Disclosure regarding our editorial content standards.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from predatory debt collection practices. Unfortunately, many collection agencies and debt collectors can get aggressive and manipulative when trying to collect on accounts. The government has stepped in with guidelines that prohibit specific actions by these parties to protect the well-being of consumers.

Understanding these laws can help consumers protect themselves from collectors trying to use abusive, deceptive or unfair practices. You can identify when a debt collector uses illegal practices, ask them to stop and make a formal complaint or take legal action if they continue.

Keep reading for a complete overview of how you’re protected by debt collection laws, what debt collectors are allowed to do and how you can handle debt in collections.

What is the Fair Debt Collection Practices Act (FDCPA)?

The Fair Debt Collections Practices Act (FDCPA) was approved as an amendment to the Consumer Credit Protection Act in 1977. Since then, it’s had multiple modifications, but the Act’s primary purpose remains the same: to protect consumers from unfair debt collection practices. The FDCPA outlines the methods debt collectors are allowed to use when contacting consumers, the rights of the consumers and the potential penalties for violations of the act.

Debt collection basics

Everyone can benefit from having a basic understanding of the basics of debt collection laws.

Debts covered under the law

First, it’s important to understand that not all debts are covered by debt collection laws. Debt covered includes:

- Credit card debt

- Auto loans

- Medical bills

- Student loans

- Mortgages and other household debts

- Other debts for personal, family or household purposes

The main exception is business debts, which aren’t covered by debt collection laws. Additionally, the FDCPA doesn’t usually cover collection initiated by the original creditor. Instead, the FDCPA covers when a debt is sold or transferred to a business whose primary purpose is collecting debts (collection agencies, debt buyers and lawyers specializing in debt collection).

What can debt collectors do?

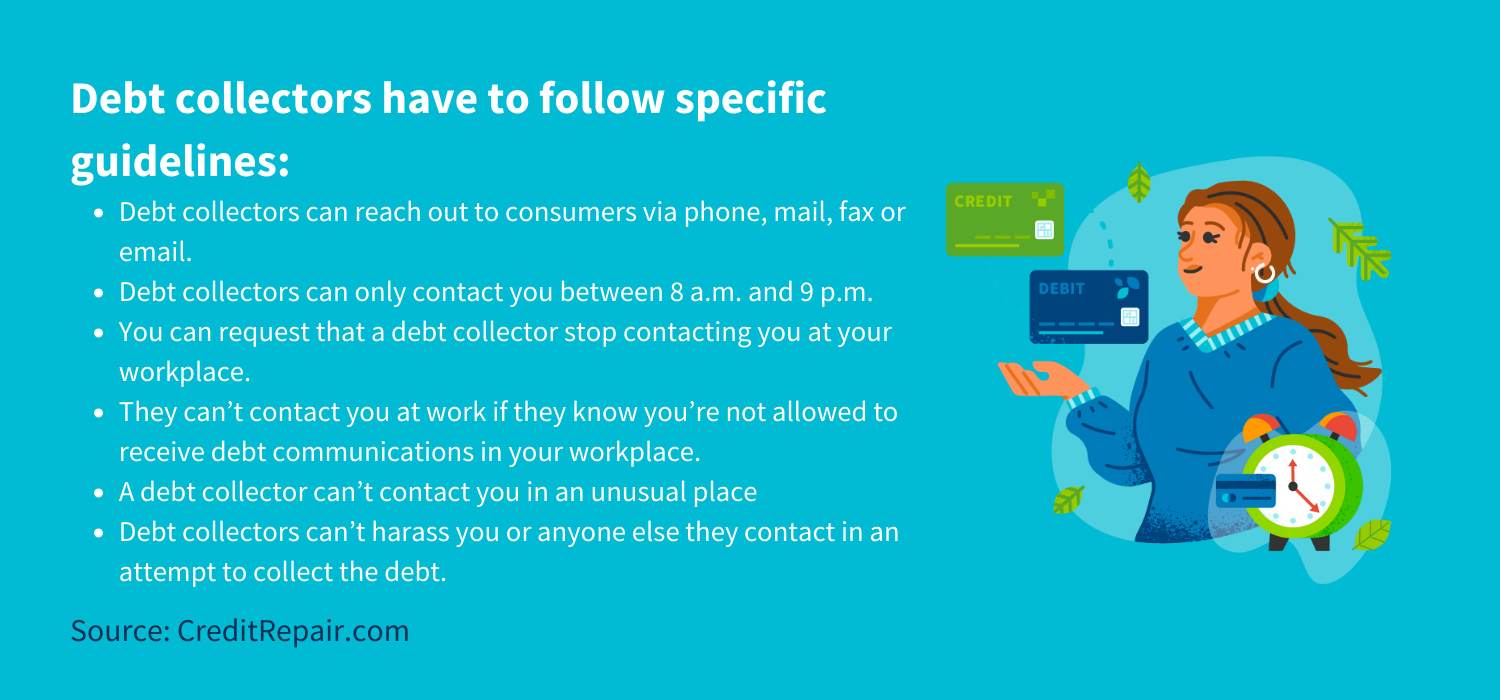

Debt collectors have to follow specific guidelines, including the following.

Time and place

- Debt collectors can reach out to consumers via phone, mail, fax or email.

- Debt collectors can only contact you between 8 a.m. and 9 p.m.

- You can request that a debt collector stop contacting you at your workplace.

- They can’t contact you at work if they know you’re not allowed to receive debt communications in your workplace.

- A debt collector can’t contact you in an unusual place, such as a restaurant, school, hospital or gym.

