Disclosure regarding our editorial content standards.

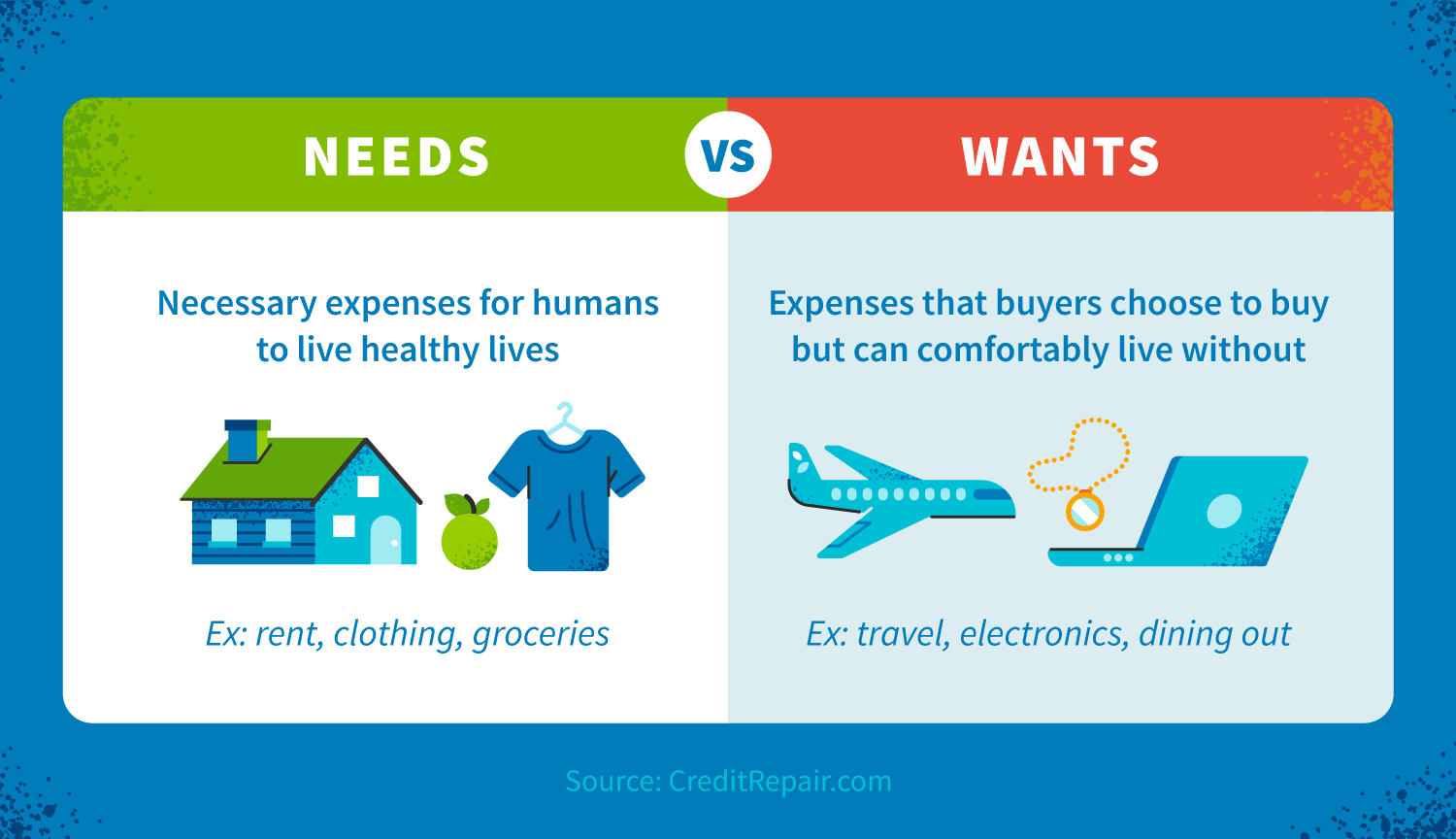

When planning your budget, needs are expenses necessary to survive such as housing, food and utilities. Wants are expenses that better your life but that you can do without.

