Disclosure regarding our editorial content standards.

A credit limit is the maximum amount of credit (or money) financial institutions offer borrowers. A bank, lender or credit card company determines your limit based on the financial information they have about you. Your credit limit can affect your credit score if you’re using all or close to all of your limit because that means you’re at risk of overspending.

How do credit limits work?

First, the borrower (you) applies for credit. The lender or credit card company will then review your information and determine what your limit will be. Once they set a limit, you are free to borrow up to that limit and follow the lender’s repayment rules.

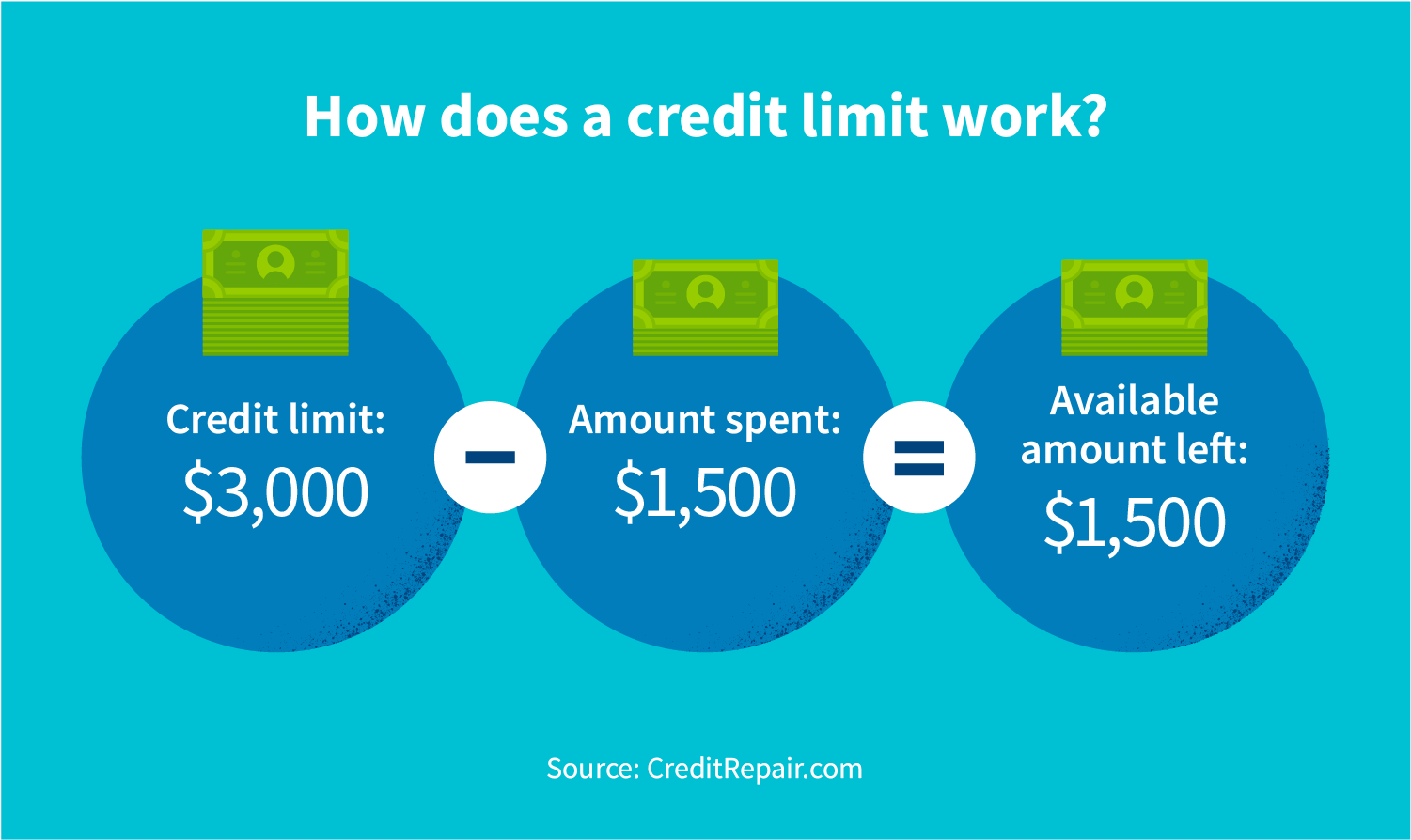

For example, if your limit is $3,000 on a credit card, that’s the maximum amount of borrowed money you have access to. Say you spend $1,500 from that card—you will now have $1,500 left to spend without risk of overspending and being penalized for it. However, remember to take interest rates and fees into consideration as well, since they’re accounted for in your credit limit.

