Disclosure regarding our editorial content standards.

If you’re in a position where you’re strapped for cash, you might be considering a payday loan. Most people understand that a payday loan comes with its disadvantages. Still, if you need money now, it can feel like the only option.

First, however, it’s essential to understand all the potential consequences of a payday loan—like that it can hurt your credit.

What is a payday loan?

A payday loan, also known as a cash advance loan, is a short-term, high-interest loan based on your income. The loan is typically for a small amount, around $500 or less on average.

Payday loans usually work as a way to borrow from your next paycheck. Because the arrangement expects you to pay the money back using your upcoming paycheck, the loan term is usually just a few weeks long (usually two weeks or one month).

The entire process of getting the loan takes only a few minutes, which is another reason it’s so tempting for people in a financial emergency. First, the payday lender verifies your income to make sure you can repay the loan. Next, they verify your bank account so they can deposit the funds.

Once you’re approved for a loan, the funds will be deposited into your account.

You’ll also have to sign two post-dated checks for the loan amount and the interest on the loan. These checks will coincide with your next payday so the lender can get their money back quickly.

The majority of people who take out a payday loan have poor or little credit. As a result, payday lenders charge incredibly high APRs and take post-dated checks for repayment to offset the risk of lending to people with bad credit.

Even in an emergency, payday loans are usually not the best option. The Consumer Financial Protection Bureau (CFPB) refers to payday loans as “debt traps” and encourages consumers to be aware of the risk of payday loans.

Many states have passed regulations to minimize the damage payday loans can do.

Payday lenders understand their borrowers are in a vulnerable situation and take advantage of this with extremely high interest rates.

Do payday loans affect your credit?

In theory, a payday loan could help your credit if you paid it back on time and the lender reports to the credit bureaus. However, most people don’t manage to do that, and many payday loan lenders don’t report timely payments anyway.

The average payday loan borrower remains in debt for five months. This is because nearly 60 percent of payday loan borrowers have trouble meeting their monthly expenses. Around 70 percent of borrowers use the funds to pay recurring bills like utilities and rent.

If you’re taking out payday loans to make ends meet, you’ll likely have trouble repaying the amount. Late payments can reduce your credit score. If you default, the payday loan could hurt your credit even more.

What to do about a payday loan in collections

If your payday loan goes to collections, it’s important to make a plan of action as quickly as possible. Consider contacting the collection agency and negotiating your debt down if you pay it all up front.

Debt collectors often offer individuals a discount if they agree to make one large payment to get rid of the debt.

Make sure you educate yourself on how to negotiate with and pay a collection agency. Get everything in writing, and avoid giving them direct access to your bank account.

Note that if you go this route and negotiate, the debt will show as “settled” rather than “paid in full” on your report. Of course, “settled” isn’t as good for your credit report, so you’ll have to evaluate if this distinction is worth the money you save on the debt.

Regardless of how you pay off the collections charge, the negative item can stay on your report for up to seven years.

Who can get a payday loan?

To qualify for a payday loan, the borrower must:

- Be 18 years or older

- Have a piece of government-issued ID

- Have proof of income (usually a paystub)

- Have an active bank account

Additionally, some lenders may require a Social Security number. Payday lenders don’t check the borrower’s credit score, so having a bad or thin credit score won’t impact eligibility.

Still, individuals can have all the above and be denied a payday loan. For example, payday lenders with an APR over 36 percent legally must deny active-duty military, their spouses and their dependents for loans.

Options for paying a payday loan

Making your payday loan payment on time is the best way to protect your credit. If you’re struggling to repay your loan, consider the following solutions.

Get a second job

A second job can provide additional income to put directly toward your loan. If you work a nine-to-five, look for open positions on evenings and weekends. Employers that hire seasonal workers may have opportunities. For example, you could be a landscaper, lifeguard or camp counselor in the summer or a retail sales associate or banquet server around the winter holidays.

If you don’t want to juggle two work schedules, consider a side hustle. You could drive for a ride-sharing company or deliver food or groceries. With these types of gigs, you set your own hours and earn a steady income.

Sell extra possessions

Take items you’re no longer using and turn them into cash. You can list large items for sale on Facebook Marketplace or Craigslist. Or, use platforms like eBay, Mercari and Poshmark to list clothing, accessories, jewelry, housewares or toys. Research the going prices for items like yours and take clear photographs from different angles to make your listings stand out.

