How much do your kids know about money? Do they already have a savings account?

Fact is, children’s savings improve early childhood development, future potential and future financial capability, according to all the current research compiled by the Corporation for Enterprise Development.

So, if you’ve got kids, you’ll definitely want to celebrate “Teach your Kids to Save Day” which is April 29, 2016, when many banks participate by visiting schools for special events and activities in the classroom.

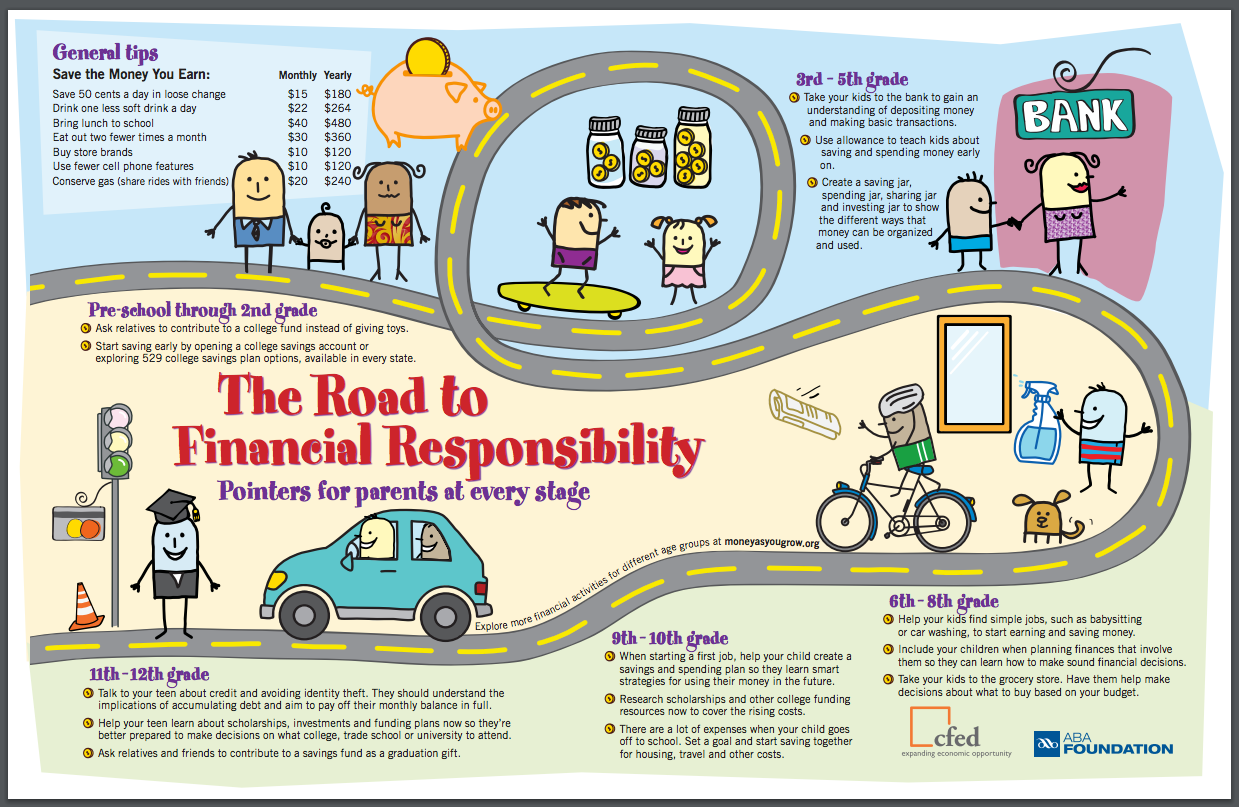

If you want to celebrate in your own way at home all year long, check out our guide, depending on age, and definitely head over to your local bank or credit union with your kids to open a children’s savings account for each child, if they don’t already have one.

Teach your child to save, as early as age 5

If you have pre-school and kindergarten-age kids, you may not realize they are developmentally capable of saving and understanding about saving by age five or six, according to a review of the recent research on children and money published in a 2015 issue of The Journal of Consumer Affairs. In fact, children who grew up saving were more likely to accumulate more savings as young adults.

