Disclosure regarding our editorial content standards.

Whether you loathe or love budgeting, it’s an important thing to do each month. This budget calculator will give you a breakdown of your budget areas to make budgeting a breeze. To start, first input your monthly net income (including paychecks and any other areas of income), then fill out each budgeting area to the best of your ability. You can see a visual breakdown of your expenses, including whether you’re over or under budget for the month, and then export to a spreadsheet to make budgeting easy each month.

Total monthly expenses

How to determine your monthly budget

There are a number of different ways to budget, whether you choose to track your spending using a cash envelope, a spreadsheet or a sinking fund. No matter your method, there are certain things and categories all budgets (including our budgeting calculator) have in common. Read on for an explanation of these categories, and how to ensure your numbers are accurate each month.

- Income: This includes your net income (take-home pay after taxes) as well as any other forms of income you have coming in each month. This number will help you determine how much money you have coming in vs. going out each month.

- Housing expenses: Whether you rent an apartment or own a home, you should track your rent or mortgage payments, utility bills and any other monthly expenses you incur—such as insurance, repairs or maintenance and cable/Internet/phone plans.

- Transportation expenses: These costs include gas, car repairs, insurance and any other fees you’re paying each month. If you don’t own a car, you should track public transit fees or rideshare costs.

- Food and personal expenses: This category includes everything from groceries to takeout, as well as any personal expenses, like entertainment costs, clothing and/or pet supplies.

- Loan and debt expenses: This spending category includes any loans or bills you’re working to pay off, like a credit card bill, a student loan or medical debt.

- Savings: You should always try to pay yourself a little each month, so this category tracks contributions to your savings account, retirement fund and emergency fund and any investment accounts you may have.

- Miscellaneous expenses: This category includes any spending areas not included in any of the categories above. This could be subscription fees, electronics or anything else you spend money on monthly.

These categories can help you round out your budget so that it works for you, which is what all budgets should do. Instead of feeling guilty for going over your budget each month, you should view your budget as more of a spending guide. Your budget should reflect your life and your spending habits, not feel restrictive and cause guilt.

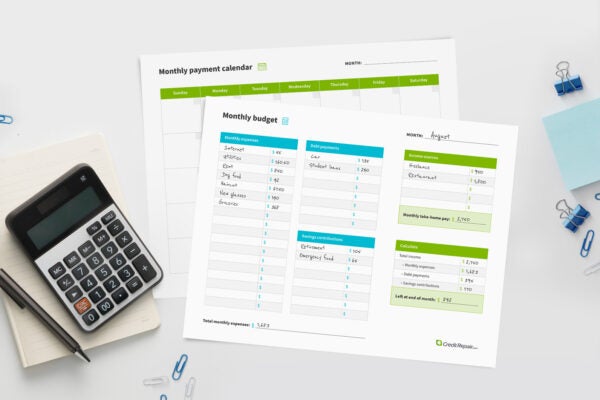

If you want an uncategorized budget so you have full control over your spending categories, these budget binder printables may be what you need. Use these if you’re new to budgeting or want to better understand the budgeting process laid out above.

Simply fill in your budgeting areas including your income, any fixed monthly expenses (such as rent), other areas you find yourself spending money in, savings contributions and debt payments. You can then print this, along with the fill-in-the-blank payment calendar, every month to put together a flexible budget that works for you and keeps you on track.

When done correctly, budgeting can help you save for retirement, give you a better idea of what you spend the most money on and even work on your credit. Budgeting each month may be tedious, but a budget calculator can help you easily see what your monthly budget looks like. Be sure to stay on top of your monthly budget for each category so you can rest easy with an up-to-date and accurate budget.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263