Disclosure regarding our editorial content standards

There are many ways to build credit without a credit card. You can take out a personal loan, get a secured credit card, become an authorized user and even report certain bills to the credit bureaus.

Some people mistakenly believe that if you don’t plan on using credit cards, there’s no real reason to build credit. Not only do lenders look at your score when you apply for a home or auto loan, but a good credit score can save you quite a bit of money. As personal finance expert Ben Luthi at Experian® explains in an article, a better credit score can save you upwards of $10,000 in interest on a car loan.

This sounds great, but can you build credit without a credit card?

The challenge you may face is that you need credit to build credit. So, what now? Fortunately, building credit without a credit card is possible, and we’re going to give you 11 different ways to do it. Keep reading to learn how to build credit without a credit card, as well as how to maintain a healthy credit score.

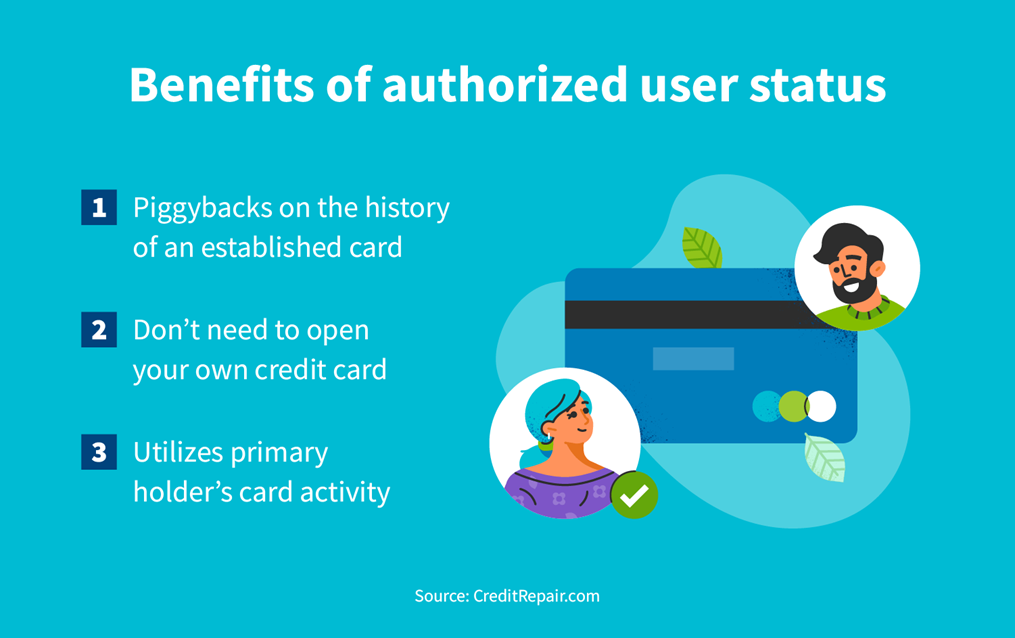

1. Become an authorized user

Often referred to as “credit piggybacking,” authorized user status allows you to leverage someone else’s credit. In this scenario, the primary holder of different credit cards adds you as an authorized user, so you’ll be able to have credit cards for building credit.

This is one of the easiest ways to build credit because all it takes is a family member or friend with strong credit who is willing to add you to their account. This takes a decent amount of trust, because although your credit will improve when they make payments, it can also drop if you make purchases and don’t pay on time.

