Disclosure regarding our editorial content standards.

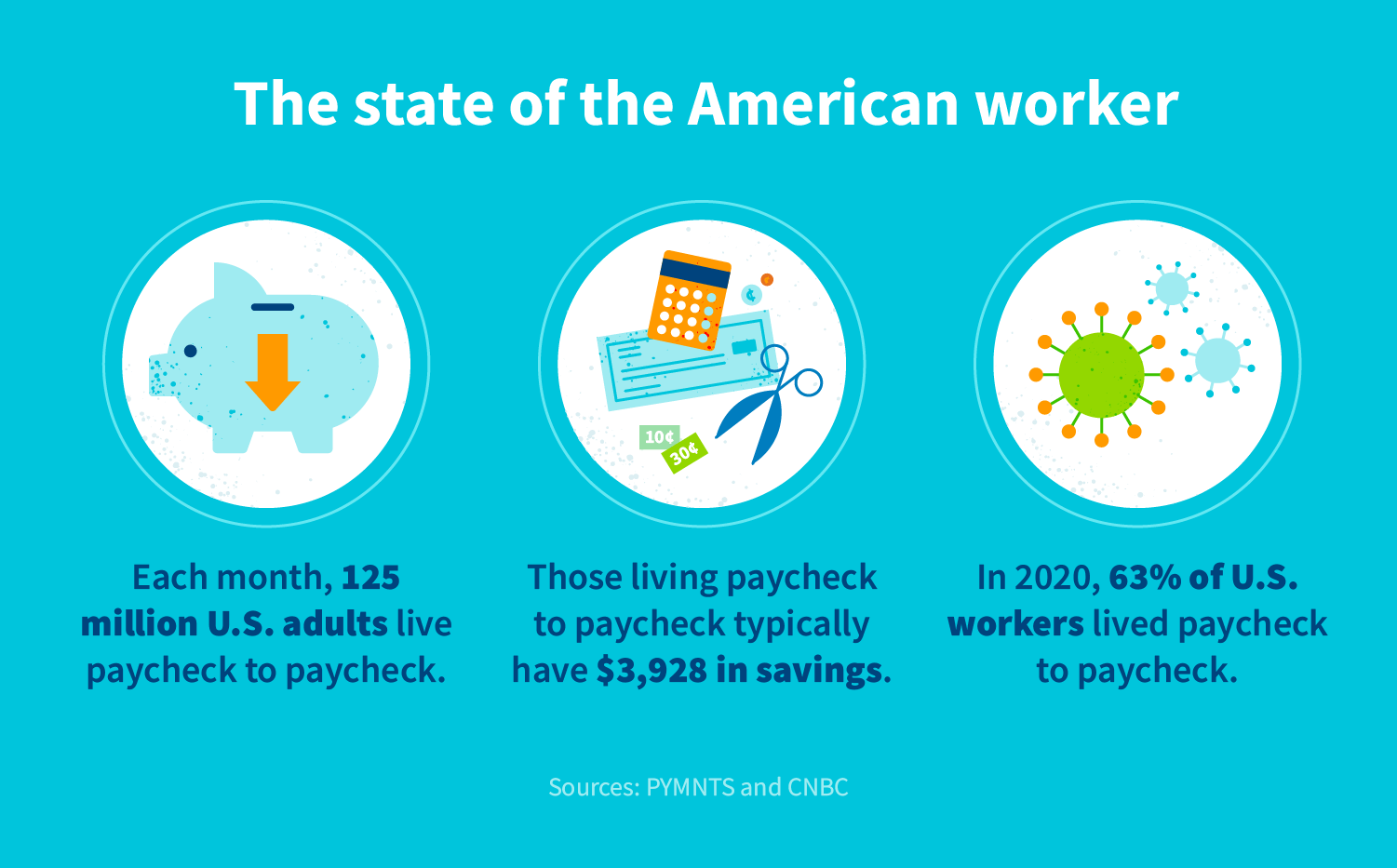

If you’ve needed to scrimp and save extra money for the days leading up to payday, you aren’t alone. According to a 2021 survey, 54 percent of U.S. workers report living paycheck to paycheck in order to make ends meet each month.

