Disclosure regarding our editorial content standards.

Insolvency occurs when you’re unable to meet your financial obligations on time, and it can be quantified by measuring how much your total liabilities exceed your total assets. In other words, insolvency is when you can’t pay your bills. If you were insolvent at the time your debt was canceled, you can claim insolvency to exempt that canceled debt from your taxes.

We’ll cover what insolvency is, what contributes to insolvency, how to claim insolvency on your taxes and what happens when you claim insolvency to help you take advantage of the insolvency exclusion that applies to canceled debt.

What is insolvency?

Insolvency is when a person or a business can’t repay debts when the balances owing have matured. Insolvency is a state of extreme financial distress that often leads to serious consequences. However, there are potential solutions to insolvency that can help an individual or business recover from their situation.

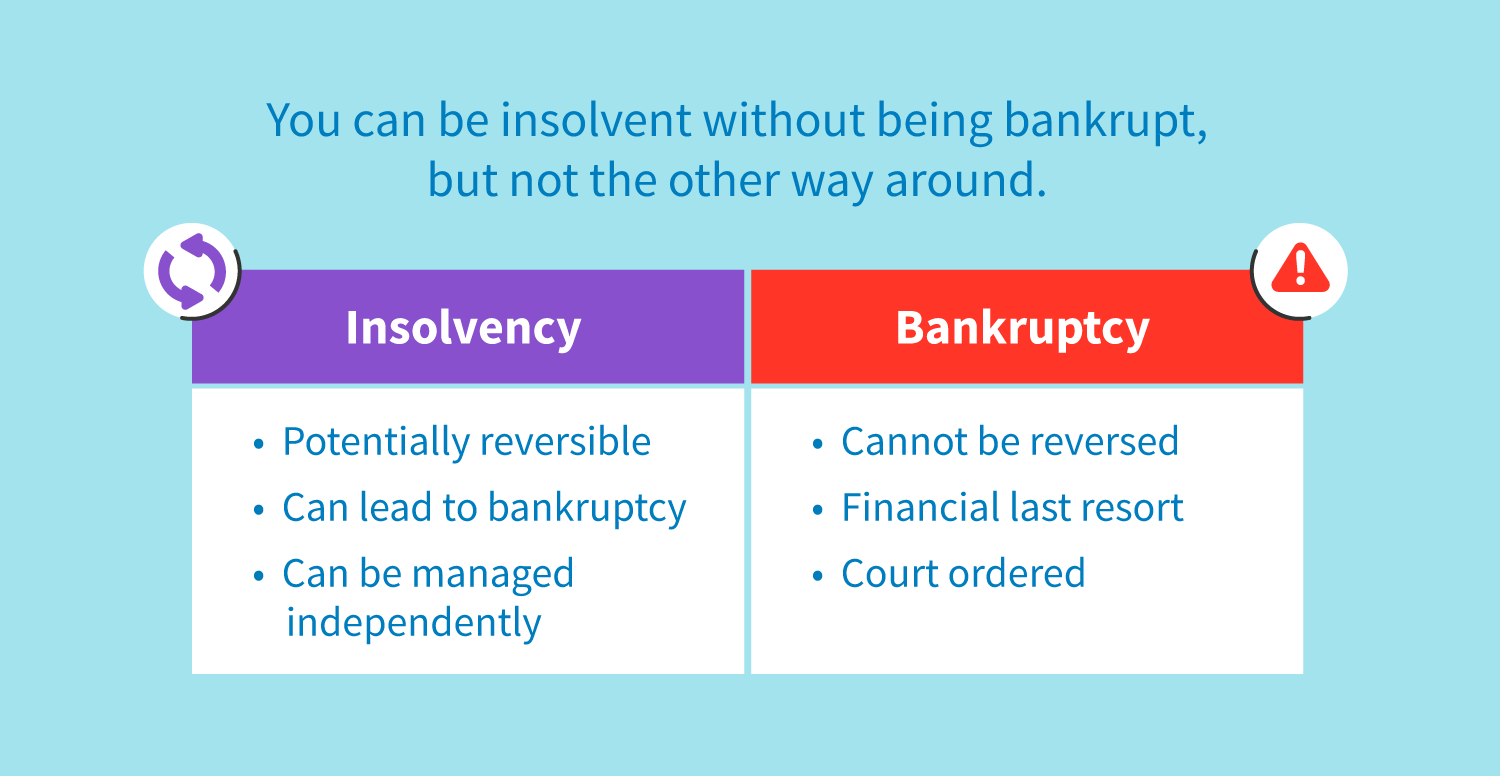

Note that insolvency and bankruptcy are slightly different terms that are often used interchangeably. Insolvency is the financial state of being unable to pay debts, while bankruptcy is the legal procedure followed when debts can’t be paid. Bankruptcy typically occurs when no other solution to insolvency works.

There are two types of insolvency:

Balance sheet insolvency

Balance sheet insolvency is when debts exceed assets. This occurs when the individual or business doesn’t have enough assets to cover their financial obligations to lenders, resulting in negative net assets. Balance sheet insolvency has a higher risk of bankruptcy than cash flow insolvency.

Cash flow insolvency

Cash flow insolvency is when a business or individual can’t pay their debts because they don’t have money. In this case, assets could be used to pay creditors, but payment hasn’t been made because the money isn’t easily accessible. For example, the individual or business could have no cash but might own property. If they sold that property, they could pay off their debts. So, cash flow insolvency refers to lacking liquid assets.

Cash flow insolvency carries a lower risk of bankruptcy than balance sheet insolvency. Creditors may be willing to negotiate the bills and offer a repayment plan because there are assets that can be used to make payments if necessary.

What happens when you are insolvent?

Business recovery

Businesses can work with their creditors to “recover” from insolvency. Lenders often don’t want to see a business claim bankruptcy, as they risk losing some of the money they’re owed. Instead, creditors may offer to restructure outstanding debts into a new repayment plan that the business can afford to keep up with. This may include pausing payments for a while or decreasing monthly payments and increasing the loan length.