Cut out unnecessary expenses

Track your spending for an entire week. Save receipts, check your banking information online and start a spending journal. After seven days, review everything you spent. Was it all necessary? Is there anything you could go without or do differently to spend less? Simple changes like making coffee at home or packing your lunch could add up to significant savings over time.

Look into an extended payment plan

In many states, payday loan providers must offer no-cost extended payment plan options. This allows you to pay what you owe over time. Unfortunately, many lenders don’t fully explain this option or even let customers know it exists. Ask your lender if you qualify for an extended payment plan before you miss a payment.

Borrow from trusted family or friends

Family or friends may be able to assist you. When you approach them, explain why you need to borrow and when you can repay. Don’t make promises you can’t keep.

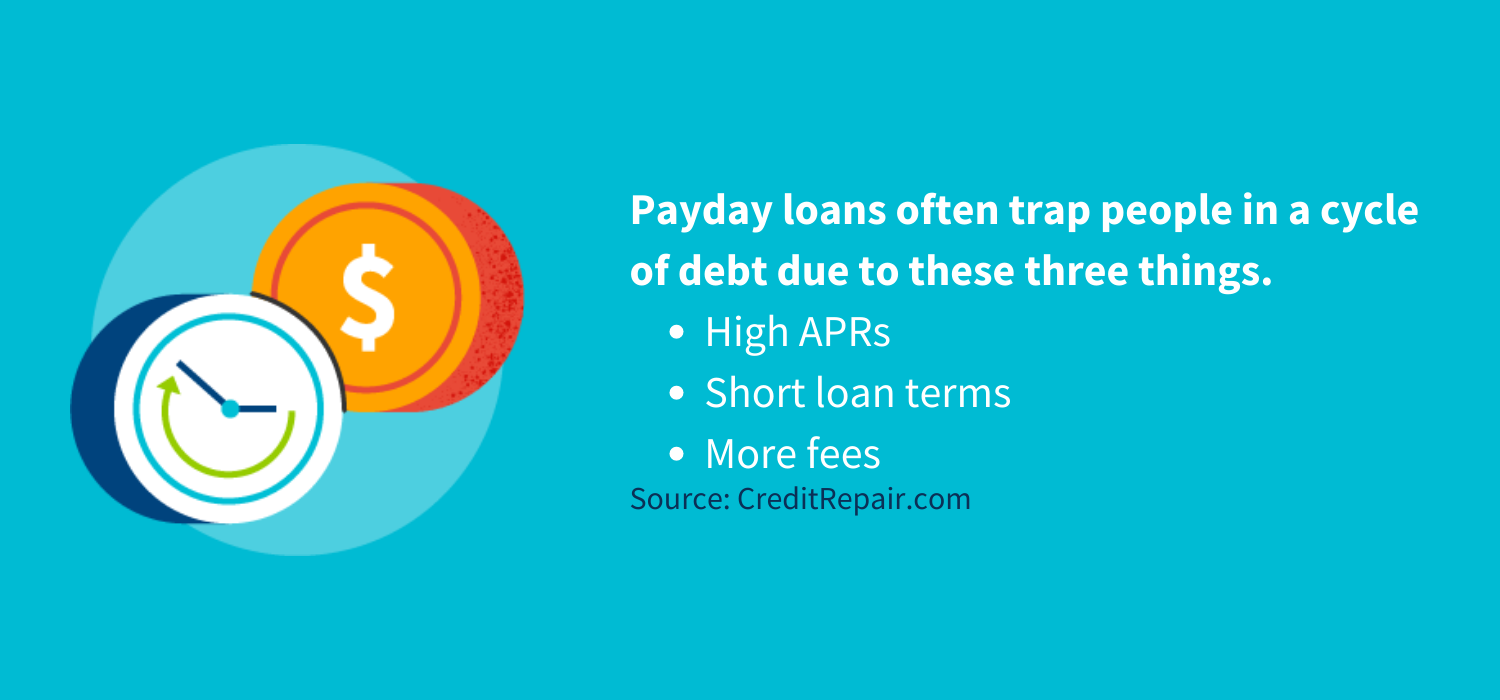

Why are payday loans often a bad idea?

Payday loans often trap people in a cycle of debt due to these three things.

High APRs

The most problematic factor of payday loans is the high APRs. Payday lenders typically charge a dollar or interest amount per $100 borrowed. The typical APR ranges from $15 to $30 per $100 borrowed.

