While credit cards can help you build your credit, it’s a good idea to have only as many credit cards as you can use and manage responsibly without falling behind on payments. Some people may be able to use several—or even dozens—at a time, but others may only be able to use one or two effectively.

Disclosure regarding our editorial content standards.

While there’s not a one-size-fits-all answer, the number of credit cards you should have depends on the associated risk to your credit score. While the factors that impact a credit score can be swayed positively by opening a new line of credit, they also can be swayed negatively, depending on the situation.

When used responsibly, credit cards can help you establish and grow your credit—not to mention offer useful rewards like travel points or cash back. When used less responsibly, however, an excessive number of credit cards could damage your credit or encourage a cycle of debt that is extremely difficult (and expensive) to get out of.

So, how do you know how many credit cards you should have? Below, we’ll explain the risks and benefits associated with having more than one credit card and provide tips for managing them.

Is it good to have multiple credit cards?

Having multiple credit cards isn’t necessarily good or bad. The main benefit of having more than one credit card is that it increases your available credit.

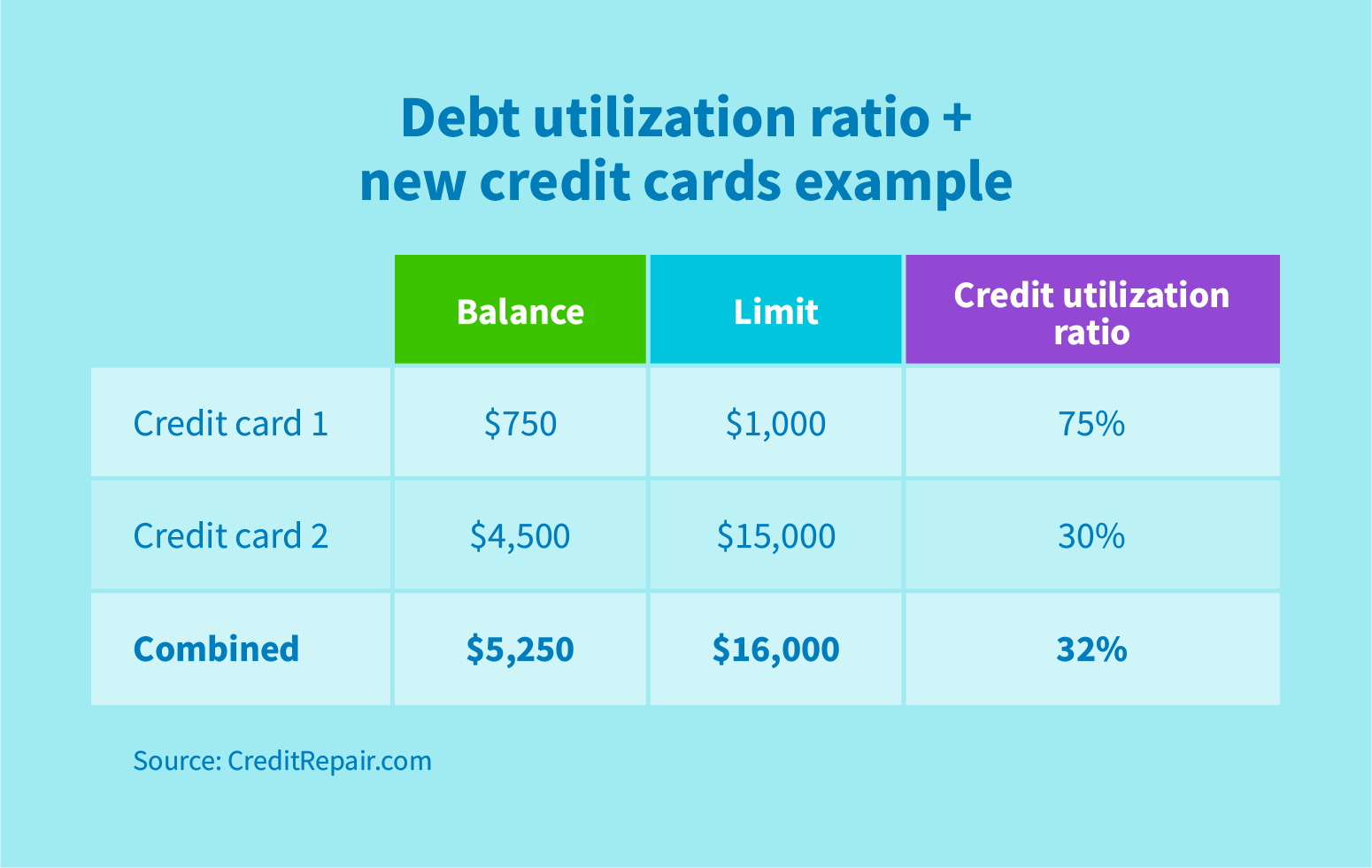

Around 30 percent of your FICO® score relates to how much of your total credit you use, so the lower you keep the percentage of your total available credit, the better it is for your score. Keeping your spending the same while gaining more available credit will lower that percentage, which can positively impact your score.

How many credit cards is too many? Can you have too few?

The average American has about four credit cards, so it’s certainly common to have more than one. However, the amount of cards that’s right for you depends on your financial situation and goals.

Though there are ways to build credit without using a credit card, if you choose to own one, it does become easier to build credit through responsible card use. On the other hand, you can’t get into credit card debt if you don’t have one to begin with.

