Disclosure regarding our editorial content standards.

Getting married involves a wonderful celebration—and a lot of logistical questions. How do you file joint taxes? Where do you go to change your name? Does marriage affect your credit score?

Regardless of your current credit score, you may be wondering what will happen to your score after you get married.

Here’s the short answer: marriage does not have any direct effect on your credit score. That said, getting married could help you raise your score in some situations, but it could test your creditworthiness in other ways.

Read on to learn about the relationship between marriage and credit scores, including details about how saying “I do” will affect your credit and tips for managing credit as a married couple.

What happens to your credit score after marriage?

Getting married does not have any immediate effect on your credit. There’s a simple reason for this: there are no joint credit reports or joint credit scores, and marital status is not one of the factors the three credit bureaus use to determine your credit score.

Additionally, if you choose to change your name after marriage, the credit bureaus will report this change on your current report, and your old name will remain listed as well.

Many people wonder if their spouse’s credit—whether poor or good—will affect their own score. Immediately after marriage, your spouse’s score won’t affect yours. However, depending on how you choose to manage your credit as a married couple, your score could indirectly be affected by your partner.

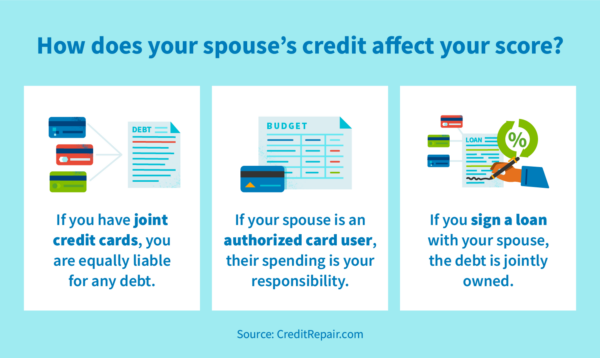

How does your spouse’s credit affect your score?

Since your spouse is not listed on your credit report, they won’t directly affect your credit score. However, your spouse’s credit habits could eventually affect your score—especially if you choose to have joint credit accounts or be authorized credit card users.

Here are a few of the ways that your spouse could indirectly affect your score:

- Joint credit cards: You and your spouse are equally liable for debt on a joint credit card, so the utilization will be reported on your credit report.

- Authorized card user: If you grant your spouse authorized user status on your cards, you are ultimately responsible for any spending, so the full balance will appear on your credit report.

- Cosigned loans: If you and your partner sign a loan together, the debt is jointly owned, so if they fail to make payments, negative items will also appear on your credit report.

Because many couples choose to join their finances together after marriage, it’s important to discuss how spending and debt will be handled. Even though your spouse’s credit score does not directly influence your credit score, their credit behaviors can influence your score if you combine any credit cards or loans.

What should you do if your spouse has poor credit?

If your spouse has poor credit, you’ll have several decisions to make as you navigate your financial lives together.

- Apply solo for loans and credit cards: If you have a higher credit score, you may choose to apply for loans or credit cards individually to secure a better interest rate.

- Aim to tackle debt: If your partner has debt from before your marriage that has affected their credit score, you’ll have to decide how to tackle it. Whether or not you are responsible for the debt may vary according to your state’s laws, so consult with a lawyer if necessary.

- Look to boost your spouse’s credit score: With a positive credit history, you may be able to provide a boost to your partner’s credit score by adding them as an authorized user on your credit card.

Ultimately, your spouse’s poor credit is likely an opportunity for growth rather than a significant obstacle. Married couples can continue to apply for credit separately, so you can enjoy the perks of your high credit score as you work together to improve your spouse’s score.

If you do choose to join credit accounts with your partner, they may see a boost in their score from your strong credit history—provided that they continue to practice good financial habits.

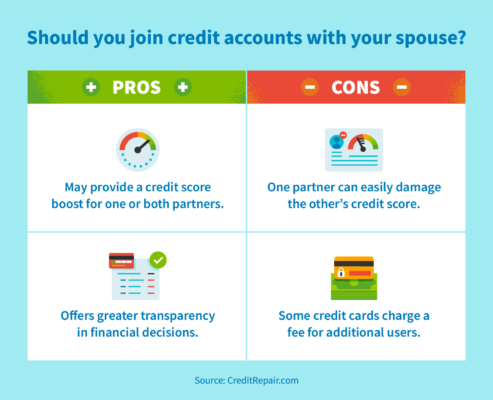

Should you join your credit accounts with your spouse’s?

Choosing to join credit accounts with your spouse is a personal decision, so it helps to consider the effects of joint vs. separate credit accounts.

Joining credit accounts may enable easier financial communication for married couples. Additionally, joining credit accounts could help boost the score of a partner with a lower credit score—and couples who already have strong credit scores are likely to qualify for joint loans, mortgages and credit cards with lower interest rates.

On the other hand, joining credit accounts is not without risk. If one partner racks up debt, fails to make payments or maxes out a credit card, their spouse is likely to see a negative effect on their credit as well. There can also be logistical hurdles to joining credit accounts, like fees for additional users.

As we mentioned at the outset, marriage brings with it both many joys and many questions. Deciding how to handle credit as a married couple is an important decision, but it’s certainly helpful to know that marriage does not directly affect your credit score.

Nonetheless, for both single and married people, it’s important to check your credit reports regularly to ensure that they are accurate. If your credit reports have incorrect information—like accounts that do not belong to you or outdated balances—your credit score could be taking an unnecessary hit. Fortunately, you can undertake the process of credit repair to work on getting your score back in shape.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263