Disclosure regarding our editorial content standards.

Debt relief programs exist to help you get out of debt and improve your finances when you’ve run out of options on your own. When your budgeting and payment plans no longer work for you and you end up in debt, you should turn to a professional.

These programs can vary based on the provider and your financial situation, so depending on what route you take, the impact on your credit can vary as well. Ideally, you’ll come out on the other side with either the same or a better credit score, plus the ability to continue improving, but it’s quite possible that you’ll end up with a harder hit to your credit than you expected. This is one of the many reasons it’s important to do your research and choose a debt relief program wisely.

Let’s go over what debt relief programs are and how to keep an eye on your credit health throughout the process.

How Does Debt Relief Work?

The term “debt relief” encompasses various financial repair options. These programs each work in their own ways but should help you achieve any or all of the following: more manageable debt, healthier credit and stronger finances overall.

Here are some of the most common types of debt relief programs and what you need to know.

Debt Counseling

This option entails having a financial advisor help you address your current debts and credit health with the goal of paying down balances (on loans and credit cards, for example). Doing so helps you establish a healthy budget and set yourself up for improved credit health. Sometimes known as debt management, debt counseling is a great starting point if you feel like you’re drowning in debt, as it can help you develop a debt repayment plan with your creditors.

Impact on credit health: Debt counseling is a great place to start when it comes to managing your debt. Every situation is different, but ultimately, you should come out of debt counseling with a more holistic view of your finances. Establishing healthy long-term habits is the best way to improve your credit health.

Debt Consolidation

Debt consolidation groups your loan payments into one monthly payment and aims to lower your interest rates. You have a few options here: credit card consolidation, a home equity loan and a personal loan. This type of refinancing is unique to your needs.

Debt and credit card consolidation can scale from merging a few unpaid loans to tackling a mountain of overdue balances, and a home equity loan could put your home at risk—being informed is key here. Working with a credit repair advisor will help you gauge your options.

Impact on credit health: Debt consolidation can help your credit if done correctly. Ideally, you’ll be able to reduce your debts and cut down the amount of interest you pay. However, by consolidating loan payments, you may also lose account history, which limits your credit diversity and can lower your credit utilization rate—which could, in turn, lower your score. Oof.

Keep an eye on the main factors used to calculate your credit score and do your best to decrease risk during debt consolidation.

Credit Card Debt Relief

Credit card debt relief helps you specifically with credit card debt. You have a few options, including a balance transfer card, a personal loan, debt consolidation, debt reduction and bankruptcy, depending on your situation. Credit card debt relief may be mentioned as a possibility during credit or debt counseling, and its goal is to help you adjust your payment terms or craft a repayment plan.

Impact on credit health: Similar to debt consolidation, you need to keep an eye on your credit health with this route. If you close too many accounts, your credit history and diversification will shrink and could negatively impact your score.

Debt Settlement

While it’s not ideal, debt settlement is still a better option than bankruptcy, as it stays on your credit report for seven years versus the 10 you’d be signing up for with bankruptcy. This involves working with a debt settlement company to negotiate paying a lower amount on your debt.

Along with the newly established payment amount, you’ll agree to repayment terms and a new due date. It’s your responsibility to stick to these parameters in order for your debt to be settled.

Impact on credit health: Even though your balance will drop to zero with a settlement, it will still show up on your credit report for seven years—showing future creditors that you’re potentially a risky borrower. A negative item like this can make it harder to get good loan terms in the future, even if you adopt healthier credit practices.

Debt Relief vs. Bankruptcy

Bankruptcy is a serious debt relief option that shouldn’t be taken lightly. Technically, bankruptcy is a type of debt relief, but you should be sure to examine all bankruptcy alternatives before going down that road. Bankruptcy stays on your credit report for up to 10 years, so it’s not recommended for healthy credit.

As we noted above, various debt relief programs can have varying degrees of impact on your credit health. Counseling and consolidation give you a better chance of boosting your credit score with little other impact, while a settlement will cause a harder hit to your credit. Bankruptcy, though, should be your last resort. Exhaust the options above before deciding to pursue bankruptcy.

Debt Relief Programs: Pros and Cons

Like with any big financial move, you should always do your research before diving in. Yes, we know reading the fine print isn’t fun, but trust us, it’s super important here! Know what you’re getting into and how it may impact your financial future before starting any debt relief program.

