Disclosure regarding our editorial content standards.

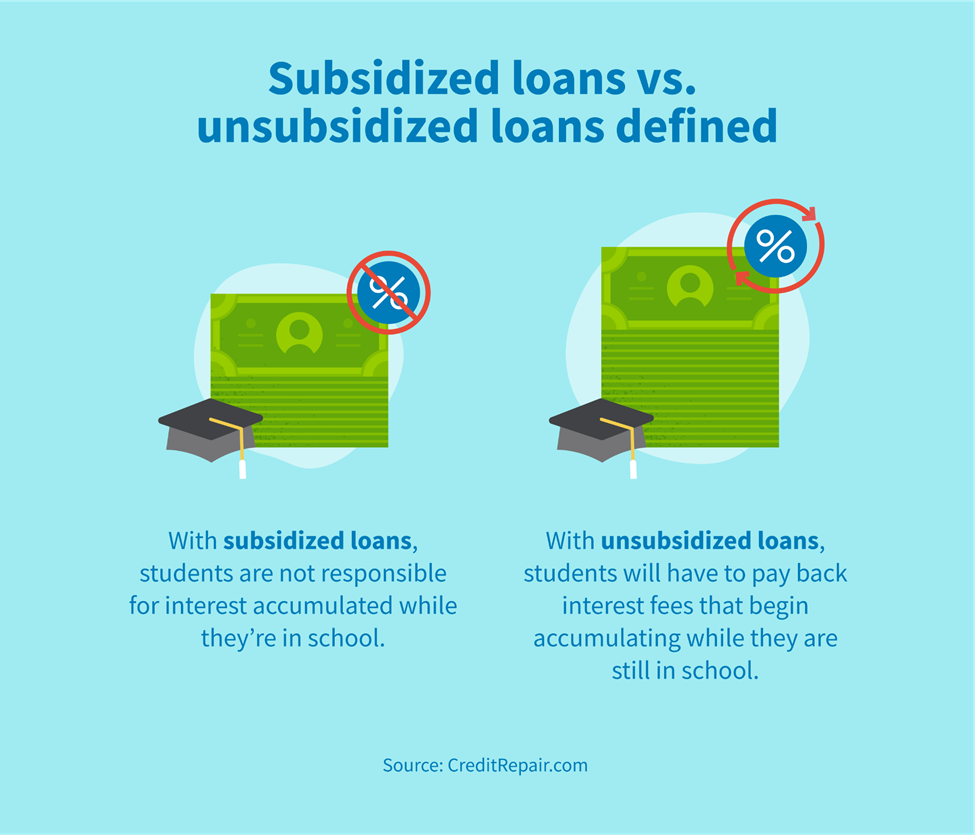

Subsidized loans are based on financial need and do not accrue interest during school and deferral periods, while unsubsidized loans do accrue interest and are not need-based.

When you’re choosing between a subsidized vs. unsubsidized loan to help pay for college, those two little letters can potentially make a big difference when it comes time to repay. While the lack of interest accrual on a subsidized loan does help save money, there are some requirements you’ll need to meet in order to qualify for that type of federal student loan.

Keep in mind these federal loans are separate from private student loans. Private student loans may have differing interest rates and application requirements. If you’re applying for private loans with no credit or bad credit, it may be worthwhile to explore credit repair to try and secure a lower interest rate.

For now, let’s dive into the key features of each federal student loan type, how to qualify and apply for each and how to repay them after you graduate.

What is a subsidized loan?

A subsidized loan is a loan that doesn’t require borrowers to pay interest that would otherwise accrue while they’re in school or just out of school. “Subsidized” in this case means the federal government subsidizes the loan by paying interest on the borrower’s behalf until the loan repayment period begins.

Borrowers must be taking classes at least half-time for this subsidy to apply. Once the borrower is no longer at least a half-time student, they will be responsible for paying interest on the full loan amount starting then. The only exceptions are during any deferment periods and the grace period after you leave school. Note that this period varies by lender but generally lasts around six months.

What is an unsubsidized loan?

Unsubsidized loans receive no assistance with interest, so borrowers are responsible for repaying interest that accrues from day one of the loan. These loans are not subsidized by the federal government or a bank.

It’s important to note that interest from these loans will apply even when the borrower isn’t required to make repayments. That means if you take out unsubsidized loans to help pay for school for four years, your loan will accrue interest at the agreed-upon rate for the duration of those four years. The amount you’ll need to repay after you’re no longer in school will thus be greater than the amount of money you initially borrowed.

Subsidized vs. unsubsidized student loans: What’s the difference?

Since borrowers with subsidized loans are not responsible for interest accumulated while they’re in school and borrowers of unsubsidized loans are, it may seem like subsidized loans are the obvious choice. However, there are a few considerations for each loan type to keep in mind before you apply for or take out either.

Each has unique pros and cons, but one potential benefit of both for students just out of high school is that taking out and repaying student loans can help you start building credit even when you have no credit.

| Subsidized | Unsubsidized | |

|---|---|---|

| Interest fees while in school | Paid for by the government | Paid for by the borrower |

| Maximum loan amount (first year) | $3,500 | $9,500 |

| Financial need | Required | Not required |

| Applicable degree types | Undergraduate | Undergraduate, graduate and professional school |

Federal subsidized student loans

Below are a few pros and cons of subsidized student loans.

