How to Get a Business Loan With Bad Credit in 6 Steps + Helpful Tips

Disclosure regarding our editorial content standards.

You never know when you’ll stumble upon an opportunity for a new business venture and need a loan. You may even need a loan to keep your business afloat. In fact, 82% of businesses fail due to lack of money. Having bad credit (which is typically a score under 670) can make securing a loan from a reputable lender challenging—but it’s not impossible. Following these steps can help you secure a business loan:

- Review your credit score and report

- Research different lending options

- Familiarize yourself with the borrowing requirements

- Consider having a cosigner

- Make a business plan if you don’t already have one

- Be ready to provide your lender with collateral

Read on to learn how to get a business loan with bad credit and other tips to make the process of securing a loan easier.

1. Review Your Credit Score and Report

Checking your personal credit score and your business credit score will tell you where you stand on the financial health scale and can help you determine which types of loans you could qualify for. Getting copies of your credit reports can also be beneficial as you can review the reports and dispute any errors or mistakes, which could help your score recover.

If your score is less than 670, you may also want to consider improving your score before applying for a loan. Your credit score doesn’t need to be perfect to secure a loan, but it will impact the amount that you are approved for and the interest rates on your loan. The higher your score, the better these rates will be.

The journey to improve your credit score may take some time, but some of the easiest steps to take include paying down your debts, avoiding late payments and decreasing your credit utilization ratio. If you move forward with your loan when you have a bad credit score, you can still work toward improving your score so that future loans or new lines of credit for your business are easier to obtain in the future.

2. Research Different Lending Options

Every time you fill out and submit a loan application for your business, a hard inquiry will be filed to your credit report and may negatively affect your score. That said, it’s best to do the research on potential lenders up front and review your options before submitting a business loan application.

Search for business loans that will give you the amount of money you need and have the repayment terms that work best for you. If you have a bad credit score, there are several different types of business loans that you can choose from, so you don’t need to commit to the first loan option you see.

3. Familiarize Yourself With the Borrowing Requirements

Once you’ve identified the type of business loan you’d like and the amount you want to borrow, take a look at the borrowing requirements that come with the loan. Each lender has their own minimum qualifications and requirements when it comes to lending someone money.

