A contactless credit card allows you to make payments by hovering your credit card over a compatible card reader using RFID and NFC technology. It doesn’t require a PIN or signature, which speeds up the transaction process.

A contactless credit card looks and functions much like a classic credit card, with one big difference. Instead of swiping your card or inserting a chip to make a purchase, you wave or tap it on a sensor—and just like that, your transaction is completed.

First introduced in 2015, contactless credit cards have been a welcome addition to wallets everywhere, especially for those looking to reduce unnecessary contact with surfaces and card readers. In fact, between May 2020 and 2021, more than 80 percent of U.S. consumers used contactless payments, according to a study conducted by Raydiant.

But before you sign up for one, it’s important to be fully informed on contactless credit cards and their pros and cons.

Table of contents:

- What is a contactless credit card?

- How do contactless credit cards work?

- Benefits of contactless credit cards

- Disadvantages of contactless credit cards

- Banks that offer contactless cards

- Contactless credit card FAQ

What is a contactless credit card?

Contactless cards come equipped with technology that allows you to complete transactions by simply holding or tapping your card on a card reader. They work similarly to mobile wallets like Apple Pay, except instead of using your mobile device to pay, you use your credit or debit card.

They’ve been popular overseas for a while but have only recently gained traction in the U.S. It’s no wonder why, as these cards save time that would otherwise be spent fiddling with cash or inserting and re-inserting a card into a reader.

How do contactless credit cards work?

A contactless credit card might sound like it works like a magic wand, but the inner workings are a bit more technical.

Contactless credit cards use radio frequency identification (RFID) technology and near-field communication (NFC) to emit short-term radio waves through a small built-in chip. A contactless credit card reader picks up these waves, completing the transaction and charging your account. This is why contactless cards are sometimes referred to as RFID cards or RFID chip credit cards.

Though “tap to pay” is a common phrase used to describe contactless credit card readers, there’s actually no tapping necessary—customers can simply hover their card a few inches above the reader for it to process their payment.

Now that you know contactless credit cards run on more than faith, trust and pixie dust, you might be wondering how exactly to use one.

How to use “tap to pay” cards

To complete a purchase using a contactless credit card, you’ll need two things:

- Contactless credit card

- Contactless credit card reader

You can tell a contactless credit or debit card from a regular one if it has a small symbol, similar to a sideways WiFi triangle. The card readers also have this mark, so you can quickly tell if a reader accepts contactless cards.

