Disclosure regarding our editorial content standards.

Waiting your next paycheck can be painful, and financial emergencies or living paycheck to paycheck can mean that you need access to your money quickly. Enter—payday loans.

Payday loans are often advertised to borrowers looking for quick and easy access to cash without barriers like a hard credit inquiry. But they also have a reputation for high interest rates and short repayment periods that can keep borrowers in a cycle of debt. Before you jump into a loan, it’s important to weigh the pros and cons of payday loans and uncover the hidden costs.

What are payday loans?

A payday loan is a type of loan that is usually between $100 and $1,500 that must be repaid within two weeks in a lump sum on your next payday. They’re marketed to borrowers who need cash fast since they offer a quick approval process. They also don’t require a hard credit check, which can be attractive for borrowers who have poor or no credit history.

You might need a payday loan if you encounter an unexpected bill or medical emergency that you don’t have cash on hand to pay for. Payday loans can help alleviate short-term money problems, but it’s important to be mindful of how this can affect your long-term financial situation.

Some other names for payday loans include cash advances, payday advance loans, quick cash loans, deferred deposit loans, check advance loans or post-dated check loans.

How do you qualify for a payday loan?

Qualifying for a payday loan is much easier than qualifying for a mortgage or even a personal loan. As long as you’re above the age of 18 and you can provide a government-issued ID and proof of income, you’re more than likely eligible for a payday loan.

How do payday loans differ from other types of loans?

What makes payday loans different from traditional loans is the short repayment period. Repayment on this type of loan is usually due when the borrower receives their next paycheck. So, payday loans must be repaid generally within two weeks or your balance will roll over and accrue more interest.

Pros of payday loans

Payday loans can be a convenient and quick method to obtain cash between paychecks. This appeals to a wide variety of borrowers since payday loans are accessible to people with all credit histories and incomes. Below are some advantages of payday loans that draw borrowers in.

1. Easy application and approval

Payday loans are known for how accessible and easy they are to obtain. Gone are the days of going in person to the bank or credit union when you can simply do all your banking online—this also applies to payday loans!

An online application process for a payday loan can be useful for those who need cash quickly and easily. A quick search can locate online lenders who are ready and available to borrowers. Many lenders offer online applications that can be completed in 10 minutes or less. Since they don’t require a hard credit check, many borrowers are approved for a payday loan right away.

2. Fast access to cash

Since cash advances are easy to apply for, you can get access to money much faster than you would a personal loan, which can take weeks to get approved for. Some borrowers can even get a payday loan within 24 hours of their application.

3. Fewer requirements than other loans

Requirements for a payday loan typically include being at least 18 years old, showing your SSN, photo ID and proof of income. This makes it easy for borrowers with poor or no credit history to easily obtain a loan.

4. No hard credit inquiry

You don’t need a good credit score to get a payday loan. In fact, lenders don’t pull your credit report, which would normally involve a hard credit inquiry that may drop your score. For those with bad credit or a lack of credit history, this can be an incentive to borrow.

5. No collateral

Unlike an auto loan or mortgage, the lender can’t seize your property if you’re unable to pay. However, they can send your debt to collection agencies or take you to court if you don’t pay back your payday loan.

Cons of payday loans

Although payday loans can be convenient, they come at a cost, including high interest rates and a high likelihood of getting trapped in a debt cycle. Below are some disadvantages of cash advances that you should take into consideration before taking out this type of loan.

1. High interest rates

Depending on your state, you may have high interest rates on your payday loans that could end up costing you over six times the amount you borrowed. In most cases, you’ll have to pay additional money on top of the amount you took out. Many states like Vermont and Arizona have even outlawed payday loans due to these high interest rates that keep borrowers trapped in a debt cycle.

2. Short repayment period

Other loans like auto loans and mortgages give borrowers ample time to repay their balance. However, the short repayment period of payday loans can make it difficult to pay back in a lump sum without any remaining balance. This is especially true if your paycheck has to cover expenses like rent, utilities and other bills.

3. Increased prevalence of predatory lending

Payday loans are often considered predatory lending. Predatory lending is when a loan is unfair or unaffordable to the borrower, which can trap them in a debt cycle. Some signs of predatory lending include the lender not checking if you’ll be able to pay back the loan and when the loan doesn’t help you build credit.