- Debt collectors can’t harass you or anyone else they contact in an attempt to collect the debt.

Involving others

- If a consumer is represented by an attorney and that’s been made clear to the debt collector, they can no longer directly contact the consumer and must keep all communications through the attorney.

- Debt collectors can reach out to your family and friends as a way to find out your phone number, address or place of work. However, they can only contact each person once and can’t share the details of your debt with anyone other than you, your spouse and your lawyer.

Informing consumers

When a debt collector contacts a consumer, they have to share specific details about the debt they’re calling about. They must share:

- The name of the original creditor or lender

- The outstanding balance owed

- That you have the right to dispute the debt if you send a written request within 30 days of contact

- That you have the right to request the contact information of the original creditor if you send a written request within 30 days of contact

What debt collectors aren’t allowed to do

There are also some clear rules around what debt collectors aren’t allowed to do.

- They can’t harass you in any way, including making threats to harm you, using obscene language or repeatedly contacting you just to annoy you

- They can’t lie to you about the amount you owe, suggest you’ll be arrested, threaten to take legal action when they don’t intend to or pretend to be a lawyer or government employee

- They can’t treat consumers unfairly, including trying to collect additional fees or money that’s not outlined in the original contract, deposit a post-dated check early or publicly reveal a consumer’s debts

What can you do about debt collectors?

Consumers can request that a debt collector or collections agency stop contacting them. You can write a letter to the collector asking them to cease communications. If you do this, make sure to keep a copy for your records. After submitting this request, the collector can only legally reach out to you one more time to notify you that they’ve received your request and will be adhering to it.

Note that asking your debt collector to stop contacting you doesn’t stop all their actions. They may choose to file a lawsuit, in which case they’ll continue communications through your attorney.

Debt collectors and your money

Before making any payments to debt collectors, make sure you understand how paying down your debt works and how debt collectors might try to get your money.

What if you want to apply payments to one debt but not the other?

If you have multiple debts in collections, you get to choose exactly where a payment goes. You notify the debt collector which debt you’d like to pay down.

Will debt collectors take money from your paycheck?

A debt collector can sue you for your debts and seek a court order for wage garnishment. If they win, a portion of your paycheck may be set aside to pay your debts.

What if a debt collector sues you?

You should never ignore a lawsuit. If a debt collector sues you, it’s beneficial to hire a lawyer to protect yourself. Showing up to court is crucial so that you have a chance to defend yourself.

Can your federal benefits be affected?

If you have federal benefits, they may be exempt from a wage garnishment court order. Often, states have independent laws around federal benefit garnishment, but these funds are protected unless it’s to pay alimony, child support, student loans or overdue taxes.

According to the FTC, federal benefits that are usually exempt from wage garnishment include:

- Social Security benefits

- Supplemental Security Income benefits

- Veterans benefits

- Federal student aid

- Military annuities and survivors’ benefits

- Benefits from the Office of Personnel Management

- Railroad retirement benefits

- Federal emergency disaster assistance

What do you do if you think the debt collector is wrong about the debt?

Sometimes, debt collectors have the wrong information. After all, they’re usually pursuing a debt that’s been transferred to them. As they aren’t the original lender, information may be mixed up in the transfer process.

If you think a debt collector is contacting you about an incorrect debt, you can dispute the debt.

How to dispute debt

Follow these steps to dispute a debt you don’t believe to be yours:

- Send the debt collector a letter asking for verification of the debt.

- Once you receive the validation information, review it to make sure the debt isn’t yours.

- Send the debt collector a dispute letter within 30 days of receiving the validation information. The dispute letter should clearly state that the debt doesn’t belong to you and that they’ll need to stop trying to contact you for collections on it.

What are debt verification notices?

Debt collectors are legally obligated to provide you with a debt verification notice if you send them a letter of dispute. The debt verification notice will detail who you owe the debt to, how much you owe and other important information. You can then cross-check the details on the debt verification notice with your own records to determine if the debt really belongs to you.

What if the debt is old?

Debt doesn’t just disappear, but there’s a statute of limitations on collection accounts. After the statute has passed, a debt collector can no longer sue you because the debt is “time-barred.”

Do you still have to pay old debt?

Debt collectors can still try to collect on an old debt and contact you via email, phone, fax and mail. However, if the statute of limitations has passed, they can’t sue or threaten to sue.

Knowing that you can’t be sued, it’s up to you to decide if you want to pay an old debt. However, note that making a partial payment in some states can “revive” an old debt and restart the statute of limitations. As a result, making a partial payment could potentially open you up to a lawsuit again.

How does the statute of limitations affect debt?

The statute of limitations typically starts from the initial missed payment date and usually ranges from 3 to 6 years. The exact length will depend on the type of debt and state regulations.

Disputing a debt won’t impact the statute of limitations. However, note that admitting ownership of a debt can restart the statute in many states. So at no point during the dispute process should you admit the debt is yours—in writing or on a call.

Do debt collections affect my credit score?

Yes, having a collections account on your credit report will impact your credit score. A collections account can stay on your credit for up to 7 years before it falls off. However, as each year goes by, this negative item should have less and less of an impact on your score.

Note that paying a collections account in full doesn’t mean it’ll be removed from your report, so payment isn’t always the best option. Instead, you might be better off pursuing a pay for delete agreement with your creditor.

In addition to lowering your score, the presence of a collections account can make future lenders hesitant to approve you for credit or loans.

If your credit is lower than you would like, you can always work with a credit repair company as well to explore more in-depth options. Contact our credit repair advisors to get a valuable perspective on your credit situation and start developing a plan for getting your credit back to a place you are happy with.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263