![What is a debt validation letter? [+ template for debt verification]](https://www.creditrepair.com/blog/wp-content/uploads/2023/01/image-2.png)

Disclosure regarding our editorial content standards.

Debt collections send a debt validation letter as proof that you owe them money. It should detail the specifics of your account, such as the debt amount, the original creditor and the date of default. To dispute the information—and delay the collection process—you can write a letter of debt verification.

Dealing with collection agencies is extremely stressful, especially if you don’t recognize the debt they’re collecting. Enter: the debt validation letter. It allows creditors to prove that your debt is valid, and they have the right to collect on it.

If you receive this letter, you want to act as soon as possible. Ignoring it could cause your credit score to plummet and even lead to a lawsuit. But there are ways to get out of paying. In this article, we’ll explain how you can use the debt validation process to delay collection—or eliminate the debt altogether.

First, let’s dig deeper into what a debt validation letter is and why it’s so important.

What is a debt validation letter?

Creditors will send a debt validation letter as proof that your debt is valid and belongs to them. The letter should have accurate and specific details about your debt, helping you determine if it’s yours to pay. Review it carefully, and don’t hesitate to dispute even the smallest discrepancy.

According to the Fair Debt Collection Practices Act (FDCA), debt collectors have five days after contacting you to send a debt validation letter. If they fail, you should request that they verify your debt—which we’ll show you how to do later. The only exception is if their initial communication included the info you’d need to validate their claim.

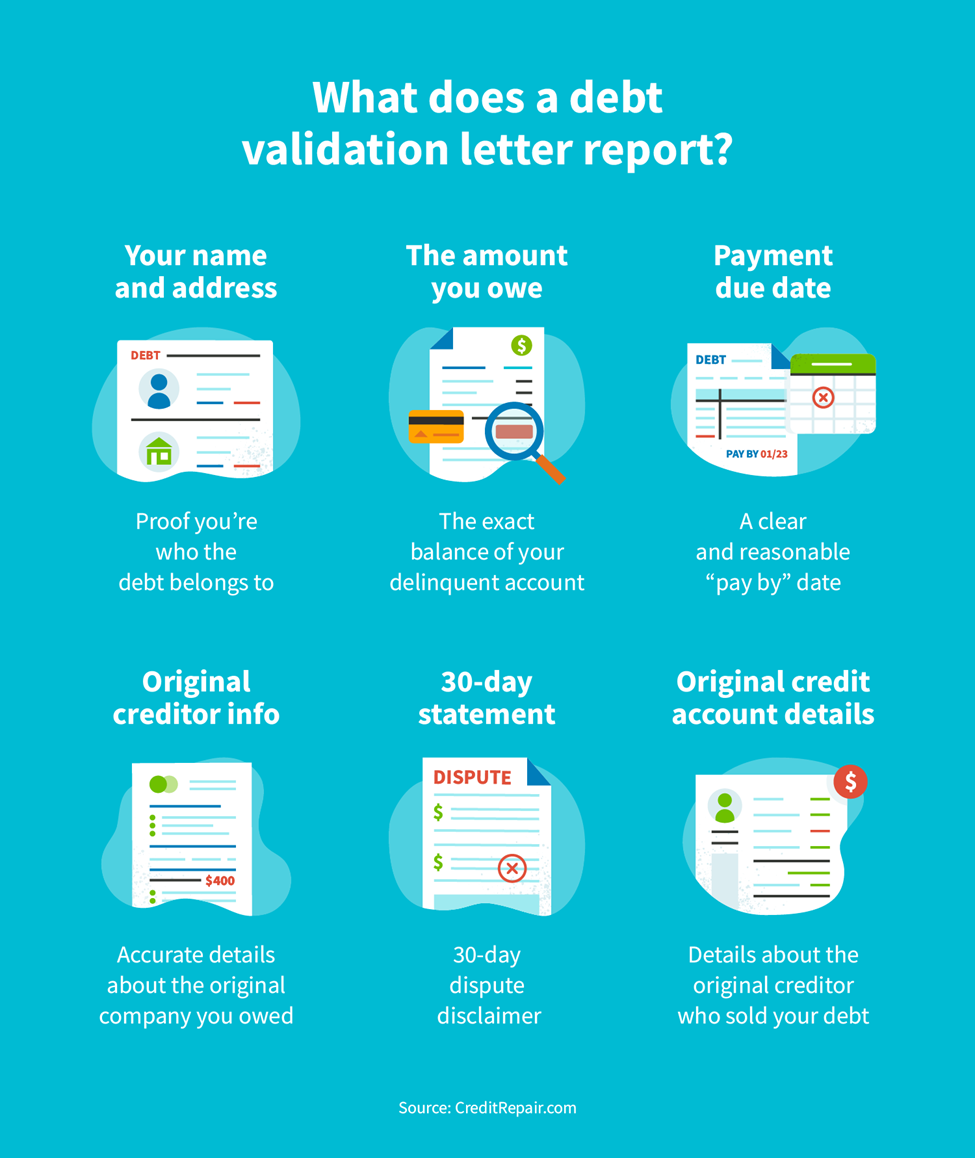

Here’s what a debt validation letter should include:

- The amount you owe: Collectors should report the exact balance of your delinquent account.