4. High likelihood of getting trapped in the debt cycle

When the borrower can’t pay back the loan in a lump sum on the due date, they’re forced to roll over the loan to the next billing cycle, like holding a balance on a credit card. When this happens, the lender can collect more interest fees and keep you in debt. If the debt isn’t repaid within 60 days, lenders can send your balance to a collection agency.

5. No positive effect on credit

One major downside to payday loans is that they do not help you build credit. Payday lenders will often forgo reporting to the three major credit bureaus: Experian®, Equifax® or TransUnion®. This means that your loan won’t help you build credit. In contrast, paying off a mortgage or a car loan can help improve your credit.

6. Targeted at communities of color

Payday lenders are most common in communities that predominantly consist of minorities. In fact, there were double the number of payday loan sites in Black or Hispanic communities compared to white communities, according to a 2016 study.

Payday lenders also specifically target people of color in their marketing campaigns—over 30 percent of payday lenders’ marketing pictures show Hispanic customers, even though they make up less than 20 percent of payday and title loan borrowers.

7. Lenders have bank account access

Oftentimes when you obtain a payday loan, the lender will give you a fast cash advance if you give them access to your bank account. Unfortunately, some payday lenders will try to take the money they’re owed out of your account without your permission. This is possible since they gained access to your bank account to deposit the cash advance in the first place.

8. Chance of lawsuit for unpaid balance

Payday lenders can send your debt to collections if you fail to pay your balance for over 60 days. While payday lenders don’t typically sue borrowers themselves, collection agencies can take you to court if you don’t repay your loan.

If the lenders of debt collection agencies are threatening to sue or use wage garnishment to scare you into paying your balance quickly, you can call a local nonprofit or an accredited financial counselor or credit counselor to help you.