Breaking the paycheck-to-paycheck cycle can help you improve your quality of life and financial stability—including your credit score. Read on for more information on how to stop living paycheck to paycheck, and don’t forget to check out the infographic on tips to level up your career to save more.

1. First things first: start budgeting

One of the most effective steps you can take to stop living paycheck to paycheck is to create and follow a budget. There are a few different ways you can budget your money, from a sinking fund to cash envelopes, so don’t be afraid to try different strategies until you find what works best for you.

The best budget will account for all of your expenses, from weekly grocery trips to car payments. Having a monthly budget can show you how much money you’ll have coming in and going out each month, so you can spend (and save) accordingly.

Tip: Create a monthly and yearly budget to guide your spending and saving.

2. Set personal financial goals

Sometimes, all you need to motivate yourself to save is a concrete goal to keep in mind. This goal can vary, but some examples are:

- Have $5,000 in your savings by the end of the year

- Pay off your credit card bill

- Take a fully paid off family vacation in the summer

- Put aside four percent of your paycheck each pay period

- Finish paying off your car lease

These goals help give you something to work toward that you can keep in mind when you’re tempted to overspend. You can even print off a picture of your goal (like your car or your dream vacation locale) and wrap your credit card in it, so you can remind yourself why you shouldn’t overspend.

Tip: Set a financial goal to accomplish in the next six months to a year.

3. Decrease spending where possible

One way to have more money each month is to cut back on unnecessary spending, which can be easier said than done. If you find yourself spending impulsively every time you go out, try to remove that temptation altogether, either by not window shopping or by leaving your cards and cash at home when you do go out.

A surefire way to cut unnecessary spending back is to have a rigid budget in place and a financial goal in mind. This can help remind you what you’re budgeting for, and how worth it resisting spending will be when your goal is met.

Tip: Make a priority list of things you need before shopping so you aren’t tempted by impulse purchases.

Source 1 + source 2

4. Avoid lifestyle inflation

When you get a raise or income bump, it’s natural to want to treat yourself for your hard work. But making a habit of spending more as you make more, also known as lifestyle inflation, can lead to some serious overspending.

While it’s certainly tempting to make some big purchases as you make more money, it’s important to stick to your budget and not make unwise financial decisions just because you can afford it.

Tip: Treat yourself to one item you’ve been eyeing when you get a raise or new job, but otherwise continue spending like you were before you got a pay bump. Save the extra money, or put it toward your goals.

5. Pay yourself first

Each month, you should try to “pay yourself” first by putting money into savings and/or retirement. If you find yourself forgetting to do this each month, you could tell your employer to reroute some of your pay into a separate savings account. This way, you don’t see the money that’s being sent there, so you don’t get a chance to miss it.

Tip: Set up three to four percent of your paycheck to be automatically drafted into your savings account each pay period.

6. Take steps to eliminate debt

If you are anxiously awaiting your next paycheck because you have debt piling up, you may want to make an aggressive plan to eliminate or downsize the debt you have. To do this, start making more frequent or larger payments on the debt that has the highest monthly interest rate to cut down on the total amount of debt you have. Once you’ve eliminated some of your debt, you can save more each month.

Tip: Create a plan to pay off debt, starting with the debt with the highest interest rate and working down.

7. Keep a “cushion” in your checking account

Once you’ve been able to put aside some money in your savings account each month, it’s advised to create a cushion of a few hundred dollars in your checking account. This cushion gives you some flexibility financially, so you aren’t stressing about overdraft fees or overspending.

This can give you peace of mind that even if you go off budget for the month or your bill at dinner is higher than you anticipated, you won’t send your bank account into the negatives.

Tip: Build up how much you save from your paycheck each month to create a cushion of a few hundred dollars (or however much you feel comfortable with) in your checking account.

8. Create an emergency fund

An emergency fund, as the name suggests, is a fund created specifically to use in the event of an emergency. This could include unexpected car repairs, damage from a fire or flood, or anything else in your life that constitutes an emergency expense. The fund ideally allows you to cover these things so you don’t need to empty your bank account for something you didn’t budget for.

