Disclosure regarding our editorial content standards.

You can buy a house with as low as a 500 FICO® credit score. Your credit score determines the type of loan you can qualify for as well as your interest rate and mortgage payment. Higher scores give you more opportunities and cheaper rates.

Since the end of the eviction moratorium from COVID-19, median rents have crossed over $2,000 per month nationwide according to NPR. With Redfin reporting rents for apartments rising 15 percent year over year, many people are looking to buy a home.

But what kind of credit score do you need to buy a house? If you have a low credit score, you may be concerned that you can’t be approved for a home loan, but we’re here to show you how that’s not the case. We’re going to explain how you can get financed for a home loan with a credit score as low as 500.

In addition to your credit score, knowing what mortgage lenders look for can make the process a lot less stressful. Here, you’ll learn what a good credit score to buy a house looks like as well as the different types of loans you can qualify for. By the time you finish reading, you’ll see how you can stop worrying about the rising costs of rent and purchase a home.

What is a good credit score to buy a house?

You can get a house with a score as low as 500, but this is different from what’s considered a “good” credit score. We wish we could give you a straight answer, but in reality, the required credit score to get approved for a home loan is based on numerous factors, including:

- The lender you choose

- The types of loan you’re aiming for

- Your overall financial well-being

It’s pretty typical that when you’re shopping around for a mortgage, you want the best interest rate—i.e., the lowest. There are differences in how your score will impact your rate, which we’ll cover below.

What is the minimum credit score to buy a house by loan type?

If you’ve looked into buying a house, you already know there are lots of mortgage loan options. Don’t panic, though! We’ll go over the basics of each, including the minimum credit score needed. Note that most lenders use your FICO score when gauging your creditworthiness.

| Loan Type | Minimum FICO Score |

|---|---|

| FHA | 500 |

| Conventional | 620 |

| VA | 640 |

| USDA | 640 |

| Jumbo | 720 |

Here are the different types of loans and the minimum score needed:

FHA loan

Minimum credit score needed: 500

If you have a low credit score or are a first-time home buyer, your best option may be a Federal Housing Administration loan, also known as an FHA loan. With a score between 500 and 579, you’ll need to make a 10 percent down payment; if you have a score of 580 or better, you may be allowed a down payment of only 3.5 percent.

Keep in mind that a lower score will likely cause lenders to be more cautious of approving your loan application. For example, if your score has suffered due to accounts in collections or unpaid accounts, lenders may have more restrictions in place for you. Keep this in mind as you shop around.

Conventional loan

Minimum credit score needed: 620

Conventional loans are offered by most lenders and are a great option if you have strong credit. This type of mortgage isn’t backed by a government agency, like the Department of Veterans Affairs (more on this below). These loans align with the down payment and income requirements set by the Federal Housing Finance Administration (FHFA). A 620 is the minimum needed, but a 640 is slightly better.

Although a 640 is a good credit score to buy a house with a conventional loan, you’ll get the best interest rate if your score is over 740. Depending on your income and the size of the loan you need, you may have a down payment that’s as low as 3 percent; however, a larger down payment is more likely to get you a lower rate.

VA loan

Minimum credit score needed: 640

A VA loan is insured by the Department of Veterans Affairs, and technically, it doesn’t have a minimum credit score requirement. You must be a veteran, an active-duty member of the military or an eligible spouse in order to qualify.

The credit score requirements vary from lender to lender, with an average of around 640.

USDA loan

Minimum credit score needed: 640

USDA loans, insured by the U.S. Department of Agriculture, are similar to VA loans in that they don’t have a set minimum credit score requirement. Again, lenders can dictate their own minimums, but they typically hover around 640.

Jumbo loan

Minimum credit score needed: 700

Typically for expensive properties over $647,000, jumbo loans are riskier for lenders because Fannie Mae and Freddie Mac don’t guarantee them or protect lenders if the borrower defaults. Lenders require a higher credit score and down payment to compensate for this risk.

What else do lenders look at for mortgage loans?

If you’re trying to buy a house, it’s important to know that lenders look at more than just your score. There are other areas you can focus on to help improve your chances of getting that home loan.