How having multiple credit cards can help you

So, is it good to have a lot of credit cards? It can be—if you’re able to use (and open) them responsibly. Here are a few benefits to holding multiple credit cards.

1. Increasing available credit

As we noted above, credit utilization plays a big role in your credit score. Experts recommend using 30 percent or less of your available credit. That means that if your credit limit on one card is $1,000, you should try to use less than $300 per month. However, if you open a second card with a $1,000 limit, your available credit doubles, meaning that charging up to $600 a month will keep you within that ideal utilization range.

2. In case of a compromised account

If you fall victim to credit card fraud, you’ll likely have to freeze the card that’s been compromised. If you only have one card, that could leave you without access to credit for several days as you wait for a new card to be mailed to you. Having at least one backup will give you an option if an identity thief targets your main card.

3. Diversifying benefits

One of the most appealing aspects of owning multiple credit cards is having multiple types of benefits. By targeting cards that give bonuses for specific types of expenses—like gas, dining or travel, for example—you can maximize cash back or bonus points. Plus, some cards come with additional perks just for holding an account, like access to airport lounges, car rental insurance, priority boarding or discounts with approved vendors.

4. For emergencies

If an unexpected expense of several thousand dollars fell into your lap, would you be prepared to pay for it out of pocket? If the answer is no, it could be beneficial to have a few credit cards with low interest rates and no annual fees on hand just in case. Since credit cards tend to have much higher average interest rates than other financing options, however, this tactic should be reserved for emergencies only.

Considerations for owning multiple credit cards

If you’re thinking about applying for many credit card, you may have lots of questions. Here are a few key considerations that should help you decide what the right number is for you.

Can you apply for too many credit cards?

As far as your credit score is concerned, yes, you can apply for too many credit cards. Lenders could see it as a risk if you’ve submitted too many credit card applications in a short time period. It’s recommended that you wait at least six months after an application before applying again.

In extreme circumstances, some people attempt to open multiple lines of credit to get the benefits and then quickly close the card after they receive the benefits. This strategy is called churning, and lenders may notice the tactic and may deem the borrower a liability. In short, you probably shouldn’t start a new line of credit with every offer mailed to you.

How many hard inquiries is too many?

Since applications require hard credit inquiries, it’s best to keep this number low if possible. There is no set number, but the above advice to wait at least six months between applications should be a useful reference point.

How many credit cards can you have?

There isn’t any defined limit on the number of credit cards you can have. If you can’t afford your existing credit card bill, even one additional card could be considered one too many. On the other hand, if you’re opening the line of credit to take advantage of benefits while lowering your credit utilization, an additional line of credit might make sense.

Does applying for a credit card hurt your credit?

Having multiple credit cards isn’t bad if you’re using them wisely. With every new account comes the need for careful credit monitoring. Your responsibility to make on-time payments and scan for suspected fraud gets a little more complicated with multiple credit accounts to manage.

While the sheer number of credit accounts you have can slightly factor into your overall credit score, the effect is usually minimal, and it’s worth looking at the big picture of how it will affect your credit score in the long term above anything else.

What happens if you don’t use your credit card?

Lenders may actually close accounts they consider inactive, according to Consolidated Credit. They advise continuing to use older accounts—even if only occasionally—to keep them in good standing, which can help your credit by increasing the average age of your credit lines.

Can you improve your credit by opening more credit cards?

On its own, the number of credit cards a person has usually does not impact their credit score. How you use that line of credit is the most important consideration. In the larger equation of how your credit score is calculated, the more important aspects to consider are if bills are paid on time, in full and with a consistent low debt utilization ratio.

Tips for managing multiple credit cards

If you do decide to hold multiple credit cards, we have a few tips for managing them that should help improve your credit while minimizing debt.

- Space out applications: Remember, multiple applications in a short period of time could send the wrong message to lenders. Wait six months or more between applications.

- Be selective: If you have a strong credit history, you stand a better chance of qualifying for cards with perks like travel points, cash back, low APRs and more.

- Avoid annual fees: Some cards come with annual fees but offer outstanding rewards and benefits. If you’re just looking for an emergency card or an increased credit limit, however, it may be best to steer clear of any unnecessary credit card fees.

- Stay on top of due dates: Consider lining up automatic payments for the same day so you can have a predictable repayment schedule. Or, consider staggering them by two weeks to ease the burden.

- Keep old accounts open: Even if you’re only making occasional small purchases, it will help your credit in the long run to maintain older accounts.

Frequently asked questions

Does opening a credit card hurt your credit?

Initially, yes. Opening a credit card will result in a temporary knock to your credit score due to a hard inquiry, but it should go back up relatively quickly if you continue making on-time payments.

Is it bad to have a lot of credit cards?

It can be bad to have a lot of credit cards if it encourages irresponsible use of credit. But with proper financial habits, it’s possible to have many credit cards and continue building your credit.

Is five credit cards too many?

Five credit cards may be too many if you don’t have a clear financial plan for them. Opening up too many credit cards in a short period of time could hurt your credit and serve as a warning sign for lenders.

So, how many credit cards should a person have?

While there are benefits to having multiple credit cards, there isn’t a cut-and-dried answer to how many credit cards you should have. You need to be able to manage the new debt responsibly and look at factors that may have an impact on your hard-earned credit score.

Before signing on the dotted line, look at the state of your credit score and note the credit card’s benefits, limits, statement end dates and payment due dates, and then decide if it’s worth the responsibility.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263