Disclosure regarding our editorial content standards.

Deferred interest is a type of loan that temporarily postpones interest payments for a set period of time.

Do interest-free loans sound too good to be true? In some cases, they are.

Without understanding the implications behind no-interest credit, you risk paying more in the end, or worse, defaulting on your loan and finding yourself in need of credit repair.

So how does deferred interest really work, and how can you make it work for you? In short, to reap the benefits of this low-cost loan, you need to pay the entire balance in full before the promotional period ends. We’ll dive deeper into this loan type and how to take advantage of it below.

What is deferred interest?

Deferred interest allows you to repay a loan interest-free for a set period of time. However, it’s worth reiterating that this isn’t a truly “interest-free” loan—it simply delays interest payments for a while.

Deferred interest can take many different forms, which is why you have to be careful when reading the terms and conditions of these loans. In your contract, look for synonymous terms for deferred interest, like:

- “Interest-free credit card”

- “Same as cash”

- “No interest if paid in full”

- “Retroactive interest”

- “No interest for XX months”

How do deferred interest loans work?

Deferred interest charges no interest for a specified period. While you’ll enjoy interest-free payments during that time, once the period has ended, you’ll pay accrued interest on the beginning balance of the loan, often at a higher rate than most average loans.

Typically advertised with large-ticket retail items, the psychology of deferred interest programs makes it seem like you’re getting to avoid interest payments entirely. Instead of taking out a loan with a set interest rate to pay for an item in full at the time of purchase, you’ll have six, 12 or 24 months to pay off the bill before you see the interest charges accrue.

The caveat: If you don’t pay within the specified period, you’ll likely get stuck with an inflated interest rate. Between that and the accrued interest, these payments could cost you more in the long run than a standard loan with a lower annual percentage rate (APR).

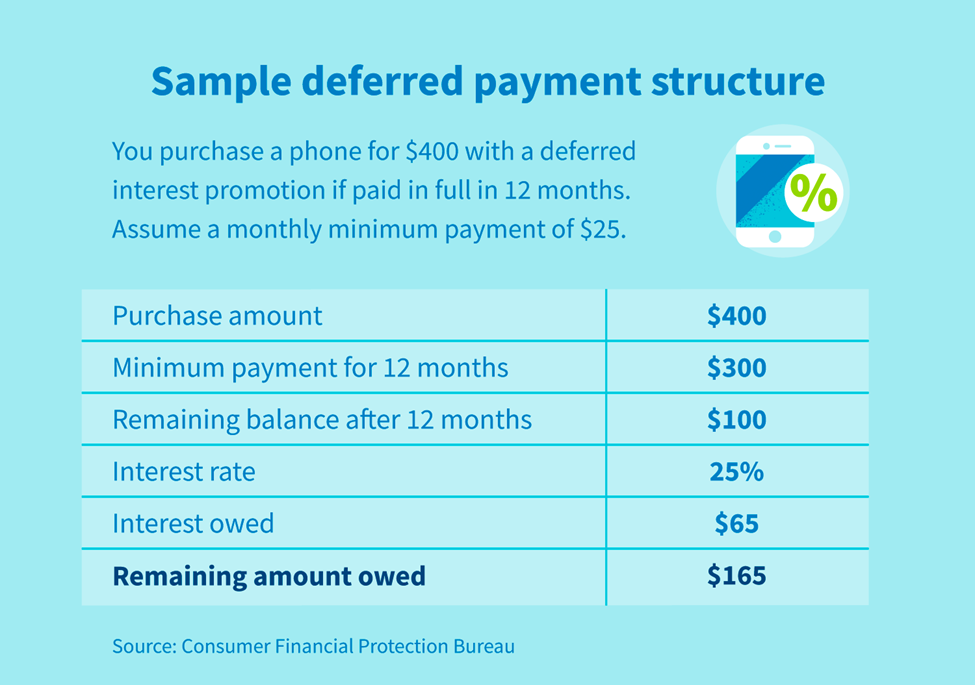

In this example, you still haven’t paid off the original $400 price of the phone after the 12-month promotional period. All the interest that was accruing (but not charged) during those 12 months gets added together, totaling $65. That figure then gets added to the $100 you still owe on your purchase. Now you’re responsible for that $65 plus any more interest you accrue as you pay off the $165.

What is accrued interest?

Accrued interest refers to the amount of unpaid interest that has accumulated on a loan. When that balance isn’t paid in full, the remaining amount accrues interest at the agreed-upon rate. Deferred interest loans don’t accrue interest during the deferral period.

0 percent intro APR promotion vs. interest deferral

With a 0 percent intro APR promotion, any remaining balance at the end of the payment period will start accruing interest once the promotion ends. Loans with deferred interest, on the other hand, accrue interest on the beginning balance of the loan if not paid in full before the deferral period ends.

While deferred loans can be advantageous for short-term purchases that you can confidently pay off within the deferral period, credit with 0 perecnt intro APR is typically more financially tactical since it waives the interest on applicable transactions made during the promotional period.

Benefits and drawbacks of deferred interest

Though there are some potentially expensive pitfalls to deferred interest loans, there are also some advantages that could make them attractive to some borrowers.

