Disclosure regarding our editorial content standards.

A joint bank account is a checking account shared by two people, giving you both access to your shared finances. There’s a lot to consider when debating whether or not to open one, including who it’s best for—generally children and parents, adult couples and aging parents.

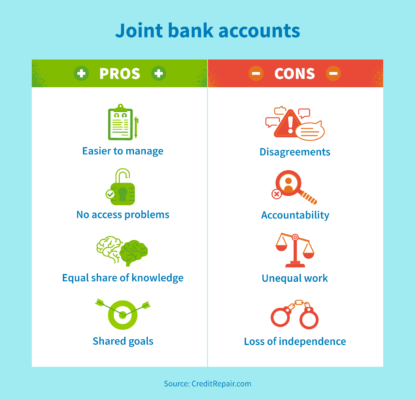

There’s no right or wrong answer for whether you should open a joint bank account. With that in mind, we’re breaking down the pros and cons of sharing accounts to help you decide whether a joint account is right for you.

How do joint bank accounts work?

A joint bank account is shared by more than one person, such as couples or children and parents. Joint bank accounts can be used just like regular checking accounts. Some situations that a joint account could be used for include:

- Couples: To pay for shared household expenses, such as mortgage payments and groceries

- Young children and parents: To teach money management basics and responsibility with a debit card

- Adult children and older parents: To pay for at-home care or shopping if the parent can’t do it independently

- Business partners: To cover payroll and business expenses from one bank account

Joint accounts allow both users to see your account activity and how money is being spent. This also helps you combine your shared savings goals, such as saving for a baby, a home or a vacation.

Who owns the money in joint bank accounts?

Joint bank accounts are used by both users, meaning no single person owns the money in a joint checking account. The most common type of joint bank accounts are called “joint tenancy accounts,” meaning both users can make deposits and withdrawals without permission from the other. If one user passes away or becomes unable to use their account, then full ownership is passed to the other user.

Joint bank accounts are different from being an authorized user, which is someone signed on to use a credit card that is already owned by someone else.

Benefits of joint bank accounts

There are a few distinct benefits to opening a joint account.

1. Easier to manage: It’s easier to keep track of incoming funds and outgoing shared expenses when your money is in one place.

2. No access problems: There will be no issues accessing money if one user is hospitalized, dies or is otherwise unavailable.

3. Equal share of knowledge: Each user has an equal ability to see how much money you have. No partner ever needs to rely on the other for information.

4. Shared goals: With one bank account between two people, you can combine your collective saving goals and accomplish them faster.

Drawbacks of opening a joint account

Of course, there are a few drawbacks to consider before opening a joint bank account, namely:

1. Disagreements: Money is one of the top reasons for couples to divorce or separate, and can prove to be a source of tension for parents and children sharing an account. If both users are set in their ways on how to manage finances (for instance, when to pay bills) or are irresponsible with money, joint bank accounts can be challenging.

2. Accountability: You have no privacy with joint bank accounts. Your spending and finances are freely visible to the other user, meaning you can be held accountable for your spending habits. If one user is a strict budgeter and the other spends money a bit more freely, this can prove to be a tension point, especially if one user causes the account to overdraft.

3. Unequal work: Though two people have access to a shared account, the responsibility of physically paying the bills can all fall on one person’s shoulders. This can lead to a feeling that work is not being shared equally among both users.

4. Loss of independence: Some users are used to having their own money and doing what they want with it. Having a joint bank account could make them feel as if they’re losing their independence and right to do whatever they want with their money.

How to open a joint bank account

Opening a joint bank account is very similar to the process of opening an individual checking account. Depending on which bank you apply with, you’ll select “joint account” when filling out your application, or add in a co-applicant once you’ve input your information. There’s also the option to add a user to an existing bank account.

When applying, you will likely need your Social Security number, birthdate, mailing address, identification information and other information relevant to the account. Once your account is approved, both account holders will be mailed cards, checks and access to the account. Opening a new checking account generally does not affect your credit score.

What to consider before opening a joint account

Considering that money is one of the top reasons for couples to divorce or separate, it’s important to discuss with your partner how you plan to handle your finances together early on. Here are a few things to consider and ask one another before opening a joint account together:

- How will we deposit money into the account?

- How much will we each deposit, and how often?

- What will we use a joint account for?

- What are the rules for using this account?

- Can one person use this account without notifying the other?

- Are we going to close our individual accounts?

Though situations can change, it’s best to discuss general guidelines for using a joint account before it’s opened to give you both an idea of how it will be used. If you cannot come to an agreement on how a joint account should be used, you may want to consider keeping separate accounts.

Knowing proper money management and budgeting techniques is important regardless of whether you decide to open a joint bank account or keep your money separate. If needed, consider adding an extra step of credit protection with our credit repair professionals to ensure your money is protected.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263