Disclosure regarding our editorial content standards.

A sinking fund is a way to save money by taking small increments of money at the end of every month and putting them into categorized savings-like funds. The term “sinking” refers to the minimization of long-term debt that may have accumulated.

Key takeaways:

- Sinking funds are accounts with money that you set aside for specific future plans.

- Typically, you add a set amount of money from your income to sinking funds every month.

- Sinking funds should prevent you from taking money from your savings account or emergency funds as often as possible.

Nobody likes dipping into their savings account. Doing so can interfere with your long-term financial goals. Plus, it’s usually an indication that times are tough. Here’s the good news—there are ways to plan ahead for specific expenses so that you don’t have to pull from your savings account, one of which is a sinking fund.

In this guide, we’ll unpack what sinking funds are and walk through how you can use them to improve your financial well-being.

Table of contents:

- What is a sinking fund?

- Pros and cons of a sinking fund

- Types of sinking funds

- How to set up a sinking fund

- Sinking fund examples

- Do sinking funds affect my credit score?

What is a sinking fund?

A sinking fund is an account with money that you set aside for a specific purpose to help you avoid dipping into your savings account or emergency backup funds.

You can divide these funds into planned categories, from serious financial decisions like buying a home to fun activities like vacationing. They’re a great tool for those looking to add more organization and planning to their financial life.

Sinking funds vs. savings accounts vs. emergency funds

While savings accounts and sinking funds seem similar, they each have unique methods and purposes.

Unlike a sinking fund, a savings account is simply one general pot of savings. While you can use money from savings in the same way as a sinking fund, splitting the money into categories via sinking funds makes it much easier to keep track of your finances.

Plus, their purposes differ—savings accounts typically help you reach your financial goals over the long term, whereas sinking funds are for specific and often shorter time frames.

An emergency fund is very different from both a sinking fund and a savings account. A sinking fund has a clear purpose with a specific amount set aside for it, while an emergency fund’s purpose may be incredibly unexpected. An emergency fund should be the very last thing you touch if an urgent expense, like home repairs following a natural disaster or an unplanned hospital visit, arises.

Pros and cons of a sinking fund

There aren’t many reasons not to open a sinking fund, but we’ll address both sides of the coin so that you have all the information you need to decide whether starting one is right for you.

Pros of sinking funds

Sinking funds can help you organize your finances, feel better about your spending, prepare for unknown expenses, prevent debt and make you more creditworthy.

1. Helps you plan and categorize your savings

If you struggle to organize your savings, integrating several sinking funds can help keep your finances orderly and easily accessible. Creating sinking funds with specific purposes will compartmentalize your income and enable more financial flexibility.

2. Allows you to spend money without the guilt

Sinking funds have a known purpose, so you can make a larger purchase without feeling the guilt of using money from your savings account. With a sinking fund, you can decide from the start what you want to purchase in that year or time frame with a specific goal in mind.

3. Prepares you for the unknown

There will always be payments or purchases that you didn’t consider when planning your finances. The purpose of a sinking fund is to provide a financial cushion that is separate from your emergency fund.

4. Prevents debt

When surprise expenses hit, it can be tempting to put them on a credit card. But this is a recipe for compounding debt, especially if a financially devastating event like job loss occurs. Sinking funds make falling into debt far less likely by keeping you prepared for a wide variety of expenses.

5. Improves creditworthiness

The better you manage your finances, the less likely you are to appear risky to lenders and credit bureaus. Sinking funds may help you qualify for lower-interest loans, higher spending limits and more by keeping you out of debt and making it easier to pay off credit cards on time.