A 2020 survey showed that only 41 percent of U.S. adults would be able to cover an unexpected $1,000 expense, and 37 percent of adults said they would need to borrow money in some capacity for an unexpected bill. Having money stored away “just in case” can grant you peace of mind that you won’t be put into debt by an unanticipated expense.

Tip: Aim to have around $1,500 to $2,000 saved in case of an emergency.

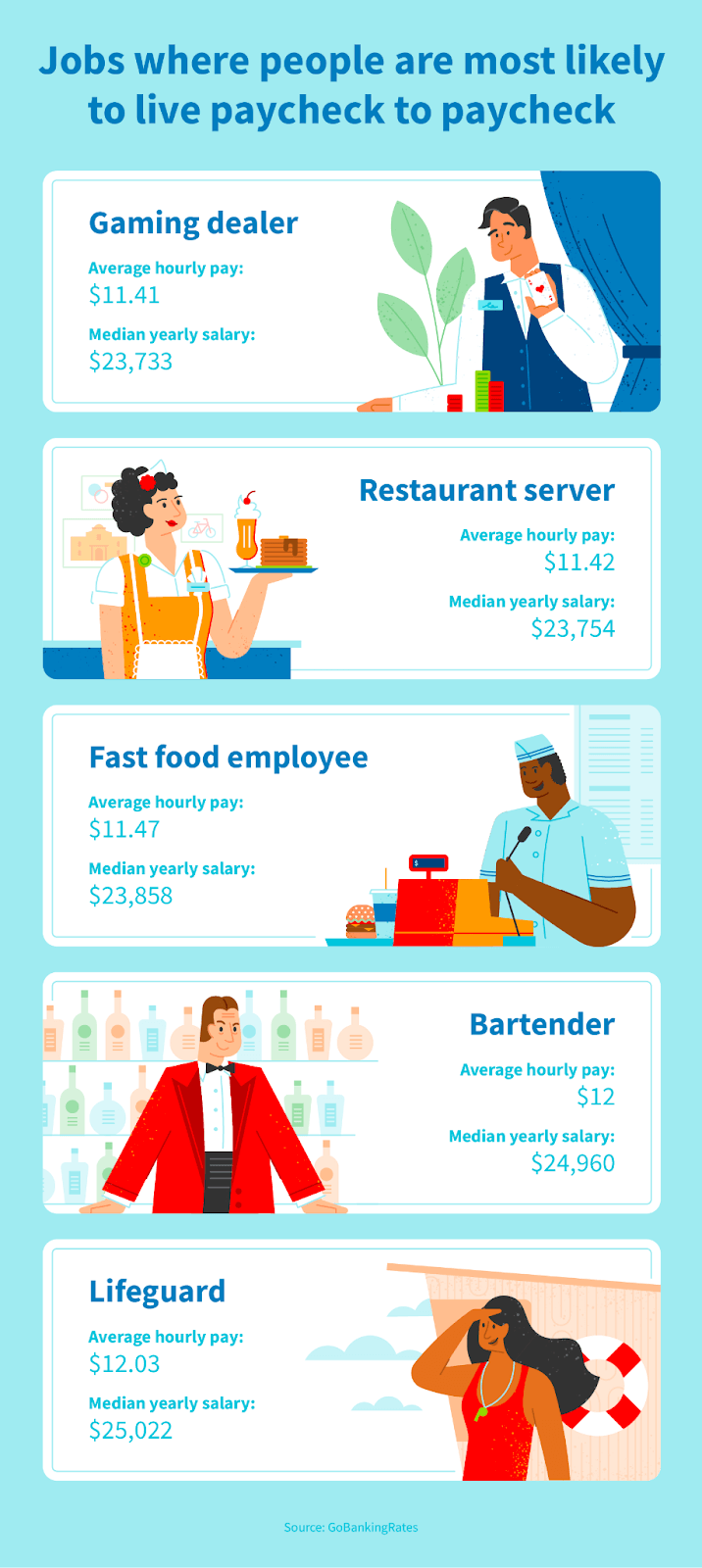

9. Increase your income

A job isn’t just about the money, but if your job isn’t paying your bills, it can cause a huge amount of stress. If your main source of income isn’t cutting it anymore, you may want to consider asking for a raise or finding a higher-paying position that meets your financial needs.

