Disclosure regarding our editorial content standards.

The feeling that comes with graduation is a bit hard to describe—a combination of relief at the end of exams, excitement about the future, pride in your accomplishment and dread of the real world knocking at your door. Unfortunately, not only will those ever-present student loans soon come due, but you’ll also need to start building credit and saving for retirement.

Schools often don’t teach their students how to actually navigate the real world. So, we’ve put together a few key pieces of financial advice for college graduates to help you get started on the right path.

1. Always pay on time

The first, most important rule of personal finance is to always pay your bills on time. Whether it’s a credit card statement, power bill or car payment, you need to make at least the minimum required payment before the due date.

With typical late fees coming in north of $30, the cost alone is a good reason to pay on time. But late fees aren’t the only reason to avoid late payments; your credit score is also a strong incentive.

Your payment history is worth up to 35 percent of your FICO® credit score, and every late payment reported to the credit bureaus can cause your credit score to drop by dozens of points. Bad credit not only makes it harder to qualify for new credit, but can also mean higher interest rates and fees, as well.

And even one reported delinquent payment can cause years of damage; up to seven years, in fact, as that’s how long delinquent payments live on your credit report.

2. Take advantage of automatic payments

Given that the most important rule is to always pay on time, you should do everything you can take care of that without too much effort. So, if you’re at all prone to forgetting payments until the last minute—or, worse, entirely—you should probably look into setting up automatic payments.

Most banks will allow you to set up regular payments from your checking or savings account, with the ability to set your chosen due date and even the amount. Of course, you’ll need to be diligent to make sure you always have enough money in your account to cover any automatic payments.

3. Build a budget with the 50/30/20 rule

While everyone should put together a proper budget, it can be especially important when working with limited income and/or trying to pay down debt (such as student loans).

A detailed budget will be the most effective, but even a simple budget outlining savings, bills and discretionary funds can keep you on track and make sure you have enough money to cover your necessities every month, which will help keep you from accumulating debt. When creating your budget, make sure that your expenses do not exceed your monthly income.

Along those lines, a key part of that budget is the savings portion. Before you put any money toward extra expenses, like new clothes or meals out, you should pay your savings account.

For the best results, treat your savings like a bill that must be paid each month before you can have fun. You’ll thank yourself in an emergency when you don’t need to take on expensive debt to cover an unexpected expense.

