Disclosure regarding our editorial content standards.

Overdraft protection is a service provided by banks to cover transactions when your checking account doesn’t have enough cash at the time. Instead of having your transaction declined, your bank will essentially cover the difference to ensure you can still make successful purchases. Banks will then move the remainder of the balance into a specified backup account and charge an overdraft fee for the service.

Overdraft protection is essentially like writing an “IOU” to the bank. Think of it like being out for dinner with a friend and finding out the restaurant only accepts cash. The only cash you have is an emergency $20, but your friend has enough cash to cover the rest of your meal.

In this situation, your friend foots the rest of your bill and you agree to pay them back at a later date. Similarly, overdraft protection is your bank “footing the bill” for the rest of your checking account purchases. When signing up for overdraft protection, you agree to pay back the amount from another cash reserve, usually your savings account or credit card.

While overdraft protection shouldn’t become a fallback for monitoring your financial health, it can be a useful tool to ensure you can make transactions even when your checking account doesn’t have sufficient funds at the moment.

However, if you fail to pay back an overdraft charge on time, it could negatively impact your credit score. This can cause fallout effects in many other areas of your financial health, which is why good financial habits, like regularly monitoring your credit, are so important.

Below, we cover how overdraft protection works so you can make an educated decision about whether overdraft protection is right for you or not.

How Does Overdraft Protection Work?

If you’re in a situation where your bank account balance falls below zero, overdraft protection is a way for your bank to cover the difference to ensure you can still successfully make transactions. However, overdraft protection comes with costs—literally. The most common overdraft fee in 2019 was $35, with the average fee coming out to $33.36.

Overdraft protection links your checking account to your credit card, savings account or another line of credit to ensure your transactions will go through successfully. It can be used as a safety net for your checking accounts to ensure you’re able to make transactions when your account balance falls into the red.

Additionally, overdraft protection ensures you won’t be charged multiple overdraft fees if you are making multiple transactions while your account is negative—as long as you’re under your overdraft protection limit.

