Disclosure regarding our editorial content standards.

When you’re struggling with debt, it’s hard to know where to get started paying it off. Whether your debt is from credit cards, student loans, a mortgage or any other source, you can benefit from learning more about the best ways to pay off debt.

Getting out of debt can improve both your financial health and your peace of mind—and it will also likely give your credit score a boost. While there’s no magic spell to remove debt from your life, there are realistic ways to start tackling it one day at a time.

Read on to get some inspiration for making small changes that could make a big difference in your approach to dealing with debt.

1. Pay more than the minimum balance

Getting a handle on debt starts with making payments that outpace interest. It can be tempting to simply pay the minimum balance on a credit card bill—after all, that eliminates late fees, at least. But a credit card’s annual percentage rate (APR) is generally quite high, which means that you are probably not making a long-term dent in your debt if you don’t pay more than the minimum.

For example, if you have $1,000 in credit card debt on a card with 20 percent APR, it would take more than 10 years to pay off the card with a minimum payment of $25—and you’d rack up almost $1,200 in interest charges along the way.

Key takeaway: Paying the minimum balance likely isn’t the best approach. Putting a bit more toward your debt each month will save you money in the long term by avoiding interest charges.

2. Make multiple payments each month

Although your loans and credit cards only require monthly payments, there are several advantages to making more than one payment each month.

Many credit cards calculate interest based on your daily average balance, so making several payments could reduce your interest charge—even if you actually pay the same amount in total. For example, if you make four payments of $100 throughout the month, your average balance will be lower than if you pay $400 at the end of the month.

For loans as well as credit cards, making multiple payments can be helpful if you tend to put off paying loans after payday. If you get paid weekly or every other week, you could try applying a percentage of your paycheck to your debt right after you get paid—that way, you’ll prioritize debt payments before any other spending.

Key takeaway: Making multiple payments can help you build the habit of putting debt payments first, and it may also reduce your credit card interest charges.

3. Find a powerful payment approach

Paying off debt sounds simple enough, but there are a few different approaches you may want to take. While some approaches will save you money in the long term, others may give you the emotional boost required to keep pushing toward your goal of being debt-free.

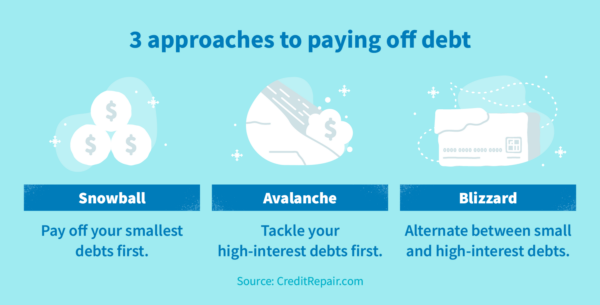

Here are the most common approaches to paying off debt:

- Snowball: With the snowball approach, you focus your attention on paying off your smallest debt while paying the minimum balance on your other debts.

- Avalanche: With the avalanche approach, you devote your resources to paying off debt with the highest interest rate first.

- Blizzard: The blizzard approach is a hybrid of the previous two—alternate between paying your smallest debts and then your highest interest debts.

Ultimately, the avalanche method will save you the most money in the long term, as high-interest debt will accrue more interest charges the longer it sits unpaid. That said, the snowball method provides an emotional lift when you see a debt cleared out, which could give you the motivation to keep making payments. The blizzard approach may be a good compromise for many people, as it provides a motivating boost while still addressing high-interest debt.

Key takeaway: Pick a strategy that suits your lifestyle and needs, and feel free to change your repayment plan if your first approach isn’t working.

4. Explore balance transfer cards

If you have high-interest credit card debt, a balance transfer card could help you make payments more easily.

Many balance transfer cards have lower APR or even zero percent promotional APR, which means that you could save significantly on interest charges by initiating a balance transfer.

These cards often involve balance transfer fees, so you’ll want to make sure that the money you’ll save on interest outweighs the fees. Also check to ensure you can pay off the debt before the promotional period ends, or you could be hit with interest rates even higher than those of your original debt.

Key takeaway: If you find a balance transfer card with low APR and fees, you could save money by moving over high-interest credit card debt.

5. Consider consolidating your debt

Debt consolidation enables you to merge several debts into a single loan—hopefully with more favorable payment terms.

If you have several high-interest debts—for example, a car payment, credit card debt and a personal loan—you could save money and simplify your payments by using debt consolidation.

Importantly, you’ll want to check the length of your consolidated loan, as you may end up paying more interest over the life of the loan if the term is longer than your original loans. Still, with a bit of research, you may be able to make lower payments on your debt with a single loan.

Key takeaway: Debt consolidation could provide you a lower interest rate and a single debt payment by helping you combine several debts into one.

6. Build a better budget

Even the perfect payment strategy won’t help if you can’t find the extra money to put toward your debt. Working on your budget can help you proactively work toward putting money aside for debt payments.

To start, track every dollar you spend—whether for essentials like rent or luxuries like dining out—to get a sense of your current situation. Then, consider using envelope budgeting to put your money to work for you. For every paycheck you earn, make a conscious decision about how you want to allocate those funds.

Eventually, your goal should be to get your budget at least a month ahead—that way, you’re using this month’s earnings to fund next month’s necessities. With financial savvy like that, you’ll get debt under control in no time.

Key takeaway: A good budget requires proactive choices about where you want your money to go after it lands in your bank account.

7. Stop using your credit cards

If your credit card spending has led you into debt, you may need to take a break. While many credit cards offer perks for spending, those rewards are quickly overshadowed by interest charges.

