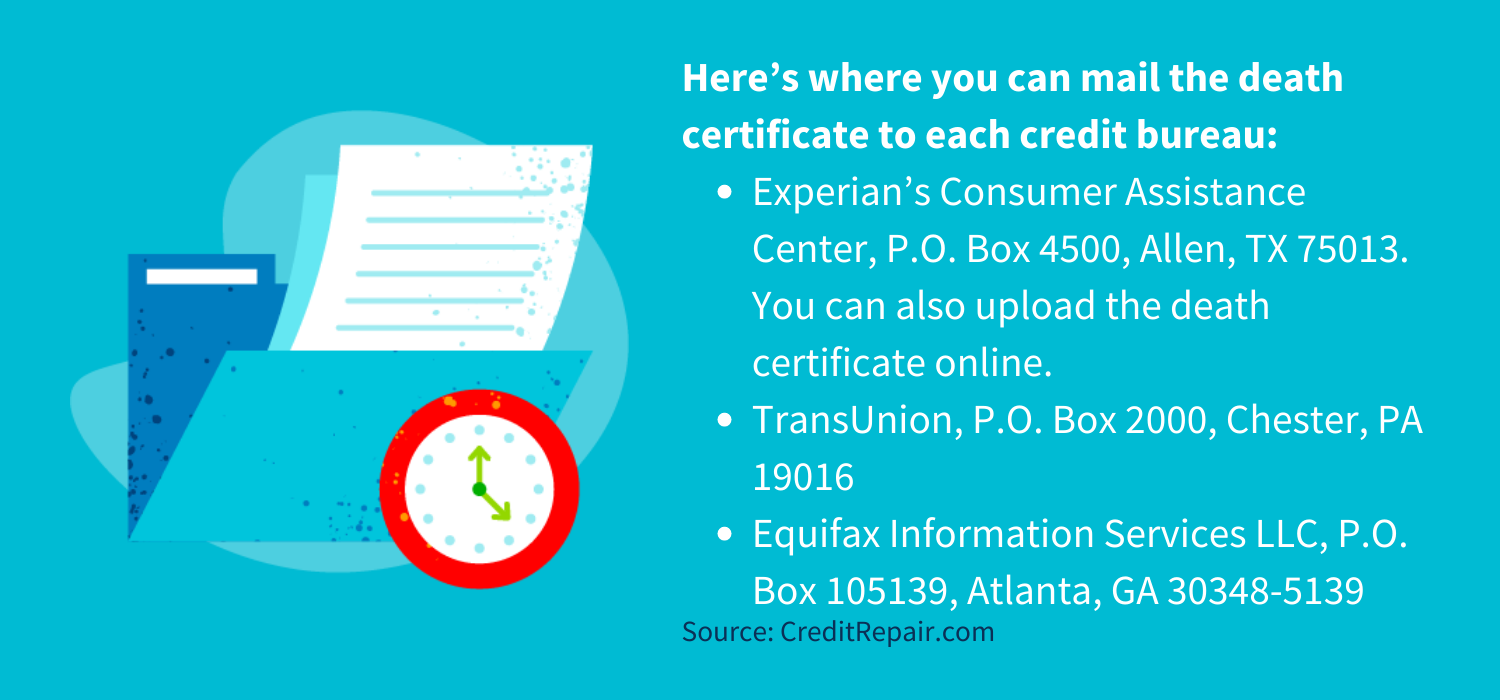

Here’s where you can mail the death certificate to each credit bureau:

- Experian’s Consumer Assistance Center, P.O. Box 4500, Allen, TX 75013. You can also upload the death certificate online.

- TransUnion, P.O. Box 2000, Chester, PA 19016

- Equifax Information Services LLC, P.O. Box 105139, Atlanta, GA 30348-5139

5. Ask for copies of the credit reports

You or the executor should contact each of the credit bureaus for the deceased person’s credit report so you have a full picture of the debts owed.

To expedite the process, you should make this request to all three bureaus when sending in the death certificate. (You’ll need to ask each credit bureau individually for the report; they won’t send it automatically just because you sent the death certificate to them.)

6. Close out credit accounts and pay off any remaining balances

Once you’ve received the credit report, you and/or the executor should contact each company listed in the credit report to close out the accounts. The executor will pay off the balances via funds from the estate. Each bank or credit line may have different requirements for this process, and some may require a copy of the death certificate.

7. Report any fraud on their credit report

If you suspect fraudulent activity on the deceased person’s credit report, you should begin the dispute process. It’s also a good idea to report the activity to the Federal Trade Commission (FTC).

Why you should report the death

Failing to inform credit bureaus of the death can cause unpleasant and potentially stressful calls from creditors or collection agencies who aren’t properly informed of the death. Not reporting the death can also allow identity thieves to open lines of credit in the deceased person’s name.

What happens to a person’s debt after they die?

When someone dies, their debts don’t just disappear. The obligation for paying off the debt falls to the deceased person’s estate, which consists of all the assets that belonged to that person. By law, any debts that the deceased had are paid from the estate.

If the estate doesn’t have enough assets to pay off all the debts of the deceased, creditors will be informed that the estate is insolvent. At that point, creditors are forced to write off the debt.

We can help you clean up your credit

Dealing with the death of a family member is never easy, but by knowing your rights and obligations, you can better face any financial concerns that arise. If the process of dealing with a deceased loved one’s credit issues has caused you concerns about your own credit, we can help you monitor it and repair any inaccuracies that have occurred.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263