Disclosure regarding our editorial content standards.

As a young adult, you’ve likely heard that you need to start building credit in order to make big purchases or get a personal loan later on in life. But if you’re new to credit and have no credit score, you may be wondering—how do I start building credit of my own?

Don’t worry—earning credit isn’t as hard as it sounds, and it’s easy to start building credit from scratch. We’ll go over what you need to do if you have no credit score and how to start things off on the right foot.

Why you don’t have credit

You likely don’t have a credit score because you don’t have a credit history, meaning you don’t have loans, credit cards or another line of credit in your name that is reported to the national credit reporting agencies. Essentially, the three major credit reporting agencies (Equifax®, Experian® and TransUnion®) have no data on you.

Even if you have a credit card, credit bureaus require that your account be active for at least six months before your first credit report shows up. If you’ve had a credit card for years, but haven’t used it for six months and have no other lines of credit, you may not have a credit score anymore.

Having no credit score means you don’t show up on credit reports and creditors have no way of determining your creditworthiness or your risk level. You’re essentially invisible to creditors. If this sounds like you, you’re not alone. According to the Consumer Financial Protection Bureau, approximately 26 million Americans were “credit invisible” in 2015.

Why you may have a credit score even without a credit card

You may be surprised to learn that you do have a credit history, even if you’ve never opened a credit card with a bank. Though it may not be a long history, things like student loans, debit cards and other information about your spending habits and borrowing practices can show up on a credit report.

If you’re interested in starting to work on your credit, consider checking your credit report to see where you stand—that could then inform your next step, like what credit card you may be best suited for. You can get a free credit report every year from the three major credit reporting agencies, and this is most easily done via AnnualCreditReport.com.

What to do if you have no credit score: 5 options

You need credit for things like apartment applications, car loans and mortgages. Though these may seem far off, it’s important to start following good credit practices early so you can build a strong credit history for yourself.

1. Become an authorized user

If you aren’t ready or able to apply for your own credit card, consider becoming an authorized user on a credit card of a family member or friend—someone you trust financially. An authorized user is any person besides the primary cardholder that is able to use cards on the account, but isn’t responsible for paying the bill each month.

Most cards don’t have an age requirement for authorized users, so it’s a great way to start building credit.

2. Find a cosigner

Just like becoming an authorized user, finding a cosigner for a loan allows someone with better credit to help you build yours. A cosigner signs on to your credit card application as a guarantor that you qualify and can pay your bill each month.

Having a cosigner gives you access to better interest rates and loans that you typically wouldn’t be able to qualify for on your own. However, if you miss payments, both your credit score and your cosigner’s will be negatively affected.

3. Apply for a secured credit card with your current bank

When you’re first starting to build credit, consider opening a line of credit with the bank that hosts your checking account and debit card. Your banking history can be enough to get you at least a secured line of credit, which those new to credit cards typically need.

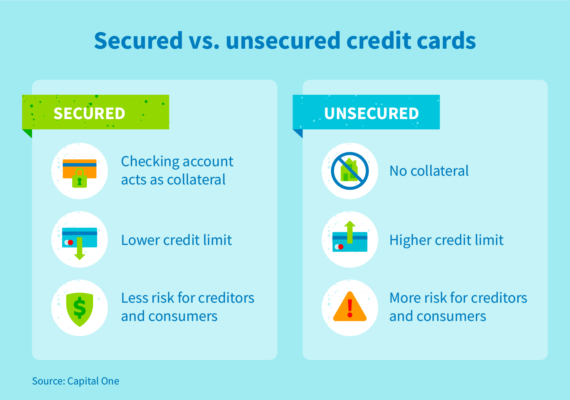

A secured line of credit means that the money in your bank account will act as collateral if you’re unable to pay off your credit card. Having this collateral makes you less of a risk to the creditor, and may be your only option when you’re first building credit. Your credit limit may not be very high, but it’s a good starting point.

However, most credit cards are unsecured, meaning that there is no collateral behind the line of credit. They’re riskier because if you don’t make the proper payments, creditors report your debt to major credit agencies or send the debt to collections. The trade-off is that your credit limit is usually much higher.

4. Report on-time payments

After you’ve applied for a credit card with your current bank, see if there are any previous payments you can report to major credit agencies, like rent, utilities and cell phone payments. Showing an on-time payment history can boost your credit. Common self-reported payments include rent or student loan payments.

You’ll need to go through a third-party service to report these payments—do some research to see who you need to reach out to. Just be sure that you’re confident you can make these payments in full and on time—otherwise, it may negatively impact your newly established credit score.

5. Consider a credit-builder loan

Credit-builder loans, also referred to as “fresh start loans,” are offered by smaller financial institutions and credit unions as a way for people with zero or poor credit history to build credit. The money you borrow goes into an account that you’re unable to access until you repay the loan in full. This way, it’s less risky for the financial institution issuing the loan.

If you’re considering a credit-builder loan, watch out for potentially high interest rates and shop around for the best deal.

Once you’ve gotten started with a credit score, it’s important to maintain it with good credit-building practices.

- Always make credit card payments on time. More often than not, late or missed monthly payments are bad news for your credit score. Set yourself a reminder to pay your credit card on time every month, or even better, set up an automatic payment to eliminate the stress of remembering. It’s worth it—even one late payment can drop your score by as much as 100 points.

- Only use 30 percent of your credit limit. Many credit card limits typically hover between $5,000 and $10,000, although new credit accounts often have much lower limits. Regardless of your max, make sure you only use about a third of your credit limit at a time, or less if possible.

- Limit your hard inquiries. Credit checks or inquiries occur when a financial institution such as a credit card issuer or lender officially checks your credit. Avoid applying for a mortgage, a car loan or multiple credit cards all in a relatively short time period. According to FICO®, people with six or more hard inquiries on a credit report may be eight times more likely to go bankrupt than those with zero hard inquiries.

- Mix up your credit accounts. Don’t rely solely on one line of credit. Creditors like to see a diverse array of credit accounts, including various loans as well as credit cards. Having a mortgage, an auto loan, a student loan and a credit card or two would be a good mix of credit.

- Be patient and give it time. When it comes to credit, having a long history of consistent payments is one of the best ways to show creditors that you’re a safe borrower. Focus on your long-term credit goals.

By following these credit-boosting best practices, you’ll be well on your way to establishing good credit and building smart financial habits. If your credit score isn’t where you’d like it to be, there may be some items on your credit report in error that you can dispute.

Why no credit score is better than a bad score

It’s a common misconception that having no credit score means your credit score is zero. Credit scores actually don’t start at zero—in fact, it’s impossible to have a credit score of zero. The two most common credit scoring systems, FICO and VantageScore®, have a minimum of 300, and it’s very rare that a person’s credit score would dip that low.

What is a bad credit score?

Typically, any score below 650 is considered a bad credit score. Though there are ranges in credit scores, a score lower than 650 will often limit your credit options. A credit score this low is a signal to creditors that you’re risky, and it may be difficult to open new lines of credit or get decent interest rates.

For this reason, it’s better to have no credit than bad credit. Typically, it’s easier to build a good credit score from scratch than to try to mend a poor one.

Whether you’re just getting started on your credit journey or are planning out your path to a great score, remember that patience is a virtue. Building credit (especially good credit) doesn’t happen overnight—it takes careful cultivation and good credit practices to reach your financial goals.