Disclosure regarding our editorial content standards.

Have you ever had a negative thought you can’t seem to shake after a miscalculation? A giant stomping around in your head saying, “Fee-Fi-Fo-Fum, you messed up and you feel dumb.” According to Carol Dweck, you’re experiencing the effects of a fixed mindset. The opposite of that is a growth mindset, or the belief that talents can be developed to the same capacity as someone who has an inherent gift for something.

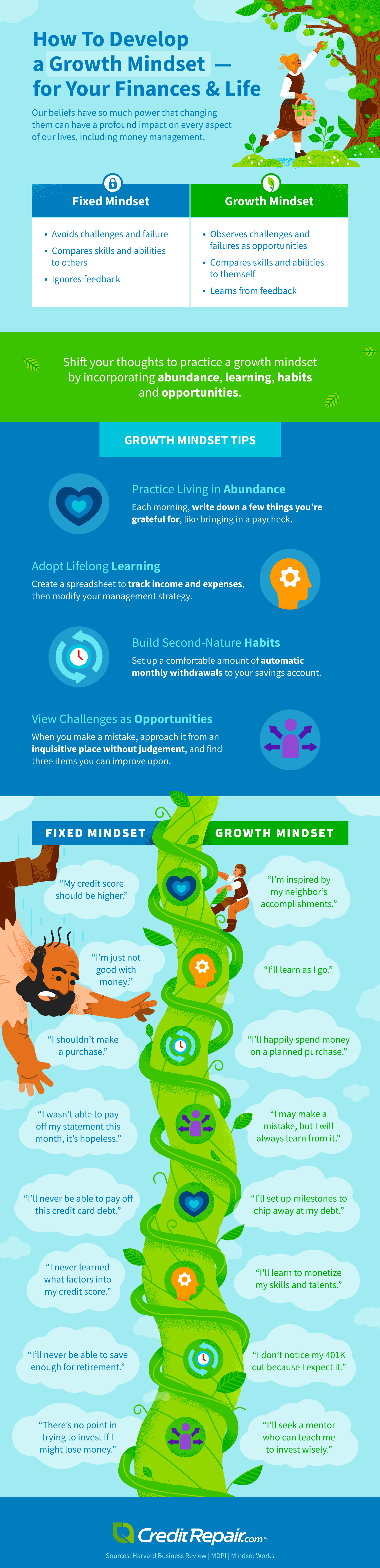

For those that practice Dweck’s theory, learning how to develop a growth mindset can improve all aspects of your life, including money management. It concludes that being able to control all thoughts, conscious and unconscious, can have a profound impact on every aspect of our lives.

By living in abundance instead of scarcity, adopting lifelong learning, building upon second-nature habits, being persistent and viewing challenges as opportunities, we can shift the negative mindset to one of growth.

Key takeaways:

- Gratitude for existing circumstances is at the core of a growth mindset.

- Skills and intelligence can be cultivated with practice.

- Instead of avoiding the wrong thing, make a habit of doing the right thing.

- Celebrate failure as an opportunity for self-improvement and a better overall performance.

What Is a Growth Mindset and Why Is It Important?

In 2006, Carol Dweck defined growth mindset in her book Mindset: The New Psychology of Success. Dweck began by exploring student’s attitudes toward failure and success, which led to the conclusion that people have either a growth mindset or a fixed one. The theory suggests that with a growth mindset, if you put in the time and effort to achieve something and believe that you can, you will.

