Disclosure regarding our editorial content standards.

The difference between gross income and net income is that one is essentially your paycheck before taxes, and the other is your paycheck after taxes are taken out. In general, gross income refers to the total amount your employer agrees to pay, before deductions. Net income, on the other hand, is your income after taxes and adjustments are subtracted.

Remember the first job you had in high school where hourly wages seemed decent? Twelve dollars, maybe $13 per hour seemed good enough to have a little extra cash in your pocket for after-school activities.

Then, when payday rolled around and you were handed your first check, you were disappointed to see a significantly lower number. Originally, you had discussed the gross pay with your employer. In actuality, those eight hours on your feet resulted in a lower amount paid out, referred to as your net income, which depends on your tax bracket, contributions and garnishments.

Because deductions and contributions can vary significantly, it’s important to know both your gross income amount and net income amount to be a financially responsible consumer. Under-budgeting can eventually lead to overspending and missing credit payments—to the detriment of your financial future.

What Is Gross Pay?

Gross pay in regard to salary is the amount you’re paid before taxes and withholdings. In an hourly wage application, gross earnings are calculated as the hours worked multiplied by the hourly pay rate. Total gross annual income is the addition of those earnings for a calendar year or the entirety of your salary.

How to Calculate Gross Income

To calculate gross income, find the total of all sources of income[2] before tax deductions and adjustments. Be sure to include salaries, wages, bonuses, tips, self-employed income, alimony, dividends and retirement distributions.

Adjusted Gross Income Example

Don’t get confused between gross income and adjusted gross income (AGI). While they seem similar, the two share a significant difference. While gross income denotes salary before any adjustments, AGI removes any eligible deductions like student loan interest or contributions to a health savings account (HSA).

What Is Net Pay?

Net pay is your gross income minus deductions, taxes and adjustments. Also called take-home pay, net income is the final amount that you’ll see on your paycheck. Having this number at the forefront of your mind may help you manage your budget more accurately to avoid debt.

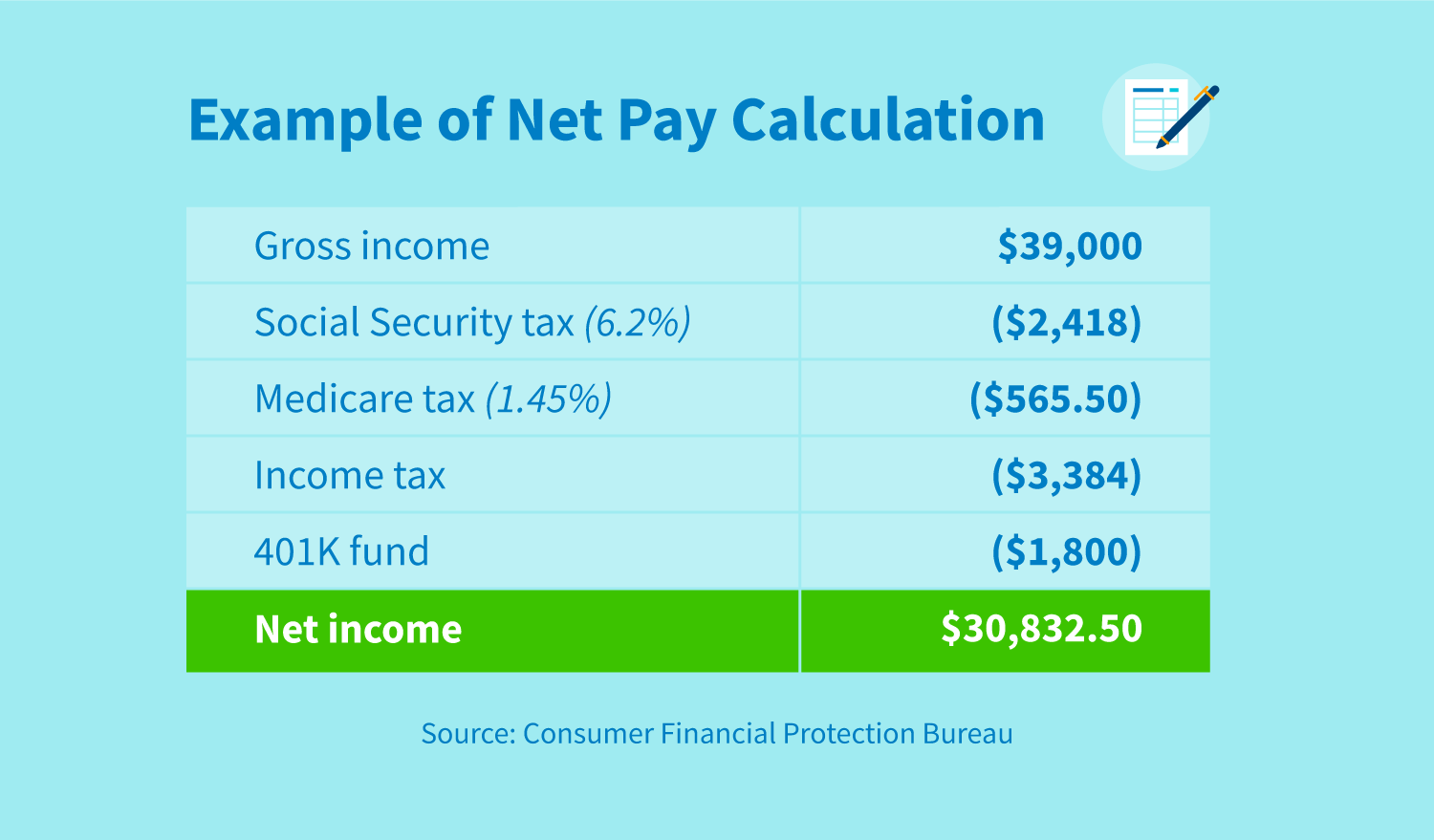

Net Income Equation

Net pay is equal to gross pay minus deductions. While some deductions are mandatory, like Social Security tax, Medicare tax, federal income tax and state income tax, others are voluntary and will vary based on certain contributions.

Deductions you might see on your gross income when converting to your net income can include:

- Federal income tax withholding

- State income tax withholding

- Local income tax withholding

- Insurance premiums

- Retirement contributions

- HSA and FSA contributions

- Social Security and Medicare

The applications of gross income and net income can vary. From loan applications to income choices, like when to ask for a raise, knowing each of these numbers will provide perspective to help you be a financially responsible person. Knowing your take-home pay will help you budget properly to avoid overspending and, in the best case, better credit health.

Sources: Federal Trade Commission | InvestingAnswers | CFPB