Disclosure regarding our editorial content standards.

Currently, it’s standard practice for car insurance companies (and other lenders) to use credit score to partially decide if a person should be approved for insurance on their vehicle (or other asset) and at what rate. Your credit-based insurance score is rooted in the information found in your credit report.

Insurance providers want to charge more to people with poor credit, as they’re deemed riskier customers. But in recent years there’s been a shift in law, with some states banning the practice. Keep reading to find out all about the states that don’t allow credit scoring in insurance rate decisions and why.

Why would states restrict insurance companies from considering credit scores?

So, why are some states stepping in and banning this practice? After all, credit scores are used to make decisions when someone is applying for an auto loan, mortgage, job application and even rental lease.

Let’s look at auto insurance as an example.

First, your credit score isn’t a reflection of how good a driver you are. So, receiving a higher insurance rate because you’re deemed a risky borrower isn’t fair, as it has nothing to do with your probability of getting into an accident.

Second, it’s been pointed out that this process is unfair as it gives the car insurance companies too much information about the customer. Insurance providers can assume that someone with a higher credit score is wealthy and has the potential to be a more profitable customer. Additionally, wealthy people are often less likely to file claims than everyone else (potentially because they are able to pay for repairs out-of-pocket).

And third, there isn’t any proven correlation between credit scores and the quality of driver someone is. So, car insurance companies are charging higher rates to individuals with poor scores (who often already are struggling financially) without valid reasons.

One report from the Consumer Federation of America found that insurance companies across Washington were charging safe drivers with poor credit an average of 79 percent more than a safe driver with an excellent credit score. This clearly shows that good, safe drivers are being penalized simply for their financial history.

What states don’t allow credit scoring in insurance?

