Disclosure regarding our editorial content standards.

While an excellent credit score can open a lot of doors, a bad credit score can slam them shut. One of the most significant markers of your financial health, a high credit score is imperative for major life milestones such as buying a home, leasing a car or applying for a new loan or credit card.

If your current credit standing isn’t where you’d like it to be, you’re probably wondering how to improve your credit score. Luckily, there are a number of methods you can use to likely achieve the credit boost you’re after.

How credit scores are calculated

Your credit score is how lenders determine your creditworthiness, and it’s calculated based on the information in your credit reports. Most credit scores fall within a scale of 300 to 850, and your score is determined by five important factors, each weighted differently:

- Payment history (35 percent): Frequency of on-time payments and late or missed payments

- Current debt (30 percent): The total amount of debt owed on all lines of credit (loans, credit cards or other credit accounts)

- Length of credit history (15 percent): The length of time your credit accounts have been opened (a longer credit history benefits your score)

- New credit requests (10 percent): The number of new credit accounts opened, also known as soft and hard inquiries

- Credit diversity (10 percent): The different types of credit accounts you have (having a mix of accounts, such as installment loans, home loans and credit cards, can improve your score)

By understanding the key factors impacting your credit score, you can prioritize the right strategies as you work to improve it. Remember that there are no quick fixes to boost your score—it’s a process that requires time, effort and patience. However, anyone can raise their credit score with some discipline and a commitment to seeing the process through. Use the strategies below to get started on your credit-building journey.

1. Pay your bills on time

Your payment history has the biggest impact on your credit score, which makes this a critical step if you’re working to improve it. Your payment history shows how likely you are to stay on top of your payments, and even a single late payment can dramatically drop your score. Use these tips if you’re currently struggling to pay your bills:

- Catch up on past-due bills as soon as possible: Late payments can remain on your credit reports for up to seven years, and those that are more recent will do more damage to your score than older items. Take care of any late payments immediately.

- Try not to miss a payment by more than 29 days: Past-due payments of at least 30 days are filed on your credit report and will hurt your score.

- Set up automatic payments: If you have a hard time remembering when various bills are due, set up automatic payments so you never miss a payment.

Making consistent, on-time payments might not cause a drastic jump in your credit from month to month, but it will improve steadily over the years in a lasting way. Consider prioritizing your most seriously delinquent accounts when getting a handle on missed payments.

2. Limit new credit requests

If you’re learning how to increase your credit score, making a point to avoid any new credit applications can help improve your score. Each new application results in a hard inquiry to your credit report, which can lower your score. Tips for this strategy are fairly straightforward:

- Avoid applying for new lines of credit: Put a hold on any applications for new credit cards, loans or other lines of credit if you’re working to raise your score.

- Avoid multiple hard inquiries at once: An occasional hard inquiry won’t dramatically hurt your score, but many of them in a short period of time—like, say, a few months—can do significant damage.

3. Keep old accounts open

Many people assume they should close out old or unused credit accounts when working to improve their credit score. However, this can actually make the job harder—closing out a credit card lowers your credit utilization, which can result in a lower score. Use these tips to work this strategy in your favor:

- Don’t close old or unused accounts: Keep older accounts open even if you don’t use them anymore to maintain a higher credit limit and increase your credit utilization.

- Only close unused accounts if they have an annual fee: There’s no sense in paying an annual fee on a credit card you don’t use. These accounts should be paid off and closed.

4. Become an authorized user

Becoming an authorized user means adding your name to someone else’s credit card account (with their permission). If you have a friend or family member with a strong credit history, becoming an authorized user means all activity on their account will also reflect on your credit report. This is an easy way to bulk up your credit score without much effort on your part. Keep these tips in mind:

- Make sure the person you ask has responsible credit habits: Since their account activity will reflect on your credit report, it’s critical to ensure they pay every bill on time and manage credit responsibly.

- Make sure the card issuer reports authorized users to the credit bureaus: If your authorized user status doesn’t show up on your credit reports, it won’t do anything to help your score. Ask their credit card issuer whether or not they report this item to the credit bureaus before going this route.

While becoming an authorized user likely won’t have a significant impact on your credit score on its own (lenders prefer to see your ability to manage credit responsibly on your own account), using this strategy in tandem with others can help give it a boost.

5. Check your credit reports for errors

A misplaced negative item on your credit report will bring your credit score down unnecessarily, and such mistakes can be disputed and potentially corrected. You should routinely check your credit reports for inaccurate information, such as unauthorized purchases or misreported late payments from your lender.

- Claim and review your free credit report once a year: You’re entitled to one free credit report per year from each of the major credit bureaus—Equifax®, Experian® and TransUnion®. You can obtain them on this official website: AnnualCreditReport.com.

- Dispute any suspected errors: Contact the credit reporting agency associated with any errors you find and request their removal.

- Consider a credit repair service: If you’re unfamiliar with handling your credit or don’t feel confident disputing errors on your own, there are credit repair professionals who can give you personalized guidance and handle the process for you.

Whether you opt to review your credit reports yourself or hire a professional to help navigate the process, regularly checking your reports for errors and disputing them is one of the easiest ways to instantly give your credit score a lift.