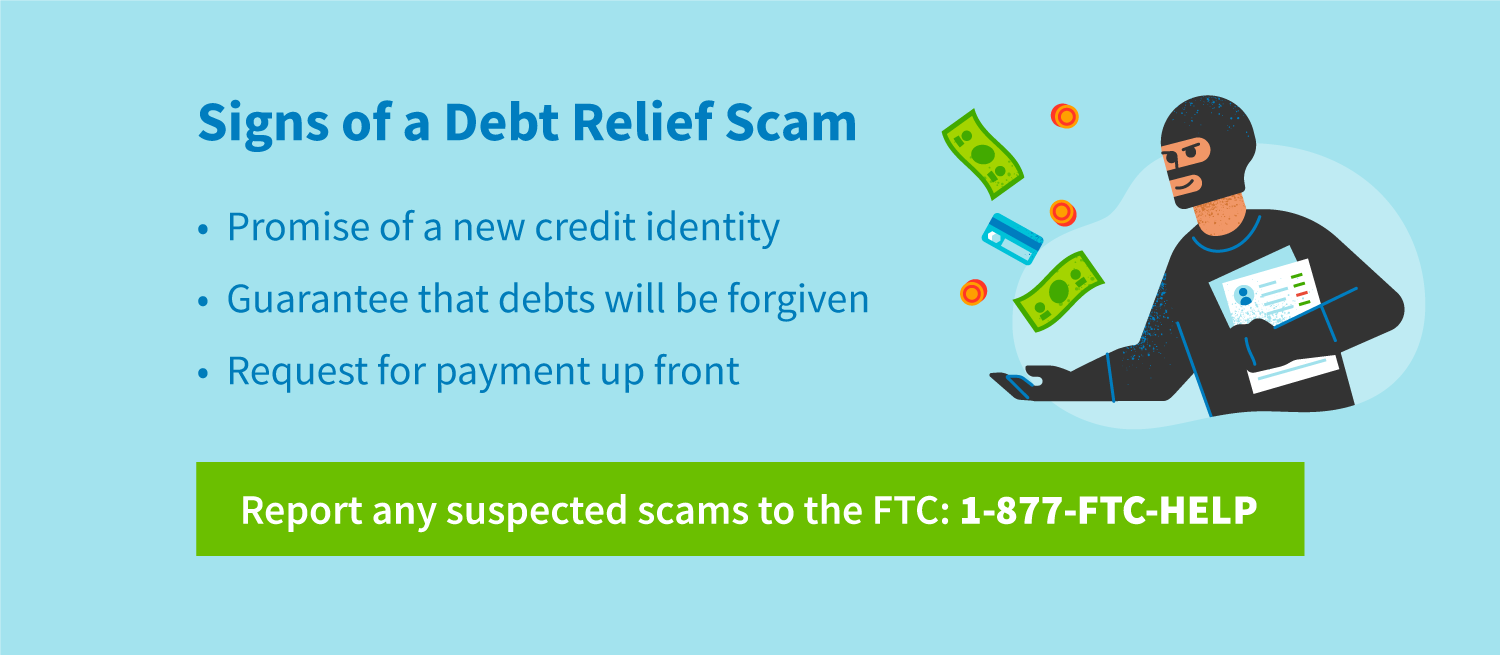

Unfortunately, debt relief scams exist and can get in the way of your dreams of improved finances. Keep an eye out for any company that promises you a new credit identity, guarantees results or asks for payment up front. Reading the fine print is another key way to spot a scam. Be sure to report any suspicious activity to the FTC.

Here are some of the core pros and cons to consider before signing on the dotted line.

Pros

- You have an opportunity for a financial fresh start.

- Your debt relief program of choice can be catered to your unique situation.

- You can walk away with smarter financial habits.

- Your debt may be reduced.

Cons

- You have to keep an eye out for scams. Report any you come across to the FTC.

- Your credit history may suffer if you close too many accounts.

- You might not necessarily save money, as hidden fees and costs can sneak up on you.

- Forgiven or canceled debt is still taxable, so you may end up paying more when Tax Day rolls around.

Debt can be overwhelming, but thankfully, there are options when it comes to fixing it. If you have questions about how your debt is affecting your credit, work with a credit advisor on the CreditRepair.com team to learn more. Plus, we’ll help you keep your credit health in mind and work toward establishing healthy long-term habits.