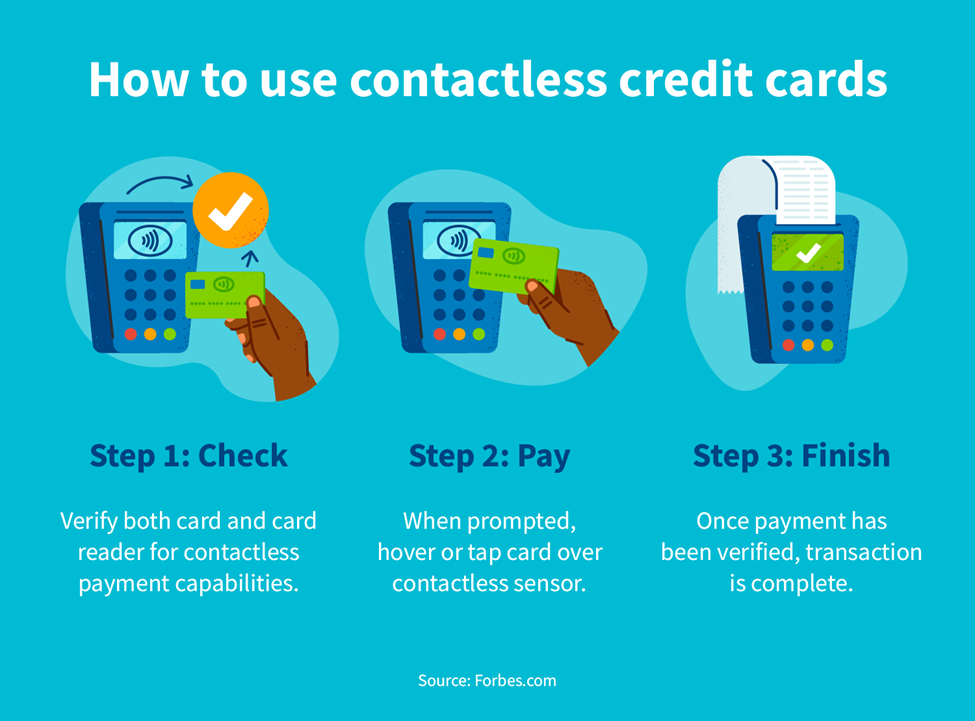

Using a contactless credit card is as easy as 1, 2, 3:

- Step 1: Check if the card and card reader have contactless capabilities.

- Step 2: Hover or tap the card on the contactless sensor.

- Step 3: Finish the transaction — no PIN or signature required.

Are contactless credit cards safe?

Safety is one of the biggest concerns surrounding contactless credit cards. Since it’s impossible to verify them with signatures or a PIN, many contactless card users worry about theft.

Though no credit card is immune to risk, contactless credit card companies have taken several steps to make sure users feel confident that their funds are safe. If your card is stolen, your credit card company’s fraud protection should cover any fraudulent charges.

There’s also a one-time code created for each individual transaction made by these cards. Similar to the technology in credit card chips, these encrypted codes are transmitted from your card to the card reader with your unique account number when you pay. What’s not transmitted is your name, billing address or card verification code.

Unlike “skimming,” where the magnetic stripe on your credit card can be replicated after a swipe, it’s near impossible for hackers to replicate this algorithm. Each code transmitted during a contactless credit card transaction is wholly unique, so you can “tap to pay” away knowing your information is safe.

As secure as contactless credit cards are, no credit card is entirely immune to fraud or theft. Here are some additional security tips to make sure your money stays safe.

- Check your account often and report any fraudulent transactions immediately.

- Keep your account information private and secure.

- Report lost cards as soon as possible.

- Keep your information updated to keep bills or other account information out of the wrong hands.

Benefits of contactless credit cards

In addition to the hefty security measures that credit card companies place on contactless credit cards, there are several benefits that come with adding these cards to your wallet. Speed and ease of use, reduced wear and tear and overseas functionality are just a few reasons more people are signing up.

1. Speed and ease of use

One of the biggest selling points of contactless credit cards is how easy they are to use. How many times has a quick checkout turned into a painfully long one due to chip reader issues, swipes not processing or worse?

With a contactless credit card, you won’t hear the dreaded beep of a failed chip insertion or have a five-minute shopping trip turn into a 15-minute one. Checking out with these cards only requires a quick contactless motion, with a user experience so easy a child could do it—though you should think twice before handing your card to your three-year-old niece.

2. Reduced wear and tear

We’ve all been there: Standing in the checkout line eyeing your credit card’s scrapes and dents, hoping it’ll swipe. At the end of the day, credit cards are pieces of plastic that are susceptible to wear and tear. Enter contactless credit cards.

Considering that these cards don’t need to be swiped or inserted anywhere, contactless credit cards tend to last longer and stay in better shape than other cards.

In addition, a card that doesn’t get swiped doesn’t come into contact with surfaces or other people’s germs. This is a big benefit for the immunocompromised or those who just want to reduce their exposure to germs.

3. Best for overseas travel

Another benefit of contactless credit cards is their prevalence world-wide—most notably in Canada, Australia and Europe. This makes international travel easier, as you can pack just one card knowing most vendors will accept it. Since PIN, credit and debit technology can vary across different countries, this payment method is especially useful.

