Disclosure regarding our editorial content standards

Purchase APR is the interest rate for a specific purchase that you make with a credit card that isn’t paid in full before the grace period.

One of the most overlooked aspects of responsible credit card usage is the interest rate. It’s easy to start spending while only paying attention to your credit card limit, but it’s recommended to keep interest rates in mind as well. A $1,000 purchase can turn into a $1,200 purchase if you aren’t paying attention to your purchase APR.

Remember, credit cards are borrowed money that need to be paid back to maintain good credit. While you may think that additional interest charges over the course of paying back the loan for a purchase don’t cost much, it adds up when you make other purchases.

Here, you’ll learn the ins and outs of purchase APR as well as how it differs from other interest rates.

What is purchase APR?

APR stands for annual percentage rate, which is the rate of interest you pay each billing cycle on your outstanding balance. Purchase APR is specific to different purchases you make. You’ll have a purchase APR for a certain amount of time, and then you’ll pay your regular interest rate on the purchase.

If you carry a balance on your credit card, which is when you don’t pay your card in full each month, then you’ll pay an interest charge. To entice you to sign up, a credit card company may offer an introductory purchase APR as low as 0 percent.

When using your credit card, each type of use may have a different APR. In addition to purchase APR, some of the different types of APR include:

- Cash advance APR

- Penalty APR

- Balance transfer APR

How purchase APRs work

Your purchase APR can come in a variety of forms depending on your credit card company. For example, you may get a 0 percent interest rate on a purchase for 18 months with one card, but another card may have a rate of 3 percent for the first 21 months.

While the regular APR may be 17 to 25 percent, the purchase APR may be 0 percent. This means that if you pay the purchase off within the set grace period, you’ll only pay the cost of the purchase and not additional interest fees.

Let’s imagine you got a shiny new credit card with 20 percent regular APR but a 0 percent purchase APR for the first 12 months.

You go out and buy yourself a brand-new TV for $1,000. To take advantage of the purchase APR, you pay $85 each month to pay it off within those 12 months. That TV only cost you $1,000.

Now, if you bought that same TV but only paid $40 per month, at the end of that year, you’ve only paid off $480. You still have $520 left to pay, and that $520 now has a 20 percent APR attached to it. If you continued to pay $40 per month, you’d pay an additional $61 in interest charges. Because at $40 per month, it’ll take an additional 15 months to pay that off, resulting in $61 in interest you’ll also have to pay.

What is a good purchase APR?

We’ve talked quite a bit in the examples about purchase APR rates as low as 0 percent, and that’s the best you’ll find. In order to qualify for cards like this, you’ll need a credit score that’s in a decent credit score range. This typically means a credit score of 650 or above.

In addition to a good credit score, you’ll also need a good payment history. Credit card companies want to know that you’re not late on payments if they’re going to offer you a good purchase APR.

What is an introductory purchase APR?

Sometimes, your purchase APR is based on a specific time frame when you first get a credit card, and this is called an introductory rate. The credit card may have a low purchase APR, but during your first year of having the card, there might be a 0 percent interest rate on purchases. For example, the purchase APR may be 3 percent normally, but if paid within the first six months, the introductory purchase APR is 0 percent.

How much does an introductory APR save you?

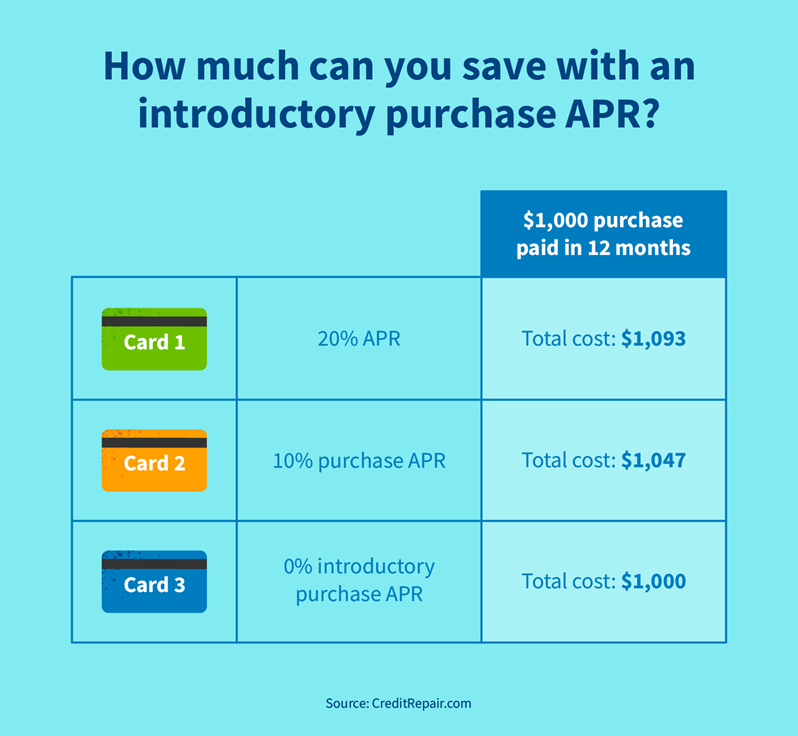

A good introductory APR can save you quite a bit of money, which is more incentive to improve your credit score if you don’t meet the requirements for these types of cards. You really start to notice the difference when you make larger purchases, which can cost you much more in interest.

Imagine you have a credit card with a 20 percent interest rate and a 0 percent introductory APR. This time, you’re buying plane tickets to another country, and it’s going to cost $3,000. Without that 0 percent APR, you’d pay almost an additional $300 if you took 12 months to pay it off. If you paid it off over two years, it’d be almost $600.

So, yes, the introductory APR is a big money saver if you can pay off the purchase within the grace period.

Where do I find the APR after the introductory rate ends?

Finding out when your introductory rate ends involves the never-fun activity of reading the fine print. In order to find it, you can typically log into your credit card company’s website and check the terms and conditions.

It’s also a great idea to always save the paperwork for a credit card in a safe place when you first get it. APRs can change, so this gives you a record of what the APR was when you signed up.

How credit repair can get you the best APR

Now you know how helpful a good purchase APR can be, but how do you get one? Well, it all starts with having a good credit score. When you have a bad credit score, not only is it tough to get a good purchase APR, but your regular interest rates will be higher as well. This is just one of the ways a good credit score can save you money.

If you don’t have ideal credit, allow CreditRepair.com to help. We have a team of credit professionals who have helped hundreds of thousands of people. We provide credit education services to help you fix your credit and maintain healthy credit, so sign up today and begin your credit repair journey.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263