Pros

- Can save students thousands of dollars on interest while in school

- Interest is subsidized during post-graduation grace period and deferment periods

- Repayment may be postponed during grace and deferment periods

Cons

- Eligibility ends after 150 percent of your program’s length (e.g., six years for a four-year program)

- Borrowers must be able to prove financial need

- Only available to undergraduate students and students in select graduate medical programs

- Borrowing limits are lower than for unsubsidized loans

Federal unsubsidized student loans

In comparison, here are a few things to consider about unsubsidized student loans.

Pros

- Do not require proof of financial need

- Available for graduate-level students and professional degree seekers

- Borrowing limits are higher than for subsidized loans

Cons

- Interest accrues during school

- Higher borrowing limits may lead students to borrow more money than they need

- May offer fewer repayment options than private loans

Who is eligible for federal student loans?

To be eligible for federal student loans, borrowers must be enrolled in undergraduate, graduate or professional school coursework. The amount and type of aid they can receive depends on family income and whether they are dependent or independent students.

To determine eligibility, prospective borrowers must fill out the Free Application for Federal Student Aid (FAFSA®). FAFSA gauges eligibility by comparing the Cost of Attendance (COA) for the student’s chosen school to their Expected Family Contribution (EFC) — which can include assets and scholarships.

Since federal student loans are intended for students with financial need, students may not be eligible for them or may qualify for lower limits if their EFC is above a threshold that changes annually in comparison to their COA.

Additionally, to maintain eligibility for FAFSA, students have to meet Satisfactory Academic Progress (SAP). To meet SAP, students have to:

- Hold at least a 2.0 GPA (on a 4.0 scale)

- Be able to finish a bachelor’s degree within six years

- Be able to finish an associate’s degree within three years

- Pass two-thirds of their enrolled credits or more each semester

How do you apply for a federal student loan?

If you think you may be eligible for federal student loans and believe they can help you finance your education, here’s how to apply.

- Step 1: Since these loans are only available to students, you should first determine which school(s) you will attend.

- Step 2: Check the FAFSA application deadlines to make sure you can submit your application on time.

- Step 3: Complete the FAFSA form, which is available online. If you need to fill out a paper copy, you can contact your college’s financial aid office or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243).

- Step 4: Wait to receive your financial aid offer from your academic institution.

- Step 5: If you do receive federal student loan funding, you’ll be required to complete entrance counseling and sign a Master Promissory Note.

For questions on specific timelines or application procedures, you can contact your school’s financial aid office.

What are federal student loan interest rates?

Federal student loan interest rates are 4.99 percent for undergraduate students. Graduate student loans have an interest rate of 6.54 percent, and PLUS Loans come with a 7.54 percent interest rate. Note that these figures may change over time.

The purpose of federal student loans is to help students pay for college. Federal student loans carry generally lower interest rates than private loans offered by banks and also may qualify for loan repayment or even loan forgiveness programs.

How student loan interest works

When you take out a student loan, you agree to repay that loan plus an additional percentage. Lower interest rates are preferable for borrowers, which is what makes federal student loans appealing options for financing their education.

Interest is factored into your total repayment on a daily basis, which is why subsidized loans can be so valuable. With subsidized loans, you aren’t responsible for repaying the interest that would otherwise be adding up during your studies. Keep in mind that student loan interest is still typically lower than other private loan types — and should be much less costly than credit card debt.

How much money can you borrow for college?

Undergraduate students are allowed to borrow a maximum $9,500 in unsubsidized loans in their first year, which increases during the second and third years up to a maximum of $57,500 total over the course of their schooling. Those limits are lower for subsidized loans and for dependent students whose parents can get PLUS Loans.

Below, we’ve broken down those limits by year.

| Year | Dependent students (unsubsidized) | Independent students (unsubsidized) | All students (subsidized) |

|---|---|---|---|

| First year | $5,500 | $9,500 | $3,500 |

| Second year | $6,500 | $10,500 | $4,500 |

| Third year and after | $7,500 | $12,500 | $5,500 |

| Graduate and professional school | N/A | $20,500 | N/A |

| Total for all years | $31,000 | $57,500 | $23,000 |

Independent vs. dependent students

Dependent students are theoretically capable of receiving support from their parent(s) and are eligible for less federal student loan funding (assuming their parents are eligible for Direct PLUS Loans). Students are considered independent if they are any of the following:

- 24+ years old

- Married

- Enrolled as a graduate-level or professional student

- A member of the armed forces or a veteran

- An orphan

- A ward of the court

- Responsible for legal dependents (not including a spouse)

- An emancipated minor

- Considered or at risk of becoming homeless

Direct PLUS Loans

Direct PLUS Loans are available through the US Department of Education for parents of undergraduate students as well as graduate-level students and professional students. For undergraduate students determining how much they can borrow in federal funding for college, their parents’ eligibility for these loans can affect their maximum allowances — those whose parents can’t receive them may be entitled to higher unsubsidized loan maximums.

