Now that credit scores have become so much more widely available, you can see yours often. This can help you track progress on a credit repair program or a on a debt management program as you work to pay down debt and make on-time monthly payments or even as one type of monitor for identity theft, as President Obama mentioned in his January 12 speech about identity theft and cyber threats.

A credit score is not your credit report

A credit score is a number, usually from 300 to 850, calculated using information from your credit reports (one from each of the three credit bureaus, which are Experian, TransUnion and Equifax) that determines the odds that you will repay a debt as agreed. These credit reports show the number, types and length of credit accounts you have open. Your payment history and your credit score is also based on this information. Any time a lender for a car loan, a mortgage or a credit card requests your credit report, a new credit score is generated with that report. Your score will determine the likelihood that you will get the best interest rates for loans and credit cards or if they will grant you the credit at all. The higher the score, the better loan terms you will qualify for and the more financial opportunities will be open to you.

Contrary to credit score myths, prospective insurance companies use only a credit report-based insurance score and prospective employers can only request a specialized credit report (on a state by state basis and only if you give your signed consent), but not your actual credit scores. Prospective landlords can check your credit score, but only if you give your signed consent.

While you can always order your free credit reports from all three credit bureaus once per year at annualcreditreport.com, your free annual credit report does not include your credit scores.

What’s a FICO Score?

The FICO score, originally created in the 1960’s by the Fair Isaac Corporation, is the credit score most lenders have always used to determine their risk of lending you money. You have three FICO scores, one for each of the three credit bureaus based on information in each credit report. Currently, FICO score 9 is the most current U.S. version available to lenders although not all lenders use the most recent version. FICO score 8 is the one that’s available to consumers. Currently there are other credit score models that lenders may use, but according to myFICO.com, 90% of lenders still use some version of the FICO score.

What’s a FAKO credit score?

The name sounds like a “fake” score but really, it’s just another name for any new credit scoring model that has come on to the market for both lenders and consumers. And, they are certainly not fake.

The VantageScore model was developed by the three nationally recognized credit bureaus Equifax, Experian and TransUnion, in 2006. Over 2,000 lenders including 6 out of the 10 largest banks used VantageScore in 2014. This score uses the same formula across all three credit reporting agencies unlike FICO which has a slightly different score with each bureau. Two out of three of the credit bureaus have also come out with their own credit score models based on their credit report on you. Experian offers a non-FICO score called the Experian National Risk Model and TransUnion offers the non-FICO TransUnion New Account Model, while Equifax still offers only a FICO score.

All of these different score models, including all the different FICO versions is the reason why you will notice slight variations in your score. Further complicating matters is that you cannot know which score any specific lender is using on you at any given time.

How can I get my score?

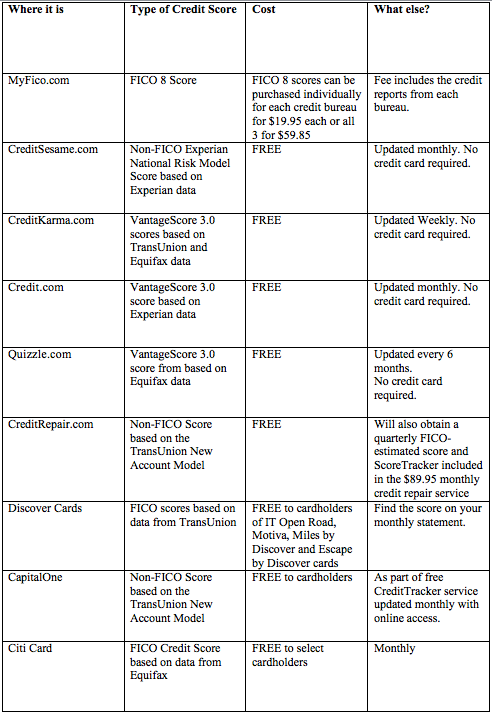

There are many ways to get the score you want, some for a fee and some for free. And, because the information in your credit reports change, the scores change often, too. Now you can see them as often as weekly. Check our chart for the one that suits you best.

Many other bank credit cards are also offering free credit scores of one type or another so check your bank statement or your bank’s website to see if this is freely available to you, already.Many more financial companies will be offering credit scores during 2015 and beyond. Bank of America and the State Employees’ Credit Union say they will offer FICO scores. Ally will begin by offering credit scores to its auto finance accounts fully this summer. USAA said it will offer free Experian VantageScores to credit card holders this March. JPMorgan Chase said it plans to offer free FICO scores to Slate cardholders but not other credit card holders or bank account holders.

Questions about credit repair?

Chat with an expert: 1-800-255-0263