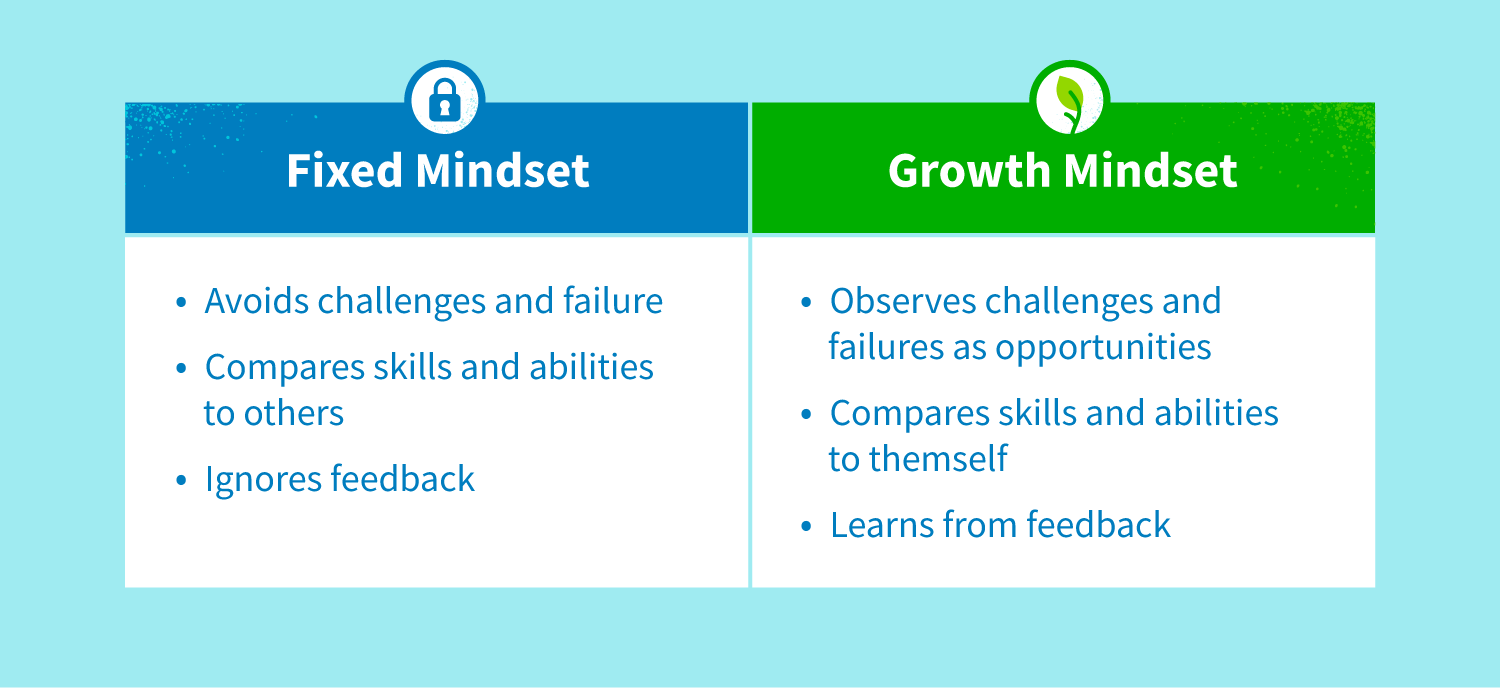

To understand a growth mindset, you must also understand a fixed mindset:

- Growth Mindset: People who have this type of attitude believe that intelligence, talents and abilities can all be improved with effort. People with this mindset actively seek challenging opportunities and acknowledge genetic aptitudes with the belief that you can surpass natural talent with continuous personal improvement and growth.

- Fixed Mindset: Those who view themselves with fixed traits believe they can’t improve or change. They have an attitude that they are inherently able or unable to do something because of their genetic predisposition, and oftentimes will avoid challenges and failure.

Fixed Mindset and Growth Mindset Examples

When people with a growth mindset face challenges, they’re able to make an observation that the perceived situation doesn’t mean you can’t get to where you want to go. Those with a fixed mindset, on the other hand, interpret challenges as impossibilities and believe they’re never going to achieve more than their innate skill level.

4 Ways to Apply a Growth Mindset to Your Finances

Financial literacy is a learned skill. We aren’t born understanding interest rates, refinancing or how to invest. Instead, we need to believe in our ability to acquire knowledge about personal finance. Having a growth mindset about money means continuously thinking “I realize I need to learn more about money.”

So often, though, people get stuck in a cycle of a limited monetary potential, believing that they’ll never surpass a life of living paycheck to paycheck. This type of thinking is a fixed mindset and limits opportunities to learn financial best practices and, ultimately, how much income you have the potential to generate.

