Disclosure regarding our editorial content standards.

Many people picture their retirement being spent on a white sand beach, sipping on something fruity and exploring new hobbies—while definitely not working. However, retirement is often not that picturesque.

For many, retirement means cutting back on the standard nine-to-five office hours, but not necessarily quitting the workforce altogether. Some retirees enjoy the structure that having a job brings, while others need some additional income to get their finances in order or help bolster their credit score.

That’s why we’ve put together this list of the 30 best part-time jobs for retirees. These allow you to pick your own hours, work on your own terms and get paid for doing something you enjoy. Whether you’re a retiree looking for a new adventure or a senior in need of some financial resources, read on for tips on making the most of your retirement—or skip to the infographic below for more information.

Median pay was calculated using figures from the Bureau of Labor Statistics Occupational Outlook Handbook, as well as data from ZipRecruiter.

Remote job opportunities

If 2020 taught us anything, it’s that there are many flexible jobs that can be done from the security of your own home. If you prefer working from home or are just looking for something without a commute, here are six remote jobs that can be done from your house—or really anywhere with a reliable internet connection.

1. HR coordinator

Every company needs someone to run the HR side of business. Your main responsibilities will be supporting employees, vetting prospective job candidates and handling paychecks, along with any other miscellaneous tasks that may come your way. You may need a related degree or previous experience.

Average hourly pay: $29.77

Best for: Retirees who want to do their part to help a company run smoothly.

2. Tax preparer

If your friends and family consider you their go-to tax assessor, you might as well get paid for your expertise. One big perk of being a tax preparer is that you’re only truly busy once a year, which is perfect for some additional income. All you’ll need to make your new position official is a preparer tax ID number, issued by the Internal Revenue Service.

Average hourly pay: $26.39

Best for: Those looking for part-time income from only working hard one season per year.

3. Paralegal

Paralegals and legal assistants are integral members of helping a law firm run smoothly. Your responsibilities will mainly include conducting legal research, writing reports and keeping client documentation organized. Best of all: You can communicate via phone and email, with no need to go into the office. You may need a degree in a relevant field or a certification.

Average hourly pay: $24.87

Best for: Any senior looking to support those that make a big difference in day-to-day lives.

4. Tutor

Helping students succeed while getting paid—what could be better? With a rise in online schooling, tutoring services are in need of qualified tutors and supplemental instructors to lend a helping hand. As long as you can prove you’re knowledgeable about the field you’re offering tutoring services in, you’re good to go.

Average hourly pay: $22

Best for: Retirees who want a position that will keep their brains (and skills) sharp.

5. Bookkeeper

Bookkeeping may be the perfect position for you if you’re keen on numbers or have handled books previously. You’ll issue payments to suppliers, invoice customers and help maintain financial records for a company. You may need prior experience in bookkeeping or a certification.

Average hourly pay: $19.82

Best for: Seniors who want to stay off their feet the majority of the day.

6. Virtual assistant

Much as the title of this position explains, many of the responsibilities of a virtual assistant are to support your superior over the Internet. The day-to-day tasks of a virtual assistant differ from company to company, but your primary objectives will be to offer an extra hand wherever you’re needed—be it scheduling, answering phones or conducting interviews.

Average hourly pay: $19

Best for: Those looking for a position where they have a clear list of tasks and to-dos.

People-facing positions

Being in a people-facing environment may be the perfect part-time move for you to make if you live alone, love helping people or simply thrive in social settings. These six positions all require you to be social, upbeat and helpful—if that sounds like a job you’d excel in, these may be the fit for you.

7. Adjunct college instructor

Use your life experiences to help teach the younger generation by becoming an instructor at a local community college, trade school or university. Some schools require teaching certifications or a master’s degree, but others will take you on as an adjunct professor with enough experience.

Average hourly pay: $27

Best for: Any retiree with a wealth of knowledge and passion for teaching.

8. Translator

As a translator, you’ll be able to work in a variety of places to lend your bilingual skills. Whether you translate documents for clients or are a dedicated translator for a company, this part-time position makes a huge difference for accessibility for all.

Average hourly pay: $24.92

Best for: Bilingual seniors who can lend their skills to make language more accessible.

9. Park ranger

Have the great outdoors been calling your name in retirement, but you aren’t fully ready to live out of a converted van? As a park ranger, you get to not only spend time outside, enjoy the fresh air and protect nature, but you also get to help people as they experience some of the best nature has to offer. Some park ranger positions require a related degree, and others may require additional emergency training.

Average hourly pay: $19

Best for: Those with a passion for the great outdoors.

10. Repairperson

Repairing all kinds of things, from bikes to toasters, is a great way to work with your hands and keep your skills sharp. Try lending your skills out as a repairperson-for-hire and charge accordingly. To level up your craft even further, see if a local trade school offers HVAC or other repair courses.

Average hourly pay: $16

Best for: Any senior who’s good with their hands and has an understanding of how things work.

