Though many of us have dealt with financial hardships before, the challenges presented by the ever-evolving coronavirus (COVID-19) pandemic are unprecedented and alarming. The CDC has provided guidelines you can follow to help protect your physical health and that of your loved ones, but you may be wondering how you can protect your financial health as well.

If you’ve found yourself worried about how to make payments and how to recover from financial setbacks, you’re not alone. Here’s a thorough guide to guarding your finances while you’re guarding your health.

The Financial Impact of Coronavirus (COVID-19)

In terms of the economy, nowhere is the effect of the pandemic more visible than in unemployment rates. Recent statistics show that nearly 10 million people applied for unemployment insurance within the past two weeks, with the previous record being 695,000 filings in 1983. And though the numbers are imprecise, the New York Times estimates that the current unemployment rate is somewhere around 13%, the highest it’s been since the Great Depression—and numbers are only expected to rise.

However, some experts maintain that there’s reason to be optimistic. This is because consumers can more or less resume their normal participation in the economy once restrictions are lifted, as opposed to during the 2008 recession. In addition, the government’s $2 trillion stimulus package should help the economy bounce back faster.

Be realistic and manage your expectations, but don’t let the bleak numbers stop you from being hopeful.

Remember that the economy will improve in the future. And more importantly, learn what steps you can take now to mitigate your financial risk so you are protected going forward.

Build an Emergency Fund

One of the first things you can do is start contributing to an emergency fund if you don’t already have one, or you can adjust how much you contribute to an existing emergency fund. This will help you rest a little easier at night, knowing you have a cushion of money in case you need it in the coming months.

How to Build an Emergency Fund

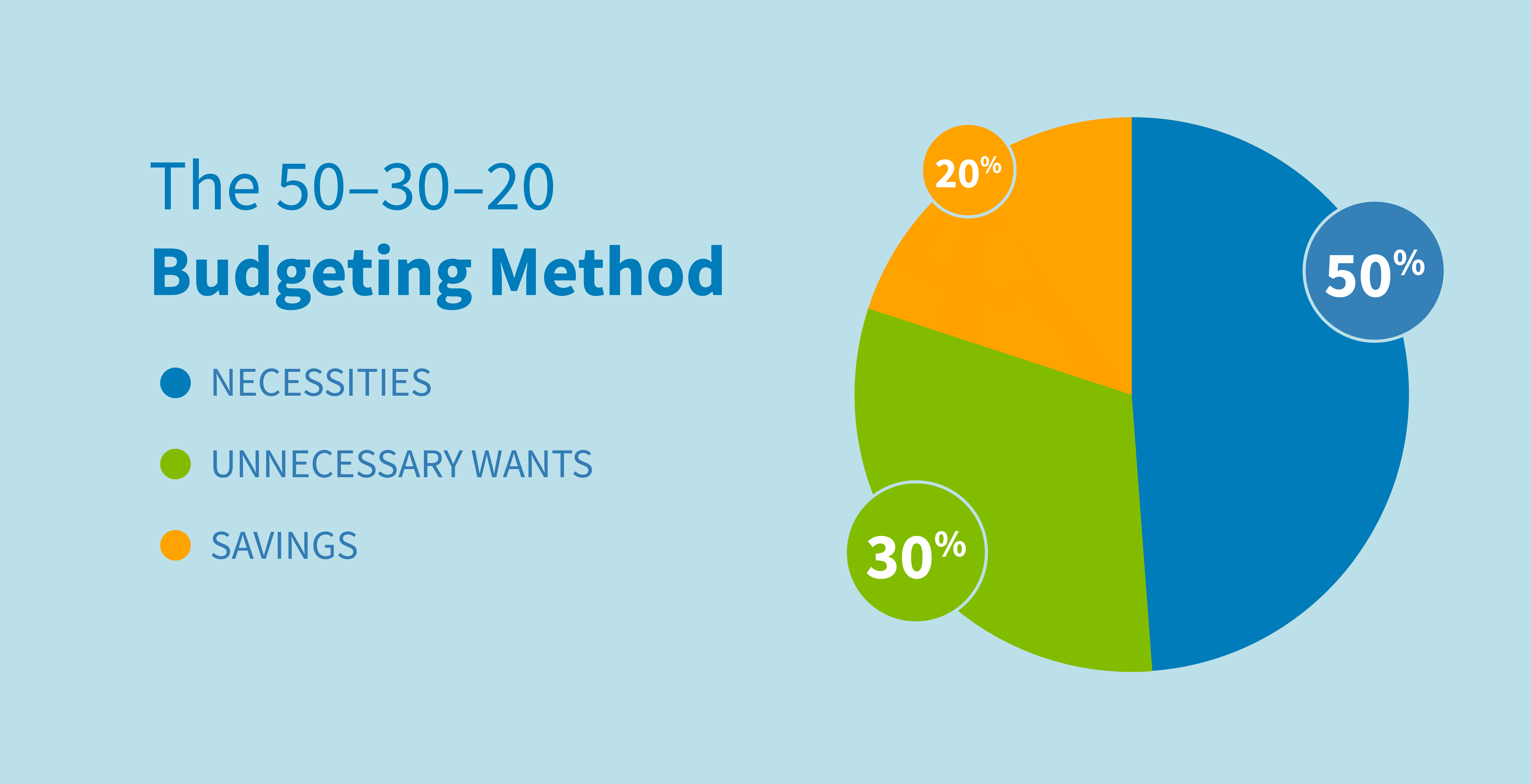

Though you have many different options when it comes to emergency funds—some economists suggest saving up to a years’ worth of money, while others say that $2,467 is a good minimum to have—an easy method to modify for your use is the 50-30-20 budget. This means that you dedicate 50% of your after-tax income to needs, 30% to wants and 20% to savings and paying off debts.

