Disclosure regarding our editorial content standards.

While shopping for a new rug, you find one online for $250. Under the listed price, you spot another payment option with four scheduled, interest-free payments of $62. Which form of payment do you go with?

If you opt for the latter, you might agree that “buy now, pay later” (BNPL) financing makes large purchases seem more possible and more financially viable. This is achieved through dividing larger purchases into smaller ones, paid back in installments on a set payment schedule.

Buying now and paying later may sound familiar to you. This is probably because the concept of purchasing an item and paying it back at a later date is, essentially, how a credit card operates. That may cause you to wonder: Does “buy now, pay later” financing affect your credit score? Read on to answer that question, as well as to learn more about what BNPL financing is, how it works and if it’s a good option for you to consider when making a larger purchase.

What is buy now, pay later financing?

Buy now, pay later financing allows you to buy something without paying the full amount due at the time of purchase. If you’re approved, the purchase total is split up into no more than four equal installments. For example, if you don’t have $1,000 on hand to buy four new tires for your vehicle, you may be able to use BNPL financing to split your purchase into four payments of $250 each if the merchant offers it.

How “buy now, pay later” financing affects credit score

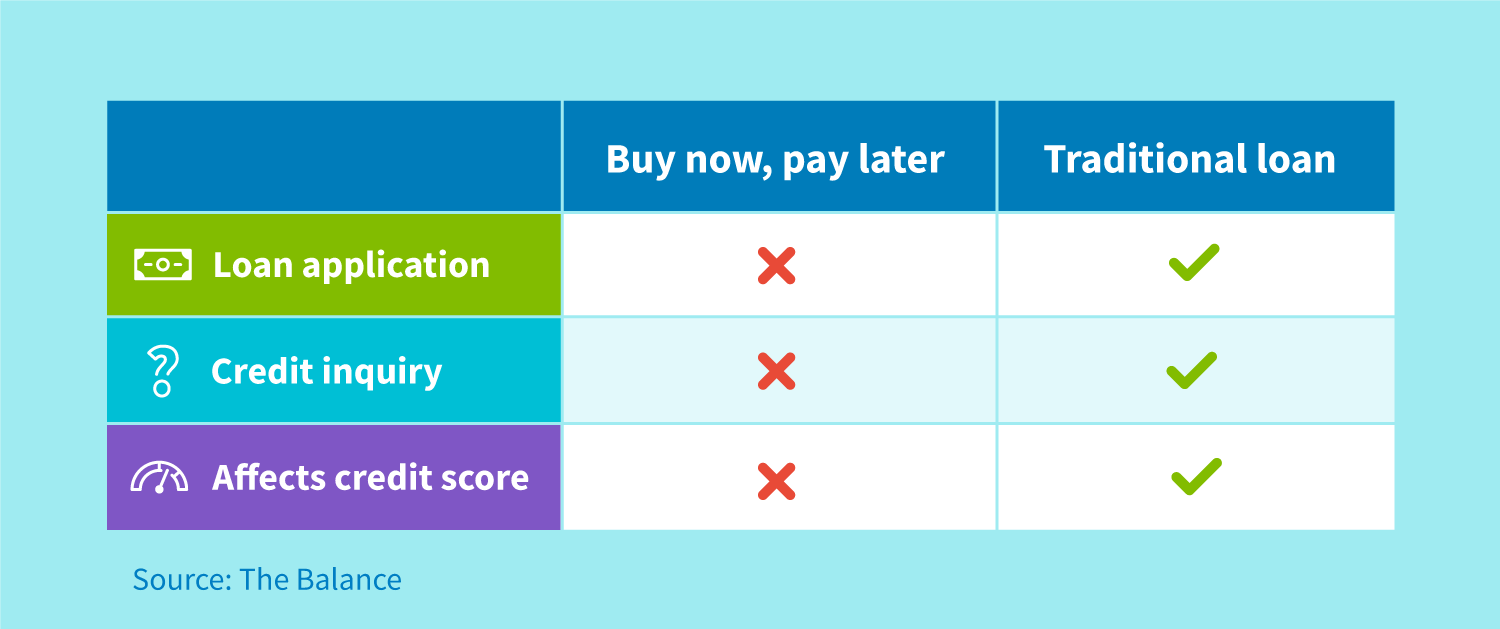

“Buy now, pay later” financing works a lot like credit cards—but it doesn’t have the same effect on your credit score. Newer BNPL systems don’t require you to fill out a loan application, meaning a credit agency doesn’t conduct a credit inquiry into your credit history.

