![How long does an eviction stay on your record? [Guide]](https://www.creditrepair.com/blog/wp-content/uploads/2022/10/image-8.png)

Disclosure regarding our editorial content standards.

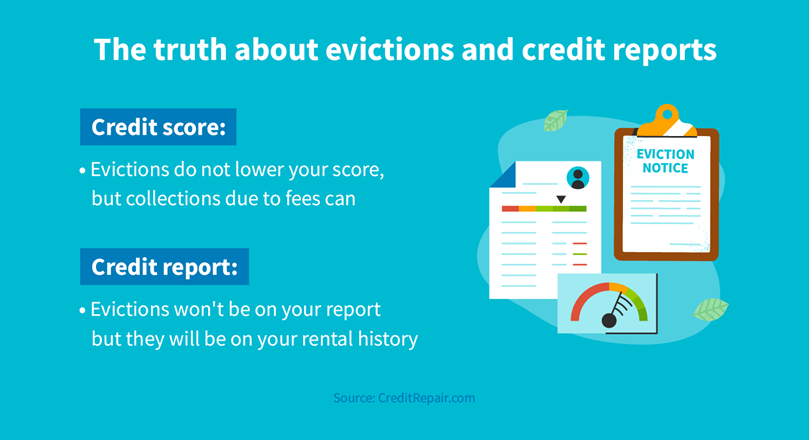

Evictions don’t show up on your credit report, but they will show up on your rental history for seven years. While an eviction won’t affect your credit, unpaid debts can go to collections, which do show up.

Between 2000 and 2018, landlords filed more than 3.6 million eviction cases. With so many evictions, you may be wondering what happens when you get evicted. More importantly, what happens to your credit?

Whether you’ve received an eviction notice or not, understanding how one affects your financial situation can help you avoid any mistakes that may damage your credit.

In this guide, you’ll learn how long evictions stay on your record, how they affect your credit and what you can do about it.

Does eviction show up on your credit report?

Evictions are not reported to the three major credit bureaus, Experian®, Equifax® and TransUnion®. But don’t get too excited just yet. This doesn’t mean that future landlords or banks won’t be able to see your eviction. Whether you’re renting or buying a home, your eviction records can be found on a separate rental history report through a tenant screening company.

This is why it’s always a good idea to stay on top of your rent payments. In addition to eviction records, other rent-associated items that may show up in your rental history include:

- Unpaid rent

- Unpaid fees

- The breaking of a lease

How evictions and collections can hurt your credit

Although an eviction notice doesn’t go on your credit report, collections do. If you have unpaid rent debt or other fees, your landlord can use debt collection services. Collections go on your credit report and can damage your credit, and there’s a whole process for removing collections from your credit report.

How long does an eviction stay on your record?

While evictions don’t show up when you read your credit report, the eviction will stay on your rental history record for seven years. This means that when you fill out rental applications, the potential landlord will be able to see this information on your rental history. To find out how much longer the eviction will be on your rental history you can contact the screening company the prospective landlord uses, or you can use this Experian RentBureau report.

How to remove an eviction from your record

Having an eviction on your record for seven years is a long time, so it’s understandable if you want to see it fall off sooner rather than later. If that’s the case, the steps below are how to remove an eviction from your record:

- Pay your debt: Contact your landlord and see if you owe anything so you can pay it off. In some cases, they may even be willing to settle the debt for less than what’s owed. Some people don’t even do this much, so your old landlord may want to do this instead of going through collections.

- Ask to have it removed: This seems too simple to work, but you may be surprised. If you paid your debt in full, you can ask your landlord to have it removed from tenant screening reports. This works even better if you were kind throughout the process.

- Handle collections: Your old landlord may have sent what you owe to collections, and that means that it’s on your credit report and hurting your credit. The process is similar: You’ll need to pay off or settle your debt with the collections agency. For this, you can use a pay-for-delete letter template.