Some states have limitations on how much payday lenders can charge, but the average APR nationally on payday loans is $15 per $100. Over a two-week loan term, that equates to a 391 percent APR.

Let’s say you borrow $400 for two weeks. At the end of the two weeks, you’ll owe $460, which translates to an interest charge of $4.29 per day. Even credit cards, which are notorious for having high interest rates, typically only have an APR between 11 and 27 percent.

Short loan terms

Since payday loans are for such a short term, it tends to bring people into a never-ending loop. As the person borrows from their next paycheck, they’ll be in the same situation on their next payday. A couple of weeks is not enough time for a person to get back on their feet.

More fees

While the high APRs on payday loans are bad enough, unfortunately, there are more fees borrowers should be aware of.

Rollover Fees

The CFPB previously reported that four out of five payday loans are rolled over or renewed. This means that 80 percent of people who take out a payday loan can’t repay it when their payday arrives.

Unfortunately, rolling over the loan incurs additional costs. Some lenders allow their borrowers to pay just the interest and roll the loan over to the next payday.

In the earlier example, this would mean paying the $60 interest and rolling over another $460 for two weeks. This means the borrower is paying $120 to borrow $400 for four weeks!

Repayment plan fees

Some lenders offer repayment plans when an individual can’t pay back their loan. Depending on your state regulations, fees for repayment plans may or may not be allowed.

Late fees

If you make your loan payment late, the lender may charge a late fee or returned check fee. This varies from state to state as some states don’t allow payday lenders to charge late fees. Additionally, if a check doesn’t clear, you may find your bank also charges you a fee for insufficient funds.

State regulations of payday loans

Since payday loans can be so predatory, many states have stepped in and implemented regulations on these lenders. These regulations can be on lending amounts, loan terms and fees.

Here are some examples of state regulations:

- California has the lowest maximum payday loan amount at $300.

- Oregon has the highest maximum payday loan amount at $50,000.

- Some states have a maximum payday loan amount based on the borrower’s income. For example, Nevada’s maximum is 25 percent of the borrower’s expected gross monthly income.

- Currently, payday loans are not legal in 11 states (Arizona, Arkansas, Connecticut, Georgia, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, Vermont and West Virginia).

- Texas is currently the only state with no restrictions on payday loans.

Before considering a payday loan, it’s essential to check your state’s regulations on payday lenders. This will give you some insight into the limitations and protections surrounding these loans in your area.

Unfortunately, not all states have set regulations around payday loans, but it’s worth checking.

Alternatives to payday loans

It’s important to understand there are plenty of alternatives to payday loans that have better terms. Some of the options include:

- Personal loans: Personal loans will offer a lower APR than a payday loan and a longer loan term. If you have poor credit, consider applying at a credit bureau rather than a bank. Credit bureaus are more likely to lend to people with lower credit scores.

- Cash advances: There are cash advance apps that offer interest-free advances on your upcoming paycheck. These advances are usually only a few days before your paycheck. Additionally, you’ll have to apply and be approved for the advance. Alternatively, you could ask for a cash advance from your employer.

- Borrowing money: If you have someone in your life you can lean on, consider asking them for a loan.

- Debt settlement: If you need money because your debts are out of control, consider debt settlement instead.

- Extended payment plans (EPPs): If you already have a payday loan, your payday lender may have an extended payment plan option. This is a mandatory requirement in some states.

Repairing your credit after a payday loan

If your credit has been hurt by payday loans, you can rebuild it with effort and attention. Follow the steps below for the best results.

Stop the cycle

You won’t be able to begin rebuilding your credit until you stop borrowing from and paying fees to payday lenders. Use the tips above to make ends meet so you don’t have to resort to costly loans.

Know your rights

Check out the laws regulating payday loans and collection agencies in your area. Report illegal activity and harassment to the Consumer Financial Protection Bureau (CFPB) and your state attorney general.

Should you get a payday loan?

It’s strongly recommended that you explore all your options before deciding to take out a payday loan. However, if this turns out to be your only option, make sure you pay the loan back as soon as possible. Payday loans can hurt your credit and financial stability.

If you’re having trouble getting other types of loans due to poor credit, consider credit repair services. CreditRepair.com can review your credit and help you dispute false or unverified information that’s dragging your credit score down.

By improving your credit, you can open up your financial options and get away from payday loans.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263