Disclosure regarding our editorial content standards.

Credit mix refers to the various types of credit accounts you have and accounts for 10 percent of your FICO® credit score.

Credit mix is like a symphony—each credit account acts as an instrument with a unique and essential role in creating financial harmony. But you don’t need to be a master conductor to understand the composition of your credit portfolio.

A basic understanding of credit mix can help you manage your finances more effectively and maintain a healthier credit score.

Today, we’ll discuss what credit mix is and how it affects your credit. We’ll also talk about how to know your current credit mix and the steps you can take to improve it.

Key learnings:

- Credit mix refers to the various types of credit accounts you have.

- Your credit mix demonstrates your ability to responsibly manage different types of credit.

- Having a good mix of credit doesn’t guarantee a high credit score, as it accounts for only 10 percent of your overall FICO score.

What is credit mix?

Credit mix refers to the various types of credit accounts you have.

Credit mix considers your open and active accounts, such as installment loans and revolving credit (more on this later). Lenders typically like seeing more diverse forms of credit because it can imply a positive management of debt.

Credit mix is one of the five factors that affect your score, and it accounts for 10 percent of your FICO credit score.

So, what is a good credit mix?

The answer really depends on the individual’s financial situation and goals. A good credit mix strikes a balance between different types of credit accounts while considering the individual’s ability to repay the debt.

According to Experian®, an ideal credit mix will have revolving and installment credit. Revolving credit sets a borrowing limit you can repay within a specified period (e.g., a credit card). Installment credit involves fixed payments for a borrowed amount over a set period (e.g., a car loan).

For instance, let’s assume you have both a credit card and a car loan. You use your credit card for everyday purchases and pay the balance in full each month. You also make timely payments on your car loan and keep the balance low. This is an example of a good credit mix, demonstrating responsible use of revolving and installment credit.

Of course, your situation might be different. You should assess your financial goals to determine the best credit mix for you. It’s important to maintain good payment history for all credit accounts and only take on debt that you can manage responsibly.

What are the different types of credit?

