Disclosure regarding our editorial content standards.

Venmo is generally safe if you take certain precautions. Because the platform uses encryption to protect your personal information, Venmo can be safely used to send money to people you trust. However, your account could be vulnerable if you lose your phone, share your password or fall victim to a scam.

Fortunately, the company provides tools to keep your account safe—and to lock your account down if someone gains access to it. Here’s our guide to Venmo security features, common scams and how to use Venmo safely.

Table of contents

- What is Venmo?

- How does Venmo work?

- Venmo risks

- Does venmo have buyer protection?

- Is Venmo safe for sellers?

- How to stay safe when using Venmo

- Common Venmo scams

- Criticisms of Venmo’s security measures

- Alternatives to Venmo

- Additional Venmo guides

- Frequently asked questions on Venmo safety

What is Venmo?

Venmo is a “peer-to-peer payment app,” which means it helps you send money directly to other people without having to share financial information. Other apps like Zelle and Cash App by Square also provide similar digital payment services.

Who owns Venmo?

Venmo was acquired by PayPal in 2013 for $800 million. Venmo differs from the other services with its social element and that it is geared more toward fast, free mobile transactions. This means Venmo also has different fee structures (for instance PayPal offers free payments only via direct bank account transfers).

How does Venmo work?

Venmo helps you send money to people you know by connecting your bank account or credit card to your Venmo account.

After signing up for a Venmo account online or using the phone app, you’ll provide Venmo access to your debit or credit card. When you send someone money on Venmo, you can simply enter their phone number or username, and Venmo will then facilitate the transaction between your financial institutions.

Venmo transaction fees

Venmo is designed to be free to use for most transactions. Standard bank transfers, direct deposits and peer-to-peer payments are all fee-free. However, Venmo does charge the following common fees:

- 3 percent for credit card transactions

- 1 percent for depositing government or payroll checks

- 5 percent for depositing all other checks

- 1.9 percent plus $0.10 for receiving payments as a merchant

For specific fees on these and other services—including Venmo crypto purchases, instant withdrawals and the Venmo credit card—visit their website.

Is Venmo safe to use?

Transactions made on Venmo are considered very safe when users follow best practices. However, with added convenience comes added risk, so you’ll want to make sure you take a moment to understand how Venmo works.