11. Receptionist

Reception is the place for you if you enjoy creating a welcoming environment and greeting people as the first face of a business. Typically, receptionists manage the lobby of a business, greeting guests and answering phones. However, you’ll sometimes be an office manager and receptionist in one, giving you plenty of duties to fill your day. Some companies require an average word-per-minute typing score, or previous experience.

Average hourly pay: $14.45

Best for: Any senior looking for a position that keeps them off their feet but in front of people.

12. Usher, ticket taker or guide

If you’ve ever wanted to get paid to work in a theater or museum, one of these three positions may be the best part-time position for you. Ushers, ticket takers and guides help make a theater- or museum-going experience that much better by answering questions, giving directions and overall being a helpful, friendly face.

Average hourly pay: $10

Best for: Retirees who want to share their passion for the fine arts with others.

Creative jobs

Retirement is perfect for exploring a new, creative side of yourself that you might not have known was there. What’s even better than exploring a new source of creativity is being able to turn that into a source of income, which these six part-time positions allow you to do.

13. Landscaper

Carefully curating an outdoor oasis where homeowners can feel calm, collected and relaxed is certainly a skill. Contract landscaping could be a great step for those who enjoy this creative outlet, which also includes mowing lawns, picking the best vegetation for a yard and generally sculpting an outdoor space for people to relax in. You may need some certifications or a business license in certain states.

Average hourly pay: $33.35

Best for: Those with an eye for outdoor design, with the skills to execute it.

14. Author

When some people retire, they say that they’re finally going to sit down and write their book. Be it a memoir, novel or history book, being an author is a great profession to consider as a retiree. For those that may want to start seeing an income come in faster than it would take to write, edit and publish a book, try your hand at authoring online articles for a publication, or submitting some essays.

Average hourly pay: $30.39

Best for: Any retiree who wants the freedom to write for pleasure again.

15. Editor

If you know the rules of AP Style frontwards, backwards and upside-down, a part-time position as an editor may be perfect for you. As an editor, you’ll either work independently or with a firm, editing all types of copy—written, web, short-form and long-form. You may need a degree in a relevant field, or have completed certifications.

Average hourly pay: $29.50

Best for: Seniors with a critical eye who want to help upgrade written work to the best it can be.

16. Artist

Turn your hobby into something you can get paid for through part-time artist opportunities. You’ll likely need to market your skills on a website, on social media or through word of mouth, but this can pay off in a big way. Whether you’re a mural artist, caricature artist or part-time artist-in-residence at a studio, there are many opportunities to get paid for creating.

Average hourly pay: $23.44

Best for: Ultra-creative seniors who want to monetize their passion project.

17. Blogger

The world of blogging is huge, with a niche for every hobby imaginable—from food blogs and bird-watching blogs to pet blogs and everything in between. Though it may take a bit of time and effort on your end to have a profitable blog, this is a great part-time gig you can do on your own terms. Those looking for something a bit more lucrative right off the bat can try lending their blogging skills to a company or ghost-writing for another blogger for profit.

Average hourly pay: $18

Best for: Seniors with good writing skills and a strong understanding of the Internet.

18. Florist

Are you regarded by loved ones for putting together beautiful bouquets of blooms or being able to transform even the most drab supermarket flowers into something special? If so, you might be the perfect person to try your hand at working for a florist. Here, you’ll create preselected bouquets for special occasions and get to flex your creative side and make arrangements from scratch to help people feel better. Preexisting knowledge of flowers is a plus when you’re applying as a florist.

Average hourly pay: $13.48

Best for: Retirees looking for a way to brighten up people’s days.

Contract job opportunities

If you’re looking for something just a bit more flexible, try a contract position where you’re hired on a client-to-client basis instead of working set hours. These six part-time job opportunities are perfect for the retiree who wants to dabble in getting back to work without too much of a commitment.

19. House sitter

House sitting is a low-stress contract job opportunity, as you’re staying in someone else’s home while they’re away. Even if they have dogs or plants with a regimented watering schedule, house sitting is a great part-time opportunity if you’re in need of a flexible position you can do on your own terms.

Average hourly pay: $34

Best for: Seniors looking for extra income without fully reentering the workforce.

20. Personal chef

Cooking doesn’t just have to be a hobby—it can also be a source of income. You have the option of working for a catering company or lending your skills out on a contracted, client-by-client basis. You usually don’t need any certifications, just the ability to cook quickly, accommodate personal tastes or allergies and be on your feet for long periods of time.

Average hourly pay: $24

Best for: Those with a passion for cooking that they want to share.

21. Resume writer

Tailoring a resume to fit the qualifications desired for a certain position is no easy feat. Consider lending your skills out as a resume writer for hire if this is something you excel in or look forward to. You can work with a firm, or work independently and charge for your time and skills.

Average hourly pay: $21

Best for: Seniors who want to help others find their dream job.

22. Gardener

Gardening is a hobby many retirees discover when they have more free time, so why not get paid for it? You can help people plant their springtime flowers, assist in general upkeep by picking weeds and mowing the lawn or help out on a farm—the options as a part-time gardener are almost endless.

Average hourly pay: $15

Best for: Retirees who want to turn their gardening hobby into a part-time career.