As you begin to obtain and manage credit, it’s good to understand the types of credit available to you:

- Secured Credit

- Uses a cash deposit from the borrower as collateral, which provides you with security if you are unable to make a payment

- The amount you put down is your credit limit

- Unsecured Credit

- The card issuer uses your payment history to prove you’ll pay them back instead of a deposit as long as you’re not considered a high-risk borrower.

- Your credit score, payment history and income determine your credit limit

- Open Credit

- Helps you pay for changing bills like electricity and phone bills

- Doesn’t have a fixed credit limit

What determines your credit limit?

Your current credit score, income, payment history, credit card type and other factors influence your credit limit.

A bank, alternative lender or credit card company will likely issue a high credit limit to you if your credit report proves that you can and will pay back the borrowed amount. In this case, you’re considered a low-risk borrower.

If your credit report shows missed payments, a low credit score or an unstable income, you are considered a high-risk borrower and will probably receive a lower credit limit, if you are approved at all.

What does available credit mean?

Available credit refers to how much a borrower has left to spend. While available credit and a credit limit go hand in hand, they are two different things. A credit limit is the amount given to you, while available credit is the amount left after purchases.

You can calculate your available credit by subtracting purchases and the interest on those purchases from your total credit limit.

Can you go over your credit limit?

Yes, you can go over your credit limit. Typically, the bank declines a transaction that puts you over your limit. However, in rare instances, you may be able to go over your credit limit. You can overspend by a small amount as long as the lender believes that you’re a low-risk borrower who will pay back the amount.

Although you can overspend in some cases, it’s not recommended since you may encounter fees, a decrease on your limit and must have the money to pay off the charge in full. If you’re routinely exceeding your credit limit, the lender can close the account and increase interest rates.

How can you increase your limit?