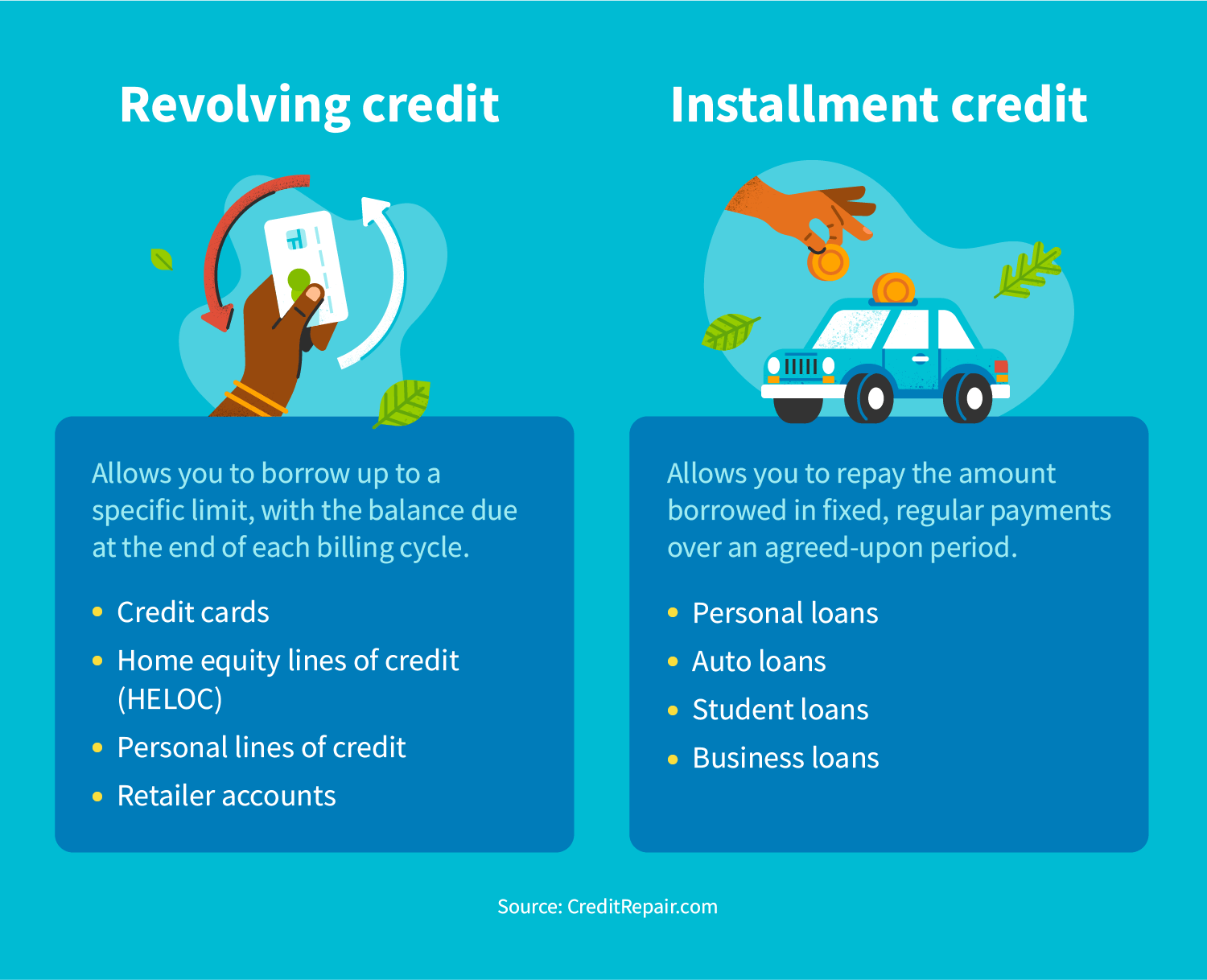

There are two main types of credit: installment credit and revolving credit.

Both forms have advantages and disadvantages depending on your financial situation. It’s important to understand which type best suits your needs before applying for any loan or line of credit.

Revolving credit

Revolving credit allows you to borrow up to a specific limit as needed, with the balance due at the end of each billing cycle.

Examples of revolving credit include:

- Credit cards

- Home equity lines of credit (HELOC)

- Personal lines of credit

- Retailer accounts

Installment credit

Installment credit allows you to repay the amount you borrowed in fixed, regular payments over an agreed-upon period. In other words, you pay your debt off gradually instead of all at once.

Examples of installment credit might include:

- Personal loans

- Auto loans

- Student loans

- Business loans

What isn’t part of credit mix?

Not all credit counts as part of your credit mix.

Creditors don’t report some types of credit to the major credit bureaus. This means they won’t show up in your credit mix when lenders review your application for a loan or another type of financing.

Generally speaking, these are the two most common credit types that aren’t part of your credit mix:

- Payday loans: Short-term, high-interest loans that borrowers have to repay on their next payday. Payday lenders typically offer these loans through storefront operations, but they’re also available online.

- Title loans: Secured loans that use the title of a vehicle as collateral. The lender places a lien on the car, so they have the right to take possession of it if the borrower defaults on the loan.

On-time payments won’t count toward your score because lenders who provide these types of loans don’t report to the credit bureaus. So, even if you make all of your payments on time, it won’t help to improve your credit score.

On the other hand, defaulting on these loans can hurt your credit score. If you default on a payday or title loan, lenders can report it to the credit bureaus, which will appear as a derogatory mark on your credit report.

How to know your credit mix

To get an accurate picture of your credit mix, get a copy of your credit report from one or all three major consumer reporting agencies:

- Equifax®

- Experian®

- TransUnion®

You’ll need to provide your full name, address, Social Security number and date of birth. You can go to AnnualCreditReport.com to access your credit report for free, or you can go directly to the credit bureaus themselves for a fee.

Your report will show the types of accounts on your file, such as mortgages, auto loans, student loans and revolving lines of credit like store cards and/or personal lines of credit.

Note whether creditors have closed any of your accounts in the past few years, since this can affect your overall score.

Once you understand what type of accounts make up your current profile, you can determine which additional products may help improve or diversify your portfolio.

How does credit mix impact your score?

Credit mix is just one of several factors considered when determining your FICO score, which is the most widely use credit scoring model. As we’ve already mentioned, credit mix accounts for 10 percent of your overall FICO score.

While having a good credit mix can help improve your credit, other significant factors exist, including:

- Your payment history (35 percent)

- Credit utilization (30 percent)

- Length of credit history (15 percent)

- New credit (10 percent)

In other words, having a healthy credit mix isn’t a synonym for having a better credit score. You should also focus on the other factors and assess whether taking out loans or opening new credit accounts is the right financial decision for your current situation.