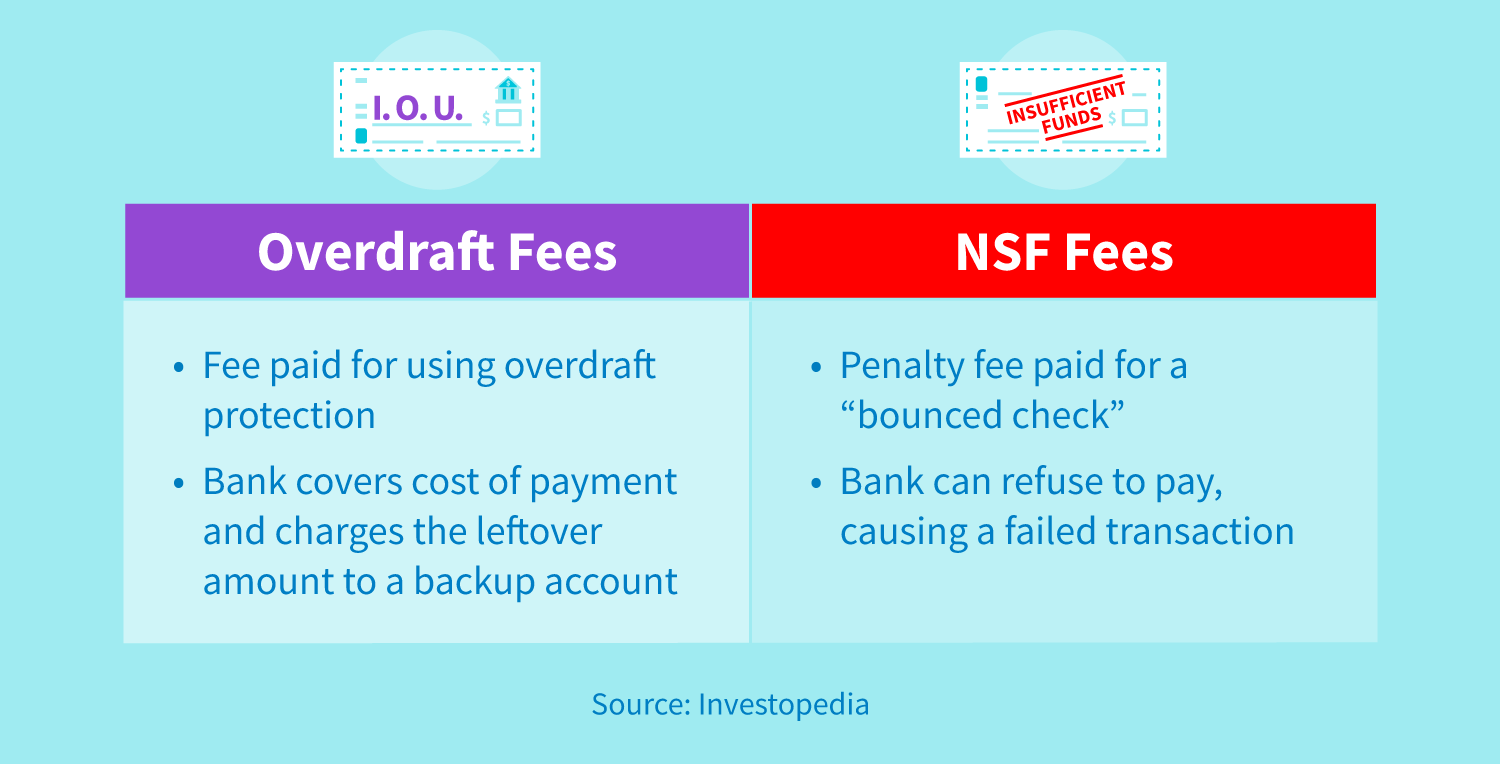

Overdraft Fees vs. Non-Sufficient Fund Fees

It’s also important to understand the difference between an overdraft fee and a non-sufficient fund (NSF) fee. While many people mistake the two, overdraft fees cover the cost of a transaction and allow it to go through, while NSF fees are charged by the bank for a failed transaction.

