Disclosure regarding our editorial content standards.

Doing your taxes can seem complicated, especially because the consequences of getting them wrong can be high. You could be charged a fine, asked to refile or audited if you make a serious mistake. Luckily, once you get the basics down, you’ll find your taxes aren’t so challenging after all. And to help guide you, here are some handy tips to know when filing taxes for the first time.

What are taxes and why do I have to pay them?

Taxes are mandatory financial contributions every individual and business must pay to the local, state and federal governments. It can feel like taxes take away your hard-earned money, but they play a key role in keeping society functioning. Taxes pay for schools for children, firefighters for communities, construction on local roads and more.

It’s important to note that while almost everyone is subject to paying taxes, how much you pay can significantly vary. The government sets tax brackets to determine what tax percentage an individual pays based on their annual income. The more someone makes, the more of their income will go to taxes.

In 2021, the lowest tax bracket for single income filers was 10 percent for anyone making up to $9,950. In comparison, the highest tax bracket was 37 percent for income earned over $523,600.

These differences are put in place so high-income earners who are more financially secure can be the ones who contribute the most to society.

How do I file taxes for the first time?

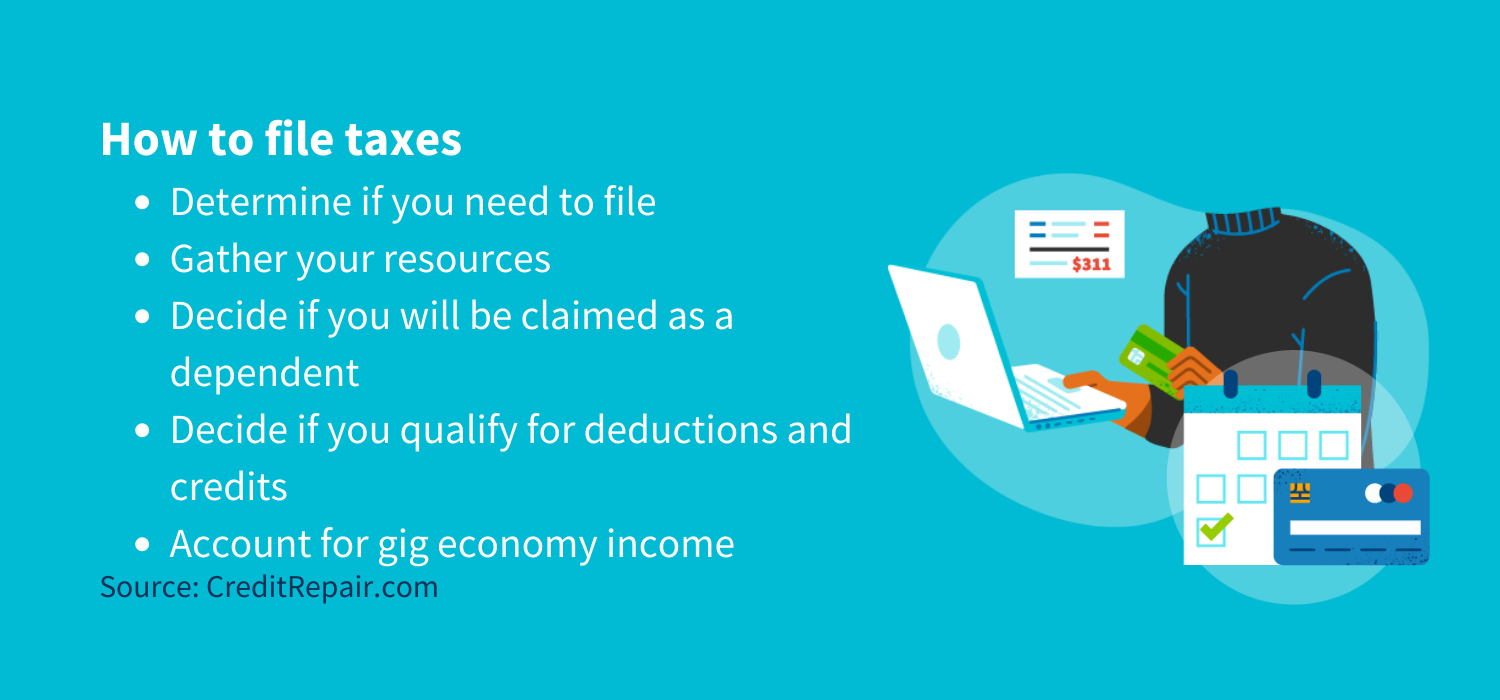

If you’re filing your taxes for the first time this year, follow these steps:

1. Determine if you need to file this year

First, you want to verify that you actually need to file your taxes this year. Factors like your marital status, age and income can determine if you need to file or not. For example, in 2021, those who are single, under the age of 65 and earned less than $12,550 don’t have to file taxes. Note that it’s important to check these qualifying factors every year as they can be updated.

2. Gather your resources

Next, you’ll want to gather everything you’ll need to file your taxes. The first thing you’ll collect is your income tax forms. If you have an employer, you’ll get a W-2 form, while self-employed individuals receive 1099 forms. The IRS wants to know about all the income you earned throughout the year, and you must report everything. You’ll even receive forms from financial institutions if you earned more than $10 in interest income.