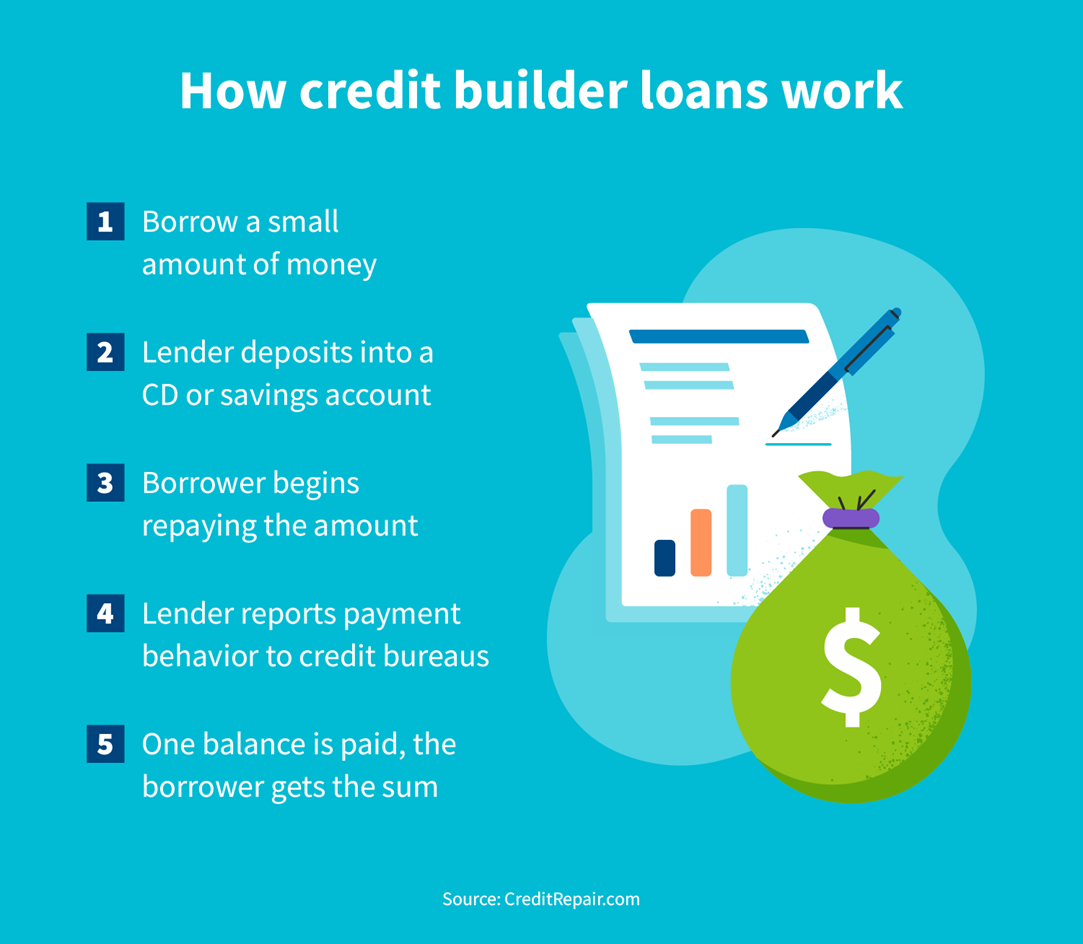

2. Get a credit builder loan

One of the best ways to build credit without a credit card is with a credit builder loan. These are a lesser-known type of loan whose sole purpose is to help you establish or repair your credit history.

These loans work the opposite way of a traditional loan or credit card because you borrow a specific sum (usually no more than $1,000), but don’t have access to the funds. Instead, the lender deposits the money into a certificate of deposit (CD) or savings account. You then begin repaying the amount and the lender sends your payment pattern and balance to the credit bureaus.

Once you pay the balance, you get your money back and, in the process, you’ve started to build a positive credit history. Essentially, you’re paying off your loan ahead of time. These loans typically pay out only a few hundred dollars at a time, but they allow you to practice good credit habits on a small scale.

3. Get a secured credit card

A secured credit card is another great option because you use your own money as a line of credit. When you hear people talking about a “credit-building debit card,” this is usually what they mean. If you’re in good standing with your bank, they can most likely provide you with a secured credit card to help you build your credit.

With a secured credit card, you’ll deposit money into a separate account, and the amount you deposit is your credit limit. When you get your credit card, you’re able to spend up to the amount you deposited, and you’ll receive a bill just like a normal credit card. As you pay off your secured credit card, the activity is reported to the credit bureaus to help you build your score.

4. Pay off your federal student loans

If you went to college or are considering taking out student loans, it’s important to consider how those loans will impact your credit. Just like any other loan, student loans show up on your credit report, so it’s important to pay them on time to help establish a positive credit history.

Most federal student loans don’t require you to begin making payments until after you’ve graduated or you’ve dropped below half-time enrollment. But you can start practicing good credit habits and building your credit sooner by making monthly student loan payments while you’re still in college.

