Let’s create a hypothetical tax refund and credit card debt situation so we can see how the different debt-pay down strategies affect payments and balances as well as the total pay-off amount.

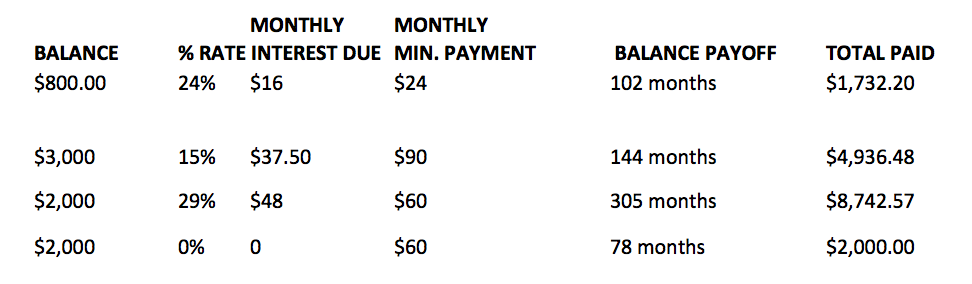

Imagine a scenario where you have four cards with different balances equaling a total of $7,800 and minimum payments calculated at 3% of your outstanding balance (typically, 1% to 3%). So, here’s a list (in no particular order) showing your four hypothetical credit card balances, interest rates, minimum payments and pay-off amounts using a credit card payoff calculator if you continued just making the monthly payments and never charged again:

Now, let’s say you get a $1,000 tax refund check (or bonus or windfall of any kind) and you’ve decided to pay it toward your credit card debt.

Should you pay it toward the card with the highest balance, the highest interest rate or the smallest balance first?

Any time you pay more than the minimum payments, you will reduce balances, the total amount of payments due and the length of time for balance pay-off. If you can make a lump sum payment, such as using your tax refund, even better. Here’s how using your tax refund for debt pay down plays out in different ways, using our hypothetical chart scenario, above.

Smallest balance first: One theory, popularized by Dave Ramsey, author of, “The Total Money Makeover” is called the “Debt Snowball” method and is based on paying the smallest balance off first, regardless of the interest rate charged. So you would order your chart from least balance to greatest. This way, from your $1,000 tax refund check you would pay off the $800 balance completely avoiding paying more than twice that ($932 more) by continuing to just pay the minimum payment and freeing up that $24 minimum payment to go toward the card with the next smallest balance. Next, you would take the remaining $200 from the tax refund plus the $24 minimum payment you were making before and pay it toward the next smallest balance (the $2,000 balance with the 29% interest, leaving the 0% card which isn’t charging you interest or growing) plus that card’s minimum balance and continue paying down that card with any remaining monies in your budget every month. At this point you adjust the pay-off of that card accounting for your lump sum payment and the larger than minimum due payment every month using that credit card pay-off calculator again. And that’s how the pay down “snowballs,” gathering speed and momentum, reducing the balances and freeing up cash to pay toward debt quickly.

Highest balance first: Now, let’s say you paid the whole $1,000 toward the card with the $3,000 balance, reducing it to $2,000. Your new minimum monthly payment would be $60.00 (instead of $90) Balance payoff would be in 121 months (instead of 144) and your payments would total $3,222.34 (instead of $4,936.48). You would continue to pay all four cards at the minimum payment (or more if you could) for a total savings of $1,714.14 and 23 months of paying. Now you have three cards each with a $2,000 balance left, one card with an $800 balance and have freed up $30 to put toward debt pay-down because of the new minimum payment.

Highest Interest Rate first: Conventional wisdom says to pay the highest interest rate card first since that’s the one charging you the most to carry a balance. Let’s see how it plays out when you put your $1,000 tax refund toward the card with the $2,000 balance and 29% interest rate. That reduces the balance to $1,000, the minimum monthly payment to $30 (from $60), the balance pay-off to 187 months (from 305 months) and the total payments to $3,599.93 (from $8,742.57). This way you would cut more than $5,000 from your total payments and free up $30 to make more than the minimum payment on this card, however you will still be paying the total payments on all the other cards.

Which debt-pay down method is right for you?

The choice of which to pay is based on your own personal credit card debt scenario. So, create a chart like I did above listing your own credit card debt information using a credit card payoff calculator to see which would save you the most money and free up the most money to speed up paying down your debt.

The amount of money saved looks significantly greater from paying down that card with the high interest rate. But, if you have several cards all with similar interest rates, the debt snowball can work wonders. One thing about the debt snowball method I can attest to is that you experience a great feeling of accomplishment as you see the changes reduce your total credit card debt quickly. And, there’s no accounting for the enthusiasm to find even more money in the budget to pack on to your debt snowball!

Questions about credit repair?

Chat with an expert: 1-800-255-0263