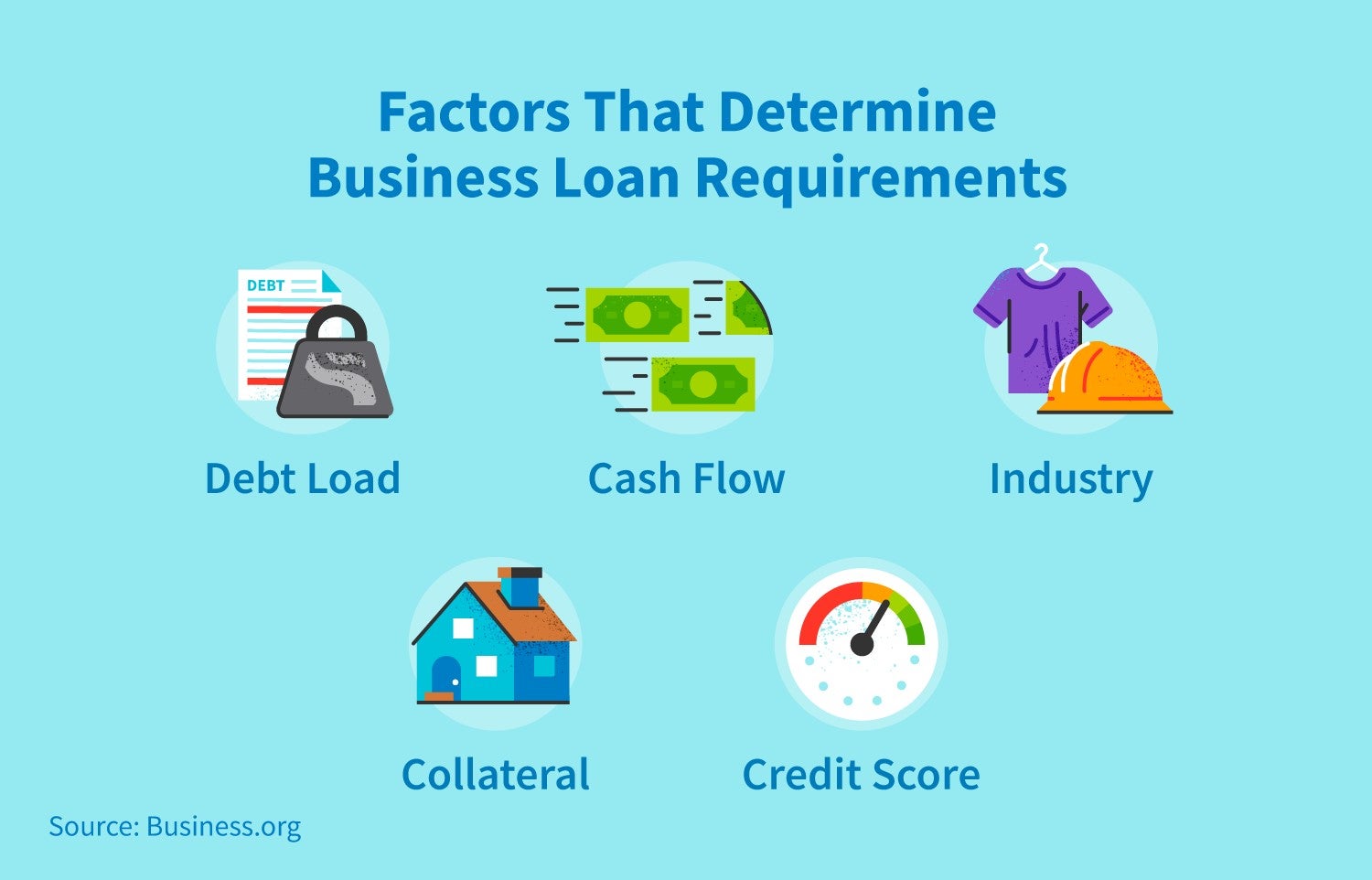

These are six of the factors that will determine your borrowing requirements and your ability to secure a business loan: how long your business has been operational, debt load, cash flow, industry, collateral and your credit score. Research your desired lender’s borrowing requirements and ensure that you’re able to meet these requirements before applying for a business loan.

If you're unable to meet their requirements, research other lenders until you find one that fits your needs, as each one will have different minimum requirements.

4. Consider Having a Cosigner

If you have bad credit, finding a cosigner can help you secure a business loan. A cosigner is required to take on payments if you’re unable to pay back the loan, so it’s important to make sure that they’re comfortable with this responsibility. Having a cosigner with a high credit score can also help boost your chances of getting a business loan if you have bad credit.

5. Make a Business Plan If You Don’t Already Have One

During the loan application process, some lenders may ask you for a business plan. Outlining monthly revenue goals and how you plan to use the loan may help convince a lender that they’re making a smart decision by investing in you—and that you’re not a financial risk. Additionally, having a well-thought-out business plan can help you manage your money better, preventing you from needing a loan in the future.

6. Be Ready to Provide Your Lender With Collateral

Providing collateral can help increase your chances of securing a business loan, especially if you’re worried about your creditworthiness. By putting up collateral, you're telling a lender that if you can’t repay the loan, they can take your collateral as payment. Pledging liquid assets or future earnings may help you get your desired business loan.

Business Loan Options for Those With Bad Credit

If you’re looking for a business loan and you have bad credit, the good news is that there are several different types of loan options available for you to choose from.

Short-Term Loan

A short-term business loan is offered by both traditional and alternative lenders and generally has terms from six to 24 months. Short-term loans typically have a specific payment schedule—lenders may even automatically withdraw payments from your business’s bank balance daily, weekly or monthly.