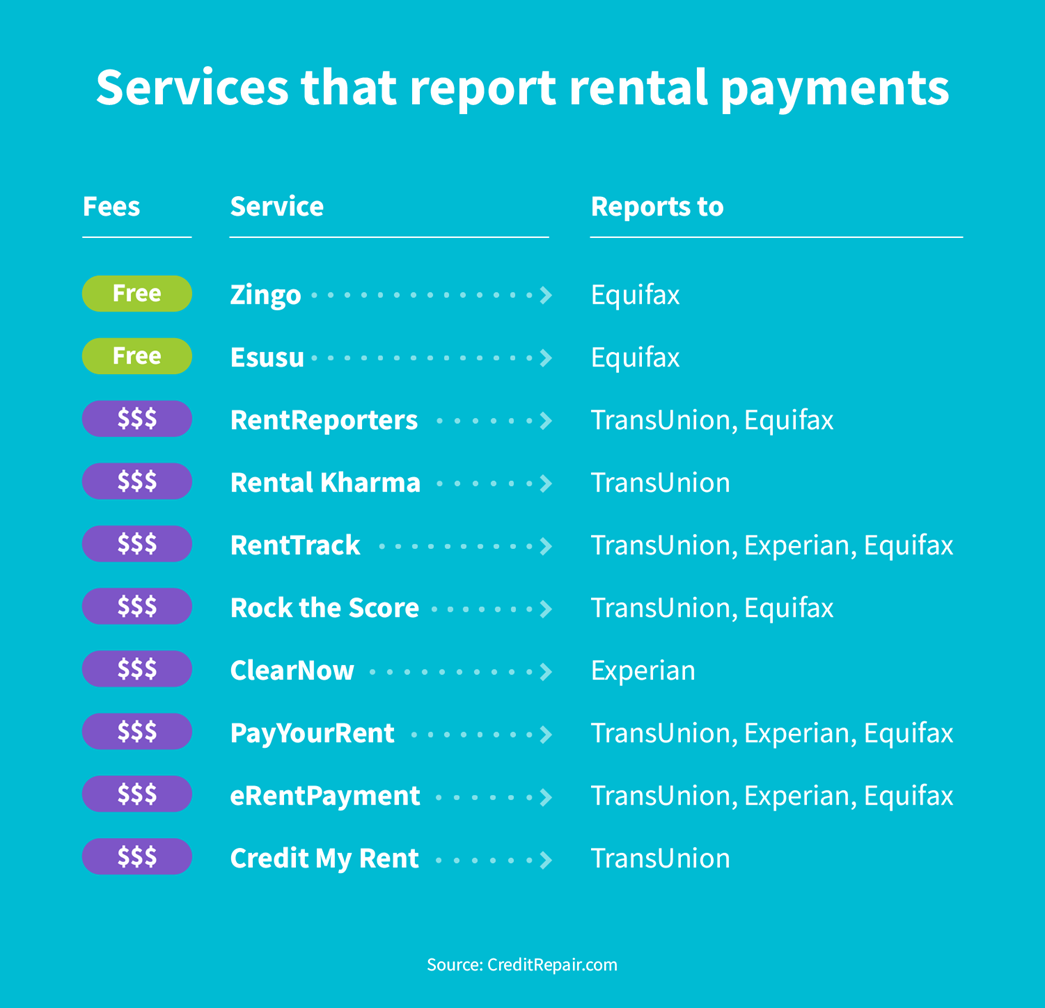

5. Report your rent payments

Most credit files don’t contain your rental history, simply because most landlords don’t bother reporting that activity unless it’s negative. However, all three major credit bureaus—Experian, Equifax®, and TransUnion®—do include rent payment information in credit reports if they receive it.

In this case, you may be able to take advantage of using a rent reporting service, such as Build It with Credit.com. that takes a bill you’re already paying and reports it to credit bureaus. This is usually more common with large commercial rental complexes as opposed to private renters.

If you’re evaluating a rental or you currently rent, you should ask the landlord if they’ll report your rent payments. If you pay your rent online, it’s worth checking if the provider will report your rent activity to credit bureaus, as some online payment service providers allow for this. You can also leverage external services like Rental Kharma or RentTrack that will report your rent to the major credit bureaus. These services help by adding up to two years of past rental payment history at your current rental.

6. Report your utility bill payments

Many utility companies check your credit when you first create an account but don’t report on your monthly payments. If you’re making all your payments on time for your electric and gas bills as well as your phone bill, this positive payment history should be able to help you build credit.

Some services offer a way to get your cell phone and utility bills reflected in your credit reports. For example, if you have a good track record for your regular monthly bills for at least three months, you might receive a boost to your existing credit score.

8. Make your auto loan payments

This is probably obvious, but it’s worth mentioning the value of paying your monthly car payments on time. This is how to build good credit while also avoiding a repossession of your car, so you’re killing two birds with one stone! Especially because vehicle loans are typically larger than most credit card limits, how you handle your car loan payments is important.

Now, you may be wondering, “How do I get an auto loan without credit?” Much like becoming an authorized user, you may be able to get a co-signer on an auto loan. This means that someone with a good credit score is taking on some of the risk, so lenders are more likely to approve the loan.

8. Pay your mortgage on time

Similar to an auto loan payment, making your monthly mortgage payment can help you build your credit if you’re a co-borrower. This is a solution for young couples who buy a home when one of the homeowners is trying to figure out how to build a credit without a credit card. As long as you’re a co-signer on the mortgage loan, you’ll be able to piggyback as you make your mortgage payments on time.

9. Take out a peer-to-peer loan

In a nutshell, peer-to-peer (P2P) lending takes the institution of banking out of the equation and allows borrowers to connect directly with individual lenders who fund loans in small increments, with the accrued interest going back to the investor.