Student loan repayment plans

Federal direct student loan repayment starts under any of the following conditions:

- The borrower graduates (after a six-month grace period)

- The borrower stops taking classes

- The borrower is enrolled less than half-time

- The loan otherwise enters its repayment period

Once you enter repayment, you will be automatically enrolled in the standard repayment plan. But is that plan the right one for your needs? Here’s how your options break down.

Standard

Under the standard repayment plan, you make fixed monthly payments that are structured to pay the loan (and interest) off in 10 years.

Pro: Since payments are the same every month for the duration of repayment, you’ll generally pay less in interest over the course of the loan.

Con: Early repayments may be high for borrowers just starting their careers.

Graduated

As the name suggests, repayments gradually increase over 10 years so that early monthly payments are lower as borrowers start entering the workforce.

Pro: Lower early payments can be helpful for borrowers who may not immediately begin earning high salaries.

Con: Lower early payments means higher payments later—plus more interest over the course of repayment.

Extended

Those who borrow over $30,000 may be eligible for an extended 25-year repayment plan.

Pro: Lower monthly payments than 10-year plans.

Con: A longer repayment period means higher total interest charges.

Pay As You Earn (PAYE)

Those enrolled in the income-driven PAYE plan will make monthly payments equal to 10 percent of their discretionary income. This option, intended for those with large amounts of federal student loan debt relative to their income, makes sure monthly payments remain lower than they would under 10-year standard repayment plans.

Pro: Monthly payments are scaled according to income.

Con: Only available for those with exceptionally high levels of debt.

Revised Pay As You Earn (REPAYE)

Like the PAYE plan, under the REPAYE plan, monthly payments are equal to 10 percent of borrowers’ discretionary income. If they haven’t paid off their loan(s) after 20 years (or 25 years for those with graduate/professional school loans), their remaining balance will be forgiven.

For married borrowers, the spouse’s income and debt are considered regardless of tax filing status.

Pros: Scales repayments with income and may forgive a portion of the total debt.

Con: May lead to higher total payments over the course of the loan than a 10-year plan.

Income-Based Repayment (IBR)

Those with large amounts of federal student loan debt and relatively low income may choose this option, allowing them to pay either 10 or 15 percent of their discretionary income. Like the PAYE and REPAYE options, these monthly payments will be lower than they would be for standard 10-year plans. After 20 or 25 years (depending on when the loan started), any remaining debt will be forgiven.

For married borrowers, the spouse’s income and debt are considered if they file for taxes jointly.

Pros: Monthly payments scale with income and a portion of the total debt may be forgiven after 20 or 25 years.

Con: The total cost of the loan will likely be higher than it would be for a 10-year repayment plan.

Income-Contingent Repayment (ICR)

Open to any borrower with an eligible direct subsidized or direct unsubsidized loan, the ICR plan has two monthly repayment options. Borrowers will either pay 20 percent of their discretionary income or a fixed amount that would pay off the loan in 12 years—whichever is lower. Any outstanding loan balances are forgiven after 25 years.

Pros: Monthly payments are often lower than they would be for 10-year plans; a portion of the loan may be forgiven after 25 years.

Con: Longer repayment periods will likely lead to higher total loan costs.

Income-Sensitive Repayment

Available only to borrowers in the Federal Family Education Loan Program, this income-sensitive repayment plan bases monthly payments on income so the loans are paid in full in 15 years.

Pro: Monthly payments are lower than they would be for 10-year plans.

Con: Overall loan costs for 15-year plans are higher than they are for 10-year plans.

Frequently asked questions

What’s the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while the borrowers are in school (at least half-time), while unsubsidized loans begin accruing interest immediately. Subsidized loans are financial need-based and also have lower borrowing limits than unsubsidized loans. Both are considered a type of federal student aid.

Which loan type provides interest subsidy?

Subsidized loans provide an interest subsidy, meaning that the lender pays the interest payments while the borrower is enrolled in classes at least half-time, during a post-graduation grace period and during any period of deferment.

Which type of loan requires that you pay the interest accumulated during college?

Unsubsidized loans require borrowers to pay back the interest accumulated during college. As with subsidized loans, borrowers must begin repaying the loan after they graduate or once they are no longer taking classes at least half-time. Any accumulated interest prior to this will be included in their repayments.

Do you have to pay back subsidized loans?

Subsidized loans do have to be paid back unless they qualify for a specific loan forgiveness program. Students who take out subsidized loans, however, are not responsible for paying interest while they are enrolled in classes at least half-time.

Which is better: unsubsidized or subsidized loans?

Subsidized loans can be perceived as better than unsubsidized loans in that they can save borrowers thousands of dollars in interest fees. However, they are more prohibitive than unsubsidized loans because they have lower borrowing limits and are only available to students with financial need. For questions about your financial package, consider consulting your school’s financial aid office or a financial professional.

No matter which federal student loan type you choose to help finance your education, it’s important to start considering your repayment options now. Being able to pay back your loans on time once you’re out of school will help keep your overall loan costs down and can even improve your credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263