If you plan to claim deductions and credits, you’ll also need to gather the relevant documents for those. Everything has to be claimed to the exact amount, and you should maintain receipt copies in case you’re asked to verify a charge.

Lastly, you’ll need to understand your filing status. The status options are:

- Single

- Married filing jointly

- Married filing separately

- Widow/widower

- Head of household

Your filing status will impact your deduction and your taxes overall.

3. Decide if someone will claim you as a dependent

Depending on your age and income, your parents may be able to claim you as a dependent on their tax return. Claiming a dependent can give your parents a sizable tax break, so you’ll want to discuss this option with them.

There are two situations in which a parent can claim a dependent:

- Qualifying child: The child is under the age of 19 and parents provide more than half the child’s financial support. Or, the child is under 24, a full-time student and the parents provide more than half the child’s financial support.

- Qualifying relative: Parents may be able to claim a dependent for a relative above 18 who earns less than $4,300 (as of 2021), lives with their parents all year and has the parents pay for at least half of their needs.

If your parents choose to claim you as a dependent, you’ll still have to file your own taxes, but you’ll all want to be on the same page.

4. Decide if you qualify for relevant tax deductions and credits

We already mentioned tax deductions and credits above. Tax deductions are items you can add to your tax filing to lower your taxable income and reduce the amount of taxes you owe. Tax credits are amounts that reduce the tax owed, dollar for dollar, and can be subtracted from the amount you owe on your tax return.

Unfortunately, you can’t rely on anyone to tell you what tax deductions and credits you qualify for. If you choose to file your taxes electronically, some software systems will make suggestions on potential tax breaks you qualify for, but even these systems won’t catch every possibility. It’s best to do your own research to see which ones apply to your situation.

As we mentioned above, you’ll need to keep detailed records that verify any tax deductions and claims you make.

5. Remember to account for any gig economy income

Approximately 36 percent of American workers participate in the gig economy as either their primary or secondary source of income. It’s easier than ever to get a side job and earn some extra cash, but this income has to be reported to the IRS.

If you’ve charged someone more than $600 throughout the year for your services, you should receive a 1099 form from them. However, even if you don’t, you’ll need to include this income on your 1040 form.

Options for filing

After you’ve gathered all your documents and understand the details of your situation, it’s time to choose how to file:

File electronically

Filing electronically is probably one of the most popular and efficient ways to do your taxes nowadays. There are easy-to-use systems (like TurboTax and H&R Block) that walk users through the entire process, making suggestions along the way. These systems come in both free and premium paid versions for those with more complicated taxes.

The system will ask you questions along the way, alert you if something doesn’t seem right, estimate your refund and file on your behalf. You can also download copies of the tax return to have all records on file.

It may seem overwhelming to file electronically, but trust us, once you start, you’ll see just how easy it can be. An added benefit of filing electronically is the fast process time—many people have their refund within three weeks!

File with a professional

Another option is to pay a professional to file your taxes for you. These professionals have the skills to understand which tax deductions and credits you’re eligible for and the experience to file correctly. Of course, not everyone wants to pay for a service they can technically do themselves. But if your taxes are complicated, filing with a professional can save you a lot of time and money.

File by hand

Of course, filing by hand is still an option. You can fill out your Form 1040 by hand and use a calculator to figure out your income minus deductions. This process isn’t the best option as you’re more likely to make a mistake when you file by hand. Additionally, you’ll have to mail your form in and wait between six and eight weeks for the IRS to process your tax return.

Paying your taxes

Not everyone gets a refund when they file their taxes—some people end up owing money. If that’s the case for you, there are three ways you can pay your taxes:

Bank accounts

Paying through your bank account is likely the easiest option—and the cheapest! You can usually find all your bank details on your online banking platform. An added benefit of paying through your bank account is that it gives the IRS your bank information for future refunds, stimulus checks and other types of deposits.

Cards

You can also use a debit or credit card to pay, but these options can include fees. A debit card will likely charge you a fee, so there’s no benefit of doing it this way versus submitting your direct bank account information.

Some people choose to pay their taxes with a credit card for the perks (cashback, points, etc.), but it’s important to weigh the pros and cons of this option. For example, if you carry a balance, you could end up paying some high interest on your taxes, which could have been entirely avoided.

Payment plans

If you end up owing a lot more taxes than you expected—and can reasonably afford—you could consider a payment plan. The IRS has several payment plan options for you to choose from, although it’s critical to realize these come with interest charges and other fees. It might cost you more in the long run, but if a payment plan is the only way to pay your taxes, it’s a solid solution.

What should I do with my tax refund?

If you receive a tax refund, don’t look at it as free money to spend. Your tax refund should be spent wisely and go to paying down debt or put into an investment, retirement or emergency fund.

And if you feel lost when it comes to your finances and credit, consider getting some help. CreditRepair.com has professionals who can provide a thorough credit education so you’re set up to make the best financial decisions moving forward.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263