These loans can be set up through a reputable P2P service and offer a valuable alternative to credit cards. That said, some peer-to-peer loans may require a credit check, so it may be hard to get one if you don’t have any established credit. This is usually recommended for someone who has established at least some credit and is looking to boost their credit score without dealing with an institution.

10. Get a personal loan

Rather than going through a lending marketplace with P2P loans, you can get a personal loan through your bank. If you have a positive history with your bank, they may provide you with a personal loan. Personal loans are reported to the credit bureaus, so as you make payments on time, you’ll improve your credit. If good standing with your bank isn’t enough to get you approved, you may be able to get a co-signer on your personal loan.

11. Bonus: Pay off collections

Paying off collections is a fantastic way to boost your credit, so we tossed it in as a bonus.

You may have heard that collections stay on your report for seven years, but there are ways to possibly remove collections from your credit report. When you pay off or settle your collections debt, you can request a pay-for-delete letter, which removes it from your report and helps your credit. Sometimes, you can use this as a negotiation tool because collection agencies really want you to pay off that debt.

Unlike the other tips on this list, you don’t need to get approved for this method (obviously). Many people run into a situation where they’re looking for easy ways to build credit, but it’s difficult to do because they have collections on their credit reports. Paying them off can help your score significantly.

How to responsibly build your credit

There’s no shortcut to building good credit. Doing so takes time and a history of on-time payments. Following these best practices will help you keep your credit on the right track and build a solid credit history.

Pay your bills on time

Regardless if it’s a car payment, medical bill or a student loan payment, make sure every payment is made on time and in full. Late payments can hurt your credit because they’re reported to the credit bureaus and result in a derogatory mark that could last for seven years. If you can, it’s always a good idea to set up automatic payments or reminders for any upcoming bills so you don’t accidentally hurt your credit.

Keep your credit utilization under 30 percent

If you have credit cards, it’s recommended that you don’t use all the credit that’s available to you, as this sends negative signals to credit bureaus. Your credit utilization is one of the primary ways your credit score is calculated because it’s worth 30 percent of your overall score. As a rule of thumb, it’s best to keep your credit utilization (the amount of credit used out of your available credit limit) under 30 percent at all times.

For example, if you have a maximum credit limit of $1,000, you’d want to try to keep your balance under $300.

Don’t apply for too many credit cards

Building good credit is a rewarding feeling, and it can be tempting to apply for more credit cards once you’ve established credit. However, be aware that every application you submit puts a hard inquiry on your credit report, which can ding your credit score.

So, how often should you apply for new credit cards? Well, a good rule of thumb is to limit your applications to once every three to six months and to only apply for the amount of credit you need.

Keep your credit accounts open

The longevity of your credit accounts is one of the many factors that plays into establishing a good credit score, so if you’ve built an account with history and good standing, keep it open. The longer an account is open, the more it helps your credit.

Monitor your credit

Building good credit doesn’t just stop at a good credit score—it’s a constant process. Not only is checking your credit regularly important for knowing where you stand, but it’s a way to monitor for fraud, make sure everything on your report is accurate and respond to any changes quickly.

For example, if your credit score falls, you can use the information in your credit report to figure out what might have caused the change. Then, you can take steps to recover the credit score points you lost. This can also help you catch identity theft sooner rather than later.

How to build credit without a credit card: FAQ

We’ve gone over plenty of ways to build credit without a credit card, but here are some answers to frequently asked questions that are useful for your credit-building journey.

How do you build credit for beginners?

Having a co-signer or becoming an authorized user is a great tool for beginners looking for the best ways to build credit. Credit scores are a measure of risk for lenders, so when you have a co-signer, it lessens their risk.

Can you have a credit score without having a credit card?

You can have a credit score without having a credit card by having any loan or bill that’s reported to the credit bureaus. You can also have a low starting credit score if you have bills sent to collections prior to getting a credit card.

Do you need a credit card to build credit?

No. By getting a loan, using alternative credit reporting methods or becoming an authorized user, you can build credit without a credit card.

Get help building your credit score today

Building credit without a credit card is possible, but it can be difficult depending on your circumstances. Some individuals have negative marks on their credit report holding their score back, but sometimes these negative marks are a mistake. It’s possible you have errors on your credit report that are preventing you from building credit—fortunately, there are ways to get these errors removed.

CreditRepair.com has a team of professionals who have years of experience helping members, work with their creditors and the credit bureaus to get errors removed from their credit reports. We also provide credit monitoring, financial education resources and additional tools to help our members maintain and improve their credit. If you need help fixing your credit, sign up with CreditRepair.com today.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263