Disclosure regarding our editorial content standards.

If you’re just beginning your financial journey, banking terminology may sound as intricate as medical jargon. When to use debit vs. credit cards, how to use them and what they even are prove to be confusing financial concepts for many.

The good news is, understanding the basics of finances doesn’t have to be complicated. Knowing the key differences between debit and credit cards, including how they work and when to use them, can help set you up for a bright financial future with excellent credit habits to boot.

| Debit vs. credit cards: an overview | ||||

|---|---|---|---|---|

| Money comes from: | How many are recommended: | Monthly fees: | Best for: | |

| Debit card | Your checking account | 1 | None required | Day-to-day purchases, such as groceries or dinner |

| Credit card | Your credit card lender | 1 to 3 | Minimum monthly payments and interest fees required | Larger purchases that can be paid off in smaller payments, like plane tickets |

What are debit cards?

Debit cards, also known as bank cards, are payment cards that deduct funds from your bank account immediately upon usage. You must have enough money in your bank account to make a purchase with a debit card. Banks place an immediate hold on the money you’ve spent, with the amount being deducted from your total balance usually within 24 to 48 hours.

There are a few ways to add money to your bank account that you can spend with your debit card, such as depositing more money into your account. You can also transfer money to or from a savings account with the same bank or use an ATM to withdraw cash. Debit cards can also be used as credit cards in certain scenarios.

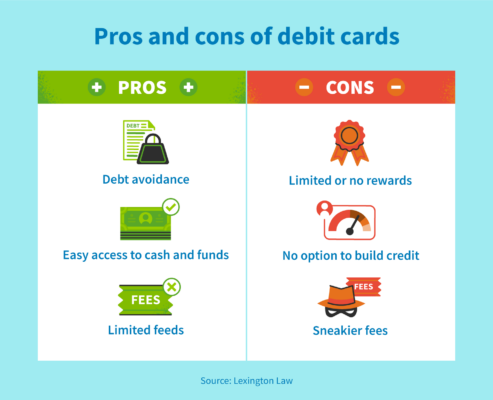

Pros of debit cards

Debit cards have numerous advantages that make them a great option for anyone just starting out on their financial journey, including these.

Debt avoidance

One of the biggest advantages of debit cards is that money is withdrawn in real time from your account, meaning you avoid going into debt as you make purchases with a debit card.

However, you run the risk of overdrafting your account if you make a purchase without having the proper funds—so it’s a good idea to always double-check how much money you have in your account before making a purchase.

Easy access to cash and funds

Debit cards give you immediate access to your funds, as well as the ability to withdraw cash from an ATM—but be cautious about using an ATM not associated with your bank, as you may be subject to fees.

Limited fees

Debit cards have very limited fees associated with them, meaning you won’t face interest charges, annual fees, balance transfer fees or other fees that are common with credit cards and can quickly add up. Debit cards do have some smaller fees, but more on that later.

Cons of debit cards

While there are certainly several advantages of debit cards, there are also some disadvantages to be aware of when using a debit card.

Limited or no rewards

Many people seek out credit cards for travel reward points, cashback opportunities and other perks that come with specialized credit cards. Most debit cards either have limited rewards programs or none at all, which may prove to be a disadvantage since some rewards (depending on how they’re redeemed) can end up saving you money.

No option to build credit

Good credit can open up a lot of opportunities, such as better housing options and access to credit cards with special rewards. Debit cards cannot build credit for you with each use, meaning that even if you have excellent budgeting skills and save more than you spend each month, it won’t be reflected in your credit score.

Sneakier fees

Many debit card users are unaware of the fees that come with debit cards and are surprised when they’re charged. Some of the lesser-known fees that can frustrate debit card users include:

- Minimum balance fees: Charged when you don’t meet your bank’s minimum account requirements

- Overdraft fees: Charged when you spend more than you have in your account, taking your balance into the negatives

- Foreign ATM fees: Charged when you use an ATM that isn’t associated with your bank

When to use debit cards

Debit cards are generally recommended for those who want strict spending control and want to avoid spending money they don’t have. If you need to withdraw or deposit cash, make a small-dollar purchase or shop at a store that doesn’t accept credit cards, using a debit card is your best bet.

It should be noted that most debit cards have a daily spending limit (usually around $2,000 to $5,000), so it’s generally recommended to avoid using a debit card for big-ticket purchases and keep it for smaller purchases, such as stopping at a local convenience store or picking up dinner.

What are credit cards?