- Info about the original creditor: The letter should have accurate details about the original company you owed.

- Details about the original credit account: If your original creditor sold your debt to a collection agency, the letter should include those details.

- Payment due date: Most times, you’ll have a “pay by” date, which gives you time to settle the debt before it shows up on your credit report

- 30-day statement: Usually, these letters include a statement that you have 30 days to dispute the debt’s validity using a debt verification letter.

- Your name and address: Collectors should provide details about you to validate that you are the person the debt belongs to.

Why is a debt validation letter important?

A validation of debt letter allows you to make collectors prove that their claim is legitimate and that you are legally responsible. It can also help determine if your original creditor sold your debt to this collector. The goal is to avoid paying a debt that isn’t yours—you’d be surprised how often this happens.

In fact, a whopping 56 percent of consumers listed “attempts to collect debts not owed” as their top complaint on the 2022 Consumer Financial Protection Bureau (CFPB) report.

The good thing is that debt collectors must validate your debt within five days of contacting you. You could even take legal action against collectors who refuse or fail to validate a debt—especially if you can prove they’re breaking debt collection law or trying to collect on a fake debt. This is especially important in cases of resurfaced debt.

For example, when the original creditor writes your debt off, it doesn’t just go away. A debt collection agency will usually buy it, meaning you have to pay them the outstanding balance. Initial creditors will sometimes send this debt to collections without notice, leaving you in the dark about your credit health.

You could also be a victim of zombie debt, which happens when debt collectors try to collect on a debt you already settled or successfully disputed. This includes when a collector threatens to sue you for a debt that’s past the statute of limitations. Fortunately, they can’t legally make you pay if they can’t validate its legitimacy.

Remember that collectors need to accurately report information about your debt to prove you owe them money. Closely review the details they report to make sure there are no errors.

What to do after you receive a letter of debt validation

While debt collectors use them to take your money, debt validation letters can also be your saving grace. When you receive a letter of debt validation, you have two options. You can either agree to pay the balance or dispute it.

Decide whether the debt is valid

After receiving a letter of debt validation, read it thoroughly to determine whether the claim is legitimate. The letter should include information about the debt, the creditor and the amount you owe.

If everything looks good, you want to try and settle it as quickly as possible. Remember that collection agencies report to credit bureaus, which can tank your credit.

Pick your payment plan

You should decide whether you want to use a payment plan or if you want to pay the full balance all at once. Choosing to settle the entire debt all in one payment is usually the better, cheaper option—especially when you learn how to pay off debt faster. However, a payment plan is great if you can’t afford to pay everything upfront.

Debt collectors usually offer a few payment options, but you can negotiate a lower balance. Remember that they bought this debt for less than it was worth, so there’s wiggle room for how much (or little) they can accept from you.

On the other hand, if you aren’t sure the debt belongs to you, disputing it can buy you more time to figure out your next steps.

Dispute the debt

Disputing a debt can be intimidating, but it’s a crucial step to take if you believe a debt is not yours or is inaccurate.

Some signs that you should dispute a debt validation letter include:

- Inaccurate information about you or the debt

- You don’t recognize the original creditor

- There’s no info about the original creditor

- The debt collector isn’t reputable

If you believe the debt isn’t yours, contact the creditor or collection agency in writing and explain why you’re disputing it. Be sure to include any evidence that you have to support your claim. You can also request a verification of the debt, which requires the creditor to provide proof that you are responsible for the debt.

Remember that if you respond to a debt validation letter after the 30-day period, the collector can consider your debt valid and continue pursuing payment. In that instance, you’ll likely have to pay to remove the collection account from your credit report.