Income

Potential lenders are going to look at your current income to make sure you’ll be able to pay your monthly mortgage. Proof of income will often include work history and pay stubs or bank statements.

If you don’t make enough money to afford your monthly payments and don’t have a backup plan in the form of savings (just in case you lose your job) they’ll see you as a high-risk borrower. You may still be approved, but with a higher rate.

They also want to make sure that you have a stable income stream. While it’s not the most important aspect they look at, being employed at the same company or within the same industry for at least two years will work in your favor.

If you are self-employed or run your own business, the lender may have additional requirements. Sometimes, they’ll request additional financial information showing that you have access to larger sums of money through your savings account, retirement fund or stock portfolio. Lenders do this because income can fluctuate when you’re your own boss, so they see it as potentially high risk.

Debt-to-income ratio

Lenders also want to know you’re a responsible borrower and don’t stretch yourself too thin. Your debt-to-income (DTI) ratio is a strong indicator of this—if you routinely spend more than you make, they’ll view this as a red flag.

Loan-to-value ratio

Your down payment has a lot of power to work in your favor. If you offer a larger down payment, lenders will see you as a more responsible candidate since you’ll be making a bigger investment. This plays into your loan-to-value (LTV) ratio.

The LTV ratio is the amount of the loan divided by the purchase price of the home. This is another assessment lenders use to determine how risky a mortgage will be for a borrower. A high LTV can be considered risky, but you can reduce your LTV ratio by putting down a larger down payment when taking out a mortgage loan.

For example, if you purchase a home at $250,000 and take out a mortgage loan for $220,000, your LTV would be 88 percent. However, if you put down $50,000 instead, bringing your mortgage loan to $200,000, your LTV becomes 80 percent.

LTV requirements vary from lender to lender, but it’s generally best to keep your LTV at 80 percent or below for best approval odds.

Savings

As previously mentioned, the lender may ask to see your savings account if you’re self-employed or a business owner. Even if you have a traditional job, they may still want to see what your savings account looks like. During the length of a home loan, the economy changes and people lose their jobs. Having a savings account with at least two or three months’ worth of mortgage payments helps the lender feel more assured that you can make your payments after an unforeseen event.

Employment history

Asking for your employment history is less common, but it’s helpful to be prepared. Lenders looking at your employment history likely want to see that you have a steady job. For example, someone who works seasonally or in a volatile industry may be considered riskier than someone who has had the same job for multiple years.

