Student Loan Forbearance vs. Deferment

If you find yourself in a situation where you can’t pay your student loans—maybe you lost your job, maybe you’re dealing with a financial emergency—know that you have other options aside from making a late payment or (eek) defaulting on your loan.

Two common alternatives you could consider are loan forbearance and deferment. We’ll walk you through the process of both forbearance and deferment, compare their benefits and drawbacks, and help you decide which is the best for your situation.

What Is Loan Forbearance?

Loan forbearance is when your loan owner grants your request to temporarily modify your loan payments, usually by decreasing the amount of the payments or halting them altogether. Typically, borrowers request forbearance in times of short-term financial hardship that are caused by unexpected problems—like illnesses or lost jobs.

If you suddenly find yourself struggling to make payments on your loan, forbearance might be a great solution for you.

How Student Loan Forbearance Works

When your lender grants your request for forbearance on your student loans, you’ll have to discuss with them the exact terms of the agreement. This includes details like how long it will last and how your payments will be modified during this time. Get a copy of the agreement in writing. Make sure you understand what’s expected of you once your forbearance period has ended—you’re still responsible for paying what you missed during that time, whether it’s in one lump sum or spread out over time. Make sure you make an agreement you can handle financially.

There are four important things you should know about student loan forbearance:

- Interest will likely still accrue during the forbearance period. It’s up to you whether you would like to pay the interest as it accrues, or let your unpaid interest capitalize and be added to your loan’s current principal.

- There are two different kinds of student loan forbearance: general and mandatory. General forbearance is for people going through financial struggles that hurt their ability to make their payments, as we mentioned earlier. Mandatory forbearance is for people who meet certain requirements, such as serving in an AmeriCorps position, or participating in a medical internship or residency.

- You can only request so much student loan forbearance. If you have been granted general forbearance, it can last for up to 12 months, and then you may request it again. Your cumulative total amount of general forbearance cannot exceed 36 months. Mandatory forbearance also lasts for up to 12 months at a time and has no upper limit.

- You cannot make progress toward student loan forgiveness while forbearance is in effect.

With these things in mind, decide whether or not you’d like to request forbearance for your student loans.

How to Apply for Student Loan Forbearance

When you’re ready to apply for forbearance, reach out to your lender. They may also require documentation that you’re qualified for the type of forbearance you’re requesting.

If you’re applying for mandatory forbearance and can prove your eligibility for it, your loan service is required to grant your request. If you’re seeking general forbearance, your success is not guaranteed, but don’t let that stop you from applying. Get in touch with your lender if you have any questions throughout the process.

What Is Loan Deferment?

Student loan deferment is functionally similar in that it delays when you need to make your payments, but it does differ in a number of significant ways that you should take into consideration when you’re deciding between deferment and forbearance.

How Student Loan Deferment Works

Student loan deferment is usually better for people who are going through a long-term financial hardship or who have a certain kind of loan, such as a subsidized federal student loan. If you have one of the loans in question, interest will not accrue during your deferment, (which can be very helpful). In addition, deferment is like mandatory forbearance in that you cannot be denied deferment as long as you qualify for it, and it can last as long as you qualify for it (depending on your deferment type).