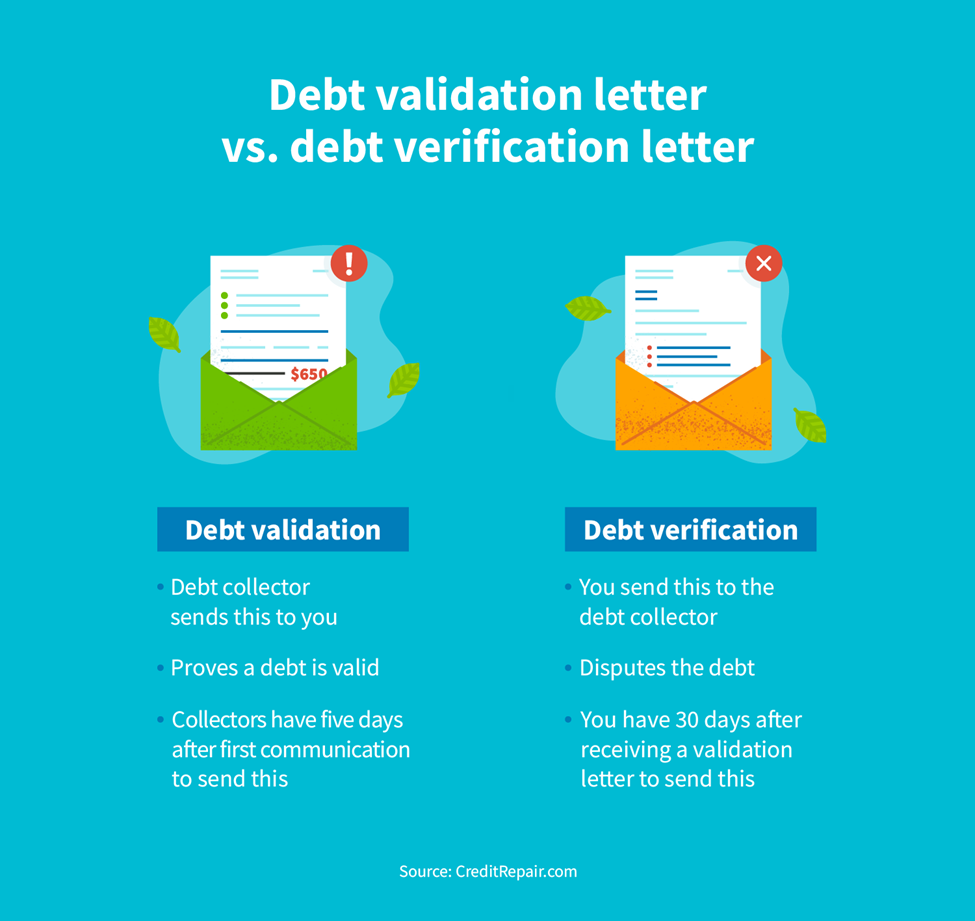

Debt validation letter vs. debt verification letter

There are two kinds of letters in the validation process: debt validation and debt verification. You’ll need to understand their purposes and differences if you want the best possible outcome.

Debt validation letter

A debt validation letter is what you receive from a debt collector. Its purpose is to prove that a debt is legitimate and belongs to you. Collectors should send one no more than five days after first alerting you about the debt.

Debt verification letter

A debt verification is what you send to request more information about the debt or to dispute it. Send this letter when you don’t recognize a debt or believe it’s inaccurate.

Keep in mind that you only have 30 days to dispute a validation letter before the collector can consider it valid and continue trying to collect. You’ll want to start writing that verification of debt letter ASAP—luckily, we’ve outlined the process below.

How to write a debt verification letter

Writing a debt verification letter is an important step when dealing with debt. It’s important to make sure you write all information accurately and professionally.

Start the letter by introducing yourself and providing contact information. Then, clarify that the letter’s purpose is to verify a debt. Provide the name of the creditor and the account number. Include the amount of the debt and the date you received the notice.

If you are disputing the debt, provide documentation to support your claim. Finally, include any other relevant information, such as payment history or the date the collection agency bought the debt. Make sure to sign the letter, include your contact information and send it as certified mail with your return address.