But these days, you may be able to reallocate some money to your savings and debts. “It’s that 30% that’s changing right now,” says finance writer Kimberly Palmer. “And so where we used to have that restaurant spending, personal care spending, getting haircuts and activities for my kids, that’s what we can now transfer into savings.”

Take a look at your budget and see if this strategy can work for you.

How to Use Your Emergency Fund During a Crisis

When a crisis situation comes up, first see if you can avoid dipping into your emergency fund by reducing your spending or supplementing your income in a new way. Once you determine that you’ve done what you can, let yourself use your emergency money guilt-free—you saved it for this!

You’ll need to decide what bills you can cover with your fund and whether you can save any money in case of a worse emergency in the near future. (During the coronavirus pandemic, for example, you may want to try to save some money for medical expenses—just in case.)

Prioritize Your Bills

It can be tough to decide which bills to pay first, but it’s worth doing in order to protect your well-being and your credit. Here are some general tips for prioritizing your bills:

- Pay for essentials first. This includes food, shelter and utilities. You may want to look into loan modification options for your housing, but regardless, your top concern is likely making sure you and your household are physically taken care of.

- Try to keep up with the minimum payments on things like your credit cards. It’s not always possible, but if you can do so, it will help you keep your head above water and help your credit be less affected.

- Weigh the consequences of delaying each bill, loan or credit card payment. For example, if you don’t pay your cell phone bill, your phone service might be shut off. Or if you don’t make a payment on your car loan, you risk hurting your credit. Identify every penalty and rank the importance of your payments accordingly.

- See if you can negotiate with your lenders and service providers. Options like forbearance, loan modification and refinancing can help you with your loans, and your utility providers might be open to changing your payment plans.

Cut Back on Spending

If cutting back on spending is an option, it may help you keep up with your payments and reduce your financial strain. Review your weekly and monthly expenses and pinpoint anything nonessential that you can cut out, such as entertainment subscriptions and weekly takeout.

When you’re grocery shopping, buy things like in-season produce and store-brand food to save more money. And though it can be tempting, right now in particular, to use online retail therapy as a coping mechanism for stress (we know it’s a struggle), make sure you stick to whatever budget you’ve decided on for yourself.

File for Unemployment Immediately

If you are recently unemployed or become unemployed in the coming months, you should file for unemployment as soon as you can. You should be able to file online for the unemployment insurance (UI) program in the state where you worked, and then you will find out exactly which unemployment benefits you qualify for.

Under the CARES Act, there are new programs that you should be aware of:

- Federal Pandemic Unemployment Compensation (FPUC) provides an additional $600/week to those who qualify.

- Pandemic Unemployment Assistance (PUA) extends benefits to those who are self-employed, as well as independent contractors and freelancers.

- Pandemic Emergency Unemployment Compensation (PEUC) extends benefits for an extra 13 weeks.

Each state has the flexibility to adjust their unemployment laws, so look into what your state is doing to help people who are unemployed during this crisis.

Don’t Be Afraid to Ask for a Deferment or Forbearance

If you’re concerned about being able to make your mortgage or rent payments, a good solution might be to ask your loan servicer for loan deferment or forbearance. The CARES Act allows homeowners with federally backed loans to request up to one year’s worth of forbearance, split into two periods of 180 days.

Under the CARES Act, there is also a temporary moratorium on foreclosures, and delinquencies will not be reported to credit bureaus. This means that being granted forbearance won’t affect your credit score.

Be aware that these provisions only apply to federally backed loans.

Utilize Your Stimulus Check

As you look forward to receiving your federal stimulus check, consider how much it might be and how you can spend that money. In general, if you are single and have no dependents, you will likely receive $1,200. If you are married and filing jointly, that amount is $2,400, and anyone with a dependent will receive an additional $500. There are income exceptions, so make sure you know what to expect for your circumstance.

If you don’t need the money immediately, putting it in an emergency fund would be smart, as would paying off high-interest credit cards. If you can afford it, reinvesting it in the economy would also be beneficial in the long run.

As to when you can expect the money? Larry Kudlow, Director of the U.S. Economic Council, said as of April 7, 2020, that “the checks from the Treasury and the IRS probably start going out . . . I think this week, perhaps early next.” However, some Americans may not receive their checks until as late as August 17, depending on whether or not they provided direct deposit information on their tax returns and what their adjusted gross income is.

Don’t Panic, and Don’t Hesitate to Ask for Help

If you’re busy keeping an eye on your health, your job, your finances, your daily news updates and everything else, it can be hard to not be overwhelmed. But don’t panic—there’s a light at the end of the tunnel. Experts have varying opinions, but some predict that the economy might start to improve in September.

When you focus on things that are in your control, like taking steps to protect your finances, you can feel more secure. If you’d prefer to get professional assistance, resources like CreditRepair.com are here to help you out. Get in touch with us today to get started.