Disclosure regarding our editorial content standards

Because the most popular credit scoring models start at 300, your starting credit score will likely be at least 300. However, practicing healthy credit habits like making payments on time and keeping your utilization rate low can help build your starting score to around 500.

Credit scores aren’t magical three-digit numbers that materialize as soon as you start using a credit card. The reality is that it takes between three to six months of account activity, such as from a student loan or credit card payments, for you to build up enough credit information to comprise your first credit score.

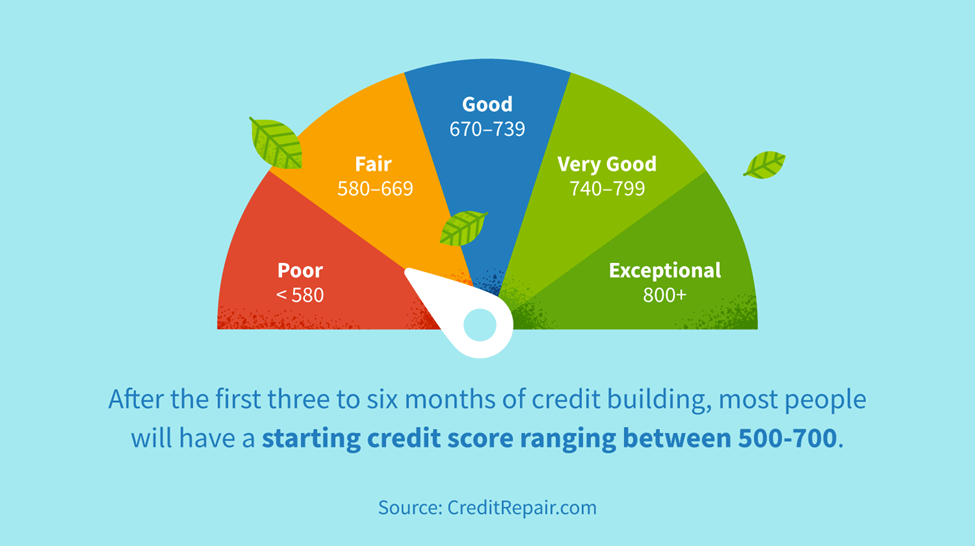

The lowest credit score calculated by most credit bureaus is 300. However, if you’re diligent about payments within your first six months, your first credit score will likely be much higher than the minimum. After the first few months of building credit, most people will have a “starting” credit score between 500 and 700.

Below, we dive into how your starting score is calculated and offer tips for how to start off your credit journey on the right foot.

What is your starting credit score?

After the first few months of credit activity, most people will start at a credit score of around 500. This is calculated based on your credit behavior for each of the FICO® scoring factors during that six-month period. If you opened just one line of credit and have been paying it on time each month, you will likely have a decent starting credit score.

It’s important to note that credit scores may differ depending on each person’s unique financial situation. Even if you pay your bills on time every month, you may have a lower starting credit score than a peer who, say, has less student loan debt than you do.

Does your credit score start at 0?

Contrary to popular belief, credit scores do not start at 0. Zero is actually lower than any credit scoring model will go.

The lowest starting credit score for both FICO and VantageScore is 300. However, it’s unlikely that your starting score will be as low as 300 if you manage your credit accounts well by paying on time and keeping your credit utilization rate low.

How is your starting score calculated?

Credit scores are calculated using information from your credit reports. This information is summarized into a three-digit score that lenders can use to determine your financial trustworthiness.

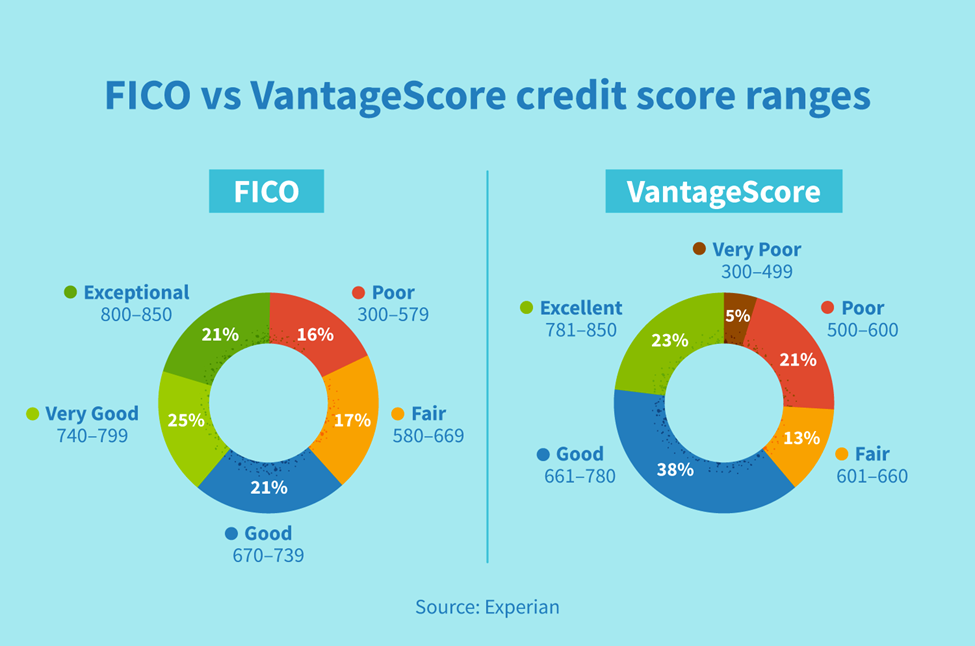

In the U.S., most credit scores are created by FICO or VantageScore Solutions. While both scoring methods include a score range, the two methods weigh certain credit factors a bit differently.