- Make sure it was removed: You may be told that the eviction is removed, but you still need to do your due diligence. Check your rental history, or credit report if it went to collections, in about 30 days. By then, it should be removed.

- File a dispute: If eviction information or collections are showing up on your rental history or credit report, you can go through the dispute process to challenge it.

What if you were wrongly evicted?

It’s possible that you were evicted in a wrongful way. This is different from a dispute because rather than going through the credit bureaus or screening companies, you’ll need to petition the court. Here are a couple of strategies you can use:

- See if the process was legal: Each state has different legal requirements for initiating the eviction process. Check your state’s laws and see if your landlord followed them. If done illegally, you may be able to have the eviction removed.

- Document the process: From the time you move in, it’s a good idea to document everything, like the state of the rental. If you can take photos, that’s even better. Keeping a detailed record of your payment history is very helpful as well as any communications you’ve had with your landlord in writing.

How to rent an apartment with evictions on your record

If you have an eviction on your rental history, don’t worry. All hope isn’t lost. Ideally, you’ll be able to have it removed from your record, but if not, you may still be able to rent. This isn’t just for apartments, either. These tips can help you with renting a home as well.

Stay proactive

The best way to rent an apartment is to never have evictions on your record in the first place. The best way to do this is to stay proactive to make sure that you don’t get evicted. Throughout your time renting, be sure to pay on time, take care of the property and avoid causing issues for your neighbors or landlord.

Prepay

Landlords are people, too, which means you can always negotiate. Having an eviction on your record is basically an indication of risk to future landlords. To set their mind at ease, you can offer to prepay a certain number of months in advance. Offering a bulk payment up front for multiple months of rent can help set their mind at ease.

Provide proof of steady employment

Showing evidence that you have a solid job and source of income is a great way to show that you’re reliable. When doing this, you should have copies of your pay stubs to show that you make more than enough to pay on time. Typically, they’re looking for one and a half times what rent costs. So, if rent is $1,000 per month, they want to see that you make at least $1,500.

If you have additional sources of income from side hustles, be sure to show them evidence of this income as well. Everything helps.

Collect reference letters

Reference letters can be helpful when you have an eviction on your record. Think about who a landlord would like to hear from. Getting a reference letter from your mom wouldn’t be helpful on its own. But if you lived with your mom recently, that might do it. Some of the best references are from other landlords who have rented to you with an eviction because it shows that an unbiased source is vouching that you’ll be a reliable tenant.

Find roommates

Having roommates lowers the risk that’s taken on by the landlord. Remember how we talked about having a steady stream of income? Well, that income is multiplied when you have one or more roommates. It’s also similar to having a cosigner when applying for credit or loan. All tenants sign the lease, so there’s additional accountability since everyone’s responsible for the rental.

Use a cosigner

We just said that finding a roommate is similar to having a cosigner, which you can also get on your rental in certain cases. Finding a cosigner (often called a guarantor in the rental world) who has a solid credit report, rental history and good income lowers the landlord’s risk. This is a signal to the landlord that they will still receive their rent payments if you weren’t reliable.

Improve credit score

Your credit score is an indicator of your financial responsibility. A good credit score shows that you make your payments on time and in full. It also shows that you have a good history of doing so. If you have bad credit in addition to an eviction, it’ll be much harder to get a rental. So, be sure to fix your credit if it needs to be repaired.

How to avoid eviction

Being in a healthy place financially is one of the primary ways to avoid an eviction due to lack of payment. When you have a lot of debt, it’s hard to make paying rent a priority because you have so many other bills to pay. If you have a bad credit score, you’re also making larger payments due to increased interest rates. This eats into the money you could be using to pay your rent.

Whether you have damaged credit or just need help managing your finances, CreditRepair.com is here for you. We have a team of credit professionals who can help you work on your credit and challenge errors on your report. We also offer financial education services as part of our membership. To learn more, sign up today.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263