Benefits of deferred interest

For those who are able to successfully repay their deferred interest loans within the deferral period, this loan type offers the following benefits.

- Accessibility: These loans are typically easier to acquire than standard loans.

- Flexibility: If you’re able to make regular payments, this can offer financing flexibility if you need available cash for other expenses.

- Immediacy: Since they often apply to specific products, these loans allow you to purchase expensive items like appliances, electronics or furniture without waiting to save enough to purchase them in cash.

- Savings: If you pay the loan off in full during the deferral period, you won’t have to pay the interest rates of a standard loan.

Drawbacks of deferred interest

Before you commit to deferred interest, it’s important to understand the drawbacks that come along with the benefits.

- High interest rates: Once the interest rates do kick in, they may be even higher than those of standard loans.

- Accrued interest: If you haven’t paid the loan off in full before interest becomes due, you may have to pay interest on the full loan amount, not just the remaining principal.

- Fine print: These contracts may include provisions not fully explained at signing, so be sure to read the terms carefully.

- Unpredictable life changes: If unexpected expenses arise during the course of repayment, you may find yourself unable to pay off the loan in time.

Does deferred interest hurt your credit?

Deferred interest hurts your credit score if your balance is not paid in full at the end of the promotional period. Additionally, a lender may still report a late payment to credit bureaus if you applied for deferment and a payment is due before the request is approved.

However, if you pay your balance in full and leave the account open, you may see a slightly improved score as the line of credit ages. Before getting a no-interest credit card, consider less risky ways to build your credit.

How to avoid deferred interest charges

The only way to avoid deferred interest charges is to pay the balance off in full before the deferral period ends. Here are a few tips to help you do that:

- Read the fine print: Deferred interest terms can range significantly. Make sure you understand the retroactive interest charges, including whether the deferred interest is accrued for the entire amount or the balance remaining at the end of the period.

- Know your deferred interest period: The final payoff date may be different than the end date of the deferred interest period. Recalculate the amount owed to make sure you can pay it off before the end of the deferred interest period.

- Don’t use the credit for other purchases: Any additional purchases made on this credit line will be subject to the same high interest rate at the end of the promotional period.

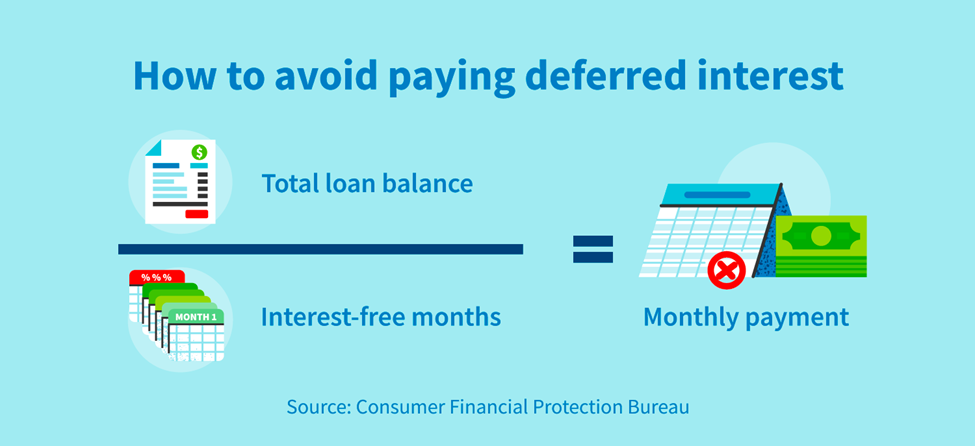

How to calculate monthly payments

To make sure you pay off your loan before interest is due, divide the total balance of the loan by the number of interest-free months, then structure automatic payments accordingly. This will help you avoid paying the high interest at the end of the promotional period.

It’s important to run the numbers to make sure your monthly payments will be enough to pay off the loan early. Also, be sure to check the terms often for any changes to the pay period or the deferred interest period.

How to avoid interest on credit cards using deferred interest

Deferred interest loans can be used to avoid paying interest on credit cards if you pay the loan off before the deferred interest period ends.

For example, if you’re considering buying an item using a standard credit card to make monthly payments that are subject to interest, deferred interest could be a viable alternative (if available). By using the calculation in the section above, make sure you can pay off the deferred interest loan during the interest-free period. If you can, then this could save you from making monthly credit card payments with a high APR.

Should you sign up for a deferred interest promotion?

You should sign up for a deferred interest promotion only if you’re confident you can repay the loan in full before the promotional period ends. Before signing up for a deferred interest program, consider the high costs associated with eventual interest payments. Read the fine print and understand if the interest will accrue from the entire purchase—including the amount already paid—or the remaining balance at the end of the period.

Deferred interest loans should be monitored extremely closely. Once the interest-free period ends, you’ll be stuck footing a higher bill if you haven’t paid the original balance in full. If you choose to get a deferred interest loan, make sure you have a plan to pay off the balance as fast as possible to avoid defaulting and hurting your credit score.

The complexity of these plans often makes them difficult to navigate—but the more you know about them, the better. And if your credit standing has been damaged by missed payments on deferred loans, we’re here to help you work on your credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263