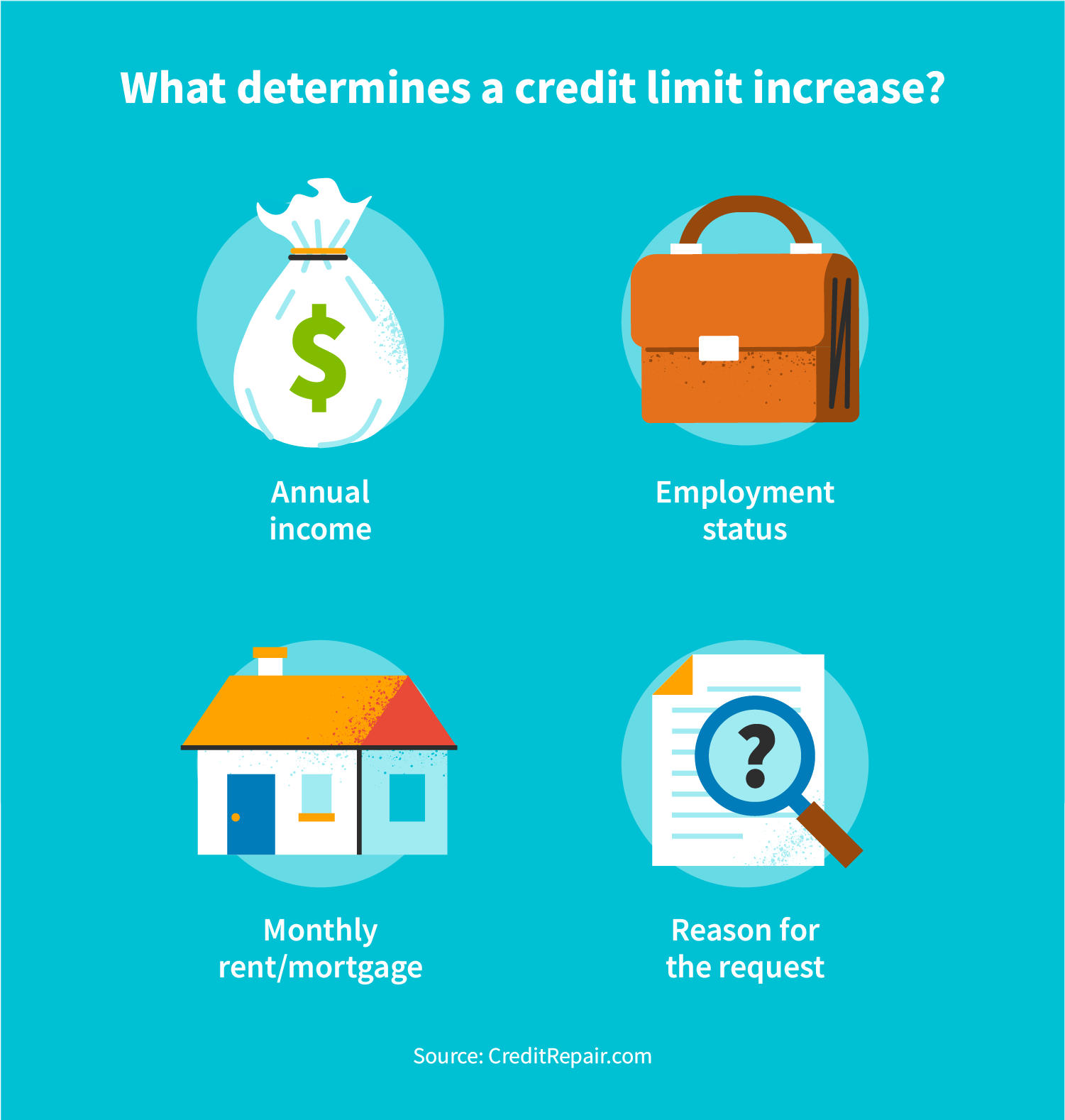

You can increase your credit limit by filing a request with your card issuer. You can typically file the request online and provide your annual income, employment status, monthly rent or mortgage payments and the reason behind the request. However, the exact process for a limit increase can vary, so it’s a good idea to check with your bank, lender or card issuers.

If you’re ready to make a large purchase or you have upcoming annual charges like a rent increase, a credit limit increase can ease potential burdens. It’s important to remember your financial situation and realistic capabilities before requesting an increase, because you will be responsible for making payments on time.

Can lenders change your limit?

Yes, your lender can change your limit, and they can do so without notice due to the parameters in the credit agreement. Credit card issuers analyze how borrowers use their cards and adjust credit limits accordingly.

Your credit limit can increase if you:

- Spend your credit responsibly

- Pay off charges on time

- Receive an increased income

- Are approved an increase

Meanwhile, a reduced credit limit can occur if you:

- Take on more debt

- Miss payments

- Don’t use the credit card

- Have errors on your credit report

- Have your identity stolen

How can I check my credit card limit?

You can check your credit limit through an online bank account, a recent billing statement or a customer service line. While a credit card can assist in larger purchases and compromising financial situations, it’s important to check your credit limit before swiping your card.

Routinely checking your credit limit doesn’t affect your credit score and can prevent overspending. Some rules of thumb for keeping an eye on your credit card limit include:

- Sign up for your bank’s mobile app for an easier view of your credit limit

- Check your limit every time you review a financial statement

- Check your limit before any large purchase

- Check your limit at least once every billing cycle

Credit line vs. credit limit

A credit line is a type of loan where you borrow and repay money on a revolving basis. Meanwhile, a credit limit is the amount of money you can borrow from a lender or credit card company.

Your credit limit is subject to change, but your credit line stays the same because it’s simply the description of the loan. A credit limit is used for credit cards, lines of credit and other credit products.

How does your limit affect your credit score?