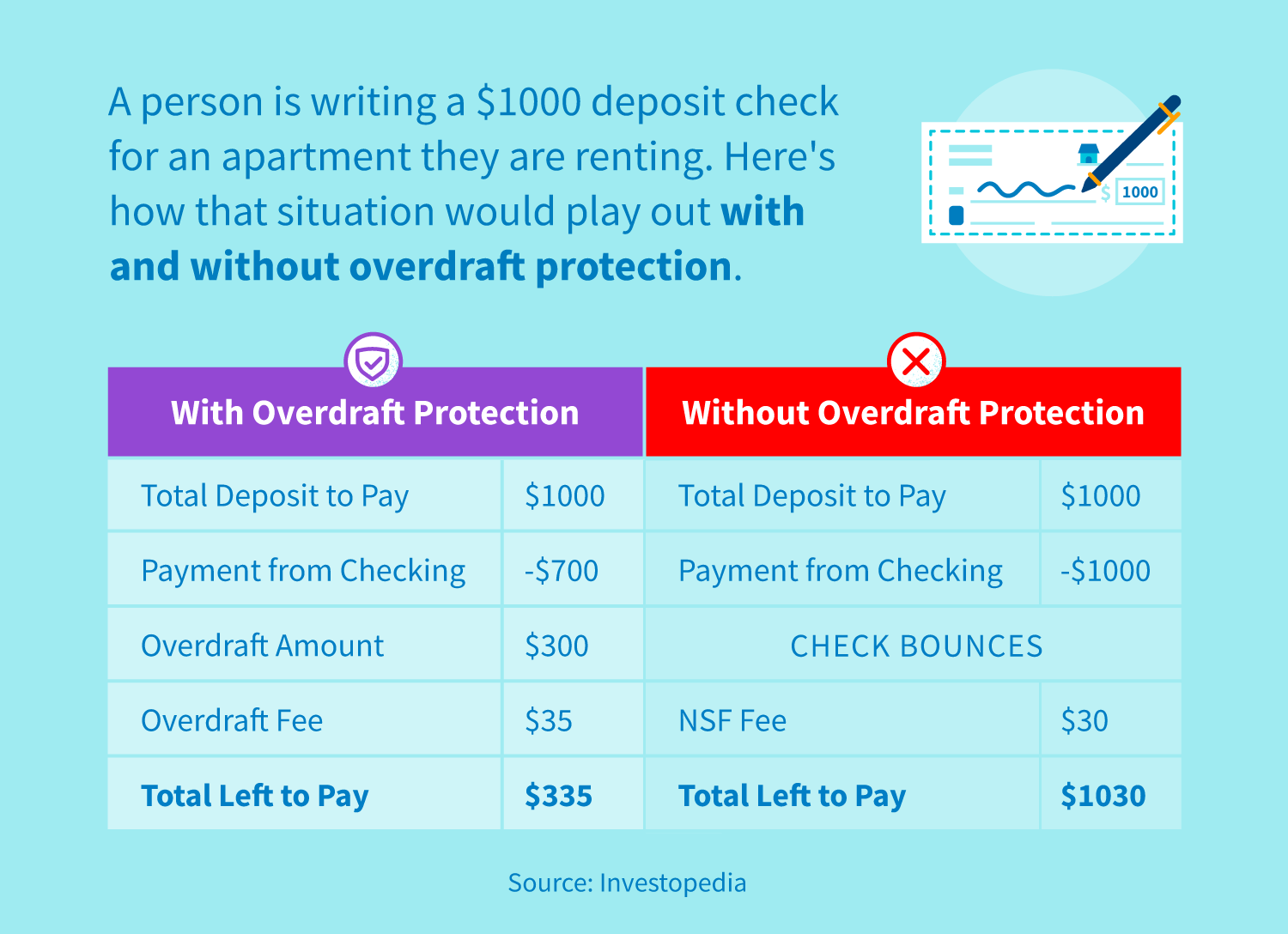

Overdraft Protection Example

Wondering what overdraft protection looks like in practice? For example, a person could be writing out a $1000 deposit check for a new apartment they’re planning to rent. However, since the renter’s checking account only has $700, the bank covers the other $300, which is then transferred to the renter’s line of credit balance to pay off at a later date.

The bank charges a $35 fee for this overdraft protection, meaning that the renter will end up paying $335 back to the bank for this overdraft protection and any possible interest.

Without overdraft protection, a renter in the same situation would have their $1000 deposit check bounce, meaning that the check would not go through and the renter would be charged a NSF fee to the bank for processing an invalid check.

In this situation, the renter has to pay a roughly $30 NSF fee (usual NSF fees range from $27 to $35) to the bank and find another source to provide the additional $300 needed to make the deposit.

What Is an Overdraft Protection Limit?

While overdraft protection has many benefits to protect users, it’s important to remember that it does come with a limit. Similar to how your credit card has a maximum credit limit, overdraft protection caps at a certain amount as well. While this varies from person to person, according to Chime, banks tend to have an average overdraft limit between $100 and $1000 based on the income and qualifications of the account holder.

How Do You Qualify?

Since the Federal Reserve requires an opt-in for overdraft protection, you need to sign up for it with your bank. To qualify for overdraft protection, you need to have an open and active account with your bank; you may also need to have an acceptable credit score.

Once you are qualified for overdraft protection, your bank will link your checking account to a backup account to cover transactions in a situation where you have insufficient funds. However, overdraft protection isn’t a “get out of jail free” card for your finances, and it’s crucial to understand how using it can negatively impact your credit score.

How Does Overdraft Protection Impact Your Credit?

Once you have overdraft protection set up, you may be wondering how it will impact your financial health, including your credit score. Read on to learn how overdraft protection may impact your credit and things to keep an eye out for.

Credit Card and Line of Credit Overdraft Protection

While your checking account usually does not impact your credit score, backing up your checking account with overdraft protection on your credit card means you can be at risk of negatively impacting your credit score.

Depending on the bank you use, some credit companies will consider overdraft payments as a type of cash advance, which is a short-term loan borrowed against your line of credit. While it can be helpful in a pinch, it’s important to know the risks that come along with using a cash advance. Cash advances start accruing interest immediately and can easily cause your credit card utilization to go up, causing a potential stockpile of additional debt and penalizing your credit score.

If you connect overdraft protection to a line of credit, you could have to pay additional fees if the overdraft balance is not paid off within the specified timeframe. Additionally, overdraft fees are added on to any balance already on your line of credit—so even with overdraft protection, it’s good practice to be aware of your current bank balance and the amount of credit you have left before hitting your credit utilization limit. You may also encounter interest fees added on to these overdraft fees, depending on your bank.

Is It Good to Have Overdraft Protection?