Short-Term Line of Credit

Similar to short-term loans, these loans require repayment over a short period of time, but they offer an approved amount of credit—like a credit card. Short-term lines of credit are common when business owners need working capital to pay for things like equipment, inventory or payroll. With a short-term line of credit, the borrower is only charged interest on the open balance or only the amount of money that you have borrowed.

Collateralized Loan

With a collateralized loan, also commonly known as a secured business loan, you put up collateral and give the lender the right to seize it to pay back your loan if you’re unable to. The collateral can not only make the borrower more invested in repaying the loan, but it can also put a lender more at ease.

Merchant Cash Advances

A merchant cash advance offers quick capital in exchange for a percentage of future earnings from credit and debit card sales. This can be beneficial for those who accept a high volume of credit or debit card payments. However, these loans have higher interest rates compared to other types of bad credit loans.

Working Capital Loans

A working capital loan is used to finance business operations like wages, taxes, inventory and other things that keep your business going. These loans are used to pay short-term operational needs and can’t be used to pay for investments or other long-term assets.

Microloans

If you’re in need of a small loan (less than $50,000), a microloan might be a good option to consider since most large banks do not want to lend small amounts of money. Microloans can be financed by a nonprofit organization or government agencies and may come with restrictions on how you can use them.

Where to Get Small Business Loans With Bad Credit

Kabbage

If you have bad credit, Kabbage is a great lender option for a line of credit because they do not have a minimum credit score requirement to apply as they review your business performance instead.

One requirement that they do have is that your business bring in at in annual revenue for at least a year. Filling out the application online is simple, and if you’re approved, you can get your loan in just a few days. Loan terms range from six to 18 months.

Fundbox

If you’re worried about meeting requirements, Fundbox may be a good option to consider getting a business loan from. This lender does not have a minimum credit score or minimum annual revenue requirement that they require businesses to meet before applying for a loan.

Fundbox calculates the value of your invoices and takes your ability to repay the loan into consideration when reviewing your application. This may take up to three business days.

OnDeck

OnDeck offers both term loans (up to $250,000) and lines of credit with fixed interest rates. Unlike the lenders above, OnDeck does have a minimum credit score requirement of 600 to get a term loan or a line of credit. They also require businesses to make a minimum annual revenue of $100,000.

BlueVine

BlueVine offers a number of loan types from lines of credit and term loans to invoice financing. While they are more lenient than other lenders for individuals who lack collateral, have poor credit and or have unpaid invoices, they do have other requirements. To qualify, you must have a credit score of 530 or higher. Your business will also need a minimum of $120,000 in annual revenue.

StreetShares

If you’re a fairly new business (at least a year old) with a lower annual income, you may consider StreetShares for a loan. While you only need a minimum annual income of $25,000, you will need a credit score of at least 600 to qualify.

Funding Circle

Funding Circle offers fixed-rate loan terms with no minimum annual revenue requirement. However, they do have a higher credit score requirement of 680 or greater. Additionally you must be in business for at least three years to qualify. Loan terms can extend up to 10 years.

What Is the Minimum Credit Score for a Business Loan?

Each lender creates their own minimum credit score requirement to secure a business loan, but a general rule of thumb is that you’ll need a personal score greater than 650. Anything less may mean that you won’t find a lender at larger banks. You can find out what a lender’s minimum credit requirements are by visiting their website.

While having a bad credit score can impact your ability to secure a loan or have high interest rates, many lenders are still willing to offer business owners some money. However, it’s important to take the necessary steps outlined above to ensure you’re able to meet the borrowing requirements, handle the rates and convince a lender that you’re not a financial risk, despite your less-than-stellar credit health. Even if you’re approved for a business loan, it’s best to still work on improving your credit score so that borrowing will be easier in the future.

We have the tools to help you fix your credit.

learn moreRelated Articles

FICO and “The score lenders use” are trademarks or registered trademarks of Fair Isaac Corporation in the United States and other countries.

** Your results will vary