Disclosure regarding our editorial content standards.

Getting a raise or a new, higher-paying job is cause for celebration. You’ve worked hard and now your salary will reflect that, so there’s nothing wrong with increasing your spending budget along with your increased pay—right?

The answer is a bit more complicated than a yes or no. While making more money isn’t a bad thing, it can sometimes lead to a phenomenon called lifestyle creep, where increased income results in increased discretionary spending.

If not controlled, this can lead to more credit card usage and debt as you begin spending more money on things you used to consider luxuries. However, lifestyle creep can be managed with a proper budget and money management skills.

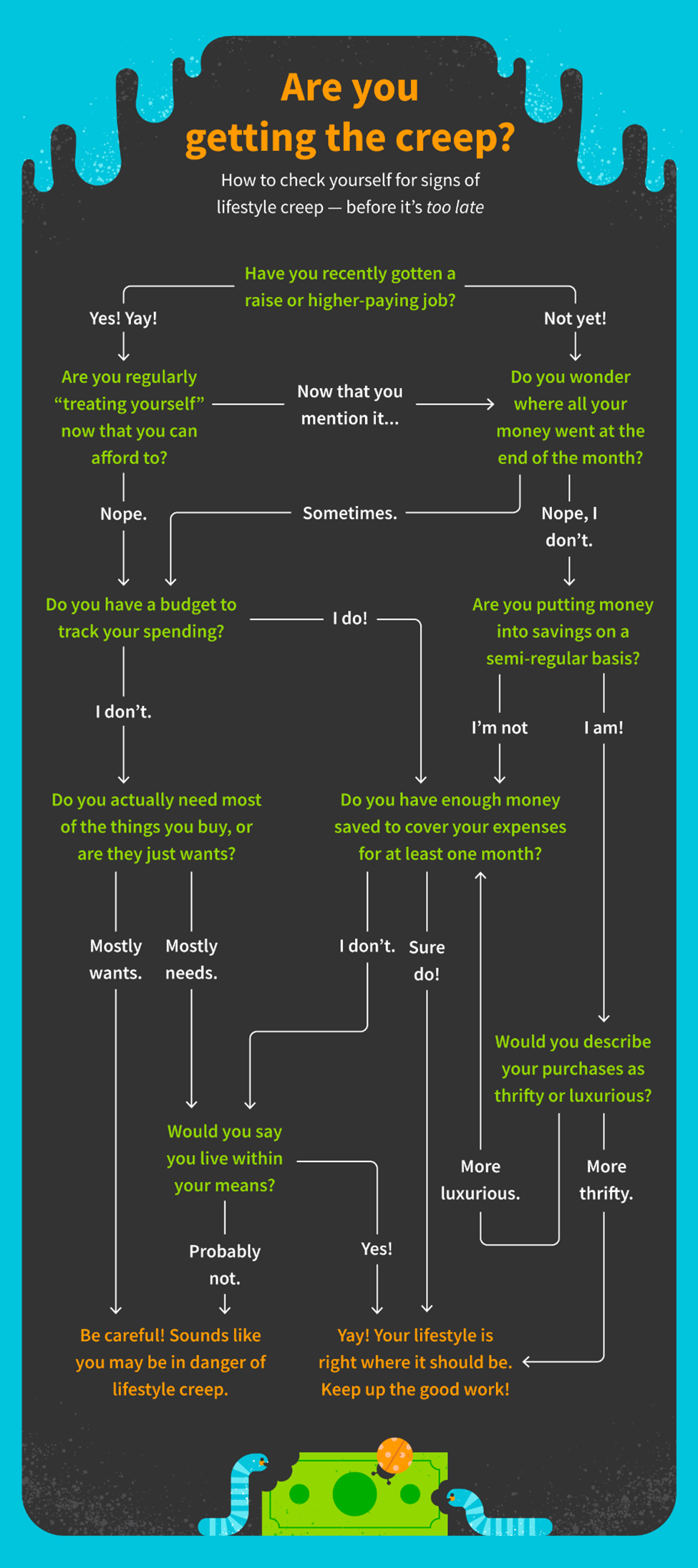

Read on to learn more about lifestyle creep, how to manage it and how to enjoy your new lifestyle without spending too much. Don’t forget to check out the infographic on ways to conquer the creep and be happy with what you have.

What is lifestyle creep?

Lifestyle creep (otherwise known as lifestyle inflation) refers to increased spending after receiving a raise or getting a higher-paying job. As soon as you can afford yesterday’s luxuries (like monthly massages or spendy vacations), they become today’s necessities.

Of course, it’s natural to want to spend more money on things you can afford for the first time after getting a raise. There’s no shame in treating yourself to a jacket you’ve had your eyes on for months or taking yourself out for a nice dinner.

How does lifestyle creep work?

Lifestyle creep becomes a problem when you realize your spending habits have spiraled beyond “treating yourself” a few times a week into a full-blown taste for the finer things that come with a hefty price tag that put you at risk for more debt.

Lifestyle creep examples include:

- Trading in your modest car for a luxury sedan

- Upgrading your TV setup with an expensive sound system

- Swapping grab-and-go work lunches for daily meals at nice restaurants

If you’re not careful, a new lifestyle can get in the way of financial goals like saving for retirement, contributing to an emergency fund or putting money away for a one-time larger purchase like a home.

Signs of lifestyle creep by age

There are two age groups that have proven to be particularly vulnerable to lifestyle creep—young consumers who are trying to save money and older folks approaching retirement. Let’s break down exactly why these groups tend to struggle with lifestyle inflation.