Having a growth mindset suggests that your personal finance capabilities are only as limited as your attitude and aptitude for learning the skill. It means you’re curious about learned improvements, not striving for perfection at every turn.

Learning how to develop a growth mindset for a better financial future takes living in abundance instead of scarcity, adopting lifelong learning, building upon second-nature habits, being persistent and viewing challenges as opportunities.

1. Live in Abundance Instead of Scarcity

With a fixed mindset, we perpetuate the belief of scarcity and often compare our lives to the lives of those around us. This leads us to believe we’ll never have enough and we live in a static situation.

“My credit score should be higher.”

“I’ll be happy if I can get that promotion.”

“I’ll never be able to pay off this credit card debt.”

Shifting this belief to a growth mindset means we have enough and we can produce as much as we want, with proper consideration and education. Think about your finances as an opportunity for growth, rather than a debt you can never repay.

Gratitude for existing circumstances is at the core of a growth mindset. How you think about yourself, what you need and how much you’re worth are all factors that impact financial literacy. Consider yourself a successful investor who appreciates what they have but acknowledges the ability for growth.

To create a growth mindset in abundance, you have to question the belief system that has built your assumptions about money including habits, earning potential, expenses and income.

Your money mantras:

- “I’m inspired by my neighbor’s accomplishments.”

- “I’m grateful I have a degree.”

- “Success, money and happiness come easily.”

2. Adopt Lifelong Learning

People with a fixed mindset tend to accept the fact they don’t know something, and use that as a way to excuse behavior that’s limiting them from reaching their goal.

“I’m just not good with money.”

“I never learned what factors into my credit score.”

“Investing is difficult, I won’t be able to understand it.”

A growth mindset happens when we continue to exercise our brains. Skills and intelligence can be cultivated with practice. The theory suggests that you can learn to save, learn to make more money or learn to get out of debt with practice. Notably, we are not the situations we were born into, and we can adapt our financial futures.

When you are rooted in the belief you can’t learn to be better with your personal finances, you’re closing opportunities to better serve your financial future.

Your money mantras:

- “I’ll learn as I go.”

- “I have the opportunity to learn about (investing, debt consolidation, repayment).”

- “I’ll learn to monetize my skills and talents.”

3. Build Upon Second-Nature Habits

People may associate financial competence with avoidance. With that negative association, it makes money management a chore, and difficult to do.

“I shouldn’t make a purchase.”

“If I could just stop buying lattes. . . .”

“I can’t run up the balance on my credit card.”

In reality, the growth mindset is about building habits that become second nature. Instead of avoiding the wrong thing, make a habit of doing the right thing, so much so that you don’t notice when you’re doing it. Set goals to create systems that make positive financial outcomes. View failure as an opportunity for growth, then modify your goals as needed.

Your money mantras:

- “I’ll happily spend money on a planned purchase.”

- “I’m investing in myself by spending this money.”

- “I don’t notice the salary percentage going to my 401(k) because I expect it.”

4. Have Persistence and View Challenges as Opportunities

A growth mindset is particularly useful to cultivate persistence. When you have a fixed mindset, you tend to avoid anything challenging or that you weren’t immediately good at.

“My business failed so I’m not going to try entrepreneurship again.”

“I wasn’t able to pay off my statement this month; it’s hopeless.”

“There’s no point in trying to invest if I might lose money.”

When you shift these mindsets to ones of growth, these scenarios become opportunities to improve. The theory celebrates failure as a way to conduct self-improvement for a better overall performance. A growth mindset means going against the grain, being persistent and attempting challenging opportunities in order to supplement a better financial future.

Instead of harsh self-criticism, identify the root cause of the failure and work to overcome it.

Your money mantras:

- “I may make a mistake, but I will always learn from it.”

- “In the past, when I tried to invest, I didn’t have much success. But I can do better.”

- “I’m glad I got feedback from the interview so I can improve those skills.”

The way we think about learning and our own abilities can have a significant impact on our financial literacy. By applying Dweck’s theory to money management, it suggests that by altering your perspective, you’ll be able to achieve positive monetary changes, whether that’s getting out of credit card debt or investing in the next big thing.

Sources: Harvard Business Review | MDPI | Mindset Works