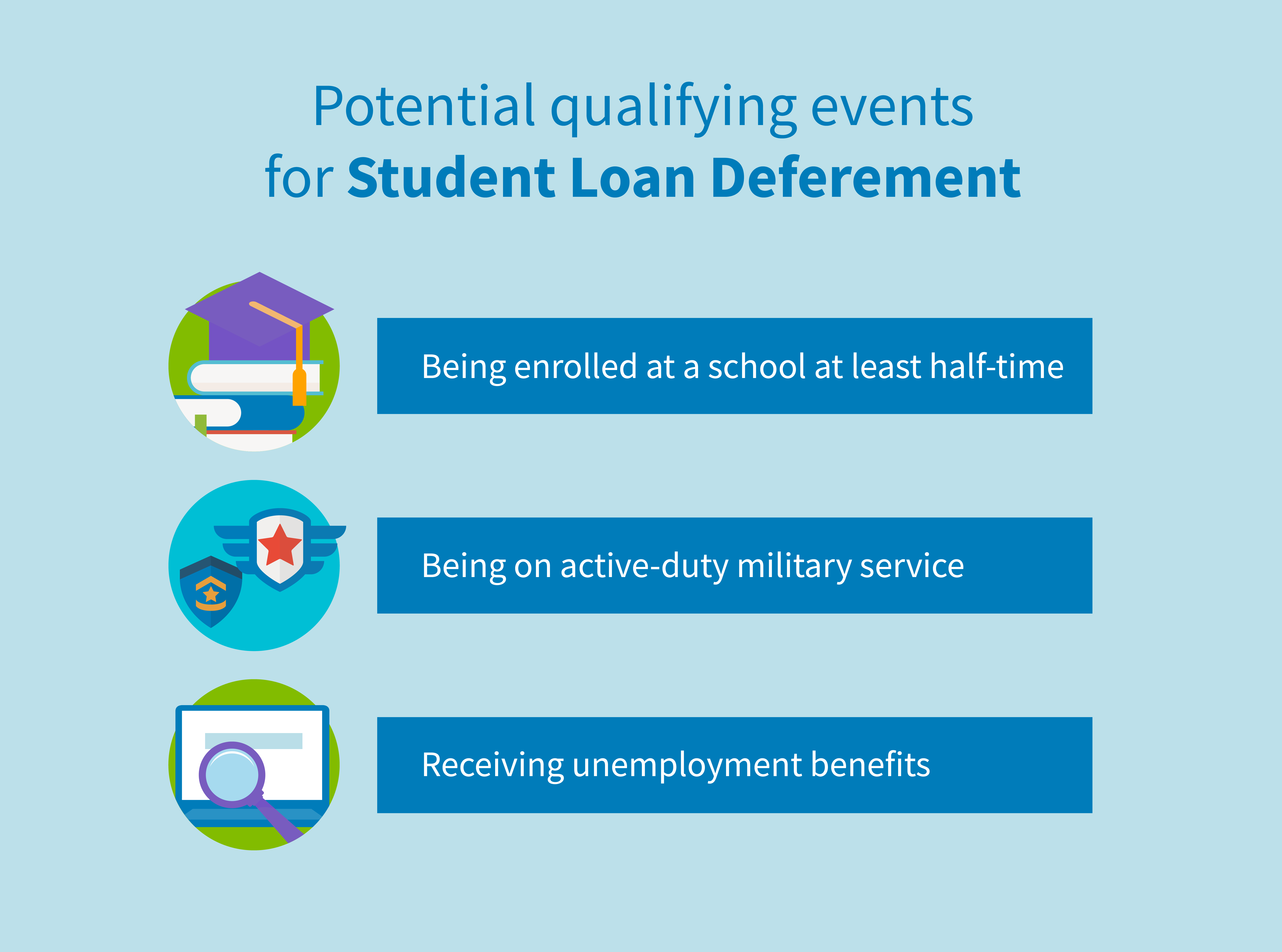

There are a number of things that make you eligible for deferment, such as:

- Being enrolled at a school at least half-time

- Being on active-duty military service

- Receiving unemployment benefits.

Check what are considered qualifying events to see if any apply to you—if not, forbearance may be right for your situation.

How to Apply for Student Loan Deferment

Like forbearance, applying for student loan deferment involves you contacting your loan service to see what form(s) they need you to fill out. They will also likely ask you to provide documentation that shows you meet the deferment requirements.

Don’t wait too long to start the application process, although fortunately, deferment and forbearance can both be applied retroactively if necessary. And always get confirmation that your request for deferment or forbearance has been approved before you stop making payments.

How Forbearance and Deferment Affect Your Credit

If you’re concerned about whether your credit will be affected by student loan forbearance or deferment, let out that breath you’ve been holding: it won’t be. It may be listed on your credit report that you utilized forbearance or deferment, but this is a neutral item that won’t hurt or help your credit score .

If anything, your taking action now will ultimately protect your score by making sure you don’t make late payments or miss them altogether. Double-check your forbearance or deferment agreement to confirm you know how to fulfill your part of the bargain.

Coronavirus, Student Loan Relief and Mortgage Assistance

The new CARES Act is one of many attempts made by the federal government to help loan payers during the current economic crisis caused by the Coronavirus (COVID-19) pandemic. It makes a number of accommodations for consumers, including putting federal student loans in automatic forbearance and giving them a zero percent interest rate. This will last until September 30, 2020 .

If this applies to you and you would still like to make your payments, you may. (In fact, it would be a great idea to do this if you can afford it!) Otherwise, focus on getting and staying as financially stable as you can before you have to start making payments again.

Understanding things like forbearance and deferment can be crucial to your future financial health. Hopefully you’re feeling more equipped to consider these options if you need to, but if you’re still feeling a little shaky on the terminology, there are always people in the industry who can help you, whether you’re trying to avoid foreclosure or you need to pause your student loans. Start addressing your concerns today and contact your trusted financial adviser.

Let us help you check on your credit score, today.

learn moreFICO and “The score lenders use” are trademarks or registered trademarks of Fair Isaac Corporation in the United States and other countries.

** Your results will vary