Disclosure regarding our editorial content standards.

Identity theft is one of those unfortunate circumstances that you never think could happen to you—until it does. In 2020, there were over 1.3 million reports of identity theft, according to reports by the Federal Trade Commission.

Even if you think it can never happen to you, it’s important to be vigilant and prepared in case the unthinkable does happen. CreditRepair.com conducted a recent survey of 1,000 Americans ages 18 and up on the prevalence of identity theft, and 74 percent of respondents misidentified just how common this is.

Key findings:

- 72 percent of survey respondents said they had not experienced identity theft in any capacity (despite the fact that identity theft affected nearly half of Americans in 2020, according to another study)

- 74 percent of respondents could not identity how many Americans are victims of identity theft each year

How many Americans have experienced identity theft?

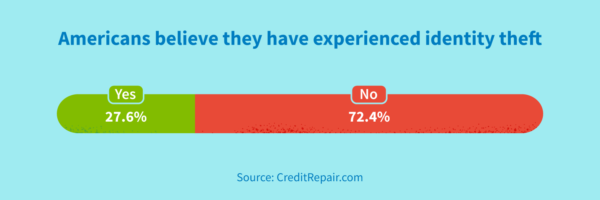

Our survey of 1,000 Americans found that 72.4 percent of respondents do not believe they have experienced identity theft in any capacity, while 27.6 percent believe they have experienced identity theft in their lifetime. This means that Americans who believe they have not experienced identity theft outnumber those who have by almost three to one.

How many Americans are actually victims of identity theft?

Though not many individuals in our survey reported having experienced identity theft, in reality, 47 percent of Americans experienced financial identity theft in 2020. It’s important to be aware of how truly common identity theft is so that you’re taking the necessary steps to stay protected (more on that later).

When asked how many Americans are victims of identity theft each year, 26.6 percent of 1,000 survey takers guessed that five to ten million Americans are victims of identity theft each year, and only 25.6 percent guessed the correct figure of one million to five million. The breakdown of responses was as follows:

- 100,000 to 500,000: 24.8 percent

- 500,000 to 1,000,000: 23 percent

- 1,000,000 to 5,000,000 (correct answer): 25.6 percent

- 5,000,000 to 10,000,000: 26.6 percent

How much money is stolen during financial identity theft?

Survey respondents also struggled to identify how much money is stolen during identity theft.

Only 28% of Americans think they’ve been a victim of identity theft—while in reality, nearly half experienced financial identity theft in 2020, which includes instances like credit card fraud or hacked bank accounts. In cases of financial identity theft, which includes instances like credit card fraud or hacked bank accounts, a median amount of $311 is stolen per year.

However, most survey respondents thought that more money is stolen than it actually is—and surprisingly, 18 percent underestimated the median amount stolen. Only 8.8 percent of respondents guessed the correct range. The breakdown of responses was as follows:

- Under $100: 11.5 percent

- $100 to $300: 4.6 percent

- $300 to $500 (correct answer): 8.8 percent

- $500 to $800: 9.3 percent

- $800 to $1,000: 12.7 percent

- Over $1,000: 53.2 percent

How to keep yourself safe from identity theft

Though there’s no exact science behind how to keep yourself and your information safe from theft, there are a few expert-backed tips on how to protect your information and money.

- Utilize two-factor authentication. Especially for websites that contain sensitive information, such as your bank or credit card company, you’ll want to ensure that you have proper security protocols in place; such as codes you need to input from your phone, security questions or facial/touch recognition in addition to your password and username. Many thieves are opportunistic, meaning they won’t want to bother with information that is securely guarded.

- Regularly change passwords. It may be a slight inconvenience to remember a handful of passwords instead of just one or two, but keep in mind that if a thief figures out one password you use for multiple platforms, all of that information is at risk. By regularly swapping your passwords for strong passwords that aren’t used for multiple sites, you give your information a better chance of being protected.

- Check on your information. Unless a thief goes on a spending spree and your credit card company verifies that it’s you, you may not be made aware that your identity has been stolen for quite some time. That’s why it’s important to regularly check your information, including your credit report and bank statements. The sooner you catch an identity thief, the sooner you can begin repairing the damage they’ve caused.

- Destroy unneeded private information. If you still receive paper credit card bills, mortgage reminders, bank statements or anything else that has your private information on it, destroy it once you no longer need it. Most of that information is available online—and physical copies could be stolen if your home is burglarized. Shred or cut up this information once you no longer need it so all personal information is no longer visible.

- Keep your information and belongings secure. Many identity thieves don’t have a targeted scheme to steal your information—they just wait until someone’s information becomes available, like through a lost wallet. It’s important to keep your information safe, never let your credit card or ID leave your sight and always double-check you have all of your important belongings before leaving a place.

These are just a few ways that you can protect yourself from identity theft, though it’s important to remember that identity theft is never the fault of the victim. Knowing the prevalence of identity theft, along with ways to protect yourself and keep your information safe, can all work together to ensure your information is protected the way it should be.

However, if your information is stolen, know that there are ways to help you rebuild your life and credit and come back even stronger than before.

This study was conducted for CreditRepair.com using Google Consumer Surveys and interpreted by Siege Media. The sample consisted of three questions with no less than 1,000 completed responses per question. Post-stratification weighting has been applied to ensure an accurate and reliable representation of the total population. This survey was conducted in August 2021.