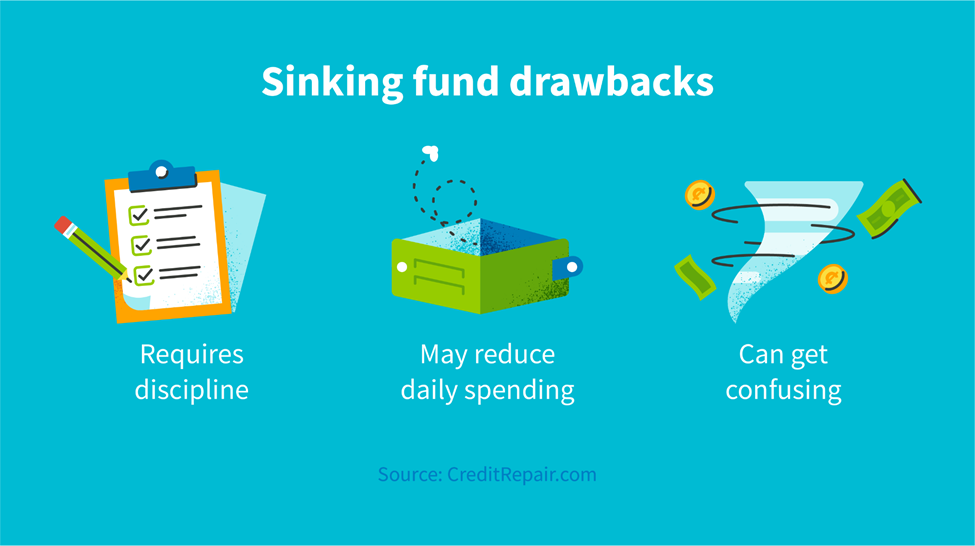

Cons of sinking funds

Sinking funds can be really good for your financial well-being, but they aren’t always easy to manage. Here are some challenges to opening and maintaining sinking funds.

1. Requires a lot of discipline

When you set aside money for a specific purpose, the only person responsible for making sure you spend that money accordingly is you. It can be tough to maintain your discipline when you have a savings account full of money—especially if you want to buy something outside of your budget.

2. May be challenging when money is tight

It isn’t easy to save lots of money when you aren’t in the best place financially. In fact, doing so might be entirely out of the question. Plus, if you open several sinking funds at once, you may find that you’re funneling all your money into accounts for future plans, leaving you with a small daily spending allowance.

3. Can get complicated

It’s important to know where your income is going. If you’ve opened 12 sinking funds that each receive different amounts of money every month, it can be difficult to keep track of everything. It’s a good idea to start slowly by opening one sinking fund at a time to get accustomed to splitting up your income.

Types of sinking funds

Before pushing money into your designated sinking funds, you first need to decide which type to prioritize, depending on your current lifestyle. There are three main sinking fund categories you should know: miscellaneous expenses, big purchases and unfortunate events.

Miscellaneous expenses

These purchases can vary depending on your current lifestyle and financial situation. Expenses like monthly car or home bills, clothes for an event or grocery shopping can fall under this category. You can also create specific subcategories under these, like a car or house sinking fund.

Big purchases

This is a broad category of sinking funds that can include many different things, such as a family vacation, a kitchen renovation or even your yearly Christmas gift list. By planning these out, you should be able to save enough money by the end of the year to easily pay for large purchases.

Unfortunate events

Having a category of funds for unexpected expenses can help you avoid dipping into your savings or worse—your emergency funds. If you have a car issue or break a device, you’ll have funds accumulated to make necessary purchases without feeling the burden of taking from savings.

How to set up a sinking fund

Setting up a sinking fund can seem intimidating if you’re new to financial planning. By following these next steps, you will be able to visualize your financial goals and create an easier transition to a more organized way of saving and spending your income.

1. Decide what types of sinking funds you need

First, you’ll want to decide on your sinking fund categories. If you’re planning a fairly expensive trip at the end of the year, that should be one of your sinking funds. Kids may have unexpected educational expenses during their school year, so you may want to create a school sinking fund.

You can keep the list short to avoid overloading yourself with too many pockets of savings. We advise you to group your sinking funds under the above categories to effectively organize your finances.

2. Choose how you will be storing your sinking funds

When deciding where you want to store your sinking funds, you need to consider how you handle your money. If you already manage your savings account well, you may consider creating a separate savings account at your bank just for your sinking funds.

If you want to avoid creating new savings accounts for your sinking funds, try taking out cash every month and putting it into physical cash envelopes. This way, you can visualize and track how much money you’re putting into each of your sinking funds.

3. Solidify how much you want to save

It’s important to decide on your savings end goal for each of your sinking funds. Be sure you know how much monthly net income you will receive before determining your sinking fund goals.

You should then decide how many months you want to contribute to your sinking funds based on your current income and funding goals. Finally, you’ll need to split the total amount of money for your goal throughout the timeline by month.

Sinking fund examples

Some examples of sinking funds include:

- Car repairs

- Home renovations

- Gifts

- Insurance payments

- Vacation funds

- Vet bills

- School or work supplies

The amount of money you contribute to a sinking fund depends on the type of sinking fund and your monthly income. If you make $5,800 per month, you may put $150 per month into your vacation sinking fund. If you make $4,200 per month, you might instead put $100 per month into it.

Ultimately, you should think about the logistics of how much you can attribute to the funds without feeling overwhelmed at the end of the month.

Do sinking funds affect my credit?

By creating intentional sinking funds, you give yourself some extra financial padding. Compartmentalizing your expenses and purchases will help you avoid swiping your credit card and racking up unnecessary debt. With less debt, you won’t have to worry as much about your credit and credit score taking a hit.

Incorporating sinking funds into your financial plan will help you maintain good credit health. If you still find yourself increasing your credit balance, we recommend you regularly check your credit and learn how to improve your credit at CreditRepair.com.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263