How does someone become insolvent?

Some of the top causes of insolvency include debt, income loss and unexpected bills. According to the IRS, you become insolvent when your total liabilities exceed your total assets. You can find out if you’re insolvent by calculating this difference in your liabilities and assets. In order to have your forgiven debt excluded from your taxable income, you have to fill out Forms 1099-C and 982, which then need to be approved by the IRS.

One of the reasons why you might be insolvent is credit card debt. If you have credit card debt, you’re not alone—as of June 2020, 41.2 percent of all American households had some form of credit card debt, with an average debt of $5,700. Credit card debt can be especially risky to take on because of its potential to compound with other types of debt.

If you use your card to pay bills every month, it can be tempting to carry over some expenses from month to month. However, this will increase the interest you pay on the debt, giving you even more debt to deal with. Paying certain types of debt (such as federal taxes) with your credit card can also incur fees, which add up if you do so regularly.

There are many things, other than credit card debt, that may lead to insolvency. These things all involve an increase in liabilities or a decrease in assets, which can happen suddenly or over time. Such reasons may include the following:

- Job loss or pay cut

- Student loan or other debt

- Divorce

- Medical bills

- Poor financial management

- Unexpected expenses

- Reduced income

If any of the above resonates with you, maybe you’ve come to the realization that you might be insolvent. Though it’s a rough situation to be in, being insolvent allows you to claim insolvency, which can get you a tax exemption on your canceled debt.

What happens when you claim insolvency?

When you claim insolvency, the IRS will review your forms and make a judgement. Here are the basics of what happens when you submit an insolvency claim:

- Once you’ve submitted your insolvency claim forms, the IRS will review your forms and calculations, then deny, question or accept your claim.

- If they deny your claim, you won’t be able to exclude your canceled debt from taxes.

- If they question your claim, you may have to provide additional details or calculations to prove to the IRS that your figures are accurate. To avoid having your claim questioned, you can complete the insolvency worksheet to show your work.

- If your claim is accepted, then you won’t have to pay taxes on your canceled debt (up to the amount that you were insolvent).

