Disclosure regarding our editorial content standards.

If you’re overwhelmed with credit card offers, fear not! The Fair Credit Reporting Act (FCRA) allows you to opt out. You can do so online, over the phone or by mail. Read on below for more information on opting in or out of credit card offers and what may be right for you.

Why do I get preapproved credit card offers?

You receive preapproved credit card offers because of the information on your credit report. Credit card companies have set requirements for certain offers, so you’ll receive credit card offers if your report shows that you meet or exceed the requirements.

Credit card companies ask credit bureaus for a list of people meeting their specific requirements. This list will turn into their call, email or mail list. A credit card company may also have a list of potential customers who have shown interest in their services. They’ll ask if those people qualify for their preapproved offers.

What are the benefits of opting out?

People who feel spammed and are overwhelmed with a cluttered inbox typically opt out of prescreened credit and insurance offers. Opting out can:

- Stop unwanted phone calls

- Remove junk emails

- Minimize the number of letters that you typically throw away

- Reduce temptation to get new credit cards

- Limit unwelcome access to your credit report to reduce risk of identity theft

What are the drawbacks of opting out?

While choosing to opt out can benefit your lifestyle, it can also prevent you from finding beneficial services. Some people enjoy prescreened credit and insurance offers for the following reasons:

- Learn what’s available so you can make a better decision on your next card

- Reduce chances of rejection by accepting a preapproved offer

- Access more product and service option

- Access to promotional rewards

How to opt out online

If you decided that opting out is right for you, you can opt out of credit or insurance offers by submitting a request through OptOutPrescreen.com, the official website for the main credit card bureaus (Equifax®, Experian® and TransUnion®).

This process requires personal information like your Social Security number, date of birth and name on the request. OptOutPrescreen will remove your name from credit card offer lists for five years once you’ve completed the process online. If you wish for a permanent opt-out, you can start the process online but must confirm the request through the mail.

