Disclosure regarding our editorial content standards.

Answer: Your score may improve depending on the scoring model used. New credit scoring models—FICO 9®, FICO 10®, VantageScore 3.0® and VantageScore 4.0®—ignore collection accounts with zero dollar balances. However, since most lenders don’t use these models yet, you may not see an improvement.

When you miss several payments to a creditor or lender, they may choose to send your account to collections. Typically, lenders try to collect the debt for 120 to 180 days before passing it off to collections.

A collection agency is a third-party vendor that will try to contact you to collect your debt.

Some people don’t know what to do about unpaid collection accounts on their reports. It’s important to note that you’re still legally obligated to pay this debt. You may have even noticed that having a debt in collections has lowered your credit score.

So, if your credit has taken a hit, will paying off collections improve your credit score? The short answer is maybe, but keep reading to learn more.

How does a debt in collections affect your credit?

When a creditor sends a debt to collections, it shows up as a negative item on your credit report because it indicates you were extremely delinquent on payments to a lender. This negative mark can then bring down your credit score, which impacts your ability to acquire credit in the future.

Unpaid debts on your credit report are typically assigned a category depending on whether they’re 30, 60 or 90 days late. However, a collection is one of the worst types of unpaid debts because it indicates that the lender has written the delinquent account off entirely.

A collection account can significantly impact your score because collection debts fall under “payment history,” which is the credit factor that makes up most of your score (35 percent).

Luckily, the impact on your credit score does lessen over time, and it should fall off your credit report completely after seven years have passed (regardless of if you’ve paid it or not).

Will your credit improve if you pay off a collection account?

With most of the current standard credit scoring models, paying a collection account off likely won’t increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender’s opinion. But that won’t necessarily change the item’s negative impact, especially if a lender only looks at your credit score and not the details of your report.

However, newer scoring models have started implementing a change that ignores collection accounts with a zero-dollar balance. So if a potential lender uses one of these models, you will benefit from having paid your account in collections and may see some improvement to your credit.

How do the credit scoring models view paid collection accounts?

As we mentioned, the new credit scoring models treat paid collection accounts differently. This means that when you pay your collection account, your score might benefit if one of the following models is used:

- FICO 9

- FICO 10

- VantageScore 3.0

- VantageScore 4.0

Unfortunately, most lenders don’t use these models yet, and it could be years before they do.

Should you pay collections debt?

So, why do people bother paying off collection accounts if doing so might not improve their credit score? Some reasons you may want to pay off collections debt include:

- Avoid legal trouble. You’re still legally obligated to pay off the debt, so by paying it, you can avoid debt collection lawsuits.

- Limit interest and fees. Debt collectors can charge interest and fees if permitted by the original agreement.

- Qualify for future loans. Lenders may deny a loan application if the borrower has a debt in collections .

- Boost your credit score with newer models. You may see your credit score improve with FICO 9 and 10 and VantageScore 3.0 and 4.0.

Note that in some states, making a payment toward the collection debt can restart the countdown for how long a debt collector can sue you for the debt (this time frame is known as the statute of limitations). Be aware of this if you’re considering making multiple partial payments on your collection account rather than one lump-sum payment.