When debts are canceled, those cancellations are treated as taxable income by the IRS. However, after you claim insolvency, that income can be excluded up to the amount of your insolvency. For example, if you have $10,000 of canceled debt, but had $7,000 of insolvency, then only $3,000 would be counted as income on your tax return.

How insolvency can affect your credit

Being insolvent will negatively affect your credit. This makes sense because if you can’t pay your bills, your credit history won’t be as strong and lenders won’t be as confident in working with you. Claiming insolvency, however, does not technically affect your credit. The situation that led to you receiving a 1099-C is what would have damaged your credit.

Insolvency vs. bankruptcy

Insolvency, thankfully, can be reversible. On the other hand, bankruptcy is a court order that outlines how an insolvent person will deal with their debts, and it can have lasting consequences on their credit rating. You can be insolvent without being bankrupt, but it doesn’t work the other way around. Bankruptcy is generally a last-ditch effort to address insolvency.

How to claim insolvency on your taxes

To claim insolvency, you’ll need to fill out IRS Forms 1099-C and 982. These forms should be filed with your federal income tax return for any year in which a discharge of indebtedness was excluded from your income. Form 1099-C reports cancellation of debt (greater than $600) to the IRS.

Form 982 determines how much of that canceled debt, if any, can be excluded from your gross income.