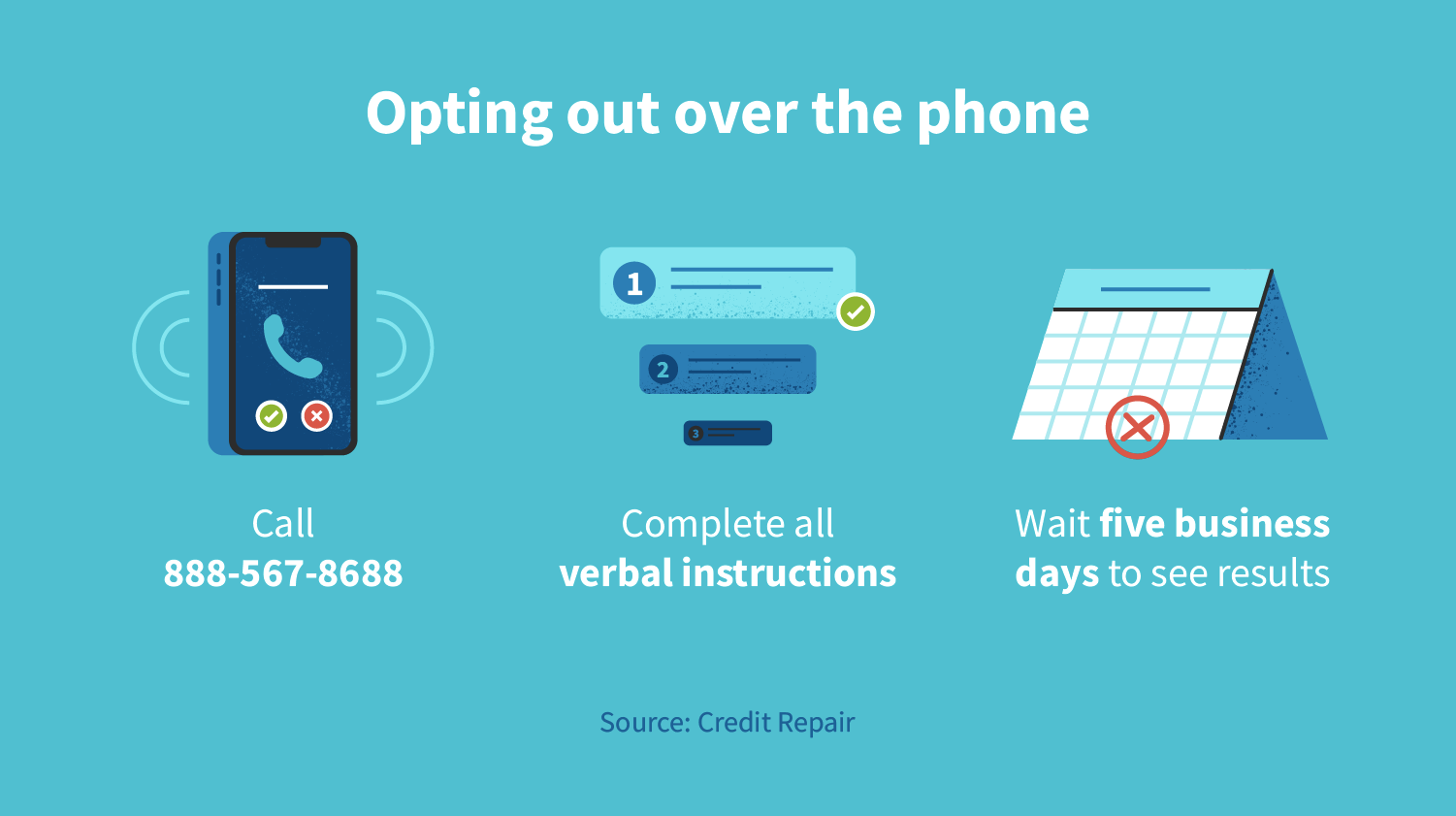

How to opt out over the phone

If you wish to use a phone for this service, you can opt out by calling 888-5-OPTOUT (888-567-8688). They’ll remove you from the lists for five years before your name is added again.

While on the phone with OptOutPrescreen, you will verbally submit a request that includes personal information. Once that’s complete you’ll no longer be on offer lists from Experian, TransUnion, and Equifax.

If you’re not used to computer processes like OptOutPrescreen.com, the over-the-phone option may be easier to understand and handle.

How to opt out of credit card offers by mail

If you’re choosing the mail option, you’ll start the process online at OptOutPrescreen.com but complete it through the mail. If you’re opting out permanently, you’re required to fill out the Permanent Opt-Out Election Form. You’ll fill out the form in writing and return it alongside the printed confirmation before your request goes into effect.