Disadvantages of contactless credit cards

Contactless credit cards can make the checkout process a breeze, but no credit card is without drawbacks. From possible security risks to their lack of universal acceptance, here are some of the cons you should be aware of.

1. Security risks

As previously discussed, one of the biggest questions customers have before signing up for a contactless credit card is about security. While contactless credit cards are virtually impossible to hack, they aren’t risk-free. Since they don’t require a PIN or signature, there’s no way to verify your identity when using these cards.

To counteract this security threat, many credit card companies limit how much you can spend with a contactless credit card in one transaction. However, these companies can suspend that limit when customers need to make high-dollar purchases due to outside matters such as extreme weather or a health crisis. If you have a contactless card, follow credit card security measures to keep your card and funds from getting stolen.

2. Not universally accepted

Though contactless credit cards are becoming increasingly popular, they aren’t universally accepted yet. Much like when credit card companies first introduced chip technology, some stores and chains haven’t invested in contactless card readers, meaning you’ll need to keep a traditional swipe or insert card in your wallet just in case—more on that shortly.

3. Multiple cards for the same purpose

If you want to sign up for a contactless credit card to replace your traditional swipe or insert cards, you may think you can go ahead and cancel your other cards to save some space in your wallet. But you should think twice before canceling any of your cards, as doing so can damage your credit score and raise your credit utilization ratio.

Cancellation penalties aside, until contactless cards are universally accepted, you should keep cards that use chip and swipe technology in your wallet. For some cardholders, having multiple cards in your wallet that serve virtually the same purpose can be frustrating, take up valuable wallet space and tempt you to spend beyond your means.

Banks that offer contactless cards

Wondering if your bank has hopped on the “tap to pay” train? Here are some major banks that offer cards with contactless capabilities.

- American Express: While not all Amex products are contactless, the bank has a huge number of contactless credit card options. You can also get a tap debit card by opening Amex’s Rewards Checking Account.

- Bank of America: Bank of America just introduced contactless cards in 2019 and now, all its new credit cards have contactless capabilities.

- Capital One: Many of the credit cards that Capital One issues in the U.S. have contactless chips. That said, you should still confirm that the card you want has this capability online or over the phone.

- Chase: Chase currently has upwards of 30 contactless credit card options, all presented on one neat contactless card comparison page.

- Citibank: Select Citibank credit cards are contactless—be sure to contact the bank in advance to confirm that the card you want has this capability.

- Navy Federal: Navy Federal also has contactless debit and credit card options, with its debit card options available to those who open a checking account with the bank.

- Wells Fargo: Wells Fargo issues contactless credit cards to all new credit card customers and existing customers—once their current card expires. As with many other banks, you can get a contactless debit card by opening a Wells Fargo checking account. The bank even offers contactless ATMs where you can tap your debit cards.

Contactless credit card FAQ

Contactless card technology can feel like wizardry, so it’s natural to have questions about how these cards work and how to stay safe when using them. We tackle some common questions below.

How do I know if my card is contactless?

All contactless cards should have a contactless symbol on their front or back. This symbol looks like a WiFi symbol (four curved lines, each bigger than the one before it) rotated on its side.

Where do I tap to pay using a contactless credit card?

To use your contactless card, hold it just above the screen of a compatible card reader. To determine whether a card reader is contactless-compatible, look for the same contactless symbol that’s on your card.

Can I accidentally make a purchase if I’m near a contactless card reader system?

Accidental contactless purchases are possible but very rare and unlikely. RFID and NFC technology require very close proximity for a card reader to process a card’s payment—the card must be a few inches from the screen. That said, keep tabs on where your cards are at all times to reduce the chances of this happening to you.

Contactless credit cards are a great option for those looking for an easy-to-use payment method that reduces contact and speeds up transactions. Like all credit cards, they come with their fair share of pros and cons that users should be aware of before signing up.

No matter what type of credit card you opt for, make sure you manage your credit responsibly by checking your credit report frequently and being proactive about fixing bad credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263