1. Determine if you’re insolvent

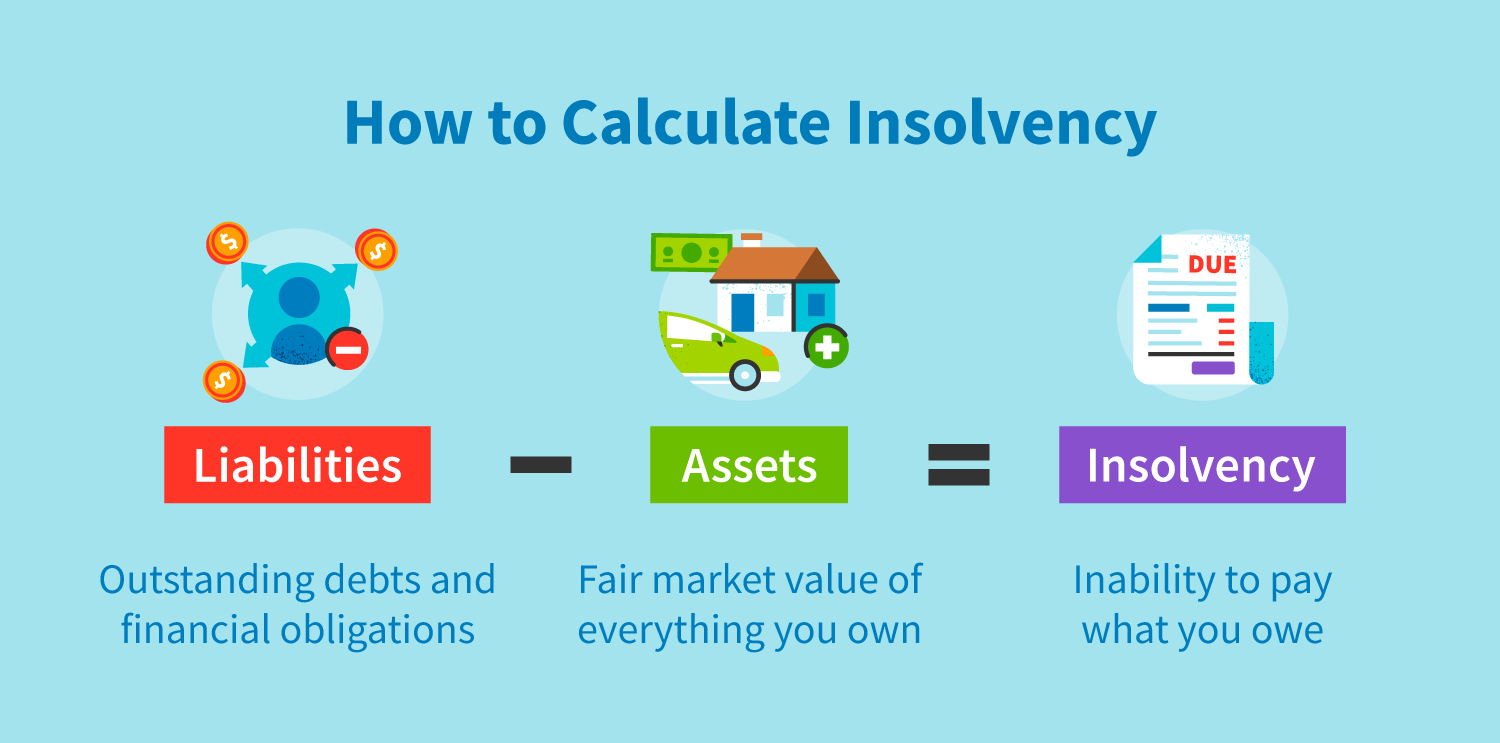

The IRS will consider you insolvent if your total liabilities exceed your total assets. In other words, liabilities – assets = insolvency. You can figure out if insolvency applies to you by comparing the difference between your total assets and total liabilities at the time your debt was canceled. This means you have to calculate both values, which can be a daunting process.

- Calculating your assets: To find the value of your total assets, put a fair market value on everything that you own (or owned at the time)—for example, jewelry, furniture, appliances, art, clothing, real estate, cash and investments—and once you have those values, add them up.

- Calculating your liabilities: For your liabilities, add up all of your outstanding debts and financial obligations, which may include utility bills, credit card bills, auto loans and mortgages.

After you’ve calculated your total liabilities and total assets, you can compare the two to determine whether your liabilities were greater than your assets at the time the debt was canceled. If so, you were insolvent.

2. Find the forms and prepare your documents

Once you’ve determined that you’re insolvent, you can claim insolvency by filling out IRS Forms 1099-C and 982. The creditor who canceled your debt should send you (and the IRS) Form 1099-C when a debt is forgiven. If your debt was canceled and you didn’t receive a 1099-C, you are still responsible for reporting forgiven debt. Try contacting your creditor if this happens.

Forms 1099-C and 982 can be found on the IRS website. You’ll need a Taxpayer Identification Number (TIN), as well as details about your canceled debt, to fill out these forms.

3. Complete form 1099-C

You’ll get a 1099-C form if your creditor canceled, forgave or otherwise reduced your debt—maybe you cut a sweet deal. It’s important that you file this form because canceled debt is considered taxable income.

To fill out Form 1099-C, use the details of your canceled debt. This includes your creditor’s details (i.e., name, address), your details, the amount of debt and a description of the debt. Include the information from your 1099-C on your standard 1040 individual tax return on Line 21 under “Other Income.” There are also instructions for how to fill out Form 1099-C on the IRS website.

4. Complete form 982

If you were insolvent at the time the debt was canceled, you can fill out Form 982 to get an exclusion on the canceled debt (counted as income) reported on the 1099-C. To fill out Form 982, check “Discharge of indebtedness to the extent insolvent (not in a title 11 case)” and write in the amount of canceled debt that should be excluded from your gross income.

Follow the guidelines to include the appropriate value for Part II (line 10a) and ignore Part III if you aren’t representing a corporation. There are also instructions for how to fill out Form 982 on the IRS website.

5. Keeping debt down

Now that you’ve canceled some of your debt and claimed insolvency, you can work toward getting rid of the rest of your debt and keeping it off once it’s gone. It’s important to manage your debt since it can negatively affect your credit score, as well as limit the financial opportunities available to you. One common way to tackle debt is to come up with a budget and stick to it.

Take control of your insolvency

If you’re unsure about a major money decision—including whether or not to claim insolvency—it can be helpful to talk with a financial advisor. Financial advisors can use their knowledge and expertise to help you better understand your financial situation, as well as make plans to achieve your financial goals.

Failure to pay credit card bills counts as insolvency, a situation you don’t want to be in. To avoid getting in such a situation, you can take control of your credit. Our CreditRepair.com advisors work by challenging questionable negative items on your credit reports and monitoring your credit for additional issues.

Questions about credit repair?

Chat with an expert: 1-800-255-0263