Annmarie P., a 44-year-old office manager, fell behind on her mortgage payments in early 2007 after she was laid off from her job. She exhausted her unemployment benefits and spent down her savings before she was able to find a new job in another city. The timing couldn’t have been worse. This was the height of the U.S. housing crisis. Annmarie’s mortgage was severely underwater and she could not sell the home at a price that would relieve her of the debt.

“I thought about doing a short sale but I found out that if I was approved, the shortfall [the difference between the sale price and the amount owed] would be reported as income and I’d be on the hook for taxes. I didn’t want to trade one financial problem for another. I mean, if I had money on hand for extra taxes I could have gotten the mortgage caught up! I was really stuck between a rock and a hard place. There was no good choice.”

She took the new job and tried renting the home, but she could not charge enough to cover the mortgage, taxes, insurance and upkeep. The deficit grew, and combined with other accounts in arrears, soon overwhelmed her.

Annmarie considered filing bankruptcy and learned that her most realistic option was chapter 13, under which her existing debts would be reorganized under a five-year repayment plan. The repayment plan would include getting caught up on the mortgage. Annmarie felt that she could negotiate and repay all of her other debts herself within that time frame but needed to be free from the mortgage in order to do so. Her final decision was to pass on the bankruptcy but let the house go back to the bank.

“I stopped paying the mortgage because I just couldn’t anymore. I have always paid my bills. I always had great credit in the past. This was not me walking away from a bad market. This was me drowning.”

Within a year, Annmarie’s credit score fell from 720 to 590. She didn’t apply for much credit but was turned down when she did. For new cell phone service she would have to pay a $350 deposit or take a prepaid plan. As she got back on her feet, she needed a car. She discovered that some lenders were willing to do business with bad credit consumers like her. The terms, though, were horrible. With few options, she took a car loan at 24 percent interest.

Smart about credit, Annmarie knew that recovering from a foreclosure would take time and care. She made sure the auto loan would be reported to the credit bureaus, and paid it on time, every month. She also negotiated payment plans with her other creditors, and, one by one, paid them off. Some creditors agreed to report the accounts as “paid as agreed” instead of delinquent.

“I was paying $25 a month here, $25 a month there. I had to pay all kinds of late fees and penalties in addition to what I owed.”

Annmarie monitored her credit carefully in order to measure her progress. After all of her delinquent accounts were paid off, she applied for a credit card. She assumed that her application for a traditional card would be declined, so she went straight for a secured card and was approved. In order to create a recent history of on-time payments and low debt utilization, she set up an automatic payment from her credit card account to her cell phone account. Then she set up an automatic payment from her bank account to her credit card account. She put the card away and didn’t use it for any other purchases. Six months after opening the account she was invited to convert it to a traditional, unsecured (and fee-free) account. About a year later, she successfully applied for a credit card with better terms and a lower interest rate. She began to use this card for small purchases, paying off the entire balance each month.

When Annmarie walked away from her mortgage, she thought she’d never be able to buy a home again. But as the years passed, her perspective changed.

Annmarie watched her credit start rebounding in the first year. It significantly improved when she paid off collections and started (responsibly) using her secured credit card. She learned that negative items (including foreclosures) are removed from a credit report after seven years (the clock starts when the account becomes delinquent and is never current again).

“It took me about three years to get my head above water financially. Then I focused for about two years on repairing my credit. That’s when I realized that I could see the light at the end of the tunnel. Some of my collections were only a year and a half from aging off my file.”

Borrowers who seek a Fannie Mae or Freddie Mac loan must wait seven years after foreclosure (with no extenuating circumstances) before becoming eligible for another mortgage. FHA-backed loans have a shorter waiting period – just three years. For both loan programs, borrowers who can prove extenuating circumstances can have their waiting period further reduced. Annmarie had no extenuating circumstances, just hard financial times. Even though her credit score had improved enough to qualify for a mortgage prior within a couple of years, she was ineligible to apply until the waiting period had passed (she didn’t want an FHA loan, which comes at a higher interest rate, so she held out for seven years). She felt emotionally ready to buy a home before she was eligible, but the extra time allowed her to save more money toward the down payment and closing costs.

“It seemed like it would take forever, but in hindsight, it was the right amount of time for me to get ready for my next home purchase.”

In September of this year, Annmarie bought another home.

Steps you can take

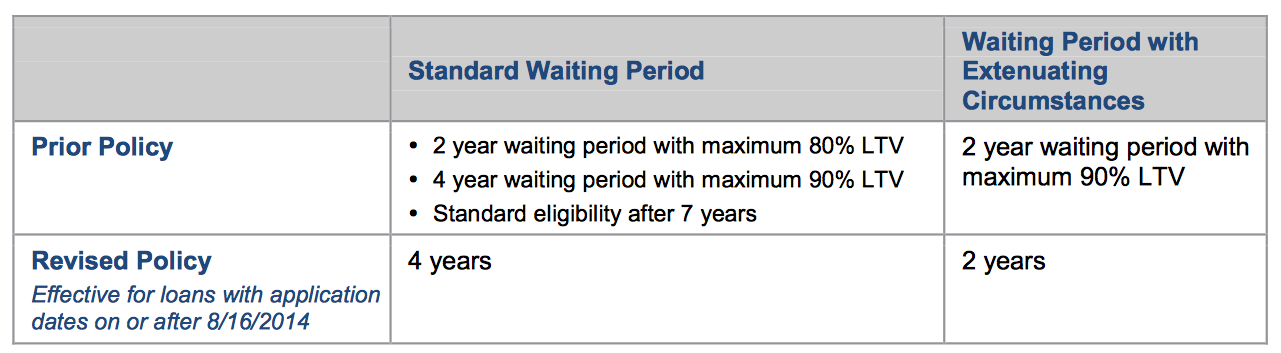

If you’ve gone through a foreclosure, bankruptcy or other significant negative event, the waiting periods for a Fannie Mae mortgage are as follows:

Source: https://www.fanniemae.com/content/fact_sheet/derogatory-credit-event-fact-sheet.pdf

For an FHA loan, the waiting period is three years. The waiting period is shortened to one year for borrowers who are eligible to participate in the FHA Back to Work Program.

During the waiting period, you can prepare yourself for loan approval in other ways.

- Pay off all collections

- Establish a two-year history of on-time payments on all accounts

- Keep debt low

- Squirrel away as much money as you can for the down payment and closing costs. You’ll need a down payment of at least 3.5 percent of the purchase price, and the best loan terms go to buyers who can put at least 20 percent down.

- Monitor your credit and know your score. Ensure that no errors appear on your credit report.

Questions about credit repair?

Chat with an expert: 1-800-255-0263