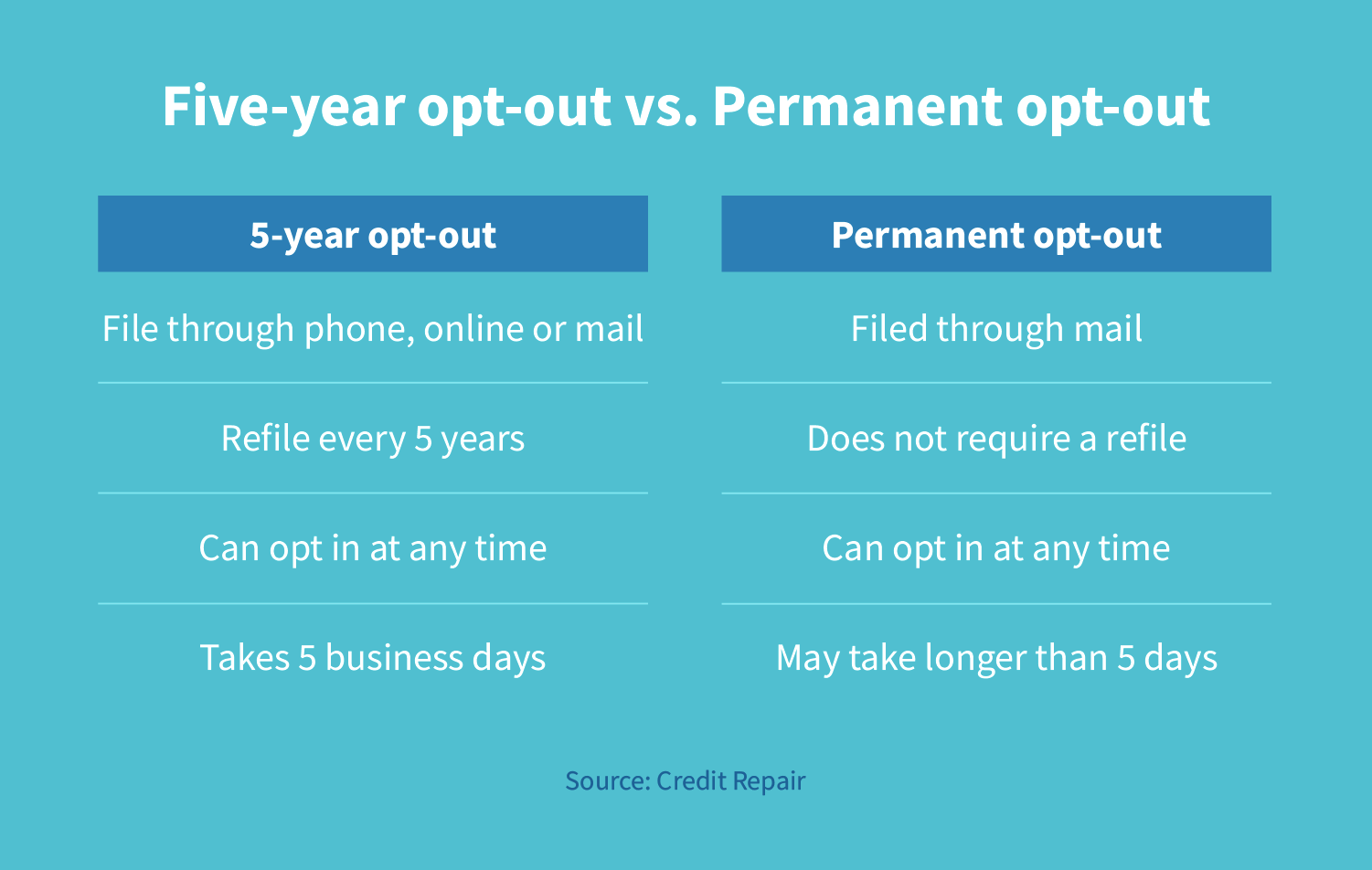

A five-year opt-out request, however, will go into effect five business days after initiating the process online. A five-year opt-out request can go through the mail, but does not require the same forms as a permanent opt-out service.

These forms will ask you to include personal information, so it’s important to accurately address and mail all paperwork back to the proper receiver, which could include any of the main credit bureaus and their approved service provider, OptOutPrescreen.

How minors can opt out of credit card offers

Minors can’t opt out on their own. If they want to opt out of offers, a parent or guardian can opt out for their minor dependents if need be. If the person is no longer a minor, they’re required to handle this process on their own.

| Age | Can they legally receive offers? | How to opt out |

|---|---|---|

| Minor under 13 | No | Contact consumer credit reporting companies and law enforcement. |

| Minor ages 13 to 17 | Yes | Parent or legal guardian can opt out for them |

Source: OptOutPrescreen.com

The FCRA does not permit children age 13 and younger to be on offer lists. If your dependent is receiving credit offers, you must contact the consumer credit reporting companies directly informing them of the matter and report the illegal use of your dependent’s information to law enforcement.

These steps may seem serious, and that’s because they are. There is a chance that someone stole the minor’s information in an identity theft scam. Unfortunately, these scams are somewhat common, especially if you’ve used an untrustworthy company for credit services. Luckily, there are steps in place to report and resolve identity theft.

How long does it take for the offers to stop?

It may take around five business days for an opt-out request to go into full effect due to the required processing time. If you’ve completed a permanent opt-out request, it can take longer than a couple of days due to the mail delivery cycle.

Even if you completed the requests, it may take a while for offers to stop. Separate companies may have received your information before the request and are not aware that you opted out.

It’s important to remember that opt-in or opt-out requests are for prescreened credit or insurance offers and do not cover retail, social media or other non-credit-related notifications. These offers may have to be individually dealt with.

How long can I opt out of offers?

You can opt out for five years or permanently. You can complete a five-year opt-out over the phone, online or through the mail. On the other hand, you must start a permanent opt-out online and complete it through the mail. If you wish to opt back in after an opt-out request, you can do so at any time as long as you follow the proper guidelines.

Will signing up for OptOutPrescreen stop all of my junk mail?

OptOutPrescreen can’t help with telemarketing calls, donation requests from schools, retail offers and more. All junk offers take time to remove since your information appears on multiple lists from multiple sources, but there are services that can help.

| National Do Not Call Registry | Removes telemarketing calls |

| DMAchoice | Removes spam mail (requires a small fee) |

| OptOutPrescreen | Removes unwanted preapproved credit and insurance offers |

Source: CreditRepair.com

How do I opt in to preapproved credit offers again?

If you’re interested in opting back in to preapproved credit offers, you can do so on OptOutPrescreen.com. The FCRA permits customers to opt in as well as opt out of preapproved credit offers.

You can call 888-5-OPTOUT to complete the request online. You must fill out forms with personal and financial information before you can receive offers. The request will take approximately five business days before offers roll in.

Can I throw away credit card offers?

Yes, you can throw away credit card offers, but you need to remove all identifying information. If you throw away a credit card offer, your personal information and access codes are available to anyone who comes across your trash.

If your information is obtained by a third party, you may be at risk of identity theft. Identity theft is a common crime within the credit and insurance industries. If you keep your personal information private, use trusted websites and remove personal information from junk mail, you can minimize your chances of identity theft.

Does opting out improve my credit score?

Opting out does not improve or hurt your credit score. If you opt in on preapproved credit card offers, you may see soft inquiries appear on your credit report, but they do not affect your score.

Understanding your financial situation, available services like credit building tools and options can be confusing. CreditRepair offers assistance, guidelines and tips to help you build your credit score and support your financial health.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263