A 2018 survey found that 70 percent of workers who asked for a raise received one, though it wasn’t always the amount they requested. If you aren’t comfortable or not in a position to ask for a raise, additional ideas to increase your income include:

- Starting a side hustle, like delivery driving or ride-sharing

- Monetize a hobby, such as selling or commissioning your work

- Create passive income opportunities

Tip: Set a goal of how much income you’d like to be making, and take necessary steps to make that happen.

10. Keep in mind the “Four Walls”

If you find yourself overspending each month, you may want to try a spending detox to show how much you can save by cutting out extraneous expenses. One method is the Four Walls budget, popularized by financial guru Dave Ramsey. The Four Walls are the top priority spending areas for your budget each month: food, utilities, shelter and transportation.

By taking care of your Four Walls each month, you’re making sure you and your family are fed, with a roof over your heads, bills taken care of and the ability to get where you need to go. By only spending money on these areas for one month, you can make your budget work for both your needs and wants (and hopefully cut out a few of the less necessary wants).

Tip: Try one month where you spend money only on your Four Walls to see how much you save when you cut out unnecessary purchases.

11. Spend intentionally

If you need some help with intentional spending, start by paying close attention to what you’re spending your money on. You might go on autopilot at the grocery store and get the same name brands you always get, but are there cheaper, generic alternatives you can swap for? You may have a set monthly shopping date with a friend, but can you have a BYO picnic instead of going to the mall?

Many major bank apps have a spending breakdown in monthly statements, so see if that’s an option for you to analyze your spending habits and cut back where necessary.

Tip: Pay close attention to and audit your spending for a week, then make adjustments based on your highest spending areas.

12. Remember the big picture

Budgeting and saving can feel frustrating, especially when you aren’t seeing huge payoffs or differences right away. However, it’s important to keep the big picture in mind and remember your “why.” By budgeting and being more intentional about your spending, you can soon have paychecks come and go without anxiously counting down the days. It’s hard work, but it will be worth it when you’re able to have confidence in your financial decisions.

Tip: Write down your saving goal in a spot you see each day, so you’re always reminded why you’re making tough financial decisions now.

What happens when you break the paycheck-to-paycheck cycle?

Now that you know some strategies on how to stop living paycheck to paycheck, you may be wondering what happens when you finally break this vicious cycle of spending, anxiety and waiting for payday. Check out three ways that not living paycheck to paycheck may improve your life.

Quality of life may improve

Fifty-eight percent of Americans feel their finances control their life, according to a 2020 survey. Breaking free of the paycheck-to-paycheck cycle can help you regain control of your life and no longer feel like you’re being controlled by money, which can lead to an overall improvement in your quality of life.

Stress levels may go down

Seventy-seven percent of those in a recent survey said they regularly feel anxious about money. Once you’re no longer living paycheck to paycheck, that major stressor may be eliminated.

Forty-three percent of those surveyed said financial stress causes fatigue, while 41 percent said it interferes with their sleep and 42 percent reported difficulty concentrating at work. The peace of mind that comes with no longer living paycheck to paycheck could have a positive impact on your overall health and well-being.

You may have more financial freedom

Once you’re no longer living paycheck to paycheck, you’ll notice greater financial opportunities and options to choose from. This also means you’ll have more flexibility when it comes to purchases—you’ll likely be able to pay for things in full, so you’ll have the opportunity to stop putting expenses on your credit card and rack up debt.

This in turn frees you from the debt repayment cycle and lets you have full control over your money. Money shouldn’t be a roadblock on the path to happiness, so financial freedom opens you up to living life on your own terms.

While stress about money may never completely go away, there are several things you can do to eliminate the need to live paycheck to paycheck each month. Taking control of your finances can then positively impact your credit by making better financial decisions that will help you pay down debt and raise your credit score.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263