If you’re applying for a loan or new line of credit, giving your Social Security number (either the full number or the last four digits) generally indicates that your credit score and history will be pulled in order to approve the application.

As a reminder, inquiries make up 10 percent of how your credit score is calculated. Without the need to do a hard check on your credit history, BNPL is not factored into your credit score. This means that many BNPL companies do not check your credit report or history, so there will be no mark on your report from them.

This doesn’t mean that BNPL companies do not check and see if you’re a good fit for using their services. This is why it’s important to make sure you have enough money to cover each installment of your monthly payment plan—if you’re routinely late on payments or don’t have enough to cover each installment, many BNPL companies will bar you from using their services in the future.

However, to keep your finances safe, be sure to read the fine print when making arrangements for any sort of payment plan, and ask if they’ll be performing a hard credit check.

How to know if your loan is reported

When borrowing any amount of money, you should check to see whether or not the loan is reported to a credit bureau. Though this usually means they perform a credit check, it’s worth asking and reading the fine print to see if your loan will be reported or reflected in your credit report.

If you use a BNPL service that does report to a credit bureau, be sure to keep smart borrowing practices in mind. Opening a new line of credit, loans included, can cause your credit score to drop as it lowers your credit age—which makes up 15 percent of your overall credit score.

If you finance through a BNPL program and your score drops, this is usually a sign that your service reports to credit agencies. It’s also important to remember to pay on time (or early, if possible!) if your loan is reported to credit bureaus.

Once you’ve completed the installment plan, be sure to check your credit report to make sure it was reported correctly. As a reminder, you can request a free credit report from each of the three major credit bureaus through AnnualCreditReport.com. When checking your credit report, be sure to see if your loan was reported as paid back accurately—otherwise, you’ll need to file a dispute with the credit bureau.

If your BNPL loan does not get reported to a credit bureau, your payments will have no effect (good, bad or otherwise) on your credit report. However, it’s still important to make timely payments to pay off your loan in full—as defaulting on your loan could cause the lender to send your debt to a collection agency to make sure you pay.

Should you use buy now, pay later financing?

Like a credit card or an installment loan, BNPL financing is a tool you can use to manage your finances. You shouldn’t use it if you won’t be able to make your scheduled payments or if you don’t really need the items you’re buying. If you need to buy something and don’t have enough money available to cover the purchase, however, BNPL financing can help you stretch your budget a little further.

Here’s an example. If you land your first office job and don’t have any professional clothing, you can use BNPL financing to buy a few outfits to wear until you get your first paycheck. BNPL financing can also help you replace a broken smartphone or buy a warm coat to wear if the temperature drops earlier in the year than expected.

Is there a credit check for buy now, pay later?

It depends. If you have to fill out a loan application and provide your Social Security number, the lender will likely run a credit check to determine if you qualify for BNPL financing. This check shows up on your credit report as a hard inquiry.

If you’re approved for the loan, your credit score may also decrease as a result of the new account. This is because the length of your credit history accounts for 15 percent of your score. Each scoring model considers your average age of accounts, the age of your newest account, the age of your oldest account and your credit utilization. Opening a new BNPL loan reduces your average age of accounts and available credit, which may cause your score to drop.

For BNPL programs that aren’t structured as loans, there’s no credit check. You don’t have to fill out a loan application or allow the financing company to do a hard pull on your credit.

Pros and cons of buy now, pay later financing

The major advantage of BNPL financing is that you can purchase must-have items even if you don’t have the full amount of cash on hand. If you don’t have any loans or credit cards, BNPL financing can also help you learn how to manage credit responsibly.

Additionally, it canteach financial responsibility to those without credit and there is no limit to what can be purchased (although many of the popular apps, including Afterpay and Klarna, do require a minimum purchase limit of around $30, as well as a maximum purchase limit of around $2,000.)