Try stepping away from your credit cards for a while and retrain yourself to spend within your means. Consider leaving your credit cards at home, removing saved cards from online shopping websites or even closing your cards if necessary. Closing your credit card accounts could lower your credit score in the short term, but the long-term benefits of paying off debt are likely more important.

Key takeaway: Credit card debt can get out of control quickly due to high interest rates, so take a break from your cards if you need to get your spending under control.

8. Create new financial habits

Getting out of debt often involves making changes in the way you think about money. Improving one financial habit often has a profound ripple effect, so consider adopting one or more of the following ideas:

- Immediately put part of your paycheck into a savings account.

- Use your employer’s 401(k) program or start an individual retirement account (IRA) to put money away for retirement.

- Set up a day each month to look at all of your financial accounts to get a sense of how you’re progressing toward your goals.

While spending money gives a short-term boost, setting and reaching long-term goals tends to lead to longer lasting financial satisfaction.

Key takeaway: Good financial habits breed more good financial habits, so try out a new savings or investment strategy as you pay down your debt.

9. Lower your bills

If you’re trying to find more money to pay off debt, it can be helpful to find ways to reduce your essential bills. Costs like housing, food and insurance are absolutely necessary, but that doesn’t mean they are unchanging.

- Bundling your home and auto insurance could save you money.

- Changing your health insurance plan could lower your premiums.

- Refinancing your mortgage could give you a more favorable interest rate.

- Checking in with your utility companies could reveal financial incentives, like a different electricity plan or a more affordable cell phone plan.

There are often discounts to be found for cable, internet, cell phones, utilities, homeowner’s insurance, auto insurance and more.

Key takeaway: While essential expenses can’t be avoided, they can sometimes be changed—which could give you more money to put toward your debt.

10. Cut extra expenses

A little extra money each month that goes toward paying off your debt can make a big difference in the long run. For example, with $5,000 in credit card debt at 18 percent interest, you could pay off your debt six months faster by paying $400 rather than $300.

Locating extra money in your budget can be tough, but oftentimes small sacrifices add up. Sometimes these expenses could be irregular but large, whereas other times they are small but frequent—perhaps even daily. Look for opportunities to cut costs, and remember that these short-term changes can lead to long-term success in getting out of debt.

Key takeaway: Cutting small but unnecessary expenses can add up to extra money you can use to pay off debt.

11. Take on a part-time job

When it comes to having extra money to tackle debt, you can either cut your expenses or increase your income. If you’re already operating on a slim budget, finding a new source of income could be the key to getting out of debt.

A part-time job that fits your lifestyle and schedule could boost your income enough to help you make extra payments on your debt. Since any money you earn from another job could be allocated entirely toward debt payments, you can make quick progress on your debt—hopefully making the part-time job a temporary solution.

Key takeaway: Extra earnings can be sent directly toward debt payments, accelerating your payment schedule.

12. Consider a career change

If your earnings have become stagnant at your current job, you may want to consider a career change. While this could be a drastic move, it could also be a financial boon that helps you get out of debt and supports your long-term financial goals.

Your job experience alone may have prepared you for many other fields, and some high-paying jobs—like a dental hygienist or air traffic controller—only require certificate programs. Increasing your income even slightly will enable you to save more money, make more debt payments and save for retirement.

Key takeaway: If your current career doesn’t have enough room for growth, consider making a move to increase your earnings—which will help with debt as well as your other financial goals.

13. Start a side hustle

Sometimes taking on a second job is impractical for a variety of reasons, but it’s still possible to earn some extra income in your spare time. A side hustle or a gig may offer reasonable pay and lots of flexibility, enabling you to turn free time into additional money. That money can then be used to increase your debt payments each month.

A side hustle could come from a skill you have, like coaching, tutoring or cooking. On the other hand, you could pursue a gig like food delivery or personal shopping. One of the key advantages of a side hustle is the flexibility to choose when you want to work, which gives you extra income when possible or extra time when you need that instead.

Key takeaway: Consider the flexibility of a side hustle for earning a little extra income to put toward your debt without taking on a part-time job.

14. Turn your passion into profit

If you have a passion that can be monetized, you may be able to earn some extra cash to support your goal of being debt-free while still spending your free time doing what you love.

Painting, making jewelry, writing calligraphy, taking photos and many more passion projects can often be monetized using a website or online store. While it can be a challenge to gain traction early on, many people experience long-term success and satisfaction by selling their original products or services.

Key takeaway: Many passions can be made profitable with a website or online store—that way, you can earn money to put toward your debt while still pursuing what you love.

15. Keep an eye on your progress

As you continue to work toward your goal of paying off your debt, you’ll want to keep a close eye on your progress. The best way to pay off debt may change for you over time—and your income, expenses and repayment strategies will need to adjust in turn.

In addition to financial freedom, paying off debt also often provides a boost to your credit score. Make sure to regularly check your credit report, which lists all of your open accounts and balances. Importantly, you should ensure that accounts you have fully paid off are listed correctly on your credit report, as inaccurate debts could damage your score—but fortunately, you can potentially repair your credit in cases like this.

Reviewed by Leikeisha Finai-Jones, Credit Consultant at CreditRepair.com.

Leikeisha Finai-Jones joined CreditRepair.com back in 2020 as a social community coordinator. Leikeisha knows how the credit industry works and how what pitfalls consumers need to look out for—Leikeisha mastered the skill of problem-solving even in tough situations involving identity theft, credit repair and other issues. Leikeisha has seen it all, and knows how consumers can make the most of their rights to boost and protect their credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.