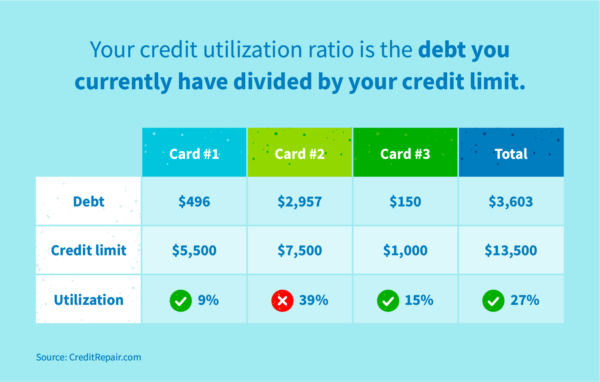

6. Lower your credit utilization

Credit utilization is a percentage found by dividing your credit balance by your total available credit. (For example, a credit balance of $400 compared to a total available limit of $2,000 is a credit utilization ratio of 20 percent.) It’s the second most significant factor in your credit score, and most lenders prefer to see a utilization of 30 percent or lower. Here’s how you can keep your utilization in check:

- Pay credit balances in full each month: This ensures you keep your credit balances low.

- Raise your credit limit: An increased limit raises your available credit, which positively impacts your utilization. Keep in mind this type of request places a hard inquiry on your credit report.

- Move your bill due dates: If your bill due dates hit at an inconvenient time—say, before your paycheck is deposited—you can call and ask your creditor to change your due dates.

7. Make frequent payments

Instead of making one large payment when your monthly bill is due, making multiple smaller payments each month can help keep your credit balances low. This can result in a lower credit utilization and, in turn, a lift to your credit score.

- Pay twice a month: Try making two smaller payments throughout the month (or every two weeks) rather than letting your balance build toward the payment due date.

- See where you can cut spending and put extra funds toward micropayments: Finding room in your budget to cut back on spending can make frequent payments throughout the month more feasible. Consider tightening your spending and putting the funds toward your credit balance instead.

8. Raise your credit limit

As mentioned above, lowering your credit utilization is an important strategy when it comes to raising your credit score, and increasing your credit limit is one way to do it. Increasing your credit limit while keeping your credit balance the same instantly lowers your credit utilization, and in turn improves your credit score.

- Avoid this strategy if you’re prone to overspending: If your spending goes up once your credit limits increase, it defeats the purpose of this strategy and can actually leave you worse off than before.

- Ask if you can raise your credit limit without a hard inquiry: Contact your credit card issuer to see if you can avoid a hard inquiry when raising your credit limits to avoid a resulting drop in your credit score.

Keep in mind there’s no guarantee that your credit issuer will approve your request to increase your credit limit. You’re more likely to be approved if you have a healthy credit history and a good relationship with your issuer. If you’ve recently missed payments, your chances may be slim.

9. Pay down revolving account balances

Even if you consistently pay your bills on time every month, keeping a high balance on revolving credit accounts can inflate your credit utilization rate and damage your score. Revolving accounts include credit cards and lines of credit, and keeping balances low can boost your credit score.

- Pay down the highest-balance credit cards first: You have a credit utilization ratio for your overall credit activity as well as one for each credit card. If you have a card with a higher utilization rate than the other, pay down the card with the higher balance first to achieve a lower utilization rate overall.

- Aim for a credit utilization of 10 percent: While the recommended utilization rate is 30 percent, aiming for 10 percent or less can boost your credit score more quickly.

10. Mix up your credit accounts

Your credit mix is the combination of the different types of accounts you have. It accounts for a smaller percentage of your credit score—just 10 percent—but lenders prefer to see a mix of credit accounts or loans in your portfolio rather than a single type alone.

- Add new account types to your portfolio: If you have only credit cards or only loans, you can improve your credit score by adding a new account type to the mix. This includes both revolving credit accounts like credit cards, and installment loans like mortgages, auto loans or student loans.

- Open and manage new accounts responsibly: While mixing up your credit accounts can help boost your score, this strategy can do more harm than good if you don’t also use those new accounts responsibly.

How can I increase my credit score fast?

If you’re wondering how to increase your credit score fast, you should know the process isn’t generally a quick one. It can take a year or more of good, consistent credit-building habits before you see your score increase. However, the answer also depends on what your current score is and what caused it to drop in the first place.

Someone with a lower credit score might see quicker improvements than someone with a strong score trying to improve it further. A commitment to paying your bills on time and keeping your credit card balances low can boost your score in as little as 30 days (credit issuers report your account activity to the credit bureaus every 30 days). Ultimately, time is one of the most important factors in seeing improvements to your score.

How can I build credit from scratch?

If you’ve never had a credit card or loan before, you may be looking to start building credit from scratch. In this case, many of the strategies above will still apply: making steady, on-time payments over a long period of time is the best way to establish healthy credit. However, there are other ways beginner borrowers can start establishing credit as well.

- Choose the credit type that best fits your needs: This might be a secured credit card (where your initial deposit is your line of credit) or a student card (which offers low interest rates and small credit limits). These types of credit accounts are great for establishing yourself as a borrower with minimal risk.

- Become an authorized user: By asking a friend or family member to allow you to become an authorized user on their credit card, you can leverage their established credit to help boost your own. Their credit standing will reflect positively on your own credit account, so long as they maintain responsible credit habits.

- Apply for a credit-building loan: Credit-building loans are great for safely building up your credit. With this type of loan, the lender deposits the loan funds into a secured account that you repay in increments—this method is especially safe if you pick a dollar amount you know you can reach easily.

While these strategies are a great place to start raising your credit score, they aren’t a guarantee of improvement. Your credit report and score are dynamic. For example, even if you lower your balance to zero, but incurred a late mortgage or rent payment to do that, your score may stay the same or get worse.

The good news is you don’t have to figure it out alone. Instead of panicking, enlist the services of a professional credit repair advisor. They can help you create and execute a foolproof game plan for raising your credit score and keeping it high.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263