23. Pet sitter/dog walker

If you treat your four-legged friend more like family, you can make an income by helping other people watch theirs. Whether you opt to walk, sit or both, you can make some money by doing what you love: caring for animals.

Average hourly pay: $14

Best for: Those with a huge heart for others’ furry friends.

24. Delivery person

With so many on-demand delivery apps in use, companies everywhere are in need of reliable delivery people to get their goods delivered from point A to point B. One of the many perks that comes with being a delivery person is that you can usually do it on your own schedule or when you feel like it.

Average hourly pay: $12

Best for: Seniors in need of a position they can clock in and out of on their own terms.

Additional part-time positions

If you’re a person who really enjoys being in an office, surrounded by your coworkers and the comforting clicks of a keyboard, these six part-time in-office positions may be the best fit for you.

25. Consultant

You might want to consider becoming a part-time consultant if you loved your previous position but are looking for something a bit more flexible. Here, you’ll lend skills learned in your career to other full-time employees in that same sector. You can advise, mentor and give your opinion based on similar scenarios you may have faced in your career.

Average hourly pay: $40

Best for: Seniors who loved their previous career.

26. Graphic Designer

As a graphic designer, you’ll be in charge of creating eye-catching graphics to accompany copy and grab a customer’s attention. Whether you work as a freelance graphic designer or work in-house for a dedicated company, this can be a unique part-time opportunity you can use to keep your creativity sharp. You may need a degree in an accompanying field or some certifications through Adobe.

Average hourly pay: $25.05

Best for: Creative retirees who want to help bring people’s visions to life.

27. Recruiter

Companies are always on the hunt for someone who can smooth out their hiring process and look for the best candidates for them. Recruiting is an easy part-time position for those passionate about helping a company grow with the best and most qualified candidates.

Average hourly pay: $22

Best for: Those who enjoy the art of the hunt for the most qualified employees.

28. Transcriber

There are hundreds of options available if you want to be a part-time transcriber. Your responsibilities can include converting words to text, or typing written documents for online platforms. This is a rapidly growing sector that is perfect for part-time work.

Average hourly pay: $16

Best for: Seniors who can hyper-focus on one task at a time.

29. Travel agent

Travel agents help others get bit by the travel bug and make their experience easy, from booking to time of departure. As a travel agent, you’ll help people plan their vacations, including scheduling flights, helping plan itineraries and finding the best deals to make their dream vacations a reality. You may need to complete a certification or accompanying courses.

Average hourly pay: $19.55

Best for: Well-traveled retirees who love to help others.

30. Career coach

If your passion lies in helping others find a job that works best for them, consider mentoring or career coaching. You can do this as a contract job or find a related business where you’ll help people with job hunting, answer their questions and send them leads on positions they qualify for.

Average hourly pay: $27.42

Best for: Those who want to help match candidates to their dream role.

How to get hired for a retiree position

Whether you’re thinking of exploring part-time positions for retirement or need some additional income to afford your lifestyle, it can be intimidating to get back into the workforce.

You aren’t alone here—according to the Transamerica Center for Retirement Studies, 41 percent of American workers plan to work part-time post-retirement. To help you join your peers in the post-retirement workforce, we’ve got you covered with some tips that are sure to help during the job search and interview process as a retiree.

1. Update your resume. Ensure your resume is up to date with your most recent position(s) and the dates held. If you’ve been enjoying retirement for a few years and don’t want a sizable gap on your resume, consider including some of the skills or hobbies you acquired in retirement on your resume.

2. Explain your absence. Especially if you’ve been out of work for more than a year, be ready to explain what you’ve been doing since you left the workplace. If the application has space to do so, give a brief summary of your absence.

3. Consider your previous company. If you really enjoyed what you did pre-retirement (or haven’t retired quite yet), consider keeping your position on a part-time basis. If that doesn’t work for your lifestyle, ask about coming back to a different position on a contract basis.

4. Keep an open mind. Perhaps the most important part of part-time job hunting as a retiree is being flexible and open to new opportunities. Consider jobs that you’d like to do, not just one that will bring in some extra income. After all, you’ve spent a majority of your life working, so why not have some fun now?

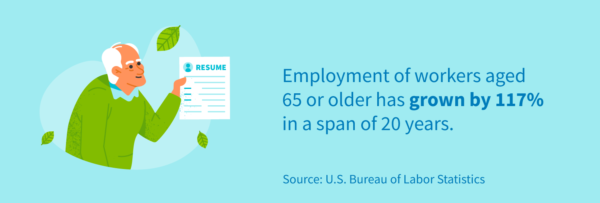

5. Don’t be intimidated. Though you may be afraid of going up against much younger competitors for the same positions, remember all that you bring to the table as an employee. In fact, workers aged 65 and older are twice as likely to work part-time than workers aged 25–64.

Now that you know some insider tips on getting hired as a retiree, review some of the great part-time job opportunities you can enjoy doing in retirement.

Going back to work or switching to a part-time role as a retiree can seem overwhelming. However, having a supplemental income from a part-time position can not only set your family up for success, but it can also help you improve the overall health of your credit score and get your finances in order for even later in life.