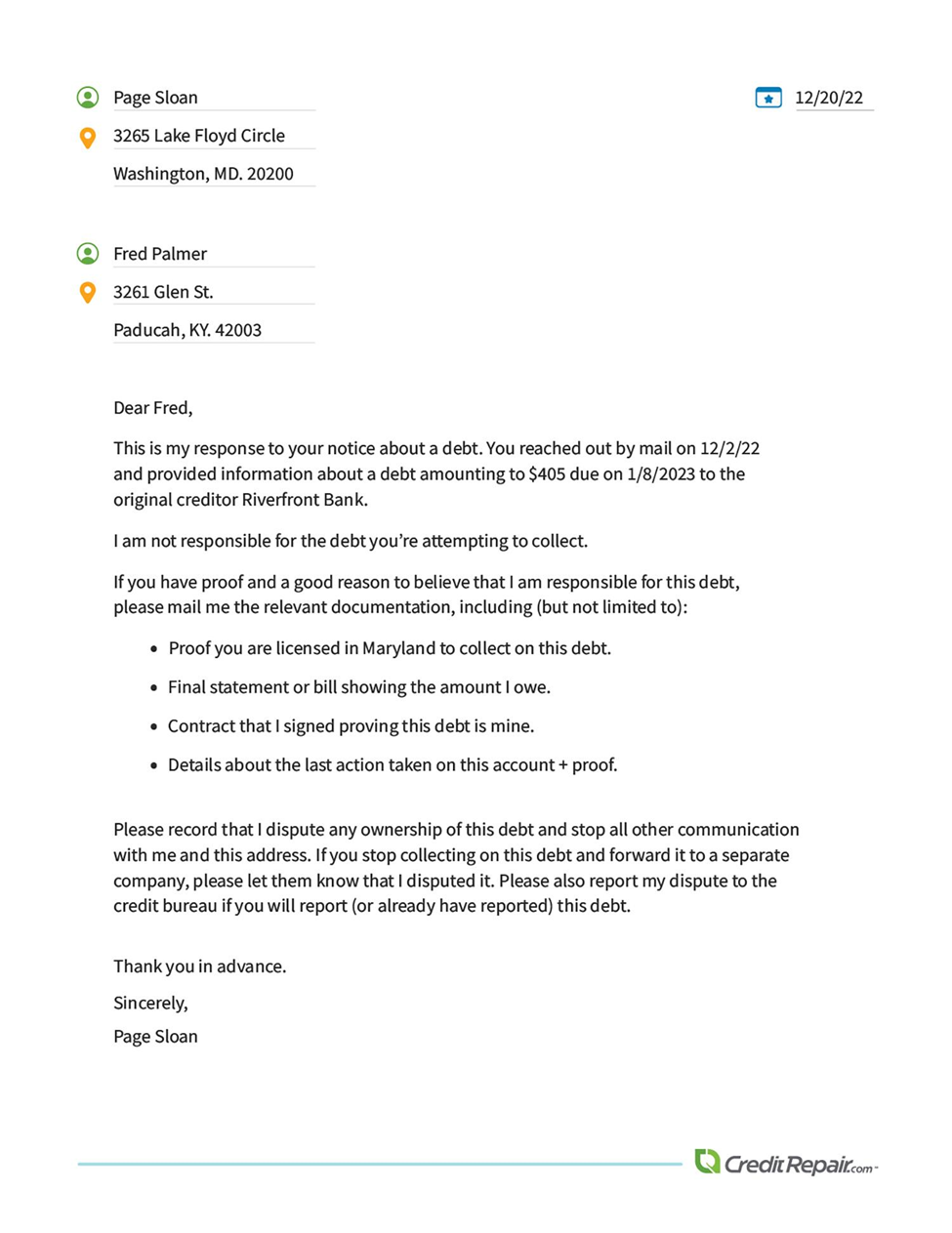

Not sure what to say? You can use this debt verification letter template:

[Your Name]

[Your return Address]

[Date]

[Collector’s name]

[Collector’s Address]

Dear [Collector’s Name],

This is my response to your notice about a debt. You reached out by [mail/phone] on [date of contact] and provided the following information about the debt: [List all details the collector shared with you regarding the debt].

I am not responsible for the debt you’re attempting to collect.

If you have proof and a good reason to believe that I am responsible for this debt, please mail me the relevant documentation, including (but not limited to):

- Proof you are licensed in [Your State] to collect on this debt.

- Final statement or bill showing the amount I owe.

- Contract that I signed proving this debt is mine.

- Details about the last action taken on this account and proof.

Please record that I dispute any ownership of this debt and stop all other communication with me and this address. If you stop collecting on this debt and forward it to a separate company, please let them know that I disputed it. Please also report my dispute to the credit bureau if you will report (or already have reported) this debt.

Thank you in advance.

Sincerely,

[Your Name]

Sample debt verification letter:

What you shouldn’t say to debt collectors

As you know by now, debt collection scams are widespread. You should be mindful of what you do—and don’t—want to say when speaking with collectors. Providing too much wrong information can stop you from rooting out a fake or fraudulent debt claim. Here’s what you should not tell debt collectors:

- Don’t give them personal information such as bank account numbers or Social Security numbers.

- Do not make any promises to pay or agree to any payment until you’re positive the debt is yours.

- Do not make any threats or use profanity.

- Do not admit that you owe the debt or provide any information about your financial situation without consulting an attorney.

- Do not give any false information or provide any information that is not true.

Debt validation and verification letters are powerful tools for maintaining good credit health. The key is to move fast and stick to the process. Try our quick and reliable service if you want to learn more about credit and how to fix your credit.

Questions about credit repair?

Chat with an expert: 1-800-255-0263