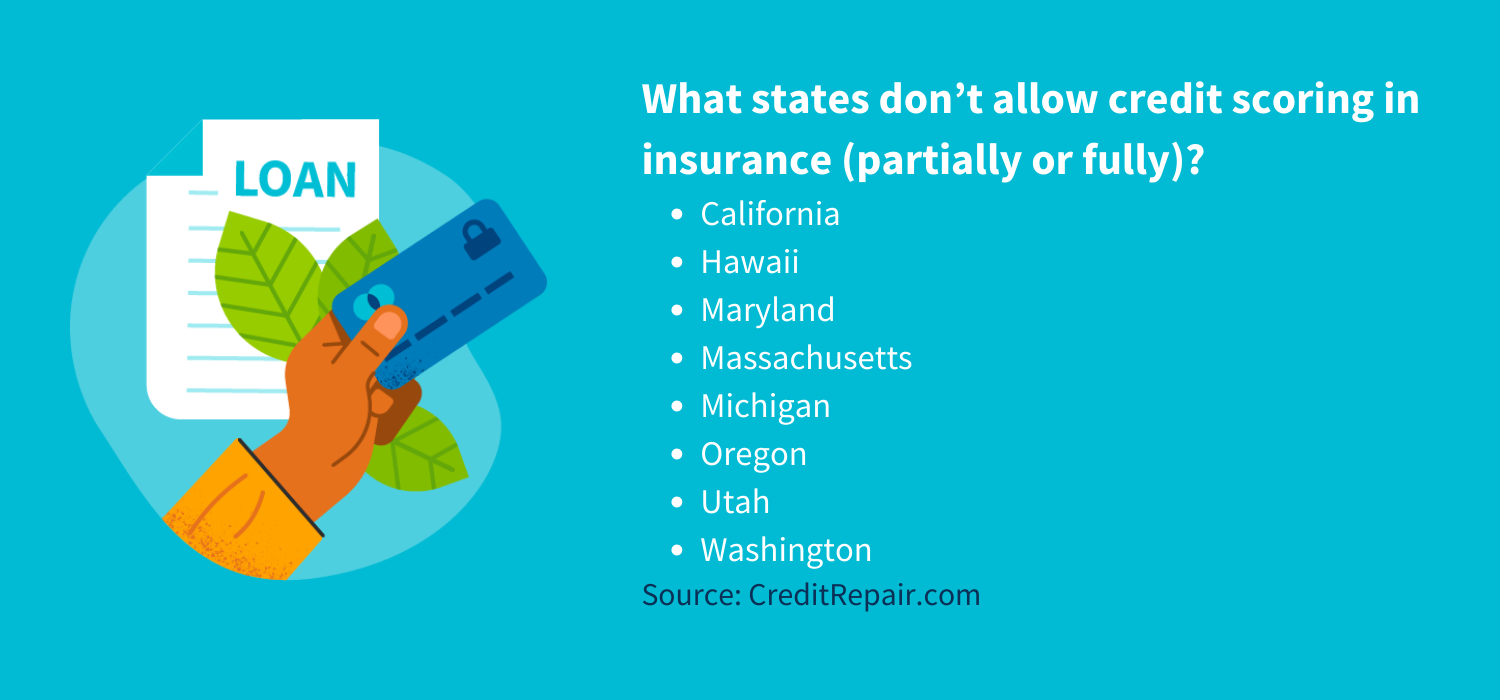

There are nuances to states making laws against credit scoring in insurance. Some states have an all-over ban, while other states have limited bans. Currently, only eight states have any form of restrictions against credit-scoring in insurance.

California

California issued a statewide ban on the practice of using credit scoring in insurance back in 2003. Insurance companies in California can’t use credit scores or credit history information when approving or determining the rates on auto policies or home insurance.

Hawaii

Hawaii doesn’t allow insurance companies to use credit information when setting underwriting standards or rating plans for auto insurance. This means your credit can’t impact your car insurance premiums or your policy’s chances of being approved or renewed.

However, Hawaii still allows credit to be factored into homeowner insurance plans.

Maryland

Maryland has strict rules when it comes to credit scoring for home insurance. Home insurance companies can’t consider credit during any part of the home insurance policy process, including a person’s application for policy or renewal, the rates they receive, premiums and more.

When it comes to auto insurance, Maryland is a little more relaxed. Auto insurance companies can’t use credit to deny a policy, cancel a policy, deny a policy renewal or increase premiums during a renewal. But auto insurers can use credit information to determine a consumer’s insurance rates.

Massachusetts

Massachusetts bans auto insurers from the practice of using credit scoring when setting rates and approving or renewing an auto policy. Homeowner insurance companies also aren’t allowed to base rates on a customer’s credit information.

Michigan

In Michigan, both home insurers and auto insurers can’t use credit scoring when approving, denying, canceling or renewing policies. Auto insurance companies also can’t use credit scores to determine a person’s insurance rate.

Oregon

Oregon prohibits insurance companies from using credit information to cancel or deny a policy approval. Additionally, credit can’t be the only reason an insurance provider denies an application. Lastly, the state limits what information from a person’s credit report can be used when determining insurance rates and in the underwriting process.

Utah

Utah allows insurance companies to consider credit information when reviewing an application, but credit can’t be the sole reason for denying an applicant. Additionally, auto insurers can use credit data only to offer customers a discount on their premiums, not to increase rates. Once a discount is applied, it can’t be removed solely because of a change in credit.

Lastly, once an individual has been a customer for 60 days, auto insurers can’t use credit data to cancel a policy, reject a policy renewal request or decline additional coverage.

Washington

Washington is the most recent state to consider the ban on credit scoring in insurance, primarily due to the COVID-19 pandemic. The state became concerned that insurance companies would increase rates as people struggled financially through the pandemic and started to see a drop in their credit scores due to missed or late payments or loan defaults.

In March 2022, Washington announced a temporary ban preventing insurance companies from using credit reports and credit scores to change rates and premiums on insurance policies. This ban covers auto, renter and homeowner insurance. The ban is set to last three years after the federal or state emergency declarations for the pandemic end, which gives consumers time to improve their credit scores.

What affects your credit score?

While it’s great to see a handful of states make these changes, it’s clear that most states aren’t included in the above list. In most places across the United States, your credit score will significantly impact your insurance policy. As a result, it’s essential to consider what can improve (or worsen) your credit score.

Your credit score is made up of five factors, each of which is weighted differently:

How to work on your credit

Now that you know what makes up your credit score and how important it can be to your insurance policies, you can make a plan to improve your credit.

Follow these simple steps and you should see a gradual improvement in your credit score:

- Pay your bills on time and, if possible, in full. Consider putting every bill you can on auto-payment so you never have a missed or late payment again.

- Keep your credit utilization as low as possible every month.

- Avoid closing old accounts, even if you don’t use them, so your credit history length doesn’t decrease.

- If you know you’re bad with credit, consider using a secured credit card instead. This will make sure you don’t incur new debt while getting the benefit of building up your credit history.

- Review your credit report regularly to make sure you don’t have any errors. If you find mistakes, it’s important to dispute them right away so they don’t continue to drag your score down unnecessarily.

Feeling overwhelmed about getting your credit back on track? The credit repair advocates at CreditRepair.com can help. We’ll review your credit report thoroughly and help you file any necessary disputes. Additionally, we can provide credit education services so you can grow your skills and work towards a stronger financial future.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263