Payday loan practices by state

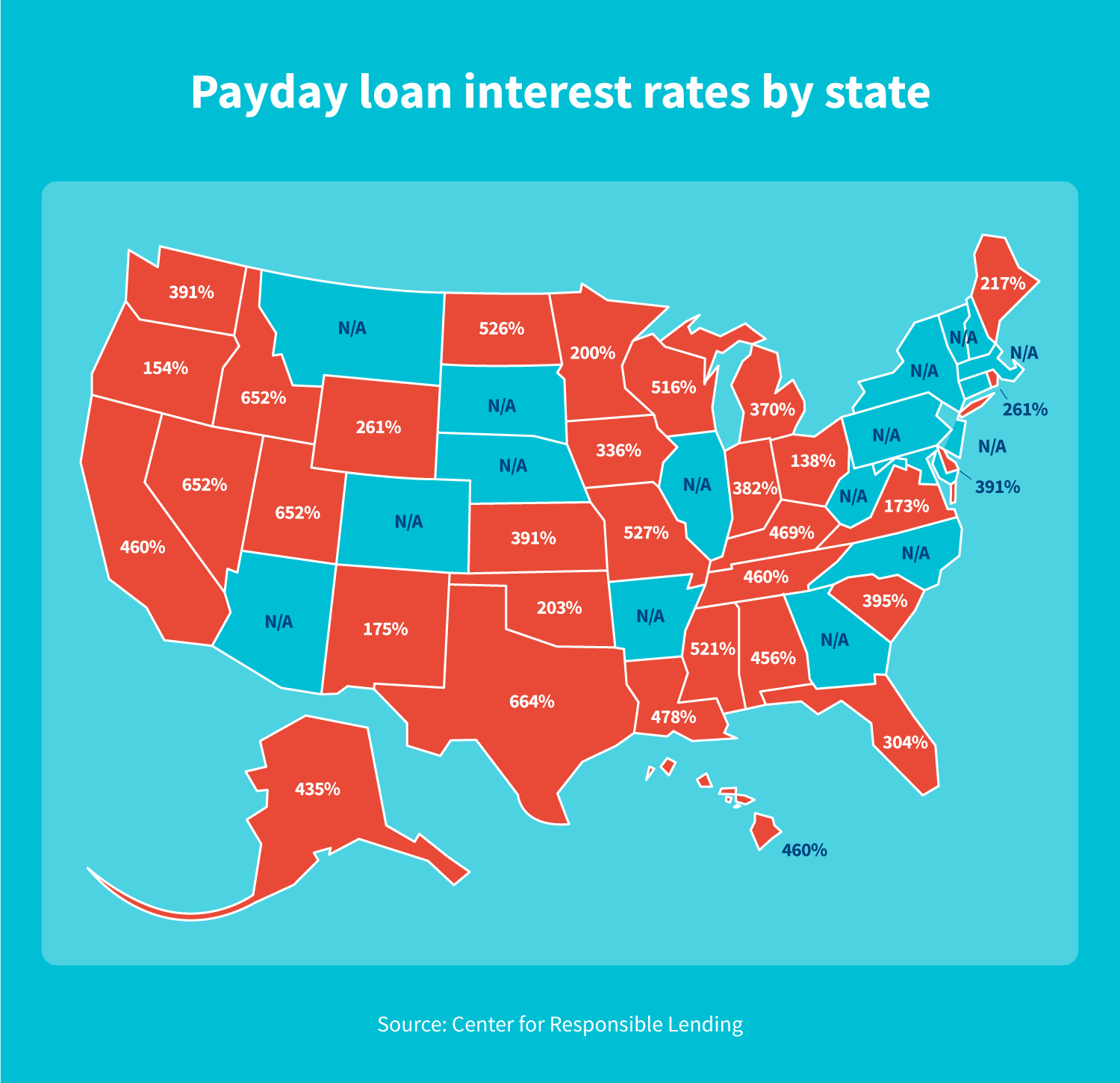

Depending on the state you reside in, the interest rate on payday loans will vary. Residents of Texas pay the highest nationwide interest rate of 664 percent, where people in Ohio pay the lowest national rate of 138 percent—it really depends on where you live!

The map above shows the interest rates for each state that does allow payday loans. Wondering where payday loan interest rates are the highest?

The top six states with the highest interest rates include:

- Texas: 664%

- Utah, Nevada and Idaho: 652%

- Missouri: 527%

- North Dakota: 526%

States with the lowest interest rates still charge approximately double the principal amount. The five states with the lowest interest rates include:

- Ohio: 138%

- Oregon: 154%

- Virginia: 173%

- New Mexico: 175%

- Minnesota: 200%

- Oklahoma: 203%

Don’t see your state? It might be one of the following states that don’t allow payday loans:

- Arizona

- Arkansas

- Connecticut

- Georgia

- Maryland

- Massachusetts

- New Jersey

- New York

- North Carolina

- New Mexico

- Pennsylvania

- Vermont

- West Virginia

Alternatives to payday loans

Payday loans can cost you a lot more in the long run, so opting for alternatives to save money will be your best bet. Below are some strategies you can use to avoid taking out a payday loan in the first place and ultimately avoid costly interest fees.

Talk to your bill collectors

Calling your utility company or phone service provider and explaining your situation can buy you more time or help prevent a late fee. Many bill collectors will give their customers a 15-day grace period before you get charged for a late bill payment. Given the high interest rates on payday loans, it may be less expensive to pay a late fee than to pay back a cash advance.

Find a nonprofit lender

There are plenty of nonprofit organizations whose mission is to help you in times of financial hardship. Obtaining a loan from a nonprofit lender like the Mission Asset Fund is much more advantageous than a payday loan since they charge zero percent interest on loans and they report your loans to the three major credit bureaus.

Consult a federal credit union

An excellent alternative to a payday loan is a payday loan alternative (PAL) which has loan terms that range from one to six months for $200 to $1,000, and can be obtained from some federal credit unions. Many federal credit unions will even provide financial counseling to their customers free of charge.

Find a cosigner for a personal loan

If you don’t qualify for a loan on your own, try to find a cosigner for a personal loan so you can get better interest rates and build your credit. A cosigner is a person who you trust who also agrees to take full legal and financial responsibility to pay off your debt if you are unable to pay. Make sure your cosigner has good credit so that you’re more likely to get approved for a personal loan with an affordable interest rate.

Is a payday loan worth it?

Payday loans have a lot of hidden disadvantages that will keep borrowers in debt. While they might seem advantageous and accessible on the surface, they come with risks that can be more trouble than they’re worth.

If you do take out a payday loan—or any loan—you’ll want to be sure to stay on top of your credit report. Your report should contain accurate information about the balance and payment history for your loan, but incorrect information could unfairly drag down your credit score. If you notice any inaccuracies, consider reaching out to CreditRepair.com for professional support removing incorrect negative items from your report.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263