Disclosure regarding our editorial content standards.

When you think of debt, what feelings come to mind? Most people feel stress, anxiety or even shame when they think of the debts they owe. However, even though debt often gets a bad rap, there are certain cases where debt can actually be helpful.

Read on to learn more about good debt vs. bad debt and how to tell the difference between them.

Key takeaways:

- Good debt brings some sort of lasting benefit to your life that has fair, reasonable repayment terms.

- Bad debt sinks your finances and can cause financial struggles or hardships, with high interest rates.

- Think of good debt as weights on your financial situation “ship” that slows it down, while bad debt is like an anchor that brings it to halt.

What is good debt?

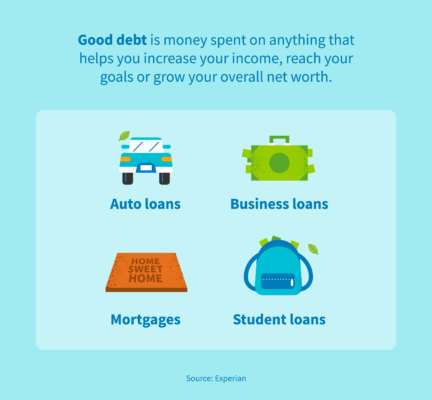

Good debt is any debt that can help you increase your income, reach your goals or grow your overall net worth. Ideally, good debt should be low interest and you should be able to pay it off.

Something to look for when considering whether something could be good debt is some sort of lasting benefit from the debt (like an education or a home) that comes with fair repayment terms.

Examples of good debt

Below are some examples of what would typically be considered a good type of debt.

- Auto loans: Auto loans help you purchase a car without paying for all of it up front. If you can make your on-time monthly payments, this can be a smart investment, especially if you drive to work or drive for a living.

- Business loans: When your business that you’ve invested your money into grows, your income grows along with it. Expanding your business with a loan can be a smart investment that helps you increase your long-term earning potential.

- Mortgages: Mortgages are one of the biggest debts you’ll ever take on, but they are generally considered a good investment. Buying a home can help increase your overall net worth, and it doesn’t hurt that most real estate values keep (or even increase) their value over time.

- Student loans: These types of loans are typically taken out to attend a four-year university and are often seen as a wise investment in your future. Many federal student loans are already subsidized, come with a prearranged payment plan and have reasonable interest payments, making these loans the definition of a good debt.

How to manage good debt

Even if your debt is considered good debt, you should have a repayment plan in place to make sure you aren’t collecting too much debt—which can automatically put you in bad debt territory, no matter what it’s for.

Look into refinancing

Refinancing, or discussing the terms of one of your credit or loan agreements you already have, can be a helpful way to make sure your debt is manageable. Many types of good debt, including student loans, mortgages and business loans, should have refinancing options—talk to your lender to see what your options look like.

Consider alternate repayment plans

Some forms of debt, like student loans, have repayment plans other than those listed in the original agreement. These include income-driven repayment plans, which take your current income into account when calculating your monthly payments. If you’ve found yourself with a job paying less or more than you expected post-graduation, you may want to consider an alternate repayment plan to help manage your debts based on what you can afford.

What is bad debt?

Bad debt, on the other hand, is generally any expensive debt that weighs your finances down and takes away from your net worth. Bad debts will usually come with high interest rates that end up costing you more down the road.

This includes debts that cause financial hardship like bankruptcy or high credit card debt and owing large amounts of money that you can’t pay back. It also includes purchases that don’t bring about any sort of lasting value—or worse, turn out to be money sinks that you never see a return from.

Examples of bad debt

Bad debt can be any debts that harm your finances, even those that were once considered good debts. Some examples of bad debt include:

- Car title loans: Car title loans require borrowers to give the lender their car title in exchange for a loan. You can continue using your car while you repay the loan, but the problem is that if you fall behind on payments, the lender has the right to seize your car and sell it to settle the debt. This bad debt can have unfortunate consequences for those who rely on their cars—beyond the impact it’ll have on your credit report.

- Credit card debt: While some credit card debt isn’t bad, there’s a fine line between good credit card debt and bad credit card debt—and it can become bad very quickly. Not paying your credit card bill on time or owing too much can result in late fees or high interest, causing you to owe even more than you’ve spent on your credit card.

- Payday loans: These are often used as an example of bad debt, as they are short-term, unsecured loans with incredibly high interest. Designed to be paid back quickly, missing just one payment can set you back to square one with how much you owe and cause you to be even further in debt.

- Personal loans: Not every personal loan is bad, but they can quickly push you deeper into debt if you aren’t careful about making on-time payments. If you take out more than you can afford to repay in a timely manner, you also face interest rates that could more than double how much you owe.

How to manage bad debt

It’s not the end of the world if you’ve found yourself stuck with bad debt, though you should work quickly to keep your debt from getting totally out of control. Having a debt repayment strategy in place can help keep you from going further in debt.

Take care of high-interest debt first

If you’ve found yourself with several debts and don’t know what to prioritize, try to focus on paying off high-interest loans first. High interest rates on a loan or line of credit, like credit card debt and payday loans, can trap you in debt for years if you aren’t careful. Try making a list of all your debts and their interest rates, then focus on repaying in descending order by interest rate.

Try the debt snowball method

If you don’t have any high-interest debt and feel confident that you can hold off on spending, you may want to try out the debt snowball method, where you pay off your debts in ascending order, starting with the smallest amount owed. This can help give you control over your debts and make sure they’re getting paid off.

It’s important to keep in mind that good debts can quickly become bad debts if you owe too much, no matter what opportunities it may open up for you. Getting into debt is easy, but getting out of debt can prove to be a challenge. Owing too much money to different lenders can harm your credit score and prevent you from making good credit decisions due to being viewed as an irresponsible borrower.

If your debt management has made you feel like you’re in a bad situation when it comes to your credit, contact the professionals at CreditRepair.com to help you out.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263