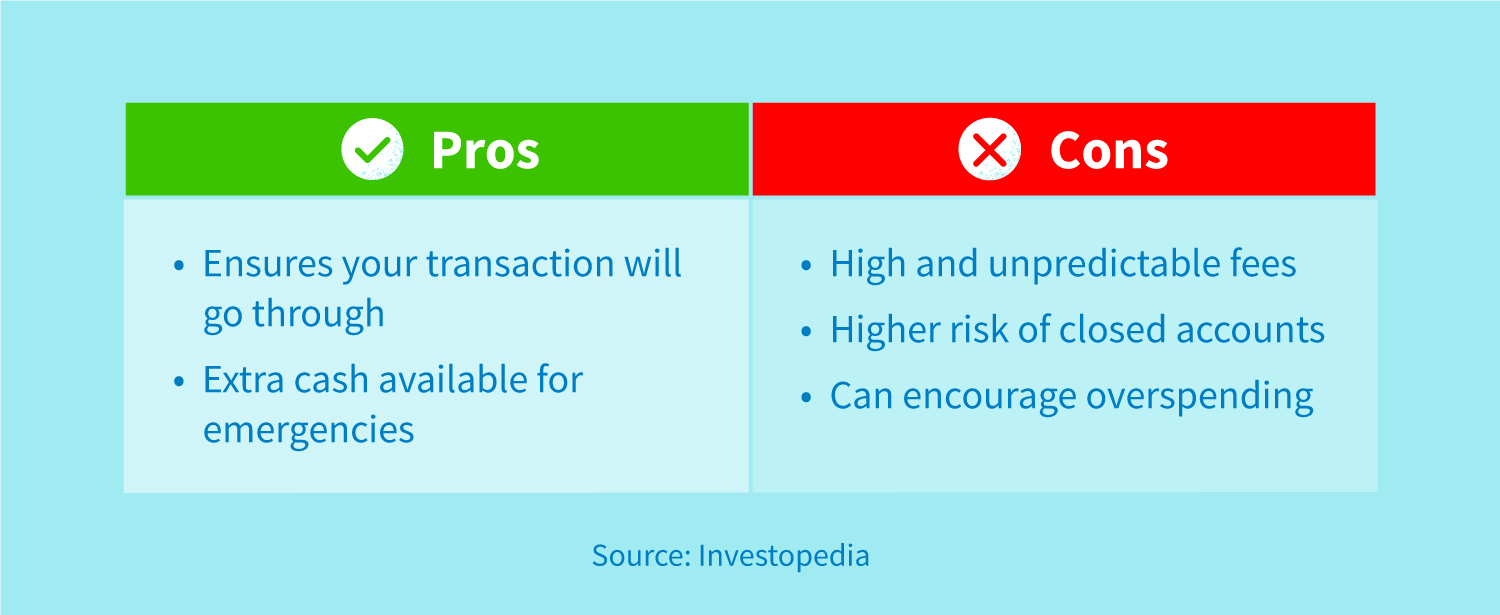

Overdraft protection is an insurance policy to protect you from declined transactions if your current checking account balance has insufficient funds. However, if you aren’t able to pay back the overdraft fees on time, the penalties may be worse than the original cost of a bounced check.

Deciding whether to opt in to overdraft protection is a personal decision. If you’re able to carefully keep track of your account balance, you may not need it. However, if you do opt in to overdraft protection, you have a safety net to ensure successful transactions—even when you don’t have sufficient funds in your account.

It’s important to consider some of the benefits and drawbacks of overdraft protection. On one hand, overdraft protection gives you peace of mind that your transactions will go through with insufficient funds in your checking account. However, overdraft protection also comes with high or unpredictable fees and a higher risk of closed accounts.

There’s no black-and-white answer to whether overdraft protection is inherently good or bad. Rather, overdraft protection is an option available to protect you in case your account is lacking funds.

Whether or not you should use overdraft protection is something you should decide based on factors like if you’re able to actively keep track of your bank balance—if you know you won’t ever accidentally go below your account balance, it may not be needed in your situation.

When deciding whether to opt in to overdraft protection, it’s important to consider your personal finance habits. While money management is an ongoing process, keeping track of your personal finances is important for financial literacy.

If you’re looking to improve your personal finances, repairing your credit is a great place to start. Whether you’re fresh out of college or a seasoned professional, our team has the tools to help you achieve your financial goals. Check out our services to help you get started on the journey to repairing your credit today.