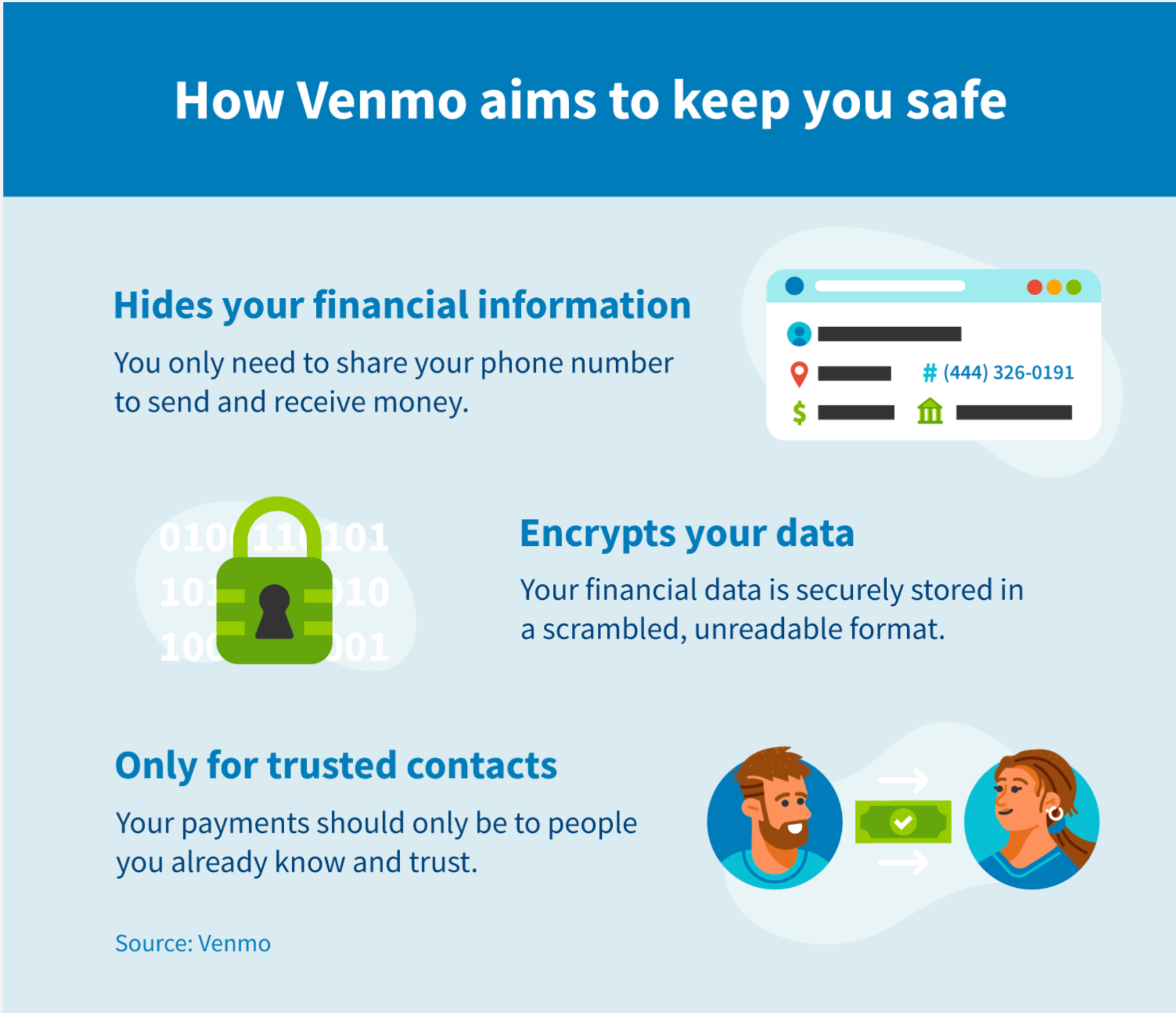

Venmo’s website lists several ways they try to keep your information safe:

- Encrypting your information: Your financial information is stored in a scrambled, unreadable format on secure servers.

- Limiting payments to trusted contacts: Venmo suggests you only use their app to send payments to people you already know and trust.

- Offering security support: Users can call theVenmo customer service number (+1 855-812-4430) if they suspect their account has been compromised.

Even with these safeguards, however, it’s still recommended that you take precautions to avoid the following risks.

Venmo risks

So, how safe is Venmo for the everyday user? Although Venmo has built-in security features that protect you, there are still several risks to be aware of, such as:

- Losing your phone while signed in to the app

- Sending funds to a dishonest seller

- Receiving funds from a dishonest buyer

- Having your password compromised

Most of the risk posed by using Venmo can be avoided by exercising caution and sound judgment. Plus, Venmo offers some fraud protections to their users.

Does Venmo have buyer protection?

While Venmo comes with risks, the company does provide some fraud protection. Your money may be protected in some of the following situations:

- An unauthorized user gains access to your account

- An incorrect amount is taken from your account after you send a payment

- Your account balance is calculated incorrectly after receiving a payment

To take advantage of their fraud protection services, you’ll need to file a claim with Venmo customer support, typically within 30 to 60 days of the disputed transaction.

Is Venmo safe for sellers?

When abiding by recommended use guidelines, Venmo is typically very safe for sellers. However, many of the risks associated with the app affect users trying to receive funds because Venmo scammers often look to get goods or services without paying for them.

How to stay safe when using Venmo

Although Venmo’s app is designed with security in mind, there are additional steps you can take to protect yourself when using it to send and receive money.

1. Monitor devices on your account

You can see which devices are logged in to your Venmo account by visiting the security settings page. If there are any devices you don’t recognize, you can immediately remove them.

2. Use a secure password

Your Venmo password shouldn’t be used anywhere else and will ideally contain a mixture of lower- and uppercase letters as well as numbers and symbols. You could also consider using a password manager like LastPass or 1Password.

3. Enable two-factor authentication

This feature requires you to enter a code sent to your phone in addition to your password when logging in. This extra security measure means that someone cannot access your account without your password and access to your text messages.

4. Turn on the PIN feature

If you stay logged in to the Venmo app on your phone, you can turn on the PIN feature, which requires you to enter a four-digit number to access the app. On Apple devices, you can also use Face ID for an additional security check.

5. Avoid sending money to strangers

Venmo’s policy states that it is only to be used for sending money between people who already know and trust each other. Venmo does not offer protection for buyers and sellers who are not satisfied with a transaction.