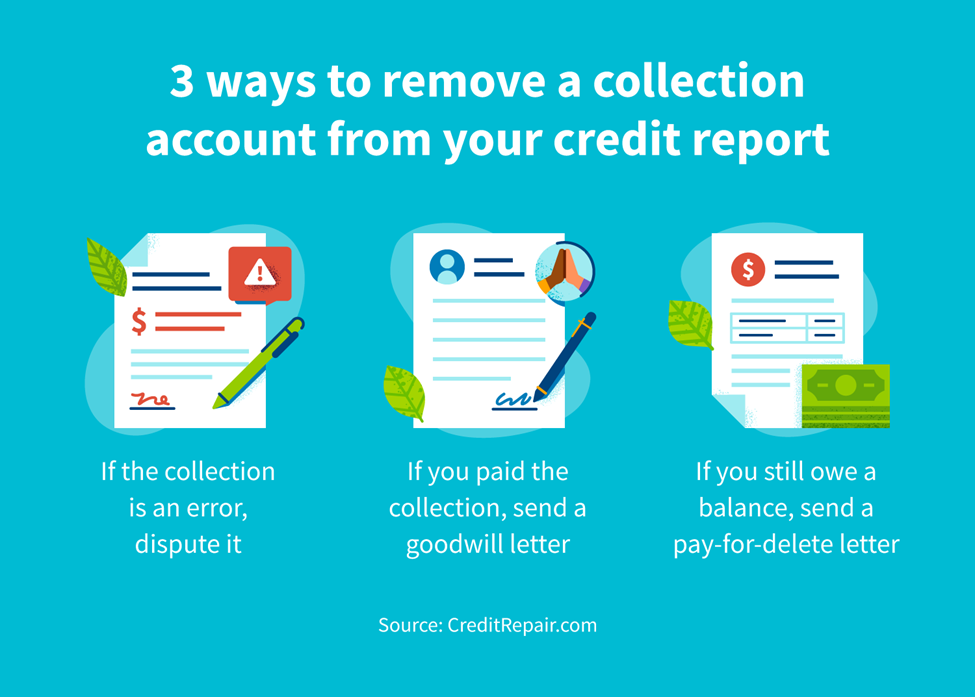

How can you remove a collection account from your credit report?

The following methods aren’t guaranteed to work for everyone, but they might work for you—otherwise, you might have to wait seven years for your collection account to drop off on its own.

You can start by reviewing your credit reports to see what you’re working with (the number of collections, the amounts, how old they are, etc.). Then decide which of these methods you want to try:

1. If the collection is an error, dispute it

If you notice a collection on your account, it’s a good idea to check your credit report for any possible errors. If you see any mistakes, you are entitled to dispute them. Errors can include wrong dates, incorrect amounts and wrong names. If any of these details are incorrect, you have a viable dispute.

| Follow these four steps to write a credit dispute letter to remove the error from your report. |

2. If you paid the collection, send a goodwill letter

Meanwhile, if you have a long history with a lender and this debt was a one-off mistake, you could send them a goodwill letter asking them to make an exception.

In this letter, you should point out how long you’ve been with this lender, details of how you’ve always been on time with payments other than this one instance and your promise to correct the situation.

To maintain a positive relationship with each other, ask them to remove the collection from your report. Note that this typically only works if you’ve also paid off the debt, so the lender hasn’t lost money.

3. If you still owe a balance, send a pay for delete letter

Even if you haven’t yet paid the debt, you can still negotiate with your collection agency. A pay for delete letter asks the collection agency to remove the debt from your credit report if you pay them a certain amount (potentially less than the original amount you owed).

Not all agencies will be open to a pay for delete agreement, but trying to get it off your credit report can be worth it. If you do go this route, make sure to get everything in writing. You should have a physical document that includes the dates, payment amounts and all negotiated terms.

What are your rights when working with collection agencies?

Consumers have the protection of the Fair Debt Collection Practices Act (FDCPA). This act helps to prevent collection agencies from using abusive, unfair, manipulative or deceitful means in an attempt to collect a debt. Under the FDCPA, collection agencies cannot:

- Contact you at work

- Contact you before 8 a.m. or after 9 p.m. unless you’ve allowed it

- Discuss your debt with anyone other than yourself or those you’ve permitted them to speak to

- Lie or deceive in an attempt to collect your debt

How to improve your credit score after a collection

The good news is that the impact of collections on your credit score lessens over time. Plus, there are other ways to improve your credit score in the meantime. Here are a few ways to work to improve your credit after a collection:

- Pay down credit balances. Paying outstanding balances may help your credit.

- Keep unused credit accounts open. Even if you aren’t currently using a credit card, keeping it open will likely lower your credit utilization ratio, which is good for your credit.

- Refrain from applying for new lines of credit. Avoid applying for credit as this may lead to a hard inquiry on your report, temporarily lowering your score.

- Work with a credit repair agency. If you’re worried about your credit after a collection, a credit repair company can work with you to help address inaccurate negative items and boost your credit.

Get professional help with collection accounts

All in all, if you have a collection account on your report, it’s best to address it. There are many professionals out there who can help, such as credit counselors and credit repair advisors.

For example, the advisors at CreditRepair.com can help you analyze your reports to find any errors and file disputes on your behalf. In the meantime, you can work on improving your credit in other ways to build your credit back up.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263