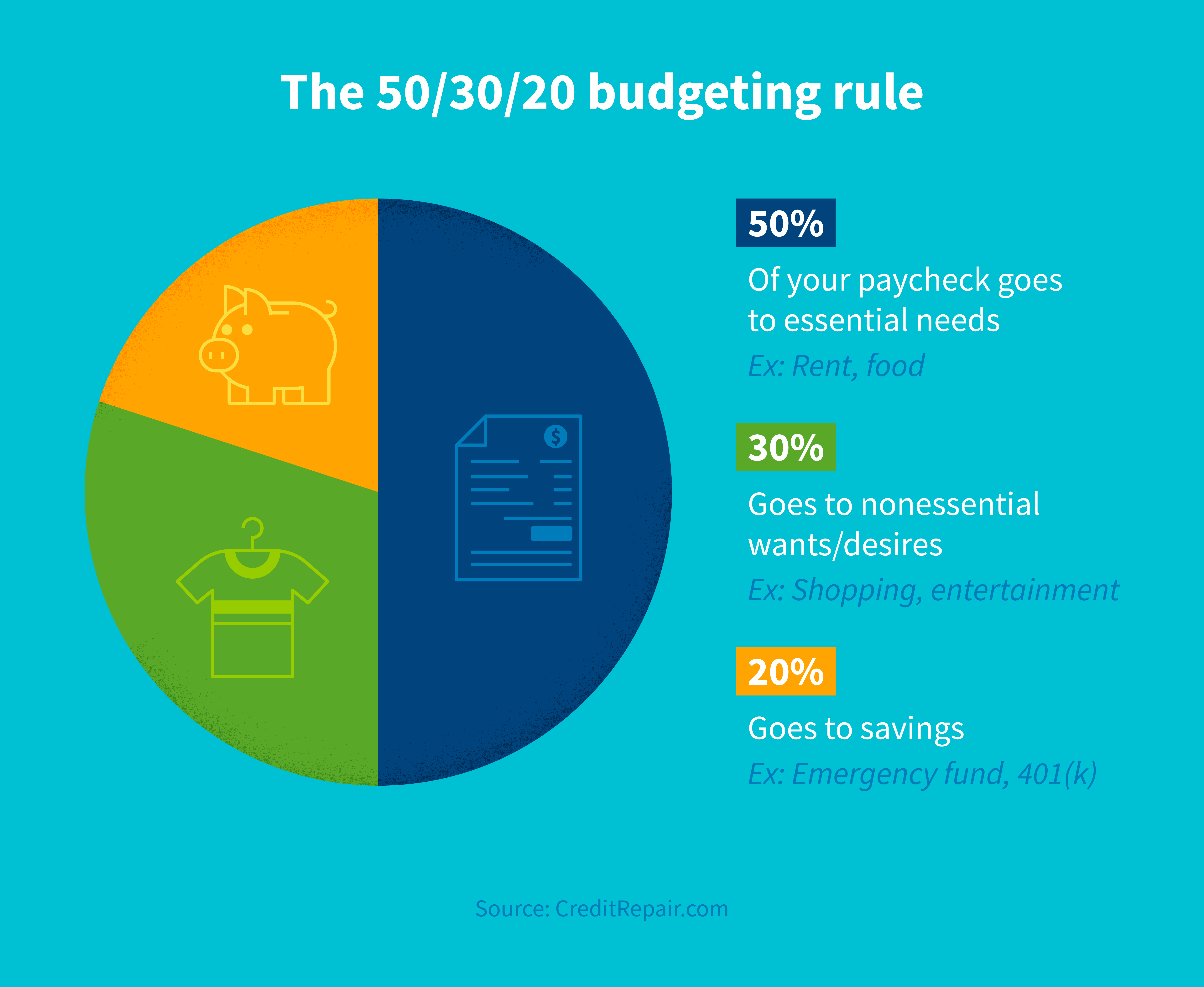

A helpful budgeting trick is the 50/30/20 rule. Set aside 50 percent of your budget to essential expenses like rent and food. Use 30 percent for nonessentials like shopping and entertainment. Put the final 20 percent toward savings. This could include your emergency fund or 401(k). This rule of thumb helps you prioritize your needs over wants and keep your savings top of mind.

4. Start paying off student loans

This one can feel a little overwhelming, but taking inventory and making a plan can help paying off student loans feel much more manageable.

The first steps are to find out how much you owe, what type of loans you have (private, federal or both) and what the interest rates are. You can check the Federal Student Aid site to view federal loan details. For private student loans, contact the lender to view your account information and details.

Next, note the repayment terms. Then, make a plan and start making your payments on time.

Paying more per month can help pay off your loan quicker and save on interest. If you have $30,000 in debt with a 5.8 percent interest rate, it will take you an estimated 10 years to pay off the loan if you pay $330.05 per month, and your total interest paid will be $9,606.77. However, if you pay $391.32 per month, you’ll pay off the loan in eight years and your total interest will be $7,657.47.

Missing a loan payment can reflect negatively on your credit report. Try to make more than the minimum payment and find a repayment plan that works well for you.

You can also consider refinancing to get a better interest rate on your loans. If you have multiple student loans, consolidating your debt may also help save you money.

5. Start building credit

If you didn’t start building credit as a college student, now is the time to begin.

Your credit score is a number between 300 and 850 that many lenders will look at to determine how likely you are to pay off your debts. Employers and landlords sometimes check your credit score, too. A score above 600 can help you secure lower interest rates on loans.

FICO is the most commonly used credit scoring system. Here’s what makes up your FICO score:

- Payment history (35 percent)

- Credit utilization (30 percent)

- Length of credit history (15 percent)

- Credit mix (10 percent)

- New credit (10 percent)

So, how do you start building your credit score? You can start by applying for a credit card. A secured credit card doesn’t require a credit history, so you can use it to start establishing credit as a new graduate.

Make sure to pay off your card on time each month and use less than 30 percent of your available credit. Consistent on-time payment will reflect positively on your credit score.

Another option to start building credit is to get a co-signer on a credit card or loan. Your co-signer can be a parent or other family member who will be responsible for paying late or missed payments plus any fees.

If you’re not ready to apply for your own credit card, another opportunity is to become an authorized user on a parent or guardian’s credit card account. You will be able to use a credit card under the cardholder’s account, and their payment history will help you start building your own credit.

As you start your new life as a young professional, keeping tabs on your credit score will help you make smart financial decisions. It can also help you know when to seek credit solutions to improve your score.

6. Make more than the minimum payment

Although your credit card statement typically comes with a minimum required payment, don’t assume that’s all you should pay.

Minimum payments are purposefully designed to encourage you to take as long as possible to repay your balance, because the longer you take, the more interest you pay, especially with one of the many high-interest credit-builder cards. Save yourself the interest fees and pay as much of your balance as you can afford each month.