Young savers

There’s a lot to start saving for when you’re young—a down payment on a house, student debt repayment and retirement—just to name a few. However, when we’re young we also want to spend our time traveling and experiencing as much as we can.

Lifestyle creep can escalate this lifestyle and make saving money incredibly challenging. This can keep young consumers from saving enough money to reach their financial goals, significantly delaying their progress. To combat this, it’s important to write down life goals and budget accordingly.

Near-retirees

About five to 10 years before retirement, individuals are often earning more than they ever have before. In the best case scenario, most long-standing expenses will be paid off. And many people in this age demographic feel tempted to spend their additional discretionary income on expensive items, like sports cars and vacation homes.

However, these lifestyle decisions can run through your paychecks quickly, leaving little to nothing behind to take care of emergencies. Retirement is about maintaining the lifestyle one has lived up until retirement rather than creating a new lavish lifestyle, as the latter can be expensive. It’s important that near-retirees continue to live within their means, regardless of how much they now make.

Financial effects of lifestyle inflation

Lifestyle changes of any kind can affect your finances, but lifestyle creep in particular can cause your spending habits to get out of control. Below are a few ways that lifestyle creep can negatively impact your finances.

Encourages you to spend in excess

Once you start making more money and can afford things you couldn’t before, your credit card usage may increase along with your regular spending. You may feel some pressure that you didn’t before to purchase nicer things or take more luxurious vacations.

Before you know it, this spending has caught up with you and your credit card bill is either much higher than before, or it has been maxed out entirely. This can come back to bite you if you aren’t able to pay off this higher bill, leading to increased interest rates and a continuing cycle of debt.

Makes you less likely to save money

One symptom of lifestyle creep is spending a higher percentage of your paycheck in order to live an increasingly lavish lifestyle. This can make it challenging to send money to your savings account. In extreme cases, you may even be tempted to take money out of your savings account to pay for something.

This could come back to haunt you once you want to start a sinking fund or start planning ahead for your financial future, such as preparing for a baby.

Makes budgeting a thing of the past

Budgeting isn’t just for when you’re living paycheck to paycheck—it’s important regardless of how much money you make. When lifestyle creep sets in, it’s easy to start saying “yes” to everything, from expensive excursions to frequent fine dining. Naturally, you may lose awareness of where your money is going.

This can quickly backfire, as your bank account may become depleted more quickly than you had expected, resulting in a missing emergency budget or worse—debt.

How to prevent lifestyle creep

A new job or a raise is certainly a cause for celebration, but that celebration doesn’t need to come with a hefty price tag. Below are five tips on how to avoid lifestyle creep so that you can enjoy a new lifestyle without succumbing to lifestyle inflation.

1. Take note of your wants and needs

Being able to distinguish between needs and wants can be difficult, but it will prove to be a very worthwhile skill when you can walk away from the temptation of an impulse purchase you really don’t need.

If you find yourself spending money to feel happy or just because you can, try being more intentional about your spending and what you’re buying. Think to yourself:

- Will this purchase still make me happy after the “buyer’s high” has worn off?

- Will I be able to use this purchase in six months? How about one year?

- What is the reason I’m making this purchase?

- Do I really need this item?

Reflecting on why you’re making a purchase can help you slow your spending and curb lifestyle creep.

2. Pay yourself first

If lifestyle creep is hurting your financial goals, you can get ahead by paying yourself first every pay period. Instead of immediately running to buy the shoes you’ve been eyeing the next time payday rolls around, put some money in your savings and retirement accounts. No matter how much or how little, it will help you get one step closer to your financial goals.

Experts agree that generally, you should be aiming to save at least 20 percent of your paycheck per pay period. Feel free to adjust this number based on your individual income and savings goals, but consider using it to guide how much you’re paying yourself.

3. Increase your budget slowly over time

Instead of increasing every part of your budget by 10 percent when you get a 10 percent raise, consider implementing smaller increases. This not only helps you get adjusted to having more money, but gives you stricter control over what and how much you spend on things like rent, dinners out, entertainment and other parts of your budget.

Once you’re accustomed to that smaller increase, consider increasing your budget again. These incremental increases can help you feel more in control of your finances and, in turn, improve your quality of life without developing risky habits.

4. Be wary of revolving debt

When lifestyle creep gets out of hand, you may find yourself collecting revolving credit card debt. Not only does this harm your financial health (which can damage your credit score), but it also collects interest which may put you further and further into debt.

Since revolving debt doesn’t need to be paid off on a specific schedule, it can be tempting to rack up revolving debt continuously over time without paying it down. To keep your debt from spiraling and hurting your score, set a strict rule for yourself capping revolving debt before it reaches a dangerous level.

5. Make “treating yourself” a treat

While rewarding yourself for a job well done is expected when you get a new job or raise, that doesn’t mean you should be having a “treat yourself” day several times per week. If you view everything you purchase for yourself as a treat, then nothing is a treat.

To avoid the temptation to reward yourself for everything you do, set up a goal chart for yourself with some rewards you’ve been eyeing. This could include:

- If you get a good performance review at work, buy yourself the shoes you’ve wanted for months

- If you meet your reading goal for the year, treat yourself to a new bookcase

- If meeting your significant other’s parents goes well, reward yourselves with a nice dinner out

Setting up rewards for yourself ahead of time helps make meeting your goals more exciting and the rewards more meaningful.

Lifestyle creep, or lifestyle inflation, can catch up with you quickly. It’s up to you to make sure that you’re living within your means and not letting your lifestyle dictate your spending. You don’t have to navigate this alone—CreditRepair.com is here to help with any issues that may arise with your credit score along the way.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263