Understanding the difference between needs vs. wants will help you manage your budget and prioritize your spending. Needs are essential to live comfortably, but wants are often expenses that you can do without.

In theory, distinguishing between needs vs. wants should be easy, but it can be difficult in practice. Understanding the difference can help you be better prepared to put together a budget you can follow. It may also help you from putting unnecessary purchases on your credit card, which can potentially lead to poor credit.

Here, we provide you with tips on how to tell the difference between needs and wants. Once you develop the habit of differentiating the two, financial planning becomes a cakewalk.

Defining wants and needs

Basically, a need is something you must have to live at least a somewhat comfortable life. Comfort is subjective, but to paint a picture, let’s discuss the basic need of shelter. You need a roof over your head, but that roof doesn’t have to be that of a mansion for you to live comfortably. You also need food, but this doesn’t mean you need fancy, expensive food to survive. Needs are the basics.

Then, there are wants, which are more of a luxury. Wants are non-essentials and expenses you can avoid. You may want more expensive clothes or a brand-new luxury car, but you only need suitable clothes and reliable transportation. The desire for a want may lessen over time, but you’ll notice when a need isn’t met and how it’s affecting your life.

The difference between needs and wants

At a glance, the difference between budgeting needs vs. wants is relatively simple. Needs are required for you to lead a healthy life, while wants are things that you’d like to have but could ultimately live without. But examples of wants and needs can be extremely helpful for understanding how these fit into your budget. Below are lists of needs and wants to better understand the difference.

Examples of needs

Needs include basic living expenses. If someone goes without a need, there is a clear adverse outcome, like lack of food or shelter. Expenses that are needs include:

- Food: groceries, pantry essentials and other necessities to prepare food

- Shelter: rent or mortgage payments

- Utilities: electricity, water and sewage

- Services: high-speed internet (if you work or study from home) and cell phone service

- Clothing: basic clothing, sturdy shoes and possibly work clothes

Examples of wants

Wants are basically everything that’s not a need—things that you’d like to own or choose to buy. Some examples of wants that you may come across while budgeting are:

- Food: restaurants, takeout and bars

- Shelter: high-quality furniture, televisions and home decor

- Transportation: a vehicle (if public transportation is available)

- Services: high-speed internet if you do not work or study from home

- Clothing: additional and expensive clothing or shoes

Personalizing your needs vs. wants

Now that you have some examples of needs and wants, you can personalize and prioritize your budget. You can use the following questions to guide your thinking around whether or not you absolutely need something. Then, you can use your personal funds and/or lines of credit to see if this purchase makes sense for you.

Does this fulfill a basic need?

Basic needs typically include food, water and security or shelter, and they can be expanded to include things most people need at some point (such as clothing). So while a new apartment or grocery trip would fulfill a basic need, a designer handbag or computer upgrade typically wouldn’t.

This isn’t to say that some wants can’t also be classified as a need—for instance, if you work from home and your computer breaks, you’ll need to replace it so you can continue working and earning an income. This question typically doesn’t apply to these scenarios, just ones where you’re tempted by something while browsing online or in store.

Ask yourself: What basic need does this cover? Is this essential to living a healthy life?

Will you be OK without this?

One main difference between a need and a want is that the nonfulfillment of a need can lead to an adverse outcome on your health or safety. Not having a want can lead to temporary discomfort, but this is not as harmful of an outcome as when you don’t have a need.

If you’re debating a purchase and trying to rein in your spending, ask yourself whether or not you’ll be able to survive without this purchase. You can also test this by not purchasing it right away and seeing if you’re thinking about the item a week later.

Dramatics aside, (you won’t literally die without a new sweater) carefully evaluate whether or not you’ll be OK without this an hour, a week, a month or six months from now. If the item in question won’t negatively impact your life if you don’t have it, then it’s easy to tell that it’s a want, not a need.

Ask yourself: Will not having this in my life cause me any sort of harm?

Will this make you happier or healthier in the long term?

When assessing the examples of needs vs. wants, you see needs very rarely change or differ over time. However, wants can be fads or trends that will fade. It may be hard when your vision is clouded with excitement, but see if this purchase will make you happy, healthy or otherwise fulfilled for a long time, or if it’s just something you want because it’s popular or trendy.