7. Set aside an emergency fund

Start putting money aside for an emergency fund—you never know when you might need it. An emergency fund can be a lifesaver in the event of an emergency medical expense or car repair, for example.

It’s advised to set aside three to six months of living expenses as your emergency fund. This takes a little bit of time to build up, but it’s often worth it in the long run.

Here are some good options for places to keep your emergency fund:

- A dedicated savings account that is connected to your checking account

- A money market account with a debit card and check-writing ability

Your emergency fund should be separate from your day-to-day accounts so that you aren’t tempted to dip into your savings for unnecessary expenses. On the other hand, the money should be readily accessible whenever you have an unexpected situation in which you need to use it.

8. Begin saving for retirement

It’s never too early to start saving for retirement. To do so, you can invest through your employer’s retirement program or an individual retirement account.

If your employer offers a 401(k) plan, you can contribute a percentage from each paycheck to an investment account. The amount you elect to contribute will be automatically deducted from your paycheck, making this an easy way to start saving for retirement at an early age.

Your employer may offer to match your contribution up to a certain percentage as well, so make sure to take advantage of that—it’s essentially free money!

If your employer doesn’t offer a 401(k) program, you can also opt for an individual retirement account (IRA). A 401(k) may have a higher contribution limit, but an IRA may have more investment options available.

There are two types of IRAs:

- Traditional IRA: Your payments are made with pre-tax dollars. You save on taxes in the short term but pay them when you withdraw the funds in retirement.

- Roth IRA: Payments are made with post-tax dollars. Taxes are withdrawn from your contributions upfront.

You can also open an IRA in addition to a 401(k).

9. Read the fine print

A common financial nightmare is being stuck with a huge bill because you didn’t carefully read through your credit card or loan agreement before signing that dotted line (or clicking that “apply” button). While you may not need to read every word in the fine print, you should always check through all the terms of a financial agreement.

This can be particularly important if you’re taking advantage of any special promotions, such as an introductory interest rate deal. While you can find lists of cards offering 0 percent APR deals, these promotions can vary in everything from the length of the offer to which types of transactions qualify for the lower interest rate.

Also, watch out for special financing deals that operate on deferred interest models. With deferred interest, you need to pay off your entire financed amount before the end of the promotional period or you’ll be charged interest on the full amount, not just whatever is left.

10. Analyze your bills

Another piece of advice for graduates entering the real world is something often overlooked in the era of digital banking but is very important nonetheless: always look over your bills and credit card statements.

Given that few people keep and balance checkbooks anymore, the only way you’ll know if unauthorized charges have been made is to go over your accounts yourself each month.

If you do find charges you don’t recognize, be it a utility bill or credit card statement, be sure to notify your provider at once. Most credit card companies offer $0 liability policies for unauthorized charges, and the law also protects you from fraudulent charges, so speak up to avoid being on the hook for purchases that you didn’t make.

11. Start investing

Investing now can help you grow your money in the long run. Start by learning about stocks, mutual funds, bonds and other types of investments.

When saving for retirement, it’s a common piece of advice to diversify your portfolio and have different investments. This makes sure that at least some of your investments are doing well at a given time.

If you’re getting into investing, it’s a good idea to take a course on investing or speak with a financial advisor to provide more detailed advice.

12. Consider the pros and cons of moving in with your parents

Weigh the pros and cons of moving back in with your parents temporarily after graduation to save on rent. Assuming your parents are on board with this arrangement, living at home for a few months can help you save up a bit before moving into an apartment by yourself or with roommates. However, it’s not an ideal situation for everyone, so always make the decision that is best for you

Pros:

- Save on rent

- Focus on saving and paying off debt

- Worry about fewer adult responsibilities

Cons:

- Less independence

- Less privacy

- Limited social life

13. Learn more about personal finance

Even though you’ve graduated, there’s no reason to put the brakes on your education. This is a great time in your life to brush up on personal finance knowledge.

Personal finance blogs, books, online courses and podcasts are great resources for finance tips and advice. You can also turn to social media—just make sure you’re consuming content from reputable sources.

If you have people in your life that you trust to ask about personal finance advice, now is the time to reach out.

It’s great to be financially conscious right out of college and prioritize budgeting, saving and paying off debts. You’ll likely thank yourself in the long run. However, it’s also important to enjoy this big time in your life. Remember to treat yourself occasionally and live a little, all while keeping your financial responsibilities in mind.

If you aren’t sure where to start, educating yourself on credit is a great way to jumpstart your personal finance journey and set goals for the future.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263