6. Beware of scammers

If you’re considering buying from a user you don’t know well, look for reviews and extra accountability measures, such as a website with customer support and valid contact information.

7. Activate text and email alerts

Turn on text and email alerts as well as push notifications to your phone so you know every time there’s activity on your account. You’ll instantly know if someone logs in or makes a transaction.

8. Be cautious with debit cards

To avoid credit card fees, many users connect their debit cards to their account. Be aware that in general, unlike credit card purchases, debit fund transfers cannot be recovered.

9. Monitor your credit

If your Venmo account is attached to a credit card, it’s useful to monitor your credit to make sure you’re not receiving fraudulent charges or missing payments. Credit monitoring can also alert you if your identity has been compromised.

Common Venmo scams

Unfortunately, Venmo users have been exposed to several types of scams. Here are a few of the most common ones:

- Reverse transaction scams: Malicious users cancel a transaction with their bank or credit card before the payment finalizes.

- Pay later scams: A buyer insists that a seller provide goods or services before they pay with no intention of finalizing payment after.

- Fake screenshot scams: Buyers send fake “completed transaction” screenshots, falsely claiming they’ve already sent money to a seller.

- Venmo email scams: Phishing scammers trick victims into sending funds or sharing account information via aggressive email requests.

- Venmo text scams: Scammers texting from anonymous numbers convince users to transfer funds or share account information.

- Venmo hacked-account scam: Hackers use the victim’s account to make purchases.

The common theme to most Venmo scams is that they generally involve anonymous or unknown users. Always be cautious when transacting with people you don’t know, especially if they make suspicious requests.

Criticisms of Venmo’s security measures

Over the years, Venmo has been subject to criticism regarding their security measures, their protections of user data and their communication regarding privacy features. As a result of a 2018 settlement with the Federal Trade Commission, however, Venmo is now required to receive external audits to make sure they are abiding by stringent customer protection guidelines.

Alternatives to Venmo

Depending on what your needs are, there are many alternatives to Venmo for peer-to-peer transactions. Here are a few to consider:

- PayPal: Venmo’s parent company charges more fees but has more buyer protections.

- Zelle: This app connects directly with banks for fee-free instant transfers.

- Cash App: Users get free transfers and access to a free debit card.

- Google Pay and Apple Cash: Both options offer free digital payments via mobile devices.

- Cash, check or money order: These tried-and-true payment methods are still viable options.

This list isn’t exhaustive, but it should provide some popular options for sending and receiving payments outside of Venmo.

Additional Venmo guidance

If you think you may be the victim of a scam, the best thing to do is report the incident to Venmo customer service. Once you’ve done that, there are a few other actions to consider.

How to cancel a Venmo payment

Once completed with registered users, payments on Venmo cannot be canceled. If you have a pending payment the recipient hasn’t yet accepted, you can cancel the payment in the “Incomplete” tab. If you think you may have sent a payment to a scammer, submit a request to the customer support team to report it.

How to delete a Venmo account

If you decide to delete your Venmo account, you can do so by logging in to your profile from a computer and clicking “Cancel My Venmo Account” at the bottom. Note that this cannot be done from the mobile app.

Frequently asked questions on Venmo safety

Will Venmo refund money if scammed users report it?

In general, unfortunately, the answer is no. If you report fraudulent payment, Venmo will likely freeze the account from which a user is committing fraudulent activity. If the money is still in the account, the user may be able to refund the money manually. For Venmo purchases made via credit or debit card, fraud victims can report the incident to their bank.

Can you delete Venmo history?

Users cannot delete their transaction history. Fortunately, Venmo gives users the option to make their transaction history private, so it should be secure as long as your account remains secure.

Why is Venmo asking for my SSN?

In some cases, Venmo identity verification measures require users to confirm their Social Security numbers. These circumstances include sending $300+ to users or transferring $1,000+ to a bank in a week, creation of a group account and processing 200+ business profile transactions in a year. If you are asked to share it, be sure to verify the request is coming directly from Venmo.

So, is Venmo safe? In most cases it is, but that doesn’t mean it’s risk-free. As is the case with all payment methods, it does have vulnerabilities that can leave users unpaid, overcharged or overdrawn. If you run into financial hardship as a result of missing income or unexpected expenses, you may benefit from working to repair your credit with professional support, which could help you straighten out your report and work toward your credit goals.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263