Credit cards are issued by financial institutions and allow users to borrow an approved amount of money from the institution. Paying with a credit card means you can make a purchase without paying out of pocket at the time of purchase, and instead make monthly payments toward the total amount you owe.

Part of a credit card agreement is that you must agree to pay back the borrowed amount in addition to interest, which varies depending on the card issuer’s terms of agreement.

Credit cards are issued in a variety of formats and categories, including:

- Premium cards: Tailored for high spenders that offer exclusive perks, like access to special events

- Reward cards: Offer a variety of perks to users depending on how they use their card, such as travel points or cash back

- Secured cards: Require a cash deposit that is held by the lender as collateral for making monthly bill payments on time

- Standard cards: Issue a line of credit to users for purchases, often without an annual fee

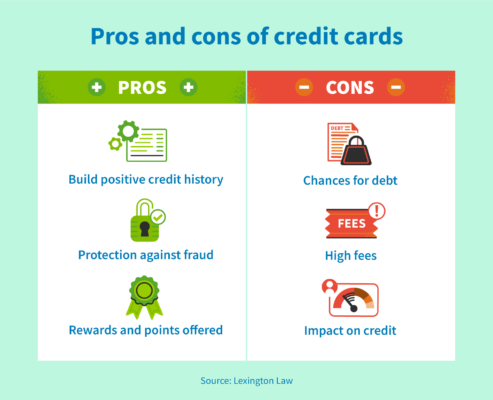

Pros of credit cards

Credit cards have a number of advantages, particularly for users looking to begin building credit in their own name.

Build positive credit history

On-time payments, regular credit card use and paying down your balance can all help you build up a positive credit history. This indicates to other lenders that you’re a responsible borrower, which can improve your chances of being approved for loans, apartments and additional credit cards down the road.

Payment history accounts for 35 percent of your credit score, so credit cards can have a significant impact on your overall score.

Protection against fraud

While identity theft can be an unfortunate outcome of spending money, you can rest assured that credit cards provide fraud protection that can help you get your money back.

Thanks to the Fair Credit Billing Act, you are not held responsible for fraudulent purchases in the event of identity theft and will only have to pay a maximum of $50 in fees.

Rewards and points offered

Points, rewards and cash back add extra value to purchases with certain cards. With specific credit cards, you can uncover major discounts and bonuses through rewards, such as airline miles or cashback opportunities.

Cons of credit cards

Consumers wary of credit cards are not just being paranoid—despite all the perks of using credit cards, there are several drawbacks.

Chance for debt

While being able to make purchases without owing the money up front may be a benefit for those who are budget-conscious, it can be just as easy to get yourself into debt. Novice borrowers, financial hardship and even mere carelessness can all lead to overwhelming debt that can be hard to overcome.

If you aren’t careful about paying off your balance each month, you might soon find yourself owing several thousand dollars on your credit card, plus interest.

High fees

Speaking of interest, some credit cards come with large, sometimes hidden fees that many borrowers don’t know about until it’s too late. Some of these fees include:

- Annual fees: Some credit cards charge annual fees for each year you have an account open with them.

- Interest fees: The longer you hold a balance on your credit card, the more interest (percentage of your credit limit) you’ll owe. If you have a high balance, your interest fees could cause your monthly payment to almost double.

- Late fees: Not paying your credit card bill on time could end up costing you even more if you get hit with a late fee.

When to use credit cards

To avoid getting into debt that you can’t pay back, it’s important to use your credit card sparingly. If you’re just getting started on building credit, consider using your card once a week for groceries, gas or other recurring purchases that you can easily pay back when your bill is due.

You can also consider using your credit card for one larger purchase that you pay off in chunks, such as plane tickets or a large home item. If you do this, be sure to pay off your balance quickly to avoid APR fees.

Which is better for credit?

Debit cards and credit cards both have pros and cons to be considered when it comes to your credit. While debit cards don’t help you build good credit, they also don’t cause you to go into debt, which can negatively impact your score.

Credit cards help you build up your credit score when practicing good financial habits, but missed payments or carrying a high balance can cause your score to go down by several points.

While we can’t prescribe using credit cards or debit cards one way or the other, carefully consider if you can pay off a purchase when debating whether to use a credit card or debit card. This can help you practice good financial habits that can in turn help you improve your credit score.

No matter which payment option you go with, it’s important to be as informed about your finances as you can be. If you want to take extra steps toward improving your credit, consider working with the professionals at CreditRepair.com.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263