Disclosure regarding our editorial content standards.

Credit scores usually update every 30 to 45 days. However, this frequency may vary depending on your lenders and financial behavior.

Whether you’ve paid off a big debt, settled a loan or kept your credit utilization in check, you’re making all the right money moves—but when will your efforts be reflected on your credit score?

Your credit scores are essential for lenders to determine whether or not to approve your financial requests, but it takes time to accurately calculate and update your scores. We’ll cover how often credit scores get updated and the financial decisions that impact your score the most.

How often do credit scores update?

Credit scores are typically updated every 30 to 45 days, but the frequency can vary based on your unique financial situation.

In order for your credit score to change, your lenders must provide information to the three major credit bureaus—Experian®, TransUnion® and Equifax®—to first update your credit report.

However, the date they send this information will be determined by each individual lender. That means one lender can send your data to Experian today, another to TransUnion next week, and then to Equifax the following week, resulting in constant variations to your credit scores.

The bureaus use the information on your credit and borrowing history to make reports that summarize your overall financial health. Credit reports include:

- Personal information

- Account history

- Credit inquiries

- Public records

The bureaus then sell these personalized reports to your potential lenders, helping them decide whether or not to approve your financial requests. Keep in mind credit reporting is voluntary—lenders are not required to deliver your information to bureaus, or may only report to one or two. Lenders that report typically do so at the end of each of your billing cycles.

Updates to your credit score can have a huge impact on your big financial plans, so it’s important to understand how your score is doing.

What causes my credit score to update?

Any changes to your credit report will affect your credit score. Your credit score determines whether you’re eligible for new lines of credit, such as applying for a credit card, purchasing a home or leasing a car. Lenders want to see you’re capable of paying your bills on time, so your score reflects your past financial behaviors.

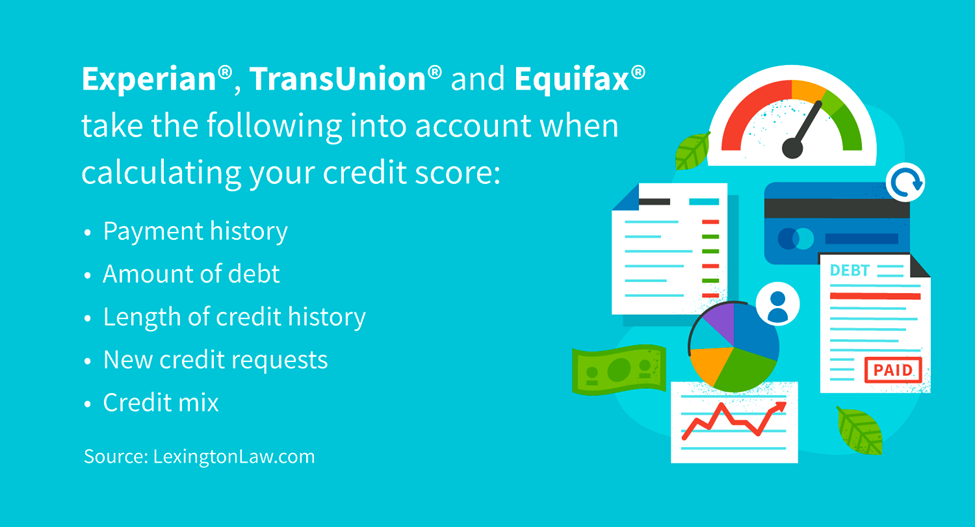

The main factors that affect your credit scores are:

- Payment history (35 percent), including both on-time and late payments.

- Amount of debt (30 percent), including loans, credit cards, etc.

- Length of credit history (15 percent), or how long you’ve been using credit.

- New requests (10 percent), including both soft and hard inquiries.

- Credit mix (10 percent), which refers to the various types of credit you have.

Note: The associated percentages reflect the weighted importance of each factor on your credit score.

Actions that indicate a sudden change in your credit habits can also have an impact on your score.

Let’s say you’ve spent the past five years building your credit: you keep your credit utilization low, you pay off credit card bills on time and consistently and you have a healthy mix of credit. Then you close a few credit cards, you pay off a few loans and you apply for a mortgage—your credit mix then shrinks, and you have a new hard inquiry. Such actions can cause your score to change, and they’re also reflected on your next credit report update.

What is rapid rescoring?

Credit lenders typically wait until the end of your billing cycle to share your information with the credit bureaus, but there is no set date for when they must report this data. If you’ve been making all the right moves but are still a few points behind qualifying for a better interest rate on a mortgage or loan, you can request a rapid rescore from your mortgage lender to quickly update your score.

Your lender would need to submit proof of recent data that hasn’t been added to your credit report. By paying a fee to the bureaus, the lender can guarantee that the change to your report will be expedited.

Keep in mind that rapid rescoring isn’t meant to erase bad credit or fix past mistakes on your credit report. A rapid rescore comes in handy if there’s an opportunity to make a quick fix in improving your score, or if there’s an external mistake on your report that proves to be inaccurate.

Credit score updates: key takeaways

- Credit scores usually update every 30-45 days, but this can vary depending on your financial situation.

- Lenders decide if and when they report information to the credit bureaus—if a lender does share information, it’s typically at the end of your billing cycle.

- You can request to have your credit score updated sooner with rapid rescoring.

FAQs

Desperately waiting for your credit score to increase? We gathered some of the most frequently asked credit score update questions to help you plan your next big money move.

Does your credit score change every seven days?

Your credit scores change when your credit report updates, which typically occurs every 30 to 45 days. However, your FICO, Equifax and TransUnion credit scores can all update on different dates—you could have your FICO score change today and your TransUnion score update next week.

What day of the month does your credit score update?

Lenders that choose to report to the bureaus typically do so at the end of your billing cycle, but the exact day of the month may be different for each provider. There’s no set date for your credit score to change.

How long does it take for your credit score to update after paying off debt?

Your credit score is typically updated every 30 to 45 days if your lender sends your financial information to one or more of the credit bureaus. You can expect it to take a month or two to see your credit score update after paying off a debt.

How quickly can I raise my credit score?

It can take years to build your credit, but there are a few ways to improve it relatively fast. Of course, how quickly you’ll be able to raise your score will depend on your unique financial situation. If time is of the essence, here are a few general steps you can take to get your score where you need it:

- Pay down your revolving credit balances

- Pay more than your minimum payment each month

- Increase your credit limit

- Keep credit utilization low

- Check your credit report for errors

- Remove negative entries that are paid off from your credit report

- Monitor your credit score

Knowing how often your credit report updates is crucial when it comes time to make a big financial decision. If you need help working towards your credit goals, consider reaching out to CreditRepair.com for professional support and a personalized credit solution.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263