At this young stage, kids are able to pay attention to sorting and remembering the different coins and dollars and learn the very basic beginning math concepts of earning money (adding) and spending money (subtracting) as well as and the concept of saving.

It’s important to talk to your young child about how money is used and spent, how you earn money and why you save money whenever these topics come up during your daily life. A trip to the bank to open a savings account with their first allowance or some birthday money is a fun and very real way to start the conversation about money.

Want a great visual way to teach kids to save? Neale Godfrey, author of Money Doesn’t Grow On Trees: A Parent’s Guide to Raising Financially Responsible Children recommends helping kids split up money they earn or receive in four separate glass jars this way:

- 10% is for charity they take off the top to share

- 30% is for quick cash for wants or needs now

- 30% is for medium-term savings to purchase something specific in one to six months

- 30% is for long-term savings for important future things such as a car and college expenses

Try these money conversation starter titles by award-winning authors just for young children:

- Just Saving My Money by Mercer Mayer

- Start Saving, Henry! by Nancy Carlson

- Berenstain Bears Trouble With Money by Stan and Jan Berenstain

Guide your child’s allowance spending throughout school years

In that same review of the science of how children learn about money, the authors scientifically settle the debate on whether parents should oversee the spending of a child’s allowance or not. Some parents feel that kids should learn about money through “real consequences” of making spending decisions (and mistakes) on their own.

But the research found that giving your child an allowance along with teaching them about saving and budgeting was the most effective way for them to build money skills for life.

Pre-teen to early teen kids are absorbing the mental attitudes and habits the adults around them use to navigate their financial lives. At this age, your kids are watching you closely and adopting your daily short-cuts and views about money.

Now is the time to talk often with your child during daily bill-paying, shopping, banking and spending activities about what is being spent, saved as well as the concrete specifics of how and why. You can:

- Discuss needs versus wants.

- Show kids more about how the bank works and why it’s important to understand banking

- Enlist their help with comparison shopping using apps and searching online

- Talk about advertising, scams and the importance of keeping financial information private

Want to monetize chores in an effective way? Try Myjobchart.com, a free online interactive job chart you can set up so school-age kids can log-in, do chores and earn points on their own, which are then translated into money that can be saved, spent or shared. This way it takes the parental arguing and nagging out of the equation and makes the child accountable.

Encourage your teen to earn money

While this can be done at any age, teenagers gain a large advantage by earning money outside the home at a part-time job while still in high school so they can learn basic but very real money lessons (and make mistakes) while still under your roof, safety and guidance.

Once they get a job they will intentionally seek out and apply financial information, compare alternatives, take action and learn from the consequences. Now’s the time they will:

- Learn about taxes and how to fill out a W-4 form

- Set up a checking account and use a debit card

- Understand the need for budgeting and saving for needs (such as paying car insurance and gas) versus wants (such as concert tickets) and how to balance the two.

- Grasp the magic of compound interest of savings accounts

- Begin understanding credit for their future.

During high school is also the perfect time to talk more about how other people earn money as well as what type of experience and education those jobs require and what kinds of salary they might earn. Conversations about comparing the costs of college and the costs of student loans and the effects both will have on their future is an important eye-opener many parents skip.

The Economic Awareness Council offers an interactive and very real College Budget Planner (complete with estimated national average costs of many items) for you and your child to plan each semester financially.

Check your own finances, first

If you want to get a handle on your own money attitudes and habits, try this exercise suggested by the Consumer Financial Protection Bureau: Think out loud during your day-to-day money and time management activities. If you want to convey what you are doing and how you are doing it with your kids, talk it through as you do it so kids can follow along.

If you find that you don’t know what you don’t know when it comes to your own money management skills, the National Financial for Credit Counseling MyMoneyCheckup tool is an online interactive assessment of how your finances are doing, where you might need help and ways to improve your financial health.

And, if you want to learn a whole heck of a lot more about your credit, read the Creditrepair.com blog regularly, along with your morning coffee, to keep your finances top of mind all day long, and share what you learn with your kids of every age.

Infographic from American Bankers Association and can be found here.

Related Articles:

Tips to Help Your Children Learn About Personal Finance and Credit

Educating Your Children About Credit Cards

Can You Freeze Your Child’s Credit Report?

Questions about credit repair?

Chat with an expert: 1-800-255-0263