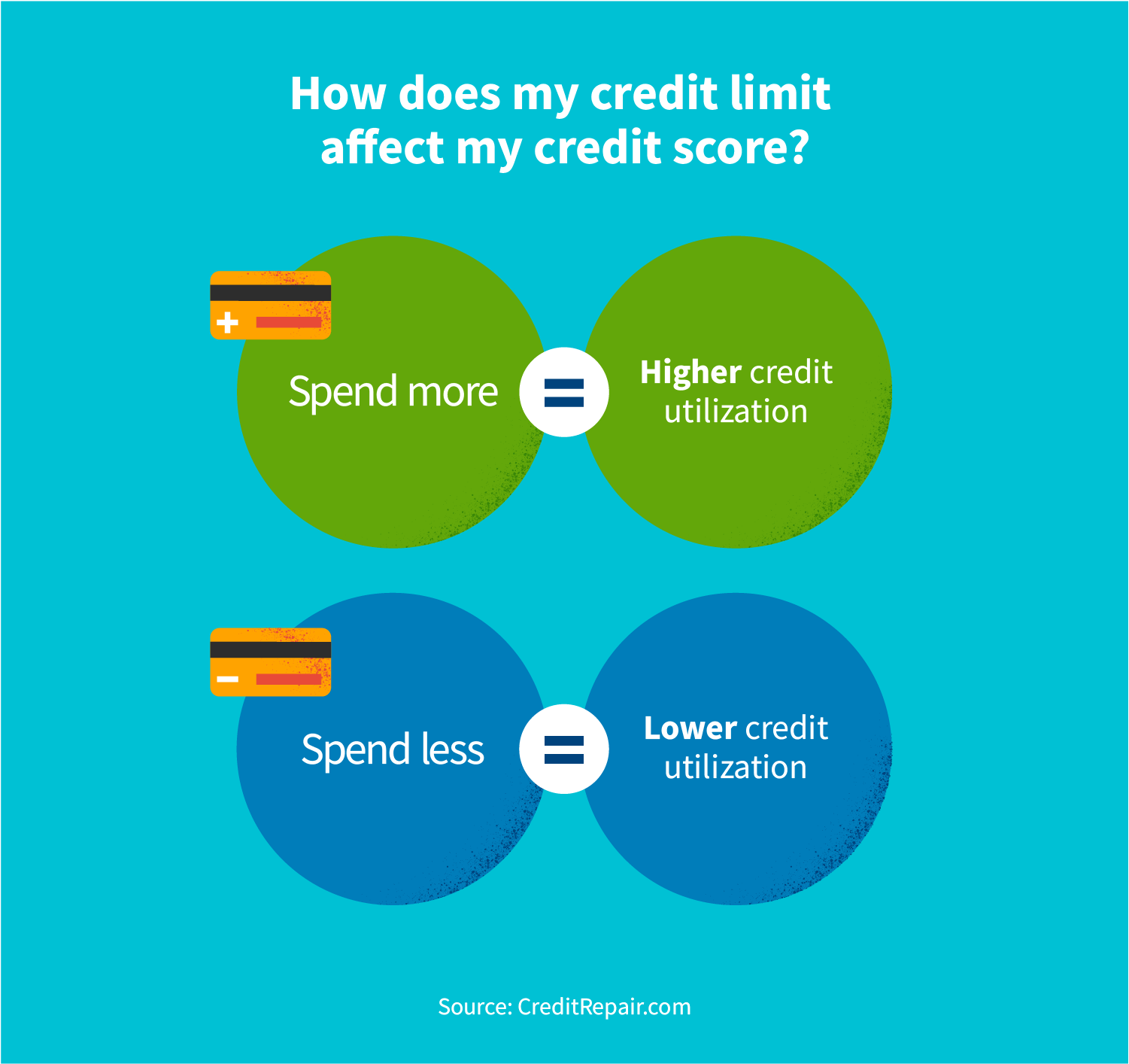

Your credit limit itself should not affect your credit score unless your spending has increased or you have gone over your credit limit. Your credit score shows lenders and credit card companies how responsible and reliable you are with your finances.

However, remember that the more of your credit limit that you spend, the more your credit utilization rate takes a hit. Your credit utilization rate is the amount you spend divided by the total of your credit limit. A good rule of thumb is to keep your credit utilization rate as low as possible to prevent an impact on your credit score.

To minimize the effect your credit limit has on your credit utilization rate and score, you should steer clear of going over your limit.

How much of your credit limit should you use?

Generally, the lower your utilization rate, the better. A good rule of thumb is to keep your utilization rate below 30 percent of your credit limit, or even lower if possible. Once you start to go over that percentage, your credit score may begin to drop. Paying off your balance each month will help you avoid overspending fees and a decrease in your score.

Understanding the ins and outs of credit can be difficult. However, tools and resources, like those at CreditRepair.com, can help you become more confident in your ability to manage your financial health.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263