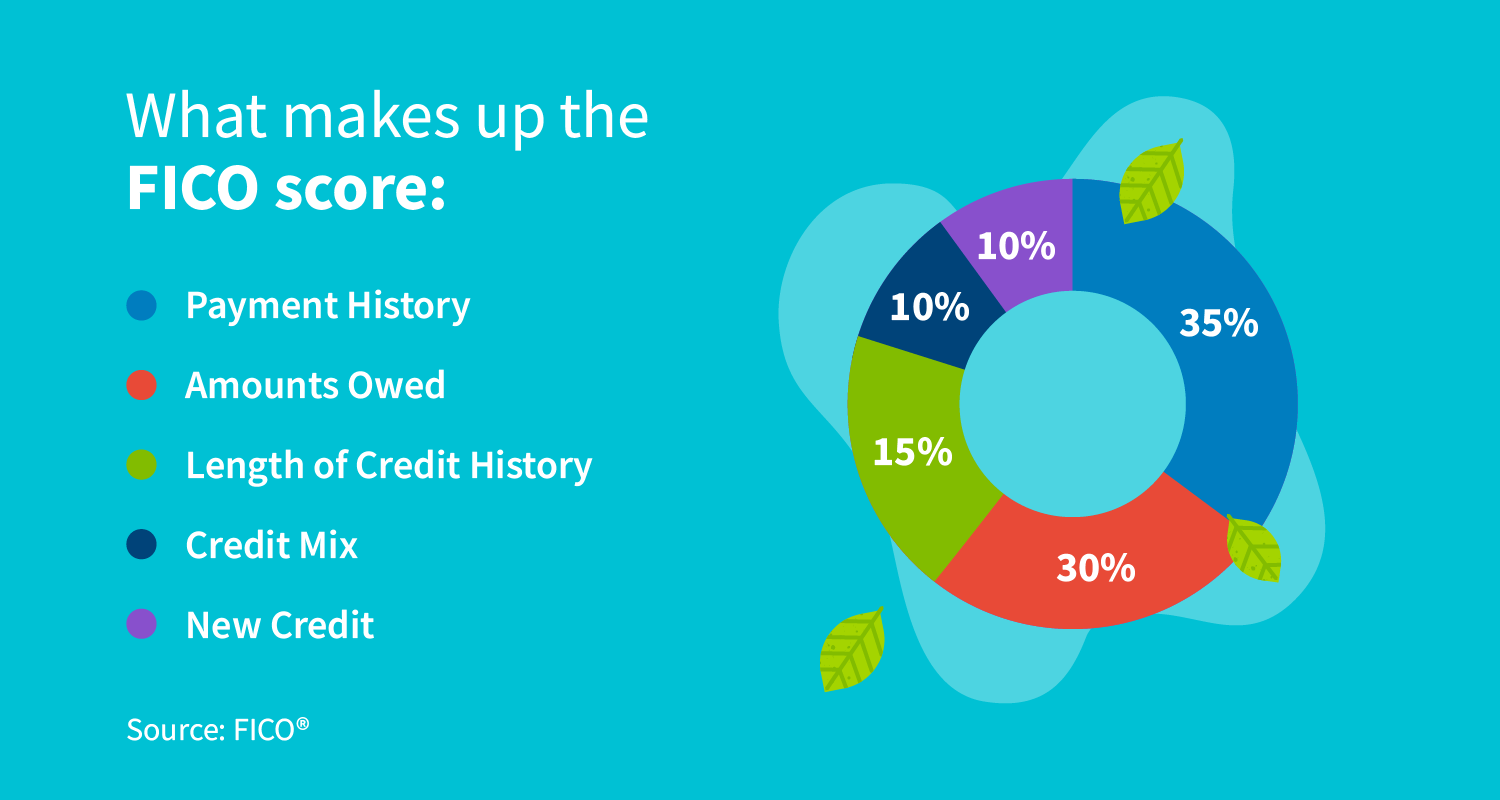

How is a credit score calculated?

Understanding how your credit score is calculated will help you better understand how to improve it. Since mortgage loan lenders typically use your FICO score to gauge your creditworthiness, that’s what we’ll cover here.

Your FICO score is made up of the following elements:

- Payment history (35 percent): Paying your bills on time is the most important factor that affects your credit score.

- Credit utilization (30 percent): It’s best practice to keep your credit usage on individual credit cards under 30 percent. The lower utilization the better.

- Length of credit history (15 percent): Longer credit histories are stronger than newly established ones. While this isn’t the biggest factor to affect your score, it’s important for building trust with lenders.

- Credit mix (10 percent): FICO scores take into account your credit mix including credit cards, installment loans, student loans, auto loans and other mortgage loans.

- New credit (10 percent): Opening new accounts temporarily lowers your credit score, so it’s important to make sure you’re not opening several credit accounts in a short period of time.

If you’re lacking in any of these areas or looking for ways to boost your score, improving the above-listed scoring factors is a great place to start.

How to improve your credit score when buying a home

It’s possible to get a mortgage loan with bad credit, but you’ll likely have a hard time getting a low interest rate. Plus, your overall loan options may be more limited. It’s best to focus on improving your credit before applying for a loan to give yourself the best chance possible.

Here are some things to keep in mind when you’re trying to buy a home:

- Regularly check your credit report and dispute errors

- Pay your bills on time and in full

- Pay off outstanding debts

- Don’t open new credit cards

- Don’t close paid-off credit cards

- Create a budget and stick to it

- Shop around for various lenders and loan types that fit your needs

Do you need to help with your credit health?

Credit health isn’t a one-and-done practice—it’s a lifelong journey that can help you in many aspects of your life. If you’re stuck when it comes to getting your credit health back on track, credit education and credit repair resources can help you.

Here at CreditRepair.com, we specialize in helping people repair their credit and make sure they know what it takes to maintain good credit. With the help of our credit repair specialists, you’ll be closer to your goal of reaching a good credit score to buy a house. If you have questions about how our process works, contact us today.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263