These advantages come with some potential drawbacks, however. If you decide to use BNPL financing, pay close attention to the repayment terms—after all this is still a form of debt, and you don’t want to owe late fees. Make sure you know exactly when each installment is due and how much you’ll owe each time.

It’s also important to understand what happens if you need to return an item purchased with BNPL financing. Some companies require you to pay off the entire financed amount before you can return your merchandise. If there’s a dispute with the merchant, you may have to continue making your installment payments until the dispute is resolved.

How to apply for “buy now, pay later”

The application process for “buy now, pay later” financing options differs from retailer to retailer. Many of the popular BNPL shopping apps, like Klarna or Afterpay, don’t require you to fill out a formal credit application, meaning there’s no credit check by a credit agency.

When shopping using BNPL, you’ll often need to give the app your banking or card information before checking out. Then, instead of checking out through the retailer and paying them directly, you’ll pay in installments to the BNPL service provider.

When using BNPL, make sure that you have enough money in your account to complete the scheduled transactions. If you’re late on completing your payment multiple times, the BNPL provider may decline to let you use their services going forward—or worse, send your defaulted loan to a debt collection agency.

Differences between retailer financing and point-of-sale installment loans

Generally, there are two separate kinds of “buy now, pay later” financing options available to you as a consumer: retailer financing and point-of-sale installment loans.

Retailer financing

To make their products more attainable, many retailers offer their own BNPL financing programs. These work very similarly to online programs through third-party apps: You purchase your item (usually with a down payment or the first installment), then continue to make scheduled payments until it is paid off. Some stores may not let you take the item home until it’s fully paid off, similar to layaway.

These programs vary from store to store, so be sure to ask your local retailer if they offer a BNPL option. If your retailer requests you fill out a loan application or they need your Social Security number, then this is a more formal loan that will require a hard credit check—so be sure to read the fine print if you’re considering retailer financing.

Point-of-sale installment loans

Point-of-sale (otherwise known as POS) loans are the BNPL programs discussed previously. These are online programs that allow users to pay their total in staggered installments with a third-party financier over a set period of time, rather than pay in full. These programs allow users to bring their item home without it being fully paid off. Offered at checkout, or the point-of-sale of an online purchase, these loans are generally interest-free and available to anyone without a formal loan application.

Tips for borrowing responsibly

When borrowing money, whether through a traditional loan or a “buy now, pay later” program, you should know not only how to pay back your owed amount, but also how to make future borrowing decisions responsibly. Here are some tips to set you up for success when borrowing from a lender.

1. Borrow only what you can repay

This may seem obvious, but it’s not a good idea to borrow a ton of money that you won’t be able to pay back in a reasonable time. Especially with “buy now, pay later” financing programs, the payment dates are not staggered as much as they would be with, say, a house loan—instead, you’re on the hook for making payments around once every two weeks.

If you’re short on cash but are thinking of purchasing something through BNPL that you won’t be able to pay back, you might want to reconsider and purchase when you have the funds to pay it off.

2. Pay on time (or early!)

Late payments can have a big effect on your credit score, especially for loans and credit cards. A good rule of thumb is to always make your debt payments either early or on time. If this is something you struggle with, consider putting your bills on autopay.

Keep in mind it’s also cheaper to pay loans or credit cards back over a shorter period of time, as interest rates don’t accrue like they do with longer payback periods.

3. Look at the fine print

When making any sort of borrowing decision, from a loan to an installment payment plan, be sure to take the time to understand exactly what the borrowing terms are. In particular, pay attention to information about interest rates, administration fees and the borrowing time table you’ll be on.

Familiarizing yourself with these terms not only helps you spot any discrepancies between what you signed up for and what you’re legally bound to do, but also makes you a more educated borrower for the future.

Considering many of us are doing more online shopping than ever before, it can be tempting to divide up purchases and make them easier on our wallets using “buy now, pay later” financing tactics. Even though these don’t have a direct impact on credit, it’s important to be careful when making financing decisions at any level.

And if you are concerned about your credit, consider getting your free online credit report evaluation on CreditRepair.com.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263