While retail therapy is sometimes called for, you should be careful about purchasing things because they make you feel better in the moment—these purchases are often forgotten about weeks (or even days) later.

Think long-term about purchases, especially large ones: if the item will still serve its purpose, and serve it well, two years from now, then you can feel better about buying. However, if you could see yourself forgetting about it between now and two years from now, you might be better off passing on the item.

Ask yourself: Is this purchase something that only makes me happy in the moment, or is it something that will still serve its purpose two years from now?

How to build a budget for needs and wants

In an ideal world, everyone would have enough money to buy everything they both want and need. However, this isn’t always the case, and there are several things you can do to build a budget that accounts for both needs and wants.

Stay in control of impulse spending

We’ve all been there—we get tempted by a big sale, see something that’s been on our wish list for a while or shop “just to look” and end up leaving with hundreds of dollars’ worth of items we now have to pay for later on our credit card bills.

Though an impulse purchase now and then won’t hurt, the temptation can be real—in fact, a 2020 survey showed that millennials spent up to $374 on impulse purchases in a 30-day time period, showing the importance of getting in control of impulse buying before it starts to control you.

Much like determining between needs and wants, getting impulse buying under control may be easier said than done. However, you can rein in your impulse spending by doing the following and more:

- Leave your credit cards at home when you go shopping if you don’t need anything.

- Shop when you have a limited amount of time to do so, like on a lunch break, so you aren’t tempted to waste time and money.

- Bring cash or cash envelopes with you instead of a credit card. Studies show that there is a psychological “pain” associated with spending cash, since you can immediately see how much you’re spending.

- Wrap your credit card with a picture of what you’re ultimately saving for like a car, your student loans, a wedding or other big purchases. Then, you can see where that money could ultimately be better spent.

- Load a prepaid card (like a gift card) with a certain amount of money to dedicate to your impulse spending every month. Treat this like your spending money or allowance for the month—once it’s out, it’s out.

Budget for both needs and wants

Ideally, you’d follow your budget to the letter every month, never going over. While some master budgeters may have accomplished this, the beginner or everyday budgeter will likely need to work on this skill. This is where the 50/30/20 budget comes in.

The 50/30/20 budget provides guidelines to help users create a budget that works for them. Budget areas are divided up to 50 percent needs, 30 percent wants and 20 percent financial goals. This allows users to be able to both afford what they need and pay for what they want.

A 50/30/20 monthly budget would look like this:

50 percent needs:

- Rent

- Utilities

- Groceries

- Insurance

30 percent wants:

- Travel fund

- New clothes

- Hobbies

- Dining out

20 percent financial goals:

- Student loan payment

- Credit card bill payments

This budgeting method is useful for people who want to be able to have a little fun with their money, pay for what they need and also get ahead of their financial goals.

Be specific in budget categories

It’s usually better to be specific than to generalize, and budgeting is no exception. One way to build a budget that works for both needs and wants is to be as specific as possible.

Here are some examples of being more specific:

- “Groceries” instead of “food” because dining out is a want

- A list of utilities rather than grouping everything under “utilities”

- Subcategories for luxury spending such as dining out and entertainment

The more specific you can be, the more you can accurately budget for each category. This helps you see your spending at a glance and helps prepare you for all of the various expenses you’ll come across on a monthly or weekly basis.

Remain mindful when using your credit card

Impulse purchases happen, and as long as you’re budgeting and doing what you can to stay on top of your spending, you shouldn’t feel guilty for indulging in something you want but don’t need from time to time. However, be sure you’re not whipping out your credit card for everything you want at the mall or while out at dinner. Putting too much of anything onto a credit card could hurt you down the line. This could include your credit score dropping, meaning you’ll need to put in the hard work necessary to rebuild your credit.

Don’t let your wants hurt your credit

When your spending on wants isn’t under control, it can lead to unnecessary credit card debt. Sometimes, you may find yourself putting needs like utilities or groceries on a credit card. Whether it’s wants or needs, errors and other issues can negatively impact your credit score.

Here at CreditRepair.com, we specialize in helping people repair and improve their credit while also providing credit education. If you need help repairing your score or creating a plan to spend more wisely, contact us today.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263