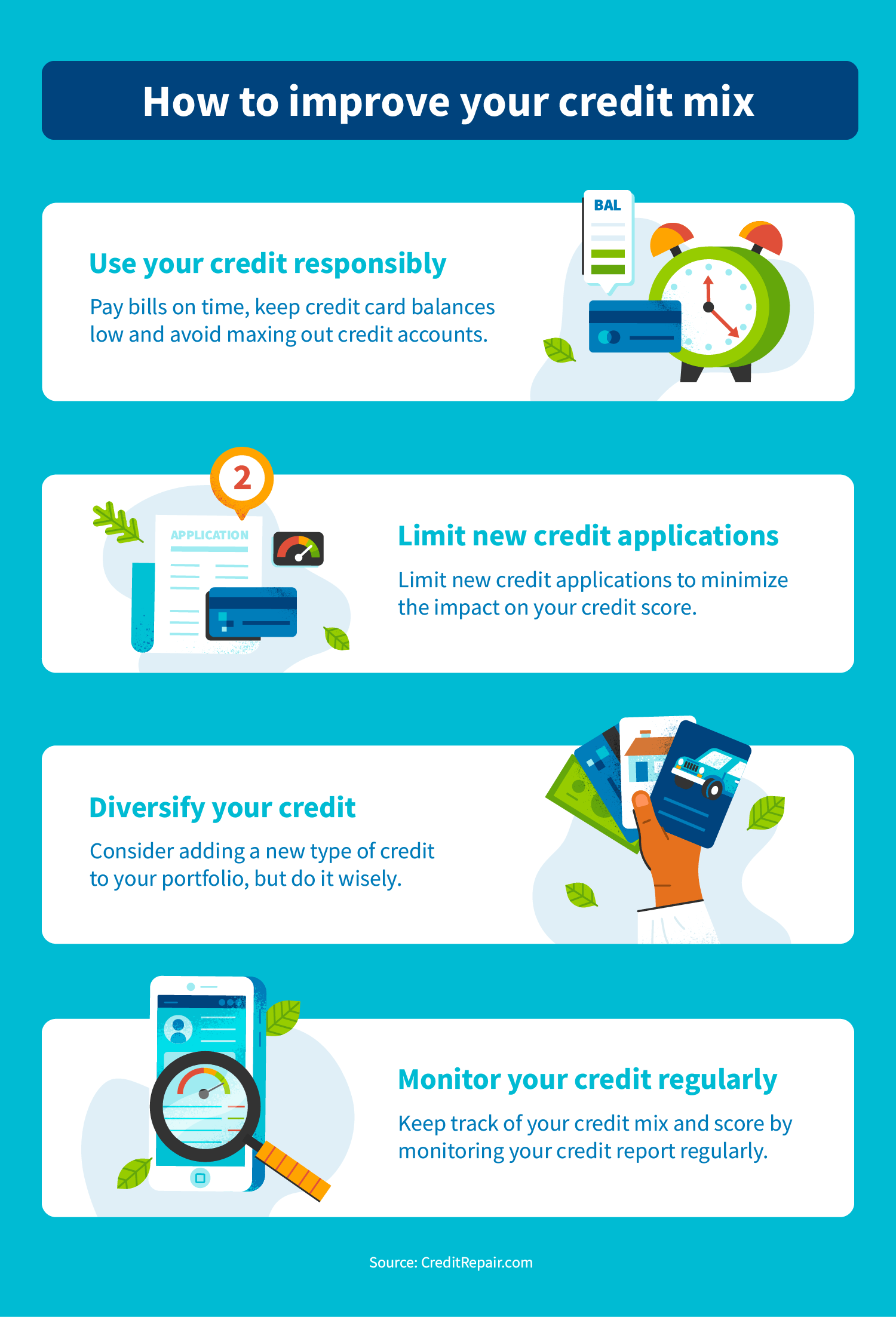

How to improve your credit mix

Just because your mix lacks a particular type of credit, it doesn’t mean you should go out and open a bunch of new accounts just to improve it. Here are a few tips to help you improve your credit mix:

- Use your credit responsibly: Regardless of your credit type, use it responsibly. Pay your bills on time, keep your credit card balances low and avoid maxing out your credit accounts.

- Limit new credit applications: Every time you apply for credit, it results in a hard inquiry on your credit report, which can temporarily lower your credit score. Limit the number of new credit applications to minimize the impact on your credit score.

- Diversify your credit mix: If you find your credit mix lacking, consider adding a new type of credit to your portfolio, but do it wisely. Research different types of credit and only apply for it when needed.

- Monitor your credit regularly: Keep track of your credit mix and credit score by monitoring your credit report regularly. This will help you identify any potential errors or areas for improvement.

Of course, every situation is different, and the best way to improve your credit mix will depend on your circumstances. If you want to improve your credit mix and overall credit health, consider using CreditRepair.com’s Credit Snapshot Tool. This tool provides an assessment of your credit situation and can help you get personalized advice for improving your credit mix and score.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263