FICO credit scoring model

FICO Scores range from 300 to 850 and are compiled from five main data points:

- Payment history: 35 percent

- Amounts owed: 30 percent

- Length of credit history: 15 percent

- New credit: 10 percent

- Credit mix: 10 percent

VantageScore credit scoring model

VantageScore credit scores also range from 300 to 850. This scoring method is determined by the following six data points:

- Payment history: 40 percent

- Age and type of credit: 21 percent

- Percentage of credit limit used: 20 percent

- Total balances: 11 percent

- Recent credit behavior: 5 percent

- Available credit: 3 percent

How to check your score for the first time

You can check your score by purchasing it directly from FICO or VantageScore, working with certain services (like credit repair companies, credit card lenders, or some banks) or visiting a free credit scoring website.

Additionally, you can request a free copy of your credit report from each of the three major credit bureaus (Equifax®, TransUnion® and Experian®) at AnnualCreditReport.com or by calling toll-free 1-877-322-8228.

Once you receive your scores and reports, read over the information carefully. You’ll want to look out for inaccurate and inconsistent information. If you do spot any errors, dispute the inaccuracy with the bureau within 30 days of receiving your report.

What your starter score can tell you

Once you’ve pulled your free credit report and know what your score is, here’s what you can learn about your current financial information:

- You actually have a credit score: In general, this is a good thing. It means you’ve been financially active enough to have generated a credit score. This will be an asset in the long run, as we know that the length of credit history and your payment track record are important in calculating your credit score over time.

- Errors or evidence of identity theft: If you know that you haven’t been actively establishing credit over the past few months, yet you see on your report that you have a low credit score, you might have a case of identity theft on your hands. Make sure to double-check your report before jumping to any conclusions, though.

- What financial benefits you can get: The main reason you’ll want to keep track of your credit score is that it affects the types of financial benefits you can qualify for, such as certain loans, credit cards and apartments. For example, most landlords won’t rent luxury apartments to tenants with anything below a 700 credit score.

What credit score does an 18-year-old start with?

For most credit cards and loans, you must be 18 or older to open an account. You must first establish a credit history before you’re given a credit score, meaning that just because you turn 18 or open a credit card doesn’t mean you’ll automatically have a credit score awaiting you.

Instead, you must establish credit by having an account in your name and make subsequent payments in order to build up enough credit information to result in a score.

How can I build credit if I don’t have credit?

If you’re just starting out on your credit journey, here are a few options to help you build up your credit score.

- Become an authorized user: Credit history is one of the main factors that goes into calculating your credit score. To build up your credit history, look into becoming an authorized user on a parent or guardian’s account. You’ll be able to reap the benefits of their credit history age and help improve your own score.

- Apply for a secured credit card: Secured credit cards require an up-front deposit that acts as your credit limit. There’s little risk to a secured credit card because if you miss a payment, your lender will simply take out the amount owed from your initial deposit.

- Keep your credit card in use: Recent and consistent credit activity can show lenders you’re being responsible with your credit. Rather than opening a card and never using it, try to use your card for recurring payments such as subscription services or monthly gas charges, and pay it off on time and in full each month.

- Report your rent payments to the credit bureaus: Reporting your on-time rental payments to the credit bureaus can help you build credit, especially for those just starting out on their credit journey. Using a rent reporting method, you can share with the credit bureaus your on-time payment history that can then be factored into your FICO and VantageScore credit scores.

How to improve your starting score

The good news is that improving your credit score and building credit is fairly simple, and you can see significant improvements in under a year. Here are a few ways you can establish healthy credit habits and improve your credit score:

- Build up your savings: The best way to make sure full and regular payments is to build up a safety net. If you have an emergency one month, your savings can help you cover your regular monthly loan and credit card bills.

- Always pay bills on time: We know it’s obvious, but honestly, sometimes it’s easier said than done. Paying a day late every once in a while isn’t a big deal, but the other 99 percent of the time you should pay off your bills in full and on time every month to show that you’re financially responsible. Set up a recurring alert on your phone or write notes to yourself to make sure you remember.

- Use credit cards minimally: Especially when you’re just starting out, you’re not going to want to make any large purchases on your high-interest credit cards. Instead, build credit steadily over time by making small purchases on your cards each month and paying them off in full.

- Avoid opening multiple new accounts: In order to avoid looking like a financial risk to lenders, avoid opening new accounts within your first year of credit history. One credit card that you pay off each month is perfectly fine, but owning multiple credit cards right off the bat can seem risky.

- Monitor your credit reports: Continue to check your credit score using a (safe) third-party service throughout the year to make sure your hard work is paying off, and be sure to request your official reports every year. This helps you to identify areas of improvement and make sure you’re not neglecting any credit accounts.

Starting your journey in the credit world can be complex, but you have people around to help you — like our team at CreditRepair.com. Take a look at our credit education services to